Pasofino Gold Intersects Gold Zones with over 20 Metres Interval at ‘Bukon Jedeh’, Dugbe Gold Project in Liberia

Pasofino Gold Limited (TSX-V: VEIN) (OTCQB: EFRGF) (FSE: N07A) is pleased to announce results of analysis from its maiden diamond core drilling at the Bukon Jedeh ‘gold camp’ (see June 3, 2024 press release) and provides an update on other key exploration targets within the Company’s Dugbe Gold Project, Liberia, which has a 3.3 Moz Measured and Indicated Mineral Resource Estimate[1].

Highlights

- 8 of the 11 holes that reached target depth have gold mineralised intervals including:

-

- BKDD001: 21.3m with an average grade of 0.9 g/t Au from 53.5m downhole

- BKDD004: 4.0m with an average grade of 2.1 g/t Au from 46.5m downhole

- BKDD011: 2.5m with an average grade of 2.2 g/t Au from 43.5m downhole

- BKDD001, the westernmost drill hole on the main trend, indicates a potential ‘build-up’ of mineralisation towards an interpreted fold closure, a structural feature similar to that controlling the nearby 2.3 Moz Tuzon deposit. Future drilling will aim to test down-dip and along trend from BKDD001, and

- Additional exploration is planned for the DSZ target, situated 4 km along strike from the Tuzon deposit, where a 2021 channel cut into bedrock returned 36m at an average grade of 0.6 g/t Au, though it remains untested by drilling.

Pasofino CEO Warren Greenslade, commented:

“The intersection of gold mineralisation over 20m in length from our maiden drilling program is highly encouraging, especially given the wide spacing between holes. Further work aimed at chasing down the zone in BKDD001 is a key focus, with efforts aimed at targeting the potential fold closure to the west. Additionally, drill testing is also warranted at the DSZ target which returned a wide interval with 0.6 g/t Au from a channel cut into bedrock. DSZ is directly on-trend from our 2.3Moz Tuzon deposit.”

Future focus in the west of the area

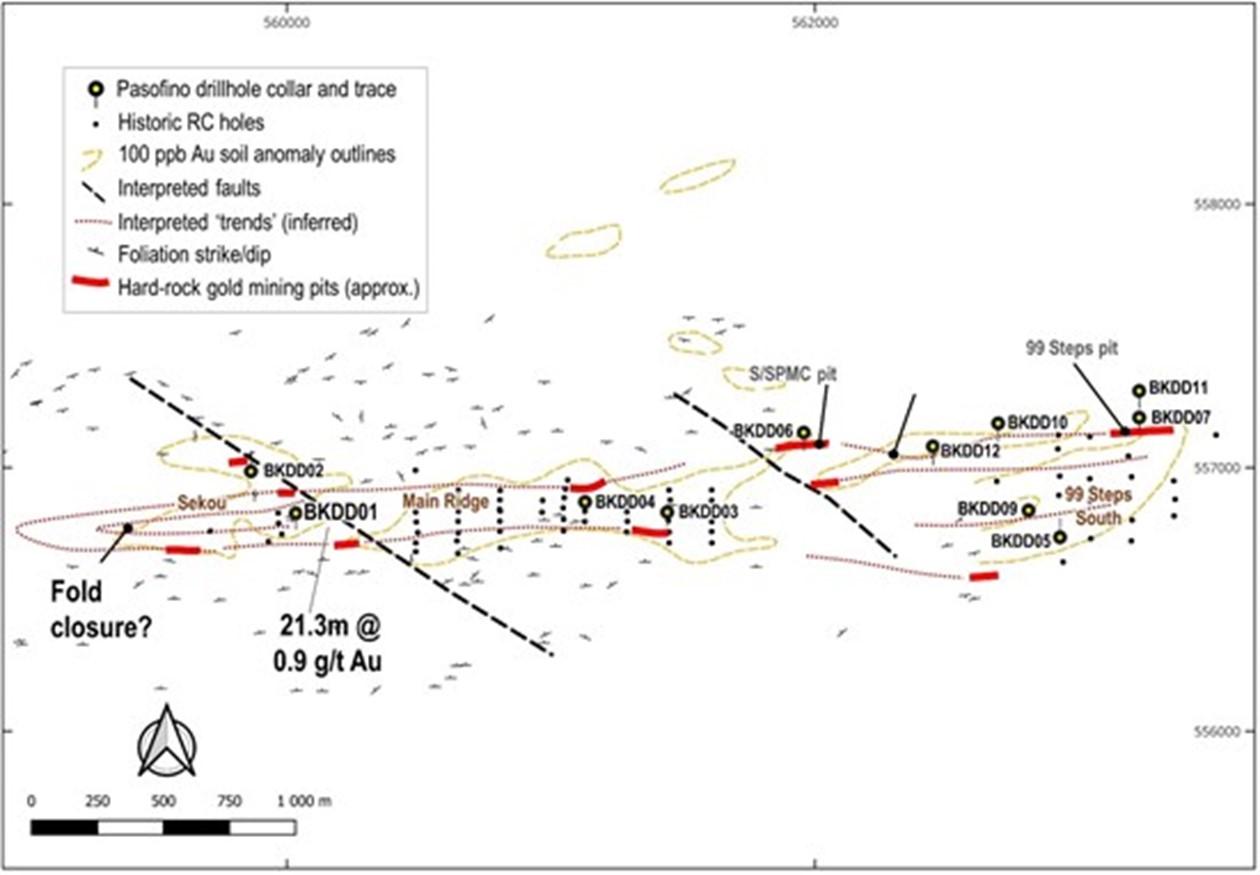

As shown in Figure 1, Pasofino’s drilling program includes several historical RC holes in the area. BKDD001’s significance lies in its location-1 km west of BKDD004, which tested the central axis of the target. It may be that the mineralisation is ‘building’ towards a fold closure interpreted in the west of Bukon based on magnetic and structural mapping.

This geological structure, which controls the nearby Tuzon deposit, suggests that the gold at Bukon may be better developed toward the hinge of a large antiform, similar to Tuzon. At Bukon, future work should focus in the west, beginning with ‘stepping-out’ from BKDD001, down-dip and along strike. While artisanal mining is less prevalent in this area, the suspected hinge zone may be plunging westward, possibly preventing outcropping. The gold at Bukon is hosted by a pyroxene-bearing gneiss with minor sulphides, very similar to the host-rock at Tuzon.

DSZ Target Offers Additional Potential

Exploration will also include testing broad gold zones encountered at the DSZ target, located only 4 km from the Tuzon deposit. The DSZ target is particularly promising, with a previous channel cut into bedrock yielding 36m at an average of 0.6 g/t Au. Individual 2-metre samples within this interval reached grades of up to 2 g/t Au. This target represents a high-priority drilling prospect for the Company, with the potential to expand on existing resources at Tuzon.

Pasofino remains committed to advancing its exploration efforts at both Bukon and the DSZ target to unlock further potential within the Dugbe Gold Project.

Figure 1. Map showing the Bukon Jedeh gold ‘corridor’ with Pasofino’s drillholes and hard rock pits.

Table 1. Coordinates and azimuth and inclination of Pasofino’s drillholes.

| BHID | EastUTM29N | NorthUTM29N | Azimuth | Inclination | Final depth |

| BKDD001 | 560034 | 556827 | 180 | -60 | 118.5 |

| BKDD002 | 559864 | 556986 | 0 | -55 | 124.3 |

| BKDD003 | 561440 | 556831 | 180 | -55 | 70.3 |

| BKDD004 | 561129 | 556870 | 180 | -60 | 100.7 |

| BKDD005 | 562927 | 556736 | 0 | -55 | 130.4 |

| BKDD006 | 561957 | 557133 | 180 | -60 | 151.3 |

| BKDD007 | 563227 | 557190 | 180 | -55 | 100.8 |

| BKDD009 | 562808 | 556838 | NA | -90 | 122.1 |

| BKDD010 | 562693 | 557168 | 180 | -60 | 145.3 |

| BKDD011 | 563227 | 557291 | 180 | -55 | 130.6 |

| BKDD012 | 562446 | 557081 | 180 | -55 | 133.5 |

BKDD008 failed at 6m depth due to fractured ground.

All hole positions collected using a hand-held GPS.

Table 2. All intersections from the 2024 diamond core drilling

| BH ID | From (m) | To (m) | Interval (m) | Au (g/t) | Oxide/Fresh |

| BKDD001 | 0.0 | 3.4 | 3.4 | 1.3 | oxide |

| and | 53.5 | 74.8 | 21.3 | 0.9 | fresh |

| BKDD002 | 8.8 | 11.8 | 3.0 | 1.4 | fresh |

| and | 26.6 | 29.6 | 3.0 | 1.1 | fresh |

| BKDD003 | 7.0 | 10.5 | 3.5 | 1.2 | oxide |

| BKDD004 | 3.5 | 7.0 | 5.3 | 1.3 | oxide |

| and | 46.5 | 49.5 | 4.0 | 2.1 | fresh |

| BKDD005 | 7.0 | 9.5 | 2.5 | 0.8 | oxide |

| BKDD006 | 79.5 | 85.5 | 6.0 | 0.9 | fresh |

| BKDD007 | no significant interval | ||||

| BKDD008 | failed hole (stopped at 6.2m) | ||||

| BKDD009 | no significant interval | ||||

| BKDD010 | no significant interval | ||||

| BKDD011 | 43.5 | 46.0 | 2.5 | 2.2 | fresh |

| and | 90.5 | 91.8 | 1.3 | 1.2 | fresh |

| BKDD012 | 112.0 | 116.5 | 4.5 | 0.7 | fresh |

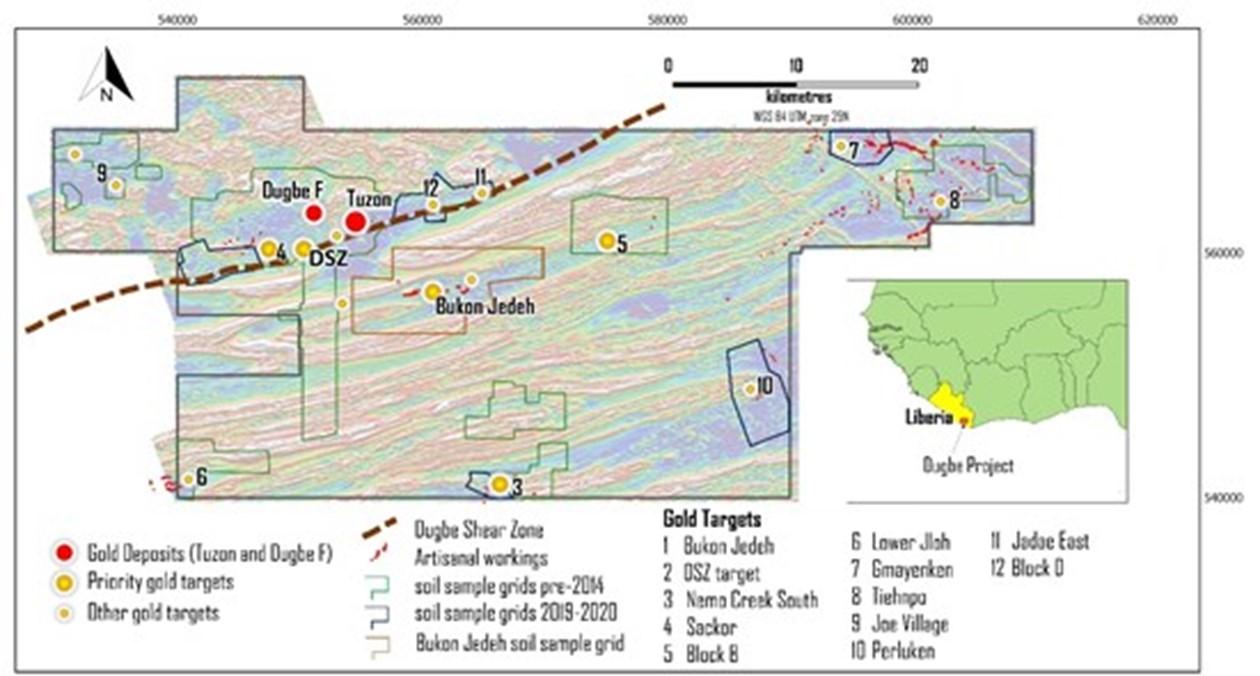

Figure 2. Map showing the Dugbe MDA area and the location of the Bukon Jedeh and DSZ targets relative to the Tuzon and Dugbe F deposits.

SAMPLING PROCEDURE AND QUALITY ASSURANCE AND QUALITY CONTROL

The drillhole collar positions were determined using a handheld GPS. Samples were mostly 1.5m and of half-core. Samples were prepared at Liberia Geochemical Services (Inc. in Monrovia) and sent analysed by SGS in Tarkwa Ghana, a facility compliant to ISO 17025:2005 for the analytical methods used for the samples. All samples were analysed by fire assay with atomic absorption finish on a sample with 50g nominal weight. A certified standard and a blank were inserted and the results of these QAQC samples are acceptable.

QUALIFIED PERSONS STATEMENT

Scientific or technical information in this disclosure that relates to exploration results was prepared and approved by Mr. Andrew Pedley. Mr. Pedley is a consultant of Pasofino Gold Ltd.’s wholly-owned subsidiary ARX Resources Limited. He is a member in good standing with the South African Council for Natural Scientific Professions (SACNASP) and is as a Qualified Person under National Instrument 43-101.

ABOUT THE DUGBE GOLD PROJECT

The 2,078 km2 Dugbe Gold Project is in southern Liberia and situated within the southwestern corner of the Birimian Supergroup which is host to most West African gold deposits. To date, two deposits have been identified on the Project; Dugbe F and Tuzon discovered by Hummingbird Resources Plc in 2009 and 2011 respectively. The deposits are located within 4 km of the Dugbe Shear Zone which is thought to have played a role in large scale gold mineralization in the area.

A significant amount of exploration in the area was conducted by Hummingbird up until 2012 including 74,497 m of diamond coring. Pasofino drilled an additional 14,584 m at Tuzon and Dugbe during 2021. Both deposits have Mineral Resource Estimates dated 17 November 2021 with total Measured and Indicated of 3.3 Moz with an average grade of 1.37 g/t Au, and 0.6 Moz in Inferred. Following the completion of the Definitive Feasibility Study in June 2022 a Mineral Reserve Estimate was declared, based on the open-pit mining of both deposits over a 14-year Life of Mine. A technical report for the Dugbe Gold Project was prepared in accordance with National Instrument 43-101 and filed on SEDAR at www.sedar.com and on the Company’s website.

In addition to the existing deposits there are many gold prospects within the Project including the Bukon Jedeh area and the DSZ target on the Tuzon-Sackor trend where Pasofino has discovered a broad zone of surface gold mineralisation in trench and outcrop along strike from Tuzon.

In 2019, Hummingbird signed a 25-year Mineral Development Agreement (“MDA”) with the Government of Liberia providing the necessary long-term framework and stabilization of taxes and duties. Under the terms of the MDA, the royalty rate on gold production is 3%, the income tax rate payable is 25% (with credit given for historic exploration expenditures), the fuel duty is reduced by 50%, and the Government of Liberia is granted a free carried interest of 10% in the Project.

ABOUT PASOFINO GOLD LTD.

Pasofino Gold Ltd. is a Canadian-based mineral exploration company listed on the TSX-V.

Pasofino, through its wholly-owned subsidiary, owns 100% of the Dugbe Gold Project (prior to the issuance of the Government of Liberia’s 10% carried interest).

MORE or "UNCATEGORIZED"

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 Kilometres West of Eureka; Follow-Up Drill Program Underway

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 ... READ MORE

Silver One Announces Closing Of Final Tranche Of $32 Million Financing

Silver One Resources Inc. (TSX-V: SVE) (OTCQX: SLVRF) (FSE: BRK1)... READ MORE

SAGA Metals Achieves 100% Drilling Success in 2025—Reports Final Assays from Trapper South at Radar Critical Minerals Project in Labrador

Exceptional grades of Titanium, Vanadium and Iron in all 15 drill... READ MORE

Near Surface Intersection Yields 6.58 g/t gold over 10.35 metres

Intersection is within 33 metres from surface and contained in a ... READ MORE

Alamos Gold Provides Three-Year Operating Guidance Outlining 46% Production Growth by 2028 at Significantly Lower Costs

Further production growth to one million ounces annually expected... READ MORE