Abitibi Metals Drills 4.9% CuEq over 5.1 Metres within 2.1% CuEq over 13.6 Metres at the B26 Polymetallic Deposit

Highlights:

- High-Grade Drill Results: Hole 1274-24-346 delivered 4.9% CuEq over 5.1 metres within 2.1% CuEq over 13.6 metres, starting at 367 metres depth.

- This high-grade mineralization delineates the southern boundary of the B26 system.

- Results align with the recently updated 2024 Mineral Resource Estimate (MRE):

- Indicated Resources: 11.3 Mt at 2.13% CuEq (1.23% Cu, 1.27% Zn, 0.46 g/t Au, 31.9 g/t Ag)

- Inferred Resources: 7.2 Mt at 2.21% CuEq (1.56% Cu, 0.17% Zn, 0.87 g/t Au, 7.4 g/t Ag)

- Geophysical Survey Initiatives: A downhole electromagnetic (EM) program is planned to explore depth extensions and potential larger mineralized sources near the B26 Deposit.

- Jonathon Deluce, CEO of Abitibi Metals, commented, “We are thrilled with Phase II results from hole 346, which showcases B26’s high-grade expansion potential at the mid-level target, particularly as we continue to work towards defining a deposit that is in the range of 30 – 50 Mt”

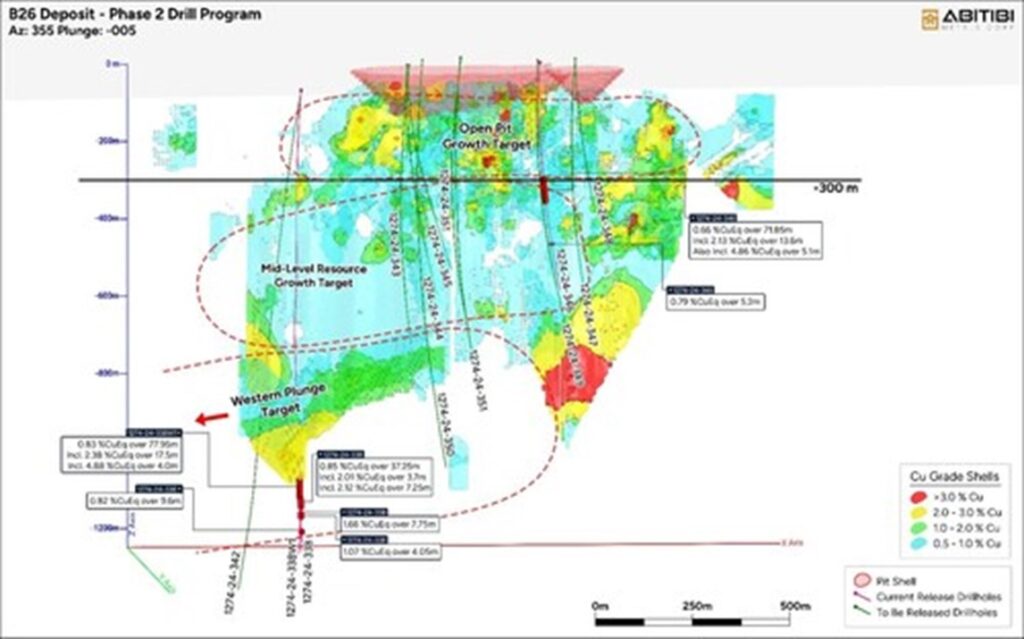

Abitibi Metals Corp. (CSE: AMQ) (OTCQB: AMQFF) (FSE: FW0) is pleased to provide an update on the 16,500-metre Phase II drill program at the B26 Polymetallic Deposit that is currently underway. The new intercept from hole 1274-24-346 is part of a seven-hole, 5,257-meter portion of the Phase II program that is designed to explore along strike from the polymetallic lenses that form the southeastern margin of the B26 system. The ongoing drilling has the objective to expand known lenses and further define higher-grade mineralization. Abitibi Metals is fully funded with $11.5 million to complete the remaining 2024 work program and an additional 20,000 meters in 2025, which will be incorporated into a Preliminary Economic Assessment to complete the option. On November 16th, 2023, the Company entered into an option agreement on the B26 Deposit to earn 80% over 7 years from SOQUEM Inc (see news release dated November 16, 2023).

Jonathon Deluce, CEO of Abitibi Metals, commented, “We are thrilled to announce results from the eastern section of the mid-level resource growth target, where we have confirmed higher grades within a previously untested 100-metre gap in drill coverage. These results reinforce our thesis of expanding the underground resource beyond the current ~850 million pounds of contained copper equivalent.”

“Hole 346 has delivered significant mineralization, with 15–20% pyrite, sphalerite, and chalcopyrite observed in semi-massive bands. These findings are particularly exciting as the southern portion of B26 has consistently shown semi-massive to massive sulfide bands with strong zinc and silver mineralization. This new data and ongoing drilling are expected to enhance our resource model by expanding the influence of higher-grade metal zones.”

Mr. Deluce continued: “We appreciate our shareholders’ patience as assay turnaround times have increased to six–seven weeks due to high sample volumes at year-end. The Company is working closely with the laboratory to expedite processing wherever possible. With continued positive visual indicators from pending drill holes, we look forward to sharing further results.”

1274-24-346

Hole 1274-24-346 was planned to fill a 100-metre gap in the drill grid and to intersect true width at hole 1274-17-252, which was drilled down dip at 180 degrees from the north. Ribboned semi-massive sulfides were intersected over a core length of 13.6 metres, hosting 1–15% chalcopyrite over metre-long intervals associated with 5–20% sphalerite. This intercept returned 0.92% copper, 2.17% zinc, 68 g/t silver, and 0.36 g/t gold from 369 to 382.65 metres.

A higher-grade interval, based on visual observations from 377.55 to 382.65 metres, yielded a CuEq value of 4.86%, comprising 2.24% copper, 4.74% zinc, 140 g/t silver, and 0.36 g/t gold. The zinc and silver-rich mineralization is encapsulated within a broader envelope of 0.66% CuEq over 71.85 metres from 310.8 metres to 382.65 metres.

Further down the hole, within a wide zone of disseminated chalcopyrite, two intervals of copper stringer mineralization were identified, returning 0.49% CuEq and 0.79% CuEq over 6.5 metres and 5.2 metres, respectively. See the detailed table below for more information.

Outlook

Results are pending for six holes targeting section 652750E to 653150E over a strike length of 500 meters, spanning vertical depths from 200 meters to 800 meters. Depending on the results, wedge drilling will be utilized to expand mineralized sectors. Peripheral holes will undergo downhole electromagnetic (EM) surveys to identify potential mineralized extensions at depth. The Company has initiated discussions with various geophysics services providers to start early this winter.

Additionally, the Company is expecting to receive reprocessed data from in-hole gravilog surveys in the near-term.

Table 1: Significant Intercepts

| Hole ID | From (m) | To (m) | Length (m) | CuEq (%) | Cu (%) | Au (g/t) | Ag (g/t) | Zn (%) |

| 1274-24-346 | 310.8 | 382.65 | 71.85 | 0.66 | 0.18 | NS | 29.8 | 0.85 |

| including | 369.05 | 382.65 | 13.6 | 2.13 | 0.92 | 0.14 | 68 | 2.17 |

| including | 377.55 | 382.65 | 5.1 | 4.86 | 2.24 | 0.36 | 140.2 | 4.74 |

| And | 497.3 | 502.5 | 5.2 | 0.79 | 0.75 | NS | 2 | 0.09 |

| Note 1: The intercepts above are not necessarily representative of the true width of mineralization. The local interpretation indicates core length corresponding generally to 80 to 90% of the mineralized lens’ true width.

Note 2: Copper equivalent values calculated using metal prices of $4.00/lb Cu, $1.50/lb Zn, $20.00/ounce Ag and $1,800/ounce Au. Recovery factors were applied according to SGS CACGS-P2017-047 metallurgical test: 98.3% for copper, 90% for gold, 96.1% for zinc, 72.1% for silver. Note 3: Intervals were calculated using a cut off grade of 0.1% Cu Eq, which represents the visual limit of the mineralized system. |

||||||||

Table 2: Drill Hole Information (Mid-Level East Target)

| Drill hole number |

UTM East |

UTM North |

Elevation | Azimuth | Dip | Length (m)

Drilled |

Status |

| 1274-24-346 | 653045 | 5513180 | 276 | 350 | -68 | 639 | Reported |

| 1274-24-347 | 652368 | 5513885 | 276 | 215 | -75 | 651 | Assays Pending |

| 1274-24-348 | 653145 | 5513080 | 276 | 354.2 | -54 | 498 | Assays Pending |

| 1274-24-349 | 653045 | 5513115 | 276 | 350 | -75.9 | 819 | Assays Pending |

| 1274-24-350 | 652751 | 5513089 | 276 | 334.2 | -76 | 1096.5 | Assays Pending |

| 1274-24-351 | 652854 | 5513027 | 276 | 338.1 | -74 | 771.4 | Assays Pending |

| 1274-24-353 | 652856 | 5513030 | 276 | 343.7 | -60 | 783 | Assays Pending |

The core logging program was run by Explo-Logik in Val d’Or, Quebec. The drill core was split with half sent to AGAT Laboratories Ltd. and prepared in Val d’Or, Quebec. All samples are processed by fire assays on 50 gr with atomic absorption finish and by “four acids digestion” with ICP-OES finish, respectively, for gold and base metals. Samples returning a gold grade above 3 g/t are reprocessed by metallic screening with a cut at 106 µm. Material treated is split and assayed by fire assay with ICP-OES finish to extinction. A separate split is taken to assay separately mineralized intervals with target grades above 0.5% Cu using Na2O2 fusion and ICP-OES or ICP-MS finish. Samples preparation duplicates, varied standards, and blanks are inserted into the sample stream.

In the 2018 resource estimate, SGS recommended the QAQC protocol to explain the replicability for the four metals (Au-Cu-Ag-Zn). The Company has set up for this program a series of assaying protocols with the objective to control QAQC issues from the beginning of the project. As a result, samples are crushed finer with 95% of particles passing 1.7 mm and a large split of 1 kg is pulverized down to 106 µm (150 mesh). Other measures put in place include the automatic re-assaying of gold results above 3 g/t by metallic screening and the use of sodium peroxide fusion in mineralized intervals interval corresponding to a target grade above 0.5% Cu.

Qualified Person

Information contained in this press release was reviewed and approved by Martin Demers, P.Geo., OGQ No. 770, a qualified person as defined under National Instrument 43-101, and responsible for the technical information provided in this news release.

About Abitibi Metals Corp:

Abitibi Metals Corp. is a Quebec-focused mineral acquisition and exploration company focused on the development of quality base and precious metal properties that are drill-ready with high-upside and expansion potential. Abitibi’s portfolio of strategic properties provides target-rich diversification and includes the option to earn 80% of the high-grade B26 Polymetallic Deposit, which hosts a resource estimate of 11.3MT @ 2.13% Cu Eq (Ind) & 7.2MT @ 2.21% Cu Eq (Inf), and the Beschefer Gold Project, where historical drilling has identified 4 historical intercepts with a metal factor of over 100 g/t gold highlighted by 55.63 g/t gold over 5.57 metres and 13.07 g/t gold over 8.75 metres amongst four modeled zones.

About SOQUEM:

SOQUEM, a subsidiary of Investissement Québec, is dedicated to promoting the exploration, discovery and development of mining properties in Quebec. SOQUEM also contributes to maintaining strong local economies. Proud partner and ambassador for the development of Quebec’s mineral wealth, SOQUEM relies on innovation, research and strategic minerals to be well-positioned for the future.

Figure 1: B26 Deposit Phase II with the Location of Significant Assay Results in 1274-24-346 (CNW Group/Abitibi Metals Corp.)

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE