Lion Rock Acquires High-Grade Gold-Lithium Volney Project in South Dakota

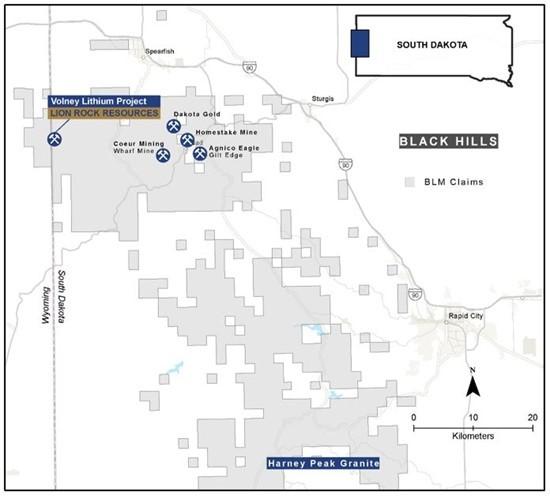

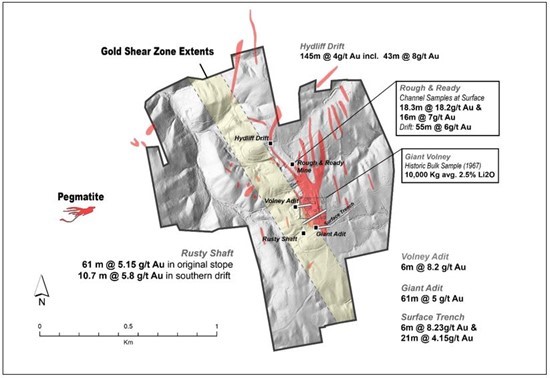

Lion Rock Resources Inc. (TSX-V: ROAR) (FSE: KGB) is pleased to announce that it has entered into an option agreement dated October 7, 2024 with Tinton Partners and The Tinton Land, LLC, pursuant to which the Optionor has granted to the Company the exclusive right and option to acquire an undivided 100% interest in the Volney property, a high-grade gold-lithium project, strategically located in the northern Black Hills of South Dakota (Figure 1). The Volney Project is comprised of 38 private claims extending over 351 acres (142 ha) and features two predominant styles of mineralization: shear-hosted gold and Lithium-Tantalum-Tin within the pegmatites. The Volney Project hosts the Giant Volney Pegmatite (Li) and numerous historic workings including Rusty Mine (Au), Rough and Ready (Sn) and Hydliff Adit (Au) shown in Figure 2. Historic results include 18.2 g/t Au over 18.3 m in channel sampling at Rough and Ready and 15 grab samples with an average grade of 4.4% Li2O at the Giant Volney pegmatite (Table 1).

Figure 1. Volney Project regional map in the Black Hills, South Dakota.

Figure 2. Volney Project map showing documented pegmatite locations, historic shafts and gold hosted shear zone.

Dale Ginn, President and CEO of Lion Rock, stated, “The Volney Project is unique in that it contains multiple commodities including gold, lithium, tantalum and tin, all of which are of a high-grade nature and near surface. The gold system runs the full length of the property and contains numerous shallow trenches, pits and other workings, but is remarkably absent of any meaningful drilling or recent exploration work. The fact that the entire project lies on private land and is road accessible year-round, decreases permitting time and allows for a timely and aggressive exploration program.”

Acquisition Highlights

- The Volney Project. The Volney Project is 142 ha in the Tinton District of the Black Hills. The Tinton District was the second-most productive alluvial goldfield in the Black Hills. Adjacent and parallel to the Giant Volney pegmatite is a 3.5 km long shear zone, host to multiple occurrences of gold mineralization and historic workings. Gold mineralization in at least three different settings including sheared/altered amphibolite, broadly mineralized basalt and iron formation. Historic pegmatites on the Volney Project comprise of seven discrete pegmatite bodies ranging from 10 to 23 m wide, converging to the south to form a >120 m wide lithium-rich pegmatite, the Giant Volney, over a known strike length of 635 m at surface (Figure 2)1.

- Historic High-Grade Gold Mineralization: The Volney Project contains an extensive shear hosted gold system, bordering the western extents of the Giant Volney. The shear zone is within an amphibolite schist derived from an archean basalt, measuring 73m wide and tested over a strike length of 3.5km. Historical workings at the Rusty Mine had reported intersections of 5 g/t– 15 g/t Au over 15-45 m in the main altered amphibolite zone2. Petrography of the core from Homestake Mining reveal the dominant sulphide minerals as pyrite, arsenopyrite and pyrrhotite. Arsenopyrite is concentrated along the margins of the quartz veins, which contains abundant magnetite inclusions making it highly magnetic. The mineralized quartz veins were observed to have native gold grains as fracture filling and between the arsenopyrite grains3

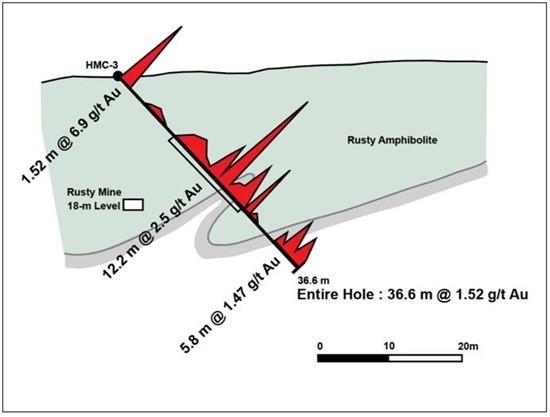

Drilling: In 1975, Homestake Mining Company drilled at the historic Rusty Shaft, intercepting gold mineralization in eight shallow holes. HMC-3 highlights 36.6 m at 1.52 g/t Au including four higher grade sections starting at surface to the end of the hole (Figure 4). All holes were no deeper than 50 m below surface.

- Historic High Grade LCT Pegmatite at Giant Volney.

- 15 grab samples collected by Nellis (1973) from the exposed quartz- spodumene orebody at the extreme southern end of the Giant Volney averaged a grade of 4.4% Li2O (Table 1)1.

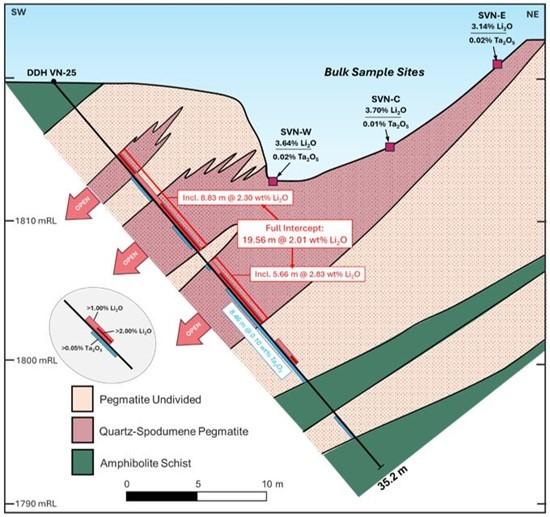

- 31 mini-bulk sample sites ranging from 45-900 kg averaged a grade of 2.4% Li2O1.

- Only two holes tested the down-dip extent of mineralization. None of the known pegmatites have been drilled below a depth of 30 m.

- Drill hole DDH VN-25 (1967) graded 19.56 m at 2.01 wt% Li2O beginning at a depth of 6.73 meters, including two higher-grade intervals separated by a barren pegmatite screen of 8.83 m at 2.30 wt% Li2O and 5.66 m at 2.83 wt% Li2O (Figure 3)1.

Volney Project History

Gold was discovered and mined in alluvial drainage below the Volney Project in the late 1800’s. Rusty Mine, Hydliff and Giant development and workings followed. The Rough and Ready Mine was primarily a Tin producer, however extensive drifting and development for gold was undertaken in the adjacent sheared amphibolite unit. The Giant Volney Mine consists of both surface and underground workings with high grade concentrates of Lithium and Tantalum produced in the 1940’s. Limited and sporadic exploration for gold and lithium occurred in the 1960’s and 1970’s, and no significant exploration has taken place since.

Table 1. Mining and Exploration History of the Volney Project

| Years Active | Mine explored | Company/Group | Details of Activity | Reference |

| 1886 | Rough & Ready | Unknown | 6.5 t of ore averaging 4.6% Sn shipped to Cornwall for treatment | Nellis (1973) |

| 1903 to 1927 | Rough & Ready | Tinton Mining Co. Tinton Reduction Co. Black Hills Tin Co. |

Development of 740 m of underground mine workings and production of 105,039 lbs of tin | Hess and Bryan (1938) Smith and Page (1941) |

| 1928 to 1929 | Rough & Ready Tantalum Hill |

Black Hills Tin Co. | Production of 1.5 t of cassiterite concentrate @ 30.7% Sn and 13.1 t of tantalite concentrate @ 38.7-57% Ta2O5 | Redfern (1992) |

| 1941 to 1944 | Giant-Volney | Fansteel Mining Corp. under lease from Black Hills Tin Co. | Production of 1,080 t of spodumene concentrate with grades of 5.6% to 6.3% Li2O, 400 t of amblygonite concentrate @ 8.3% Li2O, 21,884 lbs of tantalite concentrates @ 45% Ta2O5, and 3,800 lbs of cassiterite | Page et al. (1953) Redfern (1992) |

| 1967 | Giant-Volney | Norton Company | Drilled eight diamond core holes totaling 387.9 m targeting Ta(-Li) mineralization and 22,074 lbs of bulk samples collected | Nellis (1973) |

| 1973-1974 | Giant-Volney & Rusty | Homestake Mining Company | 8 rotary drill holes drilled to test shallow gold occurrence at the Rusty shaft | Shaddrick (1974) Norby (1984) |

Figure 3. Drill results from VN-25 and three of the mini bulk samples taken from the Volney Project (Nellis,1973).

Table 2. Grab samples taken by Nellis (1973) at the Volney Project in the Black Hills, South Dakota.

| Sample No. | Quartz Modal % |

Spodumene Modal % |

Plagioclase Modal % |

Li2O (wt%) |

| Tts-11 | 37.0 | 56.2 | 1.1 | 5.0 |

| Tts-17 | 33.2 | 51.7 | 5.2 | 4.1 |

| Tts-18 | 35.4 | 59.5 | 2.4 | 5.2 |

| Tts-19 | 48.0 | 50.0 | 0.1 | 4.4 |

| Tts-21A | 38.3 | 57.5 | 0.2 | 5.1 |

| Tts-23 | 36.6 | 63.4 | <0.1 | 5.4 |

| Tts-25 | 36.7 | 49.6 | <0.1 | 4.6 |

| Tts-26 | 54.6 | 35.9 | 1.0 | 2.9 |

| Tts-38 | 35.7 | 49.5 | 4.7 | 4.6 |

| Tts-39 | 37.6 | 44.6 | 11.0 | 4.2 |

| Tts-42 | 36.6 | 44.1 | 16.1 | 3.4 |

| Tts-45 | 45.8 | 44.1 | 2.7 | 4.1 |

| Tts-48 | 30.5 | 65.3 | 3.4 | 4.3 |

| Tts-64 | 40.3 | 58.8 | 0.3 | 5.0 |

| Tts-67 | 42.2 | 49.1 | 2.4 | 2.7 |

Surface rock samples, by their nature, are selective and may not represent the true nature of the mineral content.

Figure 4. Drill results from Homestake Mining Company, targeting the historic Rusty Shaft on the Volney Project (Nellis, 1973).

A qualified person from the Company has not verified the above-referenced results. All results have been sourced from the referenced historical documentation.

The Transaction

Pursuant to the terms of the Option Agreement, in order to exercise the Option and acquire the Volney Project, the Company must:

- issue the following common shares of the Company to the Optionor:

- within five business days of the date the Company receives final TSX Venture Exchange acceptance, such number of Common Shares as is equal to 9.9% of the Company’s issued and outstanding Common Shares following such issuance on an undiluted basis;

- within ten business days from the first anniversary of the Exchange Approval Date, such number of Common Shares as is equal to the greater of: (A) the number of Common Shares as is required to maintain the Optionor’s shareholding in the Company at an amount equal to 9.9% of the Company’s issued and outstanding Common Shares following such issuance on an undiluted basis, and (B) Common Shares having an aggregate value of US$500,000; and

- within ten business days from the second anniversary of the Exchange Approval Date, such number of Common Shares as is equal to the greater of: (A) the number of Common Shares as is required to maintain Optionor’s shareholding in the Company at an amount equal to 9.9% of the Company’s issued and outstanding Common Shares following such issuance on an undiluted basis, and (B) Common Shares having an aggregate value of US$750,000;

- make the following cash payments to the Optionor:

- US$400,000 on or before the date that is six months from the Exchange Approval Date;

- US$1,050,000 on or before the date that is 18 months from the Exchange Approval Date; and

- US$1,950,000 on or before the date that is 30 months from the Exchange Approval Date; and

- incur the following exploration expenditures:

- US$1,000,000 on or before the first anniversary of the Exchange Approval Date; and

- US$1,500,000 on or before the second anniversary of the Exchange Approval Date.

The Optionor retains (a) a net smelter returns royalty of 2% on all gold mined from the property, subject to a buy-back option for 1% of the NSR Royalty (effectively reducing the NSR Royalty to 1%) for US$1,000,000, exercisable by the Company for a period of five years from the commencement of commercial production, and (b) a gross proceeds royalty of 2% on all other minerals, subject to a buy-back option for 1% of the GP Royalty (effectively reducing the GP Royalty to 1%) for US$1,000,000, exercisable by the Company for a period of five years from the commencement of commercial production.

The Transaction is subject to the final acceptance of the TSX Venture Exchange.

About the Volney Lithium Project

The Volney Project is comprised of 38 private land claims totaling 142 ha in the Black Hills. The property is located 20 km south of Spearfish, South Dakota and approximately 15 km west of Leads. Pegmatites are within a Neoarchean greenstone belt, featuring the Giant Volney pegmatite, historically mined for tin. The property is accessible by road and strategically located with proximity to infrastructure and major mining jurisdiction.

The technical content of this news release has been reviewed and approved by Carl Ginn, P.Geo., consultant to the Company and a Qualified Person pursuant to National Instrument 43-101. The Qualified Person has not completed sufficient work to verify the historical information on the Volney Project disclosed herein, including the sampling, analytical and test data underlying the information or opinions contained in the written disclosure.

About Lion Rock Resources Inc.

Lion Rock Resources Inc. is a brownfields exploration company focused on the Maybrun Copper-Gold Project in northwestern Ontario, approximately 80 km from New Gold’s Rainy River Gold Mine and 15 km from First Mining Gold’s Cameron Lake Project. The Company also holds properties prospective for lithium in Ontario and Quebec.

MORE or "UNCATEGORIZED"

Labrador Gold Announces Closing of Change of Business and Acquisition of Units of Northern Shield

Labrador Gold Corp. (TSX-V: LAB) (FNR: 2N6) is pleased to announc... READ MORE

La Mancha Exercises Right to Subscribe for Additional Shares of G Mining Ventures

G Mining Ventures Corp. (TSX:GMIN) (OTCQX:GMINF) announces that t... READ MORE

Osisko Development Announces Proceeds of $24.9 Million From Warrant Exercise

Osisko Development Corp. (NYSE: ODV, TSX-V: ODV) announces that i... READ MORE

LIFT Closes Acquisition with SOQUEM for an Additional 25% Interest in the Galinée Property, Quebec

Li-FT Power Ltd. (TSX-V: LIFT) (OTCQX: LIFFF) (Frankfurt: WS0) i... READ MORE

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE