LUCA 2024 YEAR-END RESULTS HIGHLIGHT TRANSFORMATIVE GROWTH AND ACHIEVEMENT

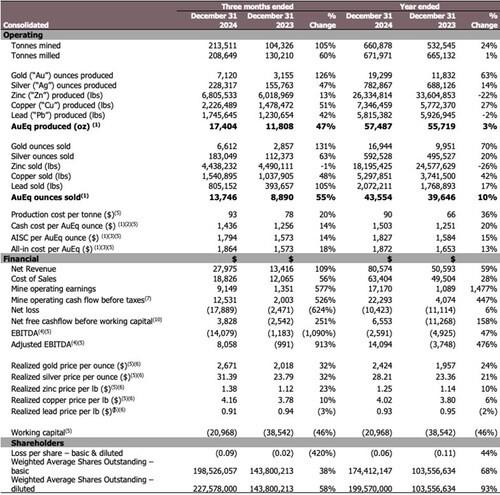

Luca Mining Corp. (TSX-V: LUCA) (OTCQX: LUCMF) (Frankfurt: Z68) is pleased to report results for the fourth quarter and year ended December 31, 2024. The Company achieved record annual production of 57,487 ounces gold equivalent leading to record-high mine operating cash flow before taxes of USD $22.3 million with net free cash flow before working capital at USD $6.6 million and an adjusted EBITDA of USD $14.1 million. These excellent results showcase the effectiveness of the Company’s programs for construction, optimization and ramp up in the operations as well as improving mine planning and operating strategy. Carrying on the positive momentum, 2025 production is expected to range from 80,000 to 100,000 ounces gold equivalent, a year on year increase of over 38 to 73%.

Net revenue for the year ended December 31, 2024, increased by 59% to USD $80.6 million, compared to 2023. Mine operating earnings rose significantly to USD $17.2 million, representing a 1,477% increase year-over-year. As anticipated, cash costs and all-in sustaining costs (“AISC”) increased by 20% and 15%, to USD $1,503 and USD $1,827 per gold equivalent ounce produced, respectively, reflecting the transition to contract mining at Campo Morada and the Company’s strategic investments in mine and mill infrastructure.

Despite the Company’s significantly improved operational performance, net earnings were materially impacted by a non-cash accounting adjustment related to the Tahuehueto silver stream. During 2024, the Company amended the terms of the Stream (refer to the August 15, 2024 press release). As part of the amendment, a portion of the Stream was settled in cash, shares, and refined silver not produced at the Tahuehueto mine. This change resulted in the Stream being reclassified as a derivative instrument and measured at fair value. The difference between the fair value of the Stream and its previous carrying value as deferred revenue resulted in a cumulative initial non-cash expense of USD $14.4 million which was recorded in the statement of loss and comprehensive loss. As a result, the Company recorded a net loss of USD $10.4 million for the year. The fair value of the Stream will be re-assessed at each quarter in the future and the resulting gain or loss will be recognized in the statement of loss and comprehensive loss.

Financial and operating results for the three and twelve months ended December 31, 2024 are summarized below. All amounts are in U.S. dollars unless otherwise indicated.

| 1. | Gold equivalents (“AuEq“) are calculated using an 84.96:1 (Ag/Au), 0.0005:1 (Au/Zn), 0.0016:1 (Au/Cu) and 0.0003:1 (Au/Pb) ratio for Q4 2024; an 85.07:1 (Ag/Au), 0.0006:1 (Au/Zn), 0.0019:1 (Au/Cu) and 0.0005:1 (Au/Pb) ratio for Q4 2023, an 82.59:1 (Ag/Au), 0.0005:1 (Au/Zn), 0.0018:1 (Au/Cu) and 0.0004:1 (Au/Pb) ratio for YTD 2024; and an 84.37:1 (Ag/Au), 0.0007:1 (Au/Zn), 0.0020:1 (Au/Cu) and 0.0005:1 (Au/Pb) ratio for YTD 2023, respectively. |

| 2. | Cash cost per gold equivalent ounce includes mining, processing, and direct overhead costs. See Reconciliation to IFRS on page 37 the Company’s MD&A. |

| 3. | AISC per AuEq oz includes mining, processing, direct overhead, corporate general and administration expenses, reclamation, and sustaining capital on page 37 in the Company’s MD&A.. |

| 4. | See Reconciliation of earnings before interest, taxes, depreciation, and amortization on page 36 in the Company’s MD&A. |

| 5. | See “Non-IFRS Financial Measures” on page 33 in the Company’s MD&A. |

| 6. | Based on provisional sales before final price adjustments, treatment, and refining charges. |

| 7. | Mine operating cash flow before taxes is calculated by adding back royalties, changes in inventory and depreciation and depletion to mine operating loss. See Reconciliation to IFRS on page 34 in the Company’s MD&A. |

| 8. | All-in cost per AuEq oz includes AISC plus interest paid and loan payments. See page 37 in the Company’s MD&A. |

| 9. | Production costs include mining, processing, and direct overhead cost at the operation sites. See reconciliation on page 37 in the Company’s MD&A. |

| 10. | Net free cash flow before working is operating cash flow before working capital changes, less capital expenditures. See page 34 in the Company’s MD&A. |

Dan Barnholden, CEO, commented, “It has been an extraordinary year for Luca. We have transformed our operations, transformed our finances, and have embarked on exciting, high impact exploration at both of our mines. Optimization programs at both mines are ongoing, and our increasing focus on precious metals grades and recoveries at Campo Morado will be an increasing focus of our efforts going forward. Over the course of 2025, we expect production levels to reach 80,000 to 100,000 ounces gold equivalent and free cash flow to be between $30 million and $40 million. These extraordinary outcomes set the stage for further organic growth initiatives and, increasingly, to turn our attention to accretive M&A opportunities, as we set our sights on becoming a leading mid-tier producer.”

Proactive and Successful Health and Safety Record

- The Company is proud of its outstanding health and safety record, having recently celebrated a major milestone of one million hours without a Lost Time Incident at Campo Morado.

- This achievement underscores the Company’s unwavering commitment to safety and operational excellence and is a testament to the dedication, professionalism and teamwork of our operations team. Their commitment to high safety standards, clear communication and collaboration made this possible.

- Maintaining a safe and efficient work environment is a key pillar of the Company’s sustainability and operational strategy. Luca continually invests in comprehensive safety training, rigorous protocols and advanced monitoring systems to protect the health and well-being of the Company’s workforce at both the Campo Morado and Tahuehueto mines.

- As a conscientious mining entity, Luca recognizes the paramount importance of the Health and Safety of our employees and the significance of Environmental, Social, and Governance considerations in all aspects of its operations. Our four key pillars of responsible and sustainable mining operations centre around Health and Safety, Environmental Stewardship, People, Community and Culture and Governance & Ethics.

Record Production

- Mill throughput significantly increased over the course of the fourth quarter as both Campo Morado and Tahuehueto ramped up to targeted levels. Campo Morado achieved its objective of 2,000 tonnes per day late in the year with Tahuehueto following closely behind, reaching its objective of an average of 820 tonnes per day in the first quarter of 2025. Commercial production at Tahuehueto was declared on March 31, 2025.

- In total, the Company produced 57,487 gold equivalent ounces in 2024 with 30% or 17,404 of our gold equivalent ounces produced in the fourth quarter.

- Consolidated gold equivalent metal production breakdown for the year was 34% gold, 16% silver, 22% copper, 24% zinc and 4% lead.

- For the twelve months ended December 31, 2024, Campo Morado accounted for approximately 68% of total gold equivalent production, while Tahuehueto contributed 32% of gold equivalent ounces produced.

- Individual metal production for the year was:

- Gold (oz): 19,299 (an increase of 63% over 2023)

- Silver (oz): 782,867 (an increase of 14% over 2023)

- Zinc (lbs): 26,334,814 (a decrease of 22% over 2023)

- Copper (lbs): 7,346,459 (an increase of 27% over 2023)

- Lead (lbs): 5,815,382 (a decrease of 2% over 2023)

- As a result of the Company’s ongoing optimization program, metal recoveries improved quarter over quarter with the exception of zinc which remained roughly the same throughout the year. Fourth quarter metal recoveries were:

- Average gold recovery: 56.3%

- Average silver recovery: 46.2%

- Average zinc recovery: 79.8%

- Average copper recovery: 79.5%

- Average lead recovery: 55.6%

Successful Exploration

- A 5,000 metre exploration program was initiated at both Tahuehueto and Campo Morado, the first drill campaigns in over a decade. The primary objective is to delineate additional near mine mineral resources to add to each mine plan. Secondly, the Company will drill further afield to test the district scale potential of its properties, with a particular focus on higher precious metals zones at Campo Morado.

- At Campo Morado, a new gold, silver, zinc mineralized zone was discovered below the main G-9 ore body.

- At Tahuehueto, drilling intersected a new high-grade brecciated gold zone within the El Creston vein system.

- These results are highly encouraging and the Company intends carry on and expand its exploration efforts. Multiple, untested priority targets exist on both projects.

Debt Reduction On Track

- The Company is on track to repay its debt as it comes due between now and mid-2026. To date, Luca’s total debt has been cut in half from $18 million down to $9 million, including the buy back and cancelling of a convertible debenture. It may be possible to significantly accelerate the debt repayment using cash generated from operations and warrant exercise.

Strong Balance Sheet

- To facilitate the ongoing work on the Campo Morado Improvement Program, exploration drilling at both Campo Morado and Tahuehueto, and commissioning of the Tahuehueto mill, the Company completed a C$11.3 million private placement in Q3 to bolster its balance sheet.

About Luca Mining Corp.

Luca Mining Corp. is a Canadian mining company with two wholly owned mines located in the prolific Sierra Madre mineralized belt in Mexico. These mines produce gold, copper, zinc, silver, and lead and generate strong cash flow. Both mines have considerable development and resource upside as well as world-class exploration potential.

The Company’s Campo Morado Mine, located in Guerrero State, hosts VMS-style, polymetallic mineralization within a large land package comprising 121 sq km. It is an underground operation, producing zinc, copper, gold, silver and lead.

The Tahuehueto Mine is a large property of over 75 sq km, located in Durango State. The project hosts epithermal gold and silver vein-style mineralization. Tahuehueto is a newly constructed underground mining operation producing primarily gold and silver contained in zinc and lead concentrates. The Company has successfully commissioned its mill and is now in commercial production.

Table 1 (CNW Group/Luca Mining Corp.)

MORE or "UNCATEGORIZED"

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 Kilometres West of Eureka; Follow-Up Drill Program Underway

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 ... READ MORE

Silver One Announces Closing Of Final Tranche Of $32 Million Financing

Silver One Resources Inc. (TSX-V: SVE) (OTCQX: SLVRF) (FSE: BRK1)... READ MORE

SAGA Metals Achieves 100% Drilling Success in 2025—Reports Final Assays from Trapper South at Radar Critical Minerals Project in Labrador

Exceptional grades of Titanium, Vanadium and Iron in all 15 drill... READ MORE

Near Surface Intersection Yields 6.58 g/t gold over 10.35 metres

Intersection is within 33 metres from surface and contained in a ... READ MORE

Alamos Gold Provides Three-Year Operating Guidance Outlining 46% Production Growth by 2028 at Significantly Lower Costs

Further production growth to one million ounces annually expected... READ MORE