Koryx Copper Announces Updated Mineral Resource for the Company’s Flagship Haib Copper Development Project in Namibia

Koryx Copper Inc. (TSX-V: KRY) announced an updated resource statement for the Haib Copper Project completed by the Company’s independent technical consultant MSA Group following all results being received from the 2024 drilling program.

Highlights

- Indicated mineral resource of 414Mt @ 0.35% Cu for 3,216 Mlbs Cu at 0.25% cut-off

- Inferred mineral resource of 345Mt @ 0.33% Cu for 2,503 Mlbs at 0.25% cut off

- Sensitivities at 0.3% Cu cut off and 0.5 revenue factor of 116 MT at 0.41% Cu for 1,058 Mlbs Cu

- Follow-on diamond core drill program comprising 8,200m will commence shortly, targeting higher grade areas and potential mineral resource extensions

- Additional significant drill program planned for later in 2024 or early 2025 to investigate areas of down dip extension with no previous drilling but the potential for significant mineral resource expansion

Heye Daun, Koryx Copper’s Executive Chairman, stated: “We are delighted with the results of the recently completed drill program, which have now been modelled and have resulted in an overall grade increase of 13-14% of the entire Haib deposit. This is a very significant improvement and has been achieved by focusing the drilling on structurally controlled, higher grade portions of especially the Target 1 area of the Haib deposit. This success is even more remarkable, given the relatively limited amount of new drilling which was completed as part of this program. It is testament to the quality of the technical work which the team carried out and which continues to identify further areas of potential grade improvement and mineral resource growth of the Haib deposit. As the incoming management team we are very excited about the positive base which has been established. The next step is to build on this by planning & executing a significantly upsized follow-on drill program, initiating the additional met testwork to hopefully demonstrate the feasibility of a more conventional process route to generally continue to de-risk and to fast-track the development of the Haib copper deposit.”

Updated Haib Mineral Resource Statement

The Mineral Resource was estimated using the Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Best Practice Guidelines and is reported in accordance with the 2014 CIM Definition Standards, which have been incorporated by reference into National Instrument 43-101 – Standards of Disclosure for Mineral Projects (NI 43-101). The Mineral Resource is classified into Indicated and Inferred categories and is reported at a cut-off grade of 0.25% copper (Cu). A summary of the Mineral Resource estimate is presented in Table 1.

Table 1: Mineral Resource Estimate for Haib as at 31 August 2024 at a 0.25% Cu cut-off

| Category | Zone | Tonnes (Mt) |

Cu Grade (%) |

Cu Content (Mlbs) |

Cu Content (kt) |

| Indicated | Northwest | 300 | 0.35 | 2,310 | 1,048 |

| Southeast | 115 | 0.36 | 906 | 411 | |

| Low Grade | – | – | – | – | |

| Total | 414 | 0.35 | 3,216 | 1,459 | |

| Inferred | Northwest | 283 | 0.33 | 2,052 | 931 |

| Southeast | 47 | 0.34 | 359 | 163 | |

| Low Grade | 16 | 0.27 | 93 | 42 | |

| Total | 345 | 0.33 | 2,503 | 1,136 |

Notes:

- All tabulated data have been rounded and as a result minor computational errors may occur.

- Mineral Resources, which are not Mineral Reserves, have no demonstrated economic viability. There is no guarantee that that all or any part of the Mineral Resource will be converted into a Mineral Reserve. The estimate of Mineral Resources may be materially affected by geology, environment, permitting, legal title, taxation, socio-political, marketing, or other relevant issues.

- Mt = Million tonnes, kt = thousand tonnes, Mlbs = Million pounds

- The Mineral Resource Statement for Haib as of 31 August 2024 is reported at a cut-off grade of 0.25% Cu within a conceptual pit shell using the following assumed parameters:

- Base Copper Price USD/lb Cu: 4.50

- Average Mining Cost at reference elevation (AISC) USD/tonne: USD 2.35 / tonne waste mined at pit rim – USD 2.50 / tonne ore mined at pit rim

- Average Processing Cost USD/tonne ore processed: 6.00

- Average G&A Overheads USD/tonne ore processed: 1.00

- Process Overall Recovery % Cu Recovery: 80%

- Selling Cost Transport of Concentrate to Smelter USD/lb Cu: 0.10

- Low Grade zone refers to the portion of the block model outside the modelled 0.2% Cu grade shells

- From the assumed parameters, a 0.1% Cu in-situ marginal cut-off grade was calculated, which together with the conceptual pit shell demonstrates reasonable prospects for eventual economic extraction (RPEEE) for the Mineral Resource. The assessment to satisfy the criteria of RPEEE is a high-level estimate and is not an attempt to estimate Mineral Reserves.

From the assumed parameters a 0.1% Cu in-situ marginal cut-off grade was calculated, which, together with the optimised pit shell demonstrates reasonable prospects for eventual economic extraction for the Mineral Resource. The assessment to satisfy the criteria of RPEEE is a high-level estimate and is not an attempt to estimate Mineral Reserves. The Haib RPEEE pit shell illustrated together with the block model in Figure 3. and Figure 4 has a strip ratio of 3.9.

While the RPEEE pit shell demonstrates reasonable economic prospects for a resource it is expected that mining and opex cost will increase as the technical team start to define the appropriate process route and mine design layout during the next phase of studies.

In comparison with the resource which was declared in the PEA report published in 2021 the updated Mineral Resource Estimate shows a decrease in tonnes by 9% for Indicated material but an increase in grade by 13%. The Inferred material shows both an increase in tonnes by 1% and an increase in grade by 14%.

| 2021 PEA Resource | 2024 Updated Resource | % change | |||||||

| Class | Tonnes (Mt) |

Cu (%) |

Metal (kt) |

Tonnes (Mt) |

Cu (%) |

Metal (kt) |

Tonnes (Mt) |

Cu (%) |

Metal (kt) |

| Indicated | 457 | 0.31 | 1,416 | 414 | 0.35 | 1,459 | -9% | 13% | 3% |

| Inferred | 342 | 0.29 | 993 | 345 | 0.33 | 1,136 | 1% | 14% | 14% |

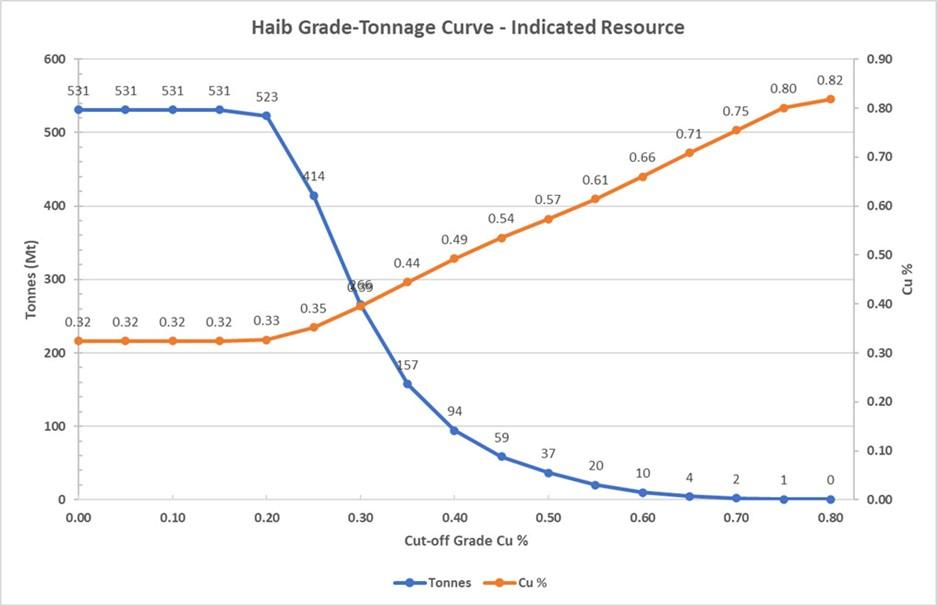

The Mineral Resource is presented at various cut-off grades in Table 2 and Figure 1 (Indicated), and Table 3 and Figure 2 (Inferred).

Table 2: Indicated Resource Grade-Tonnage – 31 August 2024

| Cut-off Cu % | Tonnes (Mt) |

Cu (%) |

Cu (Mlbs) |

Cu (kt) |

| 0.10 | 531 | 0.32 | 3,797 | 1,722 |

| 0.15 | 531 | 0.32 | 3,796 | 1,722 |

| 0.20 | 523 | 0.33 | 3,763 | 1,707 |

| 0.25 | 414 | 0.35 | 3,216 | 1,459 |

| 0.30 | 266 | 0.39 | 2,318 | 1,052 |

Figure 1: Grade-Tonnage Curves for Indicated Resource

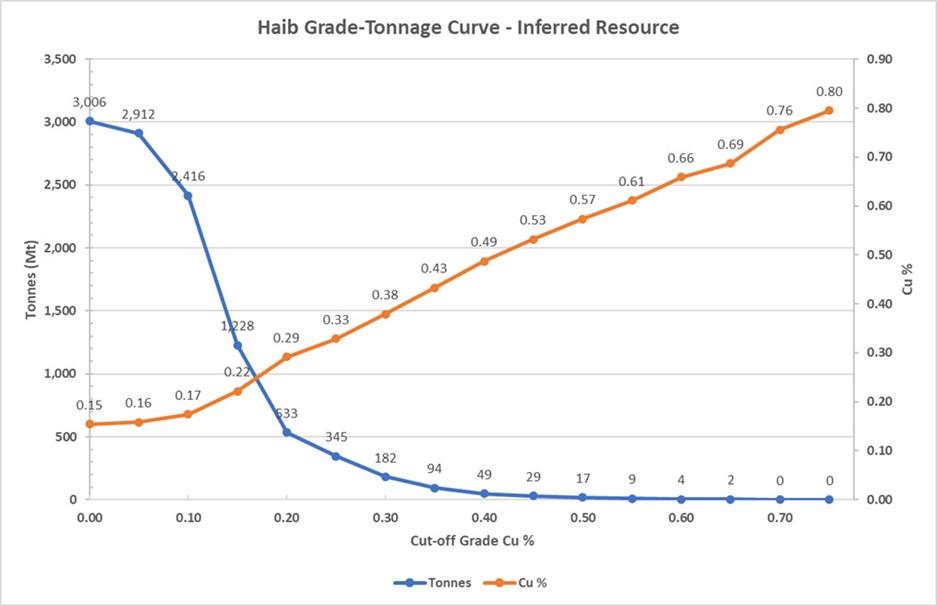

Table 3: Inferred Resource Grade-Tonnage – 31 August 2024

| Cut-off Cu % | Tonnes (Mt) |

Cu (%) |

Cu (Mlbs) |

Cu (kt) |

| 0.10 | 2,416 | 0.17 | 9,301 | 4,219 |

| 0.15 | 1,228 | 0.22 | 6,004 | 2,724 |

| 0.20 | 533 | 0.29 | 3,428 | 1,555 |

| 0.25 | 345 | 0.33 | 2,503 | 1,136 |

| 0.30 | 182 | 0.38 | 1,517 | 688 |

Figure 2: Grade-Tonnage Curves for Inferred

Resource

A sensitivity analysis was performed to determine the robustness of reducing revenue received from lower Cu commodity prices. Using a Revenue Factor of 0.5 to simulate halving the Cu price to USD 2.25 /lb produces an Indicated Resource of 116 Mt @ 0.41% Cu for 1,058 Mlbs. This higher-grade potential starter pit would be attractive for the capital payback period.

Table 4: Grade Cut-off sensitivity at different Revenue Factors

| Cut-off Grade (% Cu) | 0.20 | 0.25 | 0.30 | ||||||

| Pit Revenue Factor | Tonnes (Mt) |

Cu (%) |

Metal (kt) |

Tonnes (Mt) |

Cu (%) |

Metal (kt) |

Tonnes (Mt) |

Cu (%) |

Metal (kt) |

| 0.5 | 179 | 0.36 | 641 | 156 | 0.38 | 588 | 116 | 0.41 | 480 |

| 32 | 0.32 | 104 | 28 | 0.34 | 93 | 16 | 0.38 | 62 | |

| Pit Revenue Factor | Tonnes (Mt) |

Cu (%) |

Metal (kt) |

Tonnes (Mt) |

Cu (%) |

Metal (kt) |

Tonnes (Mt) |

Cu (%) |

Metal (kt) |

| 1.0 | 523 | 0.33 | 1,707 | 414 | 0.35 | 1,459 | 266 | 0.39 | 1,052 |

| 533 | 0.29 | 1,555 | 345 | 0.33 | 1,136 | 182 | 0.38 | 688 | |

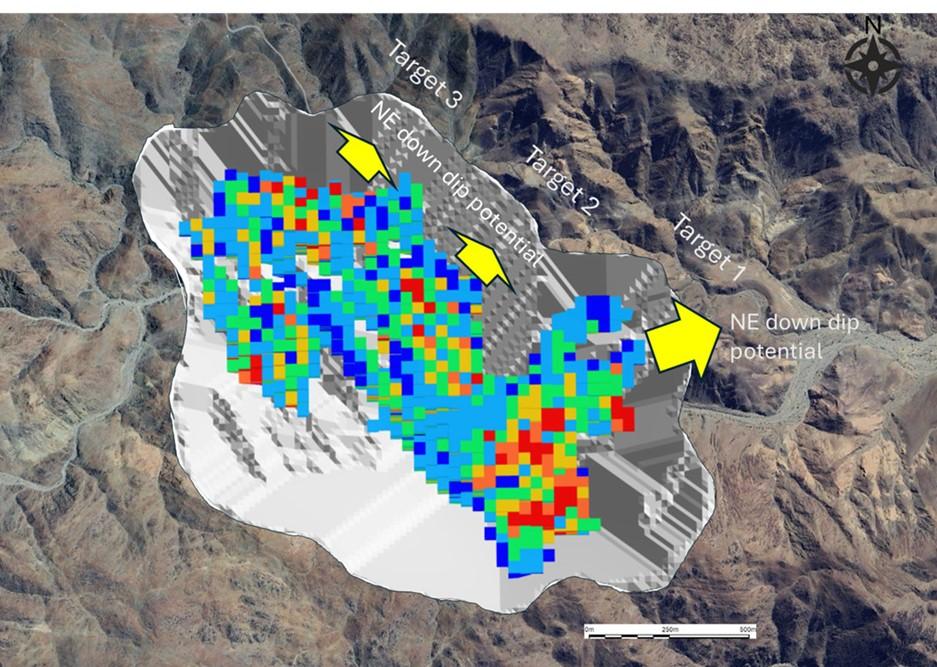

Figure 3: Haib Resource pit shell and block model – plan view

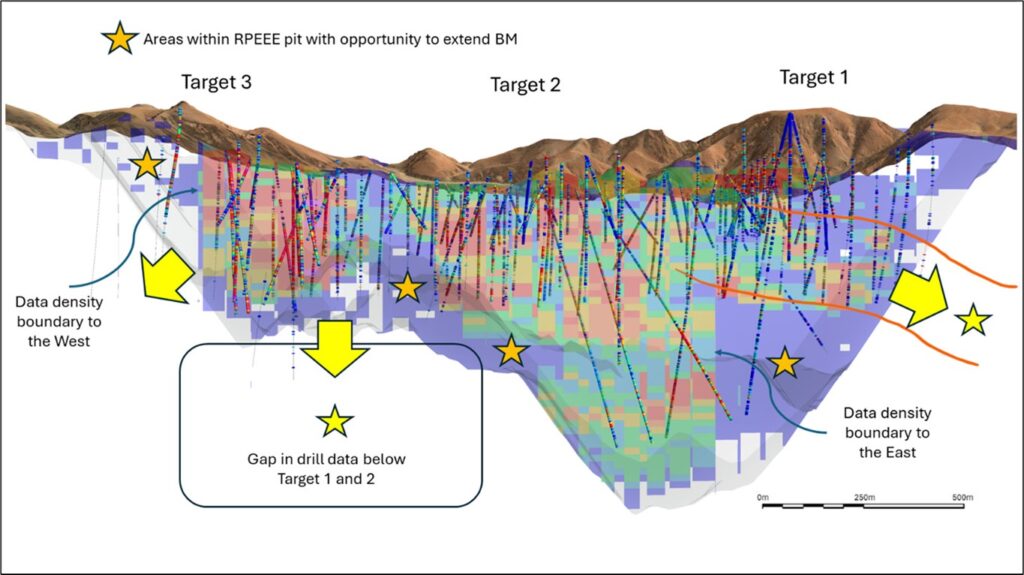

Figure 4: Haib Resource pit shell and block model – oblique view to the north

In many areas the resource estimate remains constrained by a lack of drilling, both within and below the RPEEE pit shell. Model updates show areas within the pit where east-west cross cutting structures intersect the northwest trending mineralised continuity, and where areas of higher-grade mineralization can be expected. See orange stars in Figure 4 above.

The current drill program will test this model for higher grade and greater volumes in an east-west orientation as well as targeting gaps where previous drillholes are greater than 150m apart.

Drilling in the Target 2 and 3 areas is limited to approximately 350m depth below surface. In this area the block model is constrained at depth by the lack of data, which is also limiting the shape of the RPEEE pit shell.

Below the Target 1 area (to the east) the RPEEE pit achieves a depth of 800m and highlights the upside potential for further drilling to significantly expand Targets 2 and 3 to depth. The mineralization in the Target 1 area has a shallow dip to the northeast, and holes are planned down dip to extend this resource area. The potential extensions to this mineralization are shown by the yellow arrows in Figure 4 above.

Previous Drill Programs

The Haib Mineral Resource estimate included information obtained from diamond drillholes completed between 1963 and 2024 with drilling comprising a total length of 78,934 m. In addition, one underground adit was channel sampled over a length of 126 m. The historical data was extensively validated, and all data collected by Rio Tinto Zinc (120 drillholes from 1972 to 1975), Great Fitzroy Mines (13 drillholes from 1995 to 1999) and Teck (32 drillholes in 2010) were accepted for use in the Mineral Resource Estimate.

Samples from two drill campaigns (King Resources and Falconbridge) comprising a total of 29 drillholes completed during the period 1963 to1969 were excluded from grade estimation as MSA was unable to satisfactorily validate this data. Koryx drilled 45 NQ-sized holes from 2021 to 2024, which verified the nature of the mineralization in the historical database and infilled the drilling grid along the main mineralization trend.

Mineralization has been intersected by diamond drilling to a maximum depth of 790 m below the topographic surface. Copper mineralization is predominantly chalcopyrite, however small amounts of supergene copper mineralization in various mineralogical states occurs near surface to shallow depths (generally less than 10 m).

Upcoming Drill Program

Drill rigs were mobilized to site during August and a follow-on drill program is planned to start later in September 2024. Approximately 8,200m of diamond core drilling in 36 holes has been planned to test potential resource extensions and to prove up additional mineralized material at hopefully higher grades.

A further drill program will then be planned to commence later in 2024 or early 2025 which will target the identified down dip extensions to mineralization where the RPEEE pit has been data constrained.

It is expected that a successful drill program in this area has the potential to significantly increase the total tonnage of the mineralised system.

Qualified Person

The technical and scientific information in this news release has been reviewed and approved by Mr. Dean Richards Pr.Sci.Nat., MGSSA – BSc. (Hons) Geology, who is a Qualified Person as defined by NI 43-101. Mr. Richards is the Vice President, Mineral Resource Development of the Company and is not independent of the Company under NI 43-101.

Technical Report

A NI 43-101 Technical Report associated with the MRE prepared by MSA will be filed on SEDAR+ within 45 days of this news release and will be available at that time on the Koryx Copper website.

About Koryx Copper Inc.

Koryx Copper Inc. is a Canadian copper development Company focused on advancing the 100% owned, PEA-stage Haib Copper Project in Namibia whilst also building a portfolio of copper exploration licenses in Zambia.

Haib is a large and advanced copper/molybdenum porphyry deposit in southern Namibia with a long history of exploration and project development by multiple operators. Mineralization at Haib is typical of a porphyry copper deposit and the deposit remains intact. Porphyry copper deposits are a major global source of copper with the best-known examples being concentrated around the Pacific Rim, North America and South America. Haib is one of the few examples of a Paleoproterozoic porphyry copper deposit in the world and one of only two in southern Africa (both in Namibia). Due to its age, the deposit has been subjected to multiple metamorphic and deformation events, but still retains many of the classic mineralization and alteration features typical of these deposits. The mineralization is dominantly chalcopyrite with minor bornite and chalcocite present and only minor secondary copper minerals at surface due to the arid environment.

More than 70,000m of drilling has been conducted at Haib since the 1970’s with significant exploration programs led by companies including Falconbridge (1964), Rio Tinto (1975) and Teck (2014). Teck remains a strategic and supportive shareholder. In addition to extensive drilling, metallurgical testing, geophysics and geological mapping, various mine modeling and technical studies have been completed to date.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE