Altamira Gold Intersects 131.75m of Disseminated Gold Mineralization in First Drill Hole at Mutum, Apiacas Project

Second drill rig contracted for Santa Helena Project

Altamira Gold Corp. (TSX-V: ALTA) (FSE: T6UP) (OTC PINK: EQTRF) is pleased to announce the results of the first two diamond drill holes at the Mutum target within the Apiacas project area, and to provide an update on exploration at the Santa Helena project. Both projects are located within the Alta Floresta Gold Belt in Northern Mato Grosso, Brazil.

Highlights are as follows:

- Results from the first two diamond drill holes at Mutum confirm the presence of a broad zone of disseminated gold within altered intrusive rocks. Drill hole DDMUT-0001 returned 131.75m @ 0.15g/t gold indicating the potential for significant volumes of primary gold mineralization within the project area

- Two new environmental permits totaling 110 hectares have been received to allow drill access to additional areas of the central zone of the former Mutum alluvial workings which extend over an east-west distance of 6km

- A second diamond drill rig has been contracted to begin Altamira’s maiden drill program at the Santa Helena project. An initial 2000m of diamond drilling is planned to test both high-grade gold and copper vein mineralization and possible porphyry targets with drilling expected to begin in November 2021

Michael Bennett, President and CEO of Altamira Gold commented “The results of the first drill holes at Mutum are encouraging and demonstrate that primary gold mineralization is disseminated over wide intervals within altered intrusive rocks. Although the average grade encountered in the first drill hole is subeconomic, permitting considerations meant that we were only able to commence drilling on the periphery of the target area at Mutum. The new environmental permits now doubles the area of the central portion of the Mutum target that Altamira can now drill test. At the same time in the Santa Helena Project area, we are preparing to drill test several targets for the first time with porphyry style mineralization and high grade gold and copper veins to be targeted. Diamond drilling of these targets is expected to begin during late November”.

MUTUM TARGET, APIACAS PROJECT

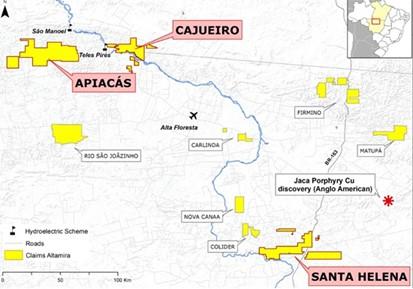

The Mutum target is part of the Apiacas Project area and is located 50 km west of Altamira’s Cajueiro gold project (Figure 1) which hosts 43-101 compliant indicated resources of 5.66Mt @ 1.02 g/t gold for a total of 185,000oz and inferred resources of 12.66Mt @ 1.26 g/t gold for a total of 515,000oz. An estimated 1Moz of colluvial gold was historically recovered from the Mutum target, suggesting the presence of a significant underlying hard-rock deposit.

Figure 1. Regional Map showing the location of the Apiacas (drilling in progress) and Santa Helena (drilling commencing Nov 2021) projects and the Cajueiro project

In 2019, geological mapping outlined an area of pervasive disseminated-style gold mineralization over at least 4 km2 at Mutum. A total of 93 surface rock samples of disseminated and altered rocks collected on surface over this area returned gold values of up to 406.6 g/t gold (see news release dated September 11, 2019). Recent exploration has also identified four high-grade vein structures with channel samples returning values up to 3m @ 10.39 g/t gold. Silver assays have also returned high grade values up to 871 g/t silver (see news release dated March 8, 2021).

In 2021, Altamira completed an extensive Induced Polarization (“IP”) geophysical program which identified an east-west trending chargeability feature 6km in length, associated with quartz-sericite-pyrite alteration and disseminated gold mineralization in intrusive rocks within the area of historic placer gold workings.

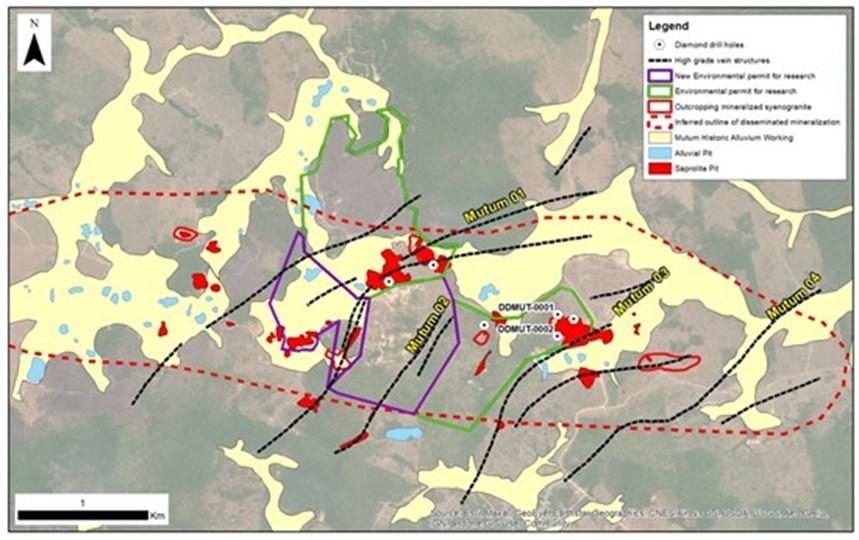

Figure 2. Location of first six diamond drill holes within the Mutum target area in the Apiacas project and the new environmental licenses where further drill testing to the west of the initial drill area will be initiated

Initial diamond drilling has been limited to the areas with active drill permits covering a 1.5 kilometer east-west corridor within the Mutum target. The first six diamond drill holes were drilled to downhole depths of between 126 m and 276 metres (see Figure 2) and targeted both chargeability anomalies and the depth extension of the surface gold mineralization indicated by both the historic artisanal mining and the channel sample results collected by Altamira (see press releases dated June 4th 2019 and June 8th 2021).

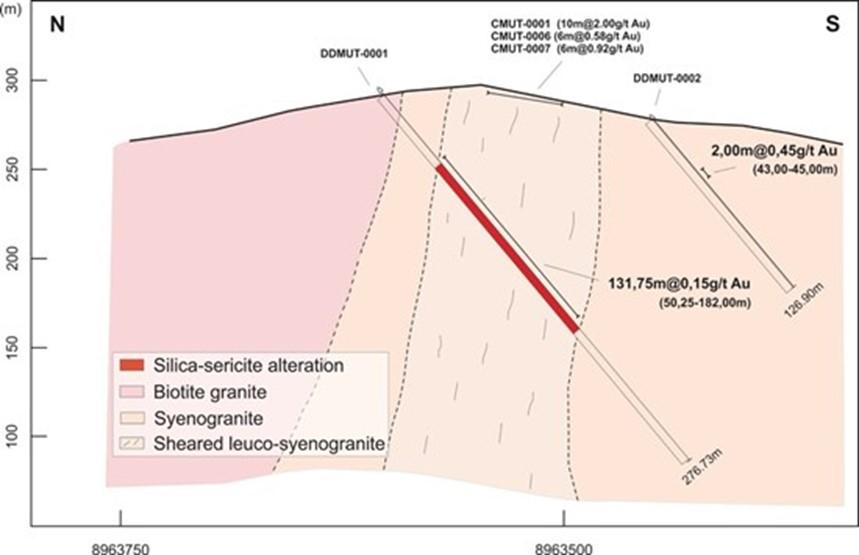

The first diamond drill hole, DDMUT-0001, returned 131.75m @ 0.15g/t gold indicating the presence of widespread disseminated gold mineralization within intrusive rocks at Mutum. The drill hole DDMUT-0001 (see Figure 3) shows a wide section of silicified and sericitized syenogranite which is foliated and displays disseminated pyrite mineralization similar to that mapped and sampled on surface. The second drill hole DDMUT-002 collared to the south of the first hole did not intersect the same silicified and sericitized syenogranite seen in the first hole but cut a two metre wide zone which assayed 0,45 g/t gold within sericitized syenogranite host rock. Drilling of the first six holes was limited to a 1.5 kilometer east-west corridor but with the extension of the environmental permit published recently drilling will be expanded a further 1.5 kilometers to the west in areas which have been historically heavily worked for gold on surface. Both disseminated pyritic and gold mineralization and north-easterly trending higher grade vein structures will be targeted in the next series of drill holes planned for this recently permitted area. Analyses from holes DDMUT-0003-6 are awaited.

Figure 3. Cross section showing the broad, shear related mineralization of drillhole DDMUT01 below the three channel samples CMUT-0001,6 and 7 on surface

SANTA HELENA PROJECT

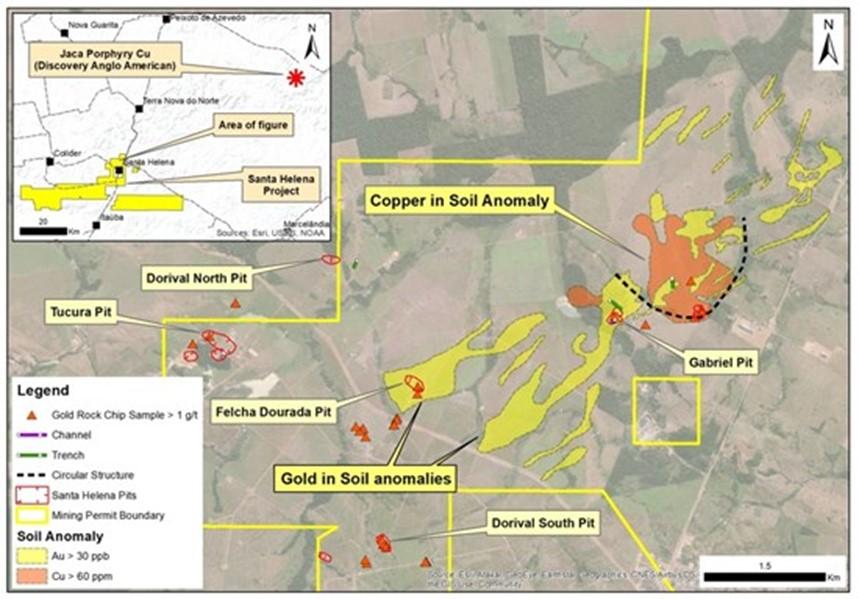

The Santa Helena project is located immediately adjacent to the paved BR-163 federal highway in the state of Mato Grosso and 60km SW of Anglo American’s Jaca porphyry copper discovery (Figure 1). Previous artisanal mining activity has focused on high-grade gold hosted in vein structures. However, mapping, soil and rock chip sampling by Altamira has identified both extensions to the known vein gold targets plus significant copper, molybdenum and gold anomalies related to areas of porphyry-style alteration in a zone which extends 7km E-W by 4 km N-S, indicating the presence of a very large hydrothermal system.

The area consists of undulating farmland with generally poor outcrop and deep weathering. Thus far, five main target areas have been identified (Figure 4), all of which have significant gold and/or copper values on surface. These include; Flecha Dourada (17 surface rock samples average of 31.2 g/t gold + 0.13% Cu), Gabriel (20 surface rock samples average of 19 g/t gold + 0.11% Cu), Dorival (6 surface rock samples average of 24.6 g/t gold) and Tucura (6 surface rock samples average 7.2 g/t gold).

Figure 4. Main targets within the Santa Helena project. Note the widely distributed garimpo pits on high-grade gold veins. Soil sampling and trenching is in progress to define precious and base metal anomalies and to develop ranked targets for ground geophysics and/or direct drill testing

A trenching program has been initiated at the Dorival North target where visible gold and copper oxides in quartz veining have been observed and mapped from surface float and trench samples (see Figure 5).

Figure 5. Visible gold and copper oxide seen in grab samples within the Dorival north target

The most easterly target, Gabriel (Figure 4), includes a small historic open pit artisanal mine which previously produced gold from a series of high-grade veins. A total of 20 rock chip samples were collected on surface from this area in 2018 and returned gold values ranging up to 171.6 g/t gold and 0.96% Cu and averaged 19.0 g/t gold and 0.11% Cu. Seven samples returned values above 10g/t gold.

Recent channel sampling in the former Gabriel garimpo pit has exposed a zone of stockwork quartz veining, 60m wide, in intrusive rocks (see Figure 6). This type of alteration is characteristic of porphyry deposits and additional trenching is in progress to assist with the siting of the initial drillholes on this target.

Figure 6. View of recently excavated trench wall at Gabriel target showing stockwork quartz veining compared to the stockwork seen in the Jaca porphyry copper deposit some 60 kilometers to the north east

Qualified Person

Guillermo Hughes, FAIG and M AusIMM., a consultant to the Company as well as a Qualified Person as defined by National Instrument 43-101, supervised the preparation of the technical information in this news release.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

About Altamira Gold Corp.

The Company is focused on the exploration and development of gold projects within western central Brazil. The Company holds 8 projects comprising approximately 190,000 hectares, within the prolific Juruena gold belt which historically produced an estimated 7 to 10Moz of placer gold. The Company’s advanced Cajueiro project has NI 43-101 resources of 5.66Mt @ 1.02 g/t gold for a total of 185,000 oz in the Indicated Resource category and 12.66Mt @ 1.26 g/t gold for a total of 515,000oz in the Inferred Resource category.

MORE or "UNCATEGORIZED"

Aldebaran Announces Closing of $40 Million Bought Deal Offering

Aldebaran Resources Inc. (TSX-V: ALDE) (OTCQX: ADBRF) is please... READ MORE

Erdene Announces Closing of $25 Million Bought Deal Private Placement

Erdene Resource Development Corp. (TSX:ERD) (MSE:ERDN) (OTCQX: ER... READ MORE

NOVAGOLD Announces Closing of Upsized Bought Deal for Gross Proceeds of US$310 Million

NOVAGOLD RESOURCES INC. (NYSE: NG) (TSX: NG) is pleased to report... READ MORE

Guanajuato Silver Sees Significant Growth in Resources at Valenciana

~ Inferred Mineral Resources Increased by 630% to 20.3M AgEq Ounc... READ MORE

Copper Quest Increases and Closes Unit Offering for Total Gross Proceeds of $2,099,890

Copper Quest Exploration Inc. (CSE: CQX) (OTCQB: IMIMF) (FRA: 3MX... READ MORE