ALPHAMIN ANNOUNCES RECORD PRODUCTION VOLUMES/ Q4 2021 EBITDA GUIDANCE OF US$74m/ DECLARATION OF FY2021 DIVIDEND

Alphamin Resources Corp. (TSX-V:AFM) (JSE AltX:APH), a producer of 4% of the world’s mined tin1 from its high grade operation in the Democratic Republic of Congo, is pleased to provide the following update for the quarter ended December 2021:

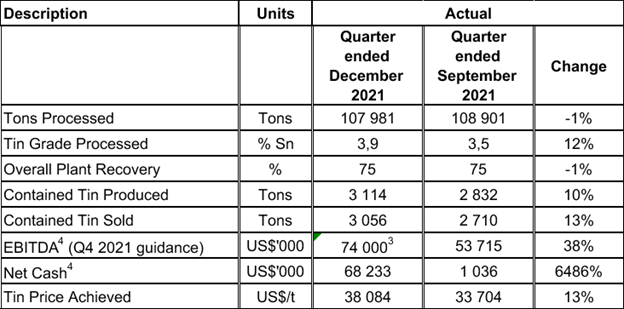

- Contained tin production up 10% from the prior quarter to 3,114 tons

- Contained tin sales up 13% from the prior quarter to 3,056 tons

- Record Q4 EBITDA4 guidance of US$74m, up 38% from prior quarter actual

- Net cash position increases to US$68m

- FY2021 dividend of CAD$0.03 per share declared

Operational and Financial Summary for the Quarter ended December 20212

1Data obtained from International Tin Association Tin Industry Review Update 2021 2Production information is disclosed on a 100% basis. Alphamin indirectly owns 84.14% of its operating subsidiary to which the information relates. 3Q4 2021 EBITDA represents management’s guidance. 4This is not a standardized financial measure and may not be comparable to similar financial measures of other issuers.See “Use of Non-IFRS Financial Measures” below for the composition and calculation of this financial measure.

Operational and Financial Performance

Contained tin production of 3,114 tons is 10% above the previous quarter. Improved underground mining practices relating to stope planning, delineation and blasting resulted in better grade control with an average tin grade of 3,8% processed during the five months ended December 2021. Waste development is now well ahead of current mining areas providing flexibility in blending high- and low-grade areas for a more consistent grade profile.

Contained tin sales of 3,056 tons increased 13% from the prior quarter.

EBITDA guidance of US$74m for Q4 2021 is estimated to be 38% higher than the actual EBITDA for the previous quarter of US$53,7m as a result of increased tin production and sales volumes, together with a higher average tin price achieved of US$38,084/t (Current tin price: ~US$39,000/t).

The Group Net Cash position as at 31 December 2021 increased by US$67m from the prior quarter.

Contained tin production guidance for the financial year ending December 2022 is 12,000 tons.

The mineral resource estimation exercise for the Mpama South deposit commenced in December 2021. Drilling activities continue with six rigs on-site and the next large batch of external assay results is expected during January 2022.

Alphamin’s audited consolidated financial statements and accompanying Management’s Discussion and Analysis for the quarter and year ended 31 December 2021 are expected to be released on or about 7 March 2022.

FY2021 Dividend Declared

Alphamin’s vision is to become one of the world’s largest sustainable tin producers. From a capital allocation perspective, the Board considers the combination of significant exploration, investment in growth and a high dividend yield a robust value proposition. Dividend distributions will be considered based on excess free cash after taking account of working capital requirements, reserve contingencies and expansion opportunities.

On this basis, the Board resolved to declare a FY2021 CAD$0.03 per share cash dividend on the common shares (approximately US$30m in the aggregate). The Dividend will be payable on 11 February, 2022 to shareholders of record as of the close of business on 4 February, 2022.

Qualified Person

Mr. Clive Brown, Pr. Eng., B.Sc. Engineering (Mining), is a qualified person (QP) as defined in National Instrument 43-101 and has reviewed and approved the scientific and technical information contained in this news release. He is a Principal Consultant and Director of Bara Consulting Pty Limited, an independent technical consultant to the Company.

MORE or "UNCATEGORIZED"

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 Kilometres West of Eureka; Follow-Up Drill Program Underway

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 ... READ MORE

Silver One Announces Closing Of Final Tranche Of $32 Million Financing

Silver One Resources Inc. (TSX-V: SVE) (OTCQX: SLVRF) (FSE: BRK1)... READ MORE

SAGA Metals Achieves 100% Drilling Success in 2025—Reports Final Assays from Trapper South at Radar Critical Minerals Project in Labrador

Exceptional grades of Titanium, Vanadium and Iron in all 15 drill... READ MORE

Near Surface Intersection Yields 6.58 g/t gold over 10.35 metres

Intersection is within 33 metres from surface and contained in a ... READ MORE

Alamos Gold Provides Three-Year Operating Guidance Outlining 46% Production Growth by 2028 at Significantly Lower Costs

Further production growth to one million ounces annually expected... READ MORE