Altamira Gold Intersects High Grade Gold Mineralization within the Cajueiro Mineral Resource and Commences Drilling at the Untested Mombaque and Guillermo Porphyry Targets, Brazil

Altamira Gold Corp. (TSX-V: ALTA) (FSE: T6UP) (OTCQB: EQTRF), is pleased to report assay results from recent resource-extension drilling at the Cajueiro Central project, Brazil.

Highlights:

- The first five diamond drillholes targeting extensions and resource infill at the Cajueiro Central mineral resource have been completed. The drillholes intersected brecciated hydrothermal quartz structures with associated sericitic alteration halos, hosted in rhyolites, consistent with the geological model established by previous programs.

- Hole CJO 114, drilled outside the current resource, returned 7.5m @ 1.02g/t gold from 1.9m depth and 5m @ 1.46g/t gold from 112m depth, confirming that mineralization extends beyond the existing resource boundaries.

- Drillhole CJO 117, drilled within the current resource, returned intercepts of 2.3m @ 6.1g/t gold from 34m and 2.9m @ 1.7 g/t from 78m depth. The upper interval included 0.7m @ 19.0g/t gold, representing the highest-grade primary intercept reported to date in the Baldo sector of the Cajueiro mineral resource, and indicating potential for higher grade shoots within the established mineralized structures.

- Drilling is also in progress at two high-priority and previously untested porphyry targets at Mombaque and Guillermo which are located within the Maria Bonita – Morro Verde trend.

CEO Mike Bennett commented; “Drilling continues to advance both within and around the Cajueiro Central resource, in tandem with drilling of several previously untested porphyry targets across the Cajueiro district. Results from initial drillholes in the current program at Cajueiro Central confirm the style, width and grade of structures extending laterally beyond the existing resource. Our objectives are to add additional ounces to the current inventory and to increase confidence in the existing resource estimate by converting Inferred resources to Indicated resources. Our second drill rig is focused on the initial drill testing of the previously untested district targets at Mombaque and Guillermo. Together with ongoing drilling at the Cajueiro and Maria Bonita mineral resources, we expect this will generate a steady flow of drill results in the coming months.”

CAJUEIRO DISTRICT

The Cajueiro district is located approximately 75km NW of the town of Alta Floresta in the state of Mato Grosso (Figure 1) in central western Brazil. The project is easily accessible by road, lies on open farmland and has grid power and a local water supply. Cajueiro is the most advanced of the key projects that Altamira controls in the region (Figure1).

Figure 1: Location of Altamira Gold’s projects in the Alta Floresta Belt.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4500/281923_bd10b1ccf41a7bac_001full.jpg

The Cajueiro district consists of two independently estimated gold mineral resources at Cajueiro Central and Maria Bonita, plus a series of eight additional untested exploration targets within a radius of 8km of Cajueiro Central.

The Cajueiro Central area has a current open pit resource1 of 5.66Mt @ 1.02 g/t gold for a total of 185,000 oz in the Indicated Resource category and 12.66Mt @ 1.26 g/t gold for a total of 515,000 oz in the Inferred Resource category (estimated using a cut-off grade of 0.25g/t Au and a gold price of US$1,500/oz).

The Maria Bonita open-pit resource consists of Indicated Resources of 24.19Mt @ 0.46g/t gold (for a total of 357,800oz) and Inferred Resources of 25.64Mt @ 0.44g/t gold (for a total of 362,400oz)2. These resources were calculated using a 0.2 g/t gold cut-off grade and a gold price of US$2,780/oz. These resources include near-surface saprolite Indicated Resources of 2.02Mt @ 0.59g/t gold (38,000oz) and Inferred Resources of 0.68Mt @ 0.40g/t gold (8,700oz).

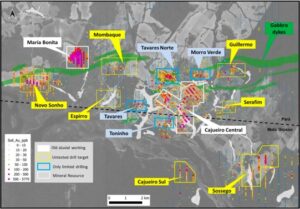

The Maria Bonita porphyry gold deposit forms part of a district-scale portfolio of prospects that are interpreted as having a similar geological origin (Figure 2). The Cajueiro area is characterized by a 15km stretch of former alluvial gold workings along the Teles Pires river. The source of some of this alluvial gold is related to a pronounced east-west corridor of gold anomalies in soils and rock chips and a set of sub-cropping intrusions extending east-west over 8km, implying the presence of a long-standing and deep-seated crustal structure.

Figure 2: Cajueiro district mineral resources at Cajueiro Central and Maria Bonita (white labels) and prospects (blue labels with scout drilling, yellow labels not yet drilled). An alignment of six of the targets occur in close spatial association to a pronounced east-west fault corridor marked by later gabbroic dykes.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4500/281923_bd10b1ccf41a7bac_002full.jpg

Cajueiro Central Drilling Update

The Cajueiro Central resource includes several subsectors, with the majority (54%) of contained gold within the northern Baldo subsector (Figure 3).

Figure 3: Cajueiro Central mineral resources showing trench and diamond drillhole locations.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4500/281923_bd10b1ccf41a7bac_003full.jpg

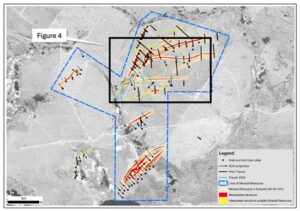

In the current drill program, five diamond drillholes have been completed to date as shown on Figure 4.

Figure 4: Locations of diamond drillholes in current program within the Central resource area.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4500/281923_bd10b1ccf41a7bac_004full.jpg

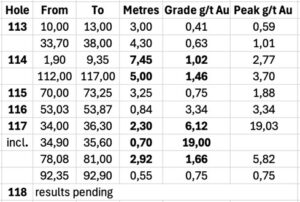

Table 1: Summary of drill results to date within the Central resource area.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4500/281923_bd10b1ccf41a7bac_005full.jpg

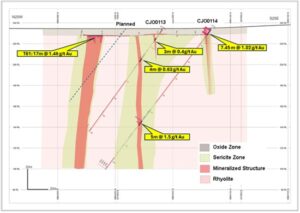

Drillholes CJO 113 and 114 partially tested a broad zone of alteration related to the SW extension of the Baldo “A” structure (Figure 4). This alteration zone contains a zone of 17m @ 1.46g/t gold in trenching which is interpreted as not having been intersected by CJO113 and which will be further drill tested as indicated in Figure 5. Where drilled further north, the Baldo “A” structure dips to the east, whereas the trenched interval is currently interpreted to be sub- vertical.

Drillhole CJO115, which lies outside the resource, intersected a low-grade zone of modest width. Holes CJ0116, 117 and 118 all intersected structures carrying grades >3g/t gold, albeit of relatively narrow widths. The intercept of 0.7m @ 19g/t gold in CJO117 (34.9-35.6m) indicates the presence of high-grade primary gold mineralization in a near surface location. This is the highest primary gold grade found to date in drilling in the Baldo sector of the Cajueiro Central resource. Baldo is the largest sector of the resource in terms of contained ounces of gold.

Figure 5: Cross section for drillholes CJO113 and 114.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4500/281923_bd10b1ccf41a7bac_006full.jpg

Mombaque and Guillermo Targets

Drilling has commenced at the previously untested targets Mombaque and Guillermo (Figure 2). The Mombaque prospect, located about 1.6 km east of the Maria Bonita discovery, hosts a significant gold-in-soil anomaly with porphyry-style alteration and quartz veining at surface that suggests a concealed mineralized system ripe for drilling (see October 16, 2024 press release). At the Guillermo target, 2.5 km northeast of the Cajueiro Central area, rock grab sampling returned high-grade gold up to 39 g/t and surrounding soil anomalies outline an extensive target area now being drill tested for the first time (see December 11, 2024 press release).

New Exploration Camp

The Company has completed construction of a new, low-cost modular exploration camp at its Maria Bonita property (Figure 6). The facility comprises container accommodation, a site office, and purpose-built core logging and sample preparation areas. The Maria Bonita camp is expected to materially enhance logistics and operating efficiency for exploration and project development in the western Cajueiro license area.

Figure 6: Aerial view of new exploration camp recently installed at the Maria Bonita property.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4500/281923_bd10b1ccf41a7bac_007full.jpg

About Altamira Gold Corp.

The Company is focused on the exploration and development of gold projects within western central Brazil, strategically advancing five projects spanning over 100,000 hectares within the prolific Juruena Gold Belt-an area that has historically yielded over 6 million ounces of placer gold3. The Company’s advanced Cajueiro project contains two gold deposits. The central area comprises NI 43-101 resources of 5.66Mt @ 1.02 g/t gold for a total of 185,000 oz in the Indicated Resource category and 12.66Mt @ 1.26 g/t gold for a total of 515,000oz in the Inferred Resource category. In addition, the Maria Bonita gold deposit comprises additional open pit Indicated Resources of 24.19Mt @ 0.46g/t for a total of 357,800oz, and Inferred Resources of 25.64Mt @ 0.44g/t for a total of 362,400oz.

Ongoing exploration and fieldwork at Cajueiro indicate the presence of multiple porphyry gold systems, reinforcing its potential for district-scale development. These hard-rock gold sources align with historical alluvial gold production, highlighting the region’s exceptional gold endowment and potential scalability. With two independently established mineral resources, a highly prospective geological setting and a track record of significant discoveries, the Company is well-positioned to unlock further value across its extensive land package.

1NI 43-101 Technical Report, Cajueiro Project, Mineral Resource Estimate: Global Resource Engineering, Denver Colorado USA, 10thOctober 2019; Authors K. Gunesch, PE; H. Samari, QP-MMSA; T. Harvey, QP-MMSA

2 NI43-101 Technical Report, Mineral Resource for the Maria Bonita Prospect: VMG Consultoria, Belo Horizonte, Minas Gerais, Brazil. 12th June 2025; Author V. Myadzel

3 Juliani, C. et al; Gold in Paleoproterozoic (2.1 to 1.77 Ga) Continental Magmatic Arcs at the Tapajós and Juruena Mineral Provinces (Amazonian Craton, Brazil): A New Frontier for the Exploration of Epithermal-Porphyry and Related Deposits. Minerals 2021, 11, 714. https://doi.org/10.3390/min11070714

On Behalf of the Board of Directors,

ALTAMIRA GOLD CORP.

“Michael Bennett”

Michael Bennett

President & CEO

Tel: 604.676.5661

Toll-Free:1-833-606-6271

info@altamiragold.com

www.altamiragold.com

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE