A Critical Investor Q & A With Golden Independence CEO Christos Doulis

Against a backdrop of massive inflation, at highest levels in decades and initiated by COVID-19 related disruptions of supply chains, Golden Independence Mining (CSE: IGLD) (OTCQB:GIDMF) (FRA:6NN) is working diligently in order to activate a few important catalysts. The first of those that can be expected before year end is the upcoming Preliminary Economic Assessment, the other one is the renegotiation of the JV terms with vendor America’s Gold Exploration (AGEI), which could increase the very recently earned-in ownership from 51% to 100%. Depending on the terms, this could be a very important improvement on valuation for investors. Since these catalysts could both be potential gamechangers, and I’m also interested in exploration plans in order to expand/infill the existing resource, this seems a good time to do a Q & A with CEO Christos Doulis.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

The Critical Investor (TCI): It was good to see you at Mines & Money in London, my first conference since PDAC 2020, these are remarkable times for sure. I noticed there were quite a few last minute cancellations, but you decided to come out in person anyway?

Christos Doulis (CD): I thought it was important to start meeting with investors face to face, particularly given our imminent completion of the earn-in and formation of the Joint Venture with AGEI at the time.

TCI: Let’s turn towards Golden Independence, and start with some basics. As you raised C$2.8M in April, and C$501k in June, your current cash position according to your presentation is C$1.5M. You very recently earned into the initial 51% ownership of the Independence Gold project, so this was right on time before year’s end, and when exactly will the PEA come out?

CD: We will also have the PEA completed before year’s end 2021.

TCI: Are you planning to raise more money soon?

CD: We will have sufficient resources to keep the lights on for well over a year but will need to raise some money to continue advancing the Independence project in 2022. At current prices any capital raise would be small and likely insiders or a strategic investor only.

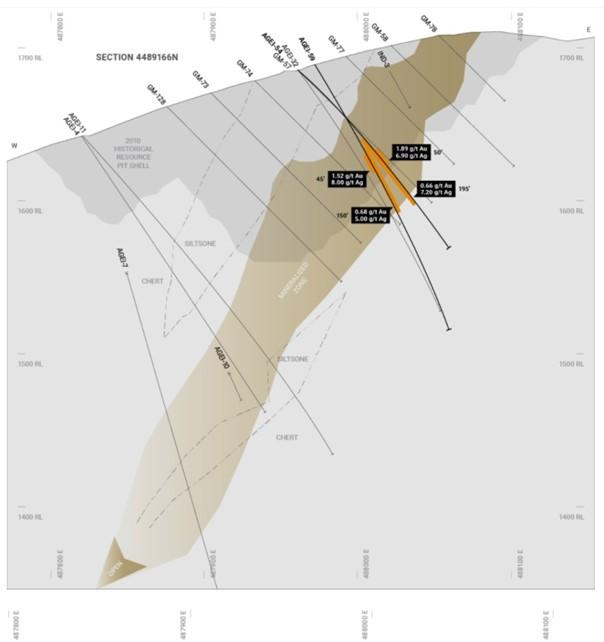

TCI: Your current resource already stands at 1.48Moz @1.18g/t Au M&I&Inf, of which 684koz @0.39g/t Au is classified as being near surface oxide mineralization. The underground portion is all Inferred, and much higher grade skarn: 796koz @ 6.534g/t Au. Interestingly this is all drilled by reverse circulation drilling (RC). I was told a while ago that in order to advance to reserves, and in turn a Feasibility Study, you need to have your resource infill drilled by diamond drilling. After looking into it, this doesn’t appear to be true as especially in Nevada lots of oxide deposits are proven up by RC drilling up to reserves. I have two questions for you: a. to what extent do you think the resource could grow when the PEA comes out, and b. why do you need diamond drilling for the skarn resource?

CD: Our near surface resource is about as big as it will get, and although additional drilling can add some ore, the total near surface (ie heap leach) project scale is unlikely to grow based on our current footprint. We use RC drilling for the shallow near surface resource but require core drilling for the deeper skarn resource.

TCI: What exploration plans do you have for the skarn resource, and do you have a size target in mind?

CD: Our current skarn resource is 796,200 ounces of gold. We believe the Independence property has the potential to host up to two times that amount of high grade skarn material.

TCI: As you are focusing on the oxide open pit component, and I made some assumptions in my last analysis on Golden Independence economics, something caught my eye in the presentation. Despite high recoveries for heap leach (around 80%) and a near surface 684koz Au resource available, it is mentioned that the company currently believes just a 7y LOM with 35koz AuEq per annum is achievable. Could you explain to me why such a small total production number of 245koz AuEq is contemplated, as the resource is much larger?

CD: Our initial near surface resource was unconstrained by metallurgy and as we advance to a PEA we will lose quite a few ounces as we better understand the redox boundary now and where the sulfides (with much lower recoveries) begin in earnest.

TCI: As you are well aware, such production numbers could result in lower NPV5 figures. Could you disclose your ballpark estimate where the PEA might be heading in this regard, and if the current market cap of C$6.58M still is very undervalued like it seemed earlier this year at a higher share price?

CD: Heap leach projects of this scale are generally in the US$40M to US$60M NPV5 range. Clearly there is upside potential in our shares from the near term cash flow potential of the heap leach as well but the really big part of the story is the world class potential of the high grade skarn at depth.

TCI: Since investing is all about share price appreciation, there are various ways to achieve this in this case. Besides an increasing gold price which is not within the span of control of the company, the resource could grow, PEA economics could improve, but also the JV deal terms could improve. Could you tell us what your ideas and potential upside are on all three subjects, if you can disclose?

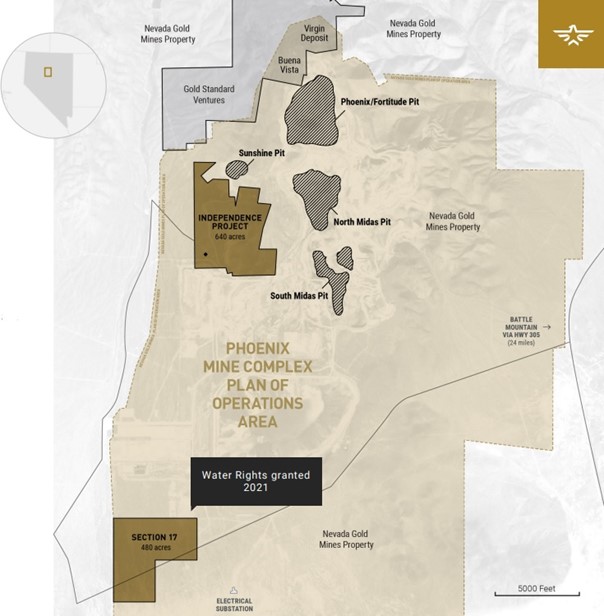

CD: Our private partner, AGEI, currently holds a 49% interest in the project but I hope to induce AGEI to consolidate 100% of the project in Golden Independence as it will make a cleaner investment vehicle and M&A target. We are also looking at potentially growing the project by regional M&A as there are several orphan heap leach deposits nearby that do not merit stand-alone development due to size but could well be part of a larger development scenario. Given our close proximity to the operating Phoenix Mine, if we could strike a deal with the operator NGM to utlize their infrastructure such as power we could also reduce capital costs at the Independence project. Discussions are ongoing.

TCI: We discussed at another time the potential to consolidate the Virgin Deposit, Buena Vista and the Sunshine Pit, to create and develop a comprehensive cluster of mineralized envelopes. There is also the opportunity to approach the deeper located skarn resource from the North Midas Pit, in case NGM buys the company. What is the current status of these negotiations if you can disclose?

CD: Negotiations are ongoing but were unable to begin in earnest until the Joint Venture was formed allowing clarity on 100% of the project.

TCI: I also understood you were in talks with Barrick, could you elaborate more on this?

CD: They are our neighbour and we are in regular dialogue regarding development of the Independence project

TCI: As drilling around super hole AGEI-32 (24.4m grading 9.11 g/t Au and 25.2 g/t Ag, all oxides) was something very special, the Phase II drill program didn’t return equally stunning results unfortunately ( highlighted by 13.7m @ 1.5g/t Au, 15.2m @ 1.89g/t Au, 25.9m @ 1.06g/t Au, 30.5m @ 1.19g/t Au and 21.3m @ 1.7g/t Au). Notwithstanding this, most results are actually within open pit boundaries.

I wondered if the stellar drill hole was simply an outlier, or could the company still be looking to more high grade oxides?

CD: We are definitely looking to find more high grade material at Independence.

TCI: In your presentation you are planning an updated resource estimate in Q4, 2022. What is your target for the new resource by then, and do you have a final target in mind?

CD: It is hard to opine on that now given that we have no active program planned yet, until we raise more cash. The upcoming new resource estimate for the PEA will build on our May resource and incorporate an additional 12 holes. I’m not anticipating a huge increase in the resource from the 12 holes. Furthermore, with the inclusion of metallurgy our total mineable resource is likely to decrease relative to our current metallurgically unconstrained resource.

TCI: Something I didn’t really wrap my head around are the permitting timelines in the presentation. Does this mean Golden Independence doesn’t need to do an Environmental Impact Statement (EIS) of 18-22 months but just an Environmental Assessment (EA) of 8-12 months? Is the company already proceeding with baseline studies etc?

CD: We operate under the EA regime which is basically an amendment to an existing EIS. We are well advanced on environmental and other baselines studies to advance the heap leach portion of the project to production.

TCI: What is the status of the lawsuit regarding a different view about compensation for the Independence Project?

CD: Our initial court date in set for July 2022. No further comment.

TCI: I noticed the Hilo spin-out. What is actually the benefit for the company?

CD: The benefit is for our shareholders that now have an additional equity in their portfolio.

TCI: We discussed a potential uplisting to the Venture earlier this year. To me Golden Independence looks like a no brainer for institutional investors, but often they have no mandate for CSE stocks. What is the status of this possibility?

CD: It is very possible we will move to TSXV in the future.

TCI: As we are nearing the end of this interview, do you have anything else to add for the audience?

CD: It has been a terrible year for gold but I urge your readers to recall the old adage to “Buy when others are selling”. We have significantly de-risked the project and company over the last year and yet our shares are at their lowest. To me this looks like a great time to buy Golden Independence,

TCI: Thank you for your time.

This concludes the Q & A with CEO Christos Doulis, and should provide readers with an adequate update of his plans with Golden Independence for now.

Conclusion

With another wave of COVID-19 coming, tax loss selling approaching peak levels, a Fed doubting wether it should taper or not, inflation running wild and the gold price stagnating around US$1800/oz, Golden Independence seems to focus on its own subjects, as they earned into a 51% of the JV, a PEA is coming out within weeks, and hopefully in Q1, 2022 a successfully renegotiated deal with the arm’s length vendor. As the PEA economics will likely not surprise to the upside, this renegotiation is extremely important to Golden Independence from a valuation standpoint. After this the company could look at further expanding the resource, and especially the deeper underground skarn mineralization. The skarn is of interest for Nevada Gold Mines, which owns the Phoenix Mine complex literally a stone throw away, since Phoenix ran out of exactly the same type of ore and is mining low grade skarn at the moment. Let’s see if CEO Doulis can successfully navigate Golden Independence through these volatile markets.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter on my website www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a long position in this stock. Independence Gold is a sponsoring company. All facts are to be checked by the reader. For more information go to www.goldenindependence.co and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

MORE or "UNCATEGORIZED"

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 Kilometres West of Eureka; Follow-Up Drill Program Underway

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 ... READ MORE

Silver One Announces Closing Of Final Tranche Of $32 Million Financing

Silver One Resources Inc. (TSX-V: SVE) (OTCQX: SLVRF) (FSE: BRK1)... READ MORE

SAGA Metals Achieves 100% Drilling Success in 2025—Reports Final Assays from Trapper South at Radar Critical Minerals Project in Labrador

Exceptional grades of Titanium, Vanadium and Iron in all 15 drill... READ MORE

Near Surface Intersection Yields 6.58 g/t gold over 10.35 metres

Intersection is within 33 metres from surface and contained in a ... READ MORE

Alamos Gold Provides Three-Year Operating Guidance Outlining 46% Production Growth by 2028 at Significantly Lower Costs

Further production growth to one million ounces annually expected... READ MORE