Giyani Receives Letter of Interest from EXIM for US$225 million

Giyani Metals Corp. (TSX-V:EMM) (GR:A2DUU8) developer of the K.Hill Battery-Grade Manganese Project in Botswana is pleased to announce that it received a non-binding letter of interest from the Export-Import Bank of the United States for up to US$225 million in financing to support the construction of the Project.

Highlights:

- Following several months of engagement with EXIM, Giyani has received a non-binding LOI dated 6 June 2025 from US EXIM for up to US$225 million long-term debt with a repayment period of up to 15 years for construction of the Project.

- The potential funding from EXIM falls under the Supply Chain Resilience Initiative the aim of which is to reduce US dependence on critical mineral supply chains controlled by the People’s Republic of China.

- US EXIM is the official Export Credit Agency to the US Government.

- A key requirement to unlock the funding from EXIM is to secure offtake contracts with US companies, which is a fundamental component of Giyani’s strategy.

The LOI from EXIM is not a binding commitment to provide financing; rather, it marks an initial step in the formal application process. Any potential debt financing remains contingent upon the successful completion of due diligence, agreement on final terms, and execution of definitive documentation, namely a Definitive Feasibility Study. Giyani has a DFS underway which is forecast to be completed in Q1 2026.

Charles FitzRoy, President and CEO of the Company, commented:

“The receipt of the LOI from EXIM marks an important milestone on Giyani’s journey to securing project financing for the construction of the K.Hill Manganese Project. Giyani has held numerous discussions with EXIM which have culminated in the issuance of the LOI. Whilst this is the first step in the process of securing possible funding, this important milestone validates Giyani as a preferred strategic developer of battery-grade manganese products. We look forward to furthering our relationship with EXIM and other strategic partners as Giyani continues to diligently work towards its goals and ultimately maximize value for our stakeholders through the development of this vital critical minerals project.

ECA funding is an important part of financing critical minerals projects, as it offers the potential to secure lower cost loans than traditional debt, with longer repayment periods. These type of structures can enable groups like Giyani to maximize value for shareholders by securing more attractive annual repayments for project financing

About the Supply Chain Resilience Initiative

The SCRI is a strategic program launched in January 2025 by EXIM to enhance US economic security by reducing dependence on critical mineral supply chains controlled by the People’s Republic of China. SCRI aims to strengthen US manufacturing sectors such as semiconductors, batteries, and electric vehicles, by ensuring a stable and diversified supply of critical minerals.

More information about the SCRI can be found at the following link.

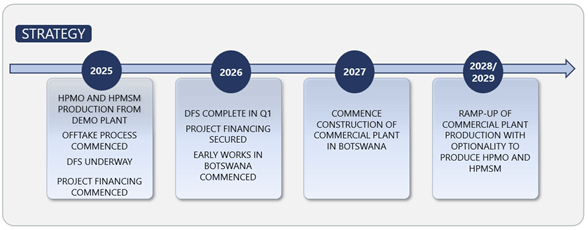

Strategy Overview

About Giyani

Giyani is focused on becoming a preferred western-world producer of sustainable, low carbon high purity battery grade manganese for the EV and ESS industry. The Company has developed a proprietary hydrometallurgical process to produce battery-grade manganese (HPMSM and HPMO), a lithium-ion battery cathode precursor material critical for EVs and ESS.

Additional information and corporate documents may be found on www.sedarplus.ca and on Giyani Metals Corp. website at https://giyanimetals.com/.

About EXIM

The Export-Import Bank of the United States (EXIM) is the US Government’s official export credit agency, created in 1934 to promote American jobs by financing the export of US goods and services. EXIM offers tools such as export credit insurance, loan guarantees, and direct loans to help US companies, particularly small and mid-sized businesses, compete in global markets when private sector financing is unavailable. In 2025, EXIM introduced the SCRI to enhance the security and reliability of US supply chains by supporting overseas projects that supply critical materials to American manufacturers.

MORE or "UNCATEGORIZED"

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 Kilometres West of Eureka; Follow-Up Drill Program Underway

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 ... READ MORE

Silver One Announces Closing Of Final Tranche Of $32 Million Financing

Silver One Resources Inc. (TSX-V: SVE) (OTCQX: SLVRF) (FSE: BRK1)... READ MORE

SAGA Metals Achieves 100% Drilling Success in 2025—Reports Final Assays from Trapper South at Radar Critical Minerals Project in Labrador

Exceptional grades of Titanium, Vanadium and Iron in all 15 drill... READ MORE

Near Surface Intersection Yields 6.58 g/t gold over 10.35 metres

Intersection is within 33 metres from surface and contained in a ... READ MORE

Alamos Gold Provides Three-Year Operating Guidance Outlining 46% Production Growth by 2028 at Significantly Lower Costs

Further production growth to one million ounces annually expected... READ MORE