Jordan Roy-Byrne – “Implications of False Breakdown in Gold”

Amid escalating conflict in the Middle East and its oversold condition, Gold surged higher last Friday to nearly $1945/oz.

That surge occurred days after a bullish intraday reversal from $1823/oz on October 6 and a gap higher on October 7. Then Gold continued higher for a few days before Friday’s explosion.

In September, Gold broke down and lost support at $1900, losing the 40-month moving average and 50% retracement around $1850/oz.

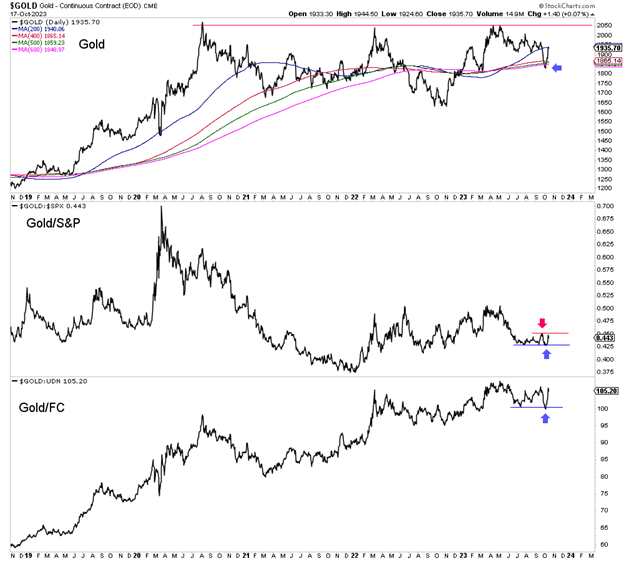

In the chart below, we see how Gold had lost its band of long-term moving averages (side arrow), Gold against the S&P 500 had closed at an 11-month low, and Gold against foreign currencies had closed at an 8-month low.

Those fledgling breakdowns quickly reversed, and Gold holding above $1900 would confirm a false breakdown. Moreover, if Gold against the S&P 500 could surpass the red line (red arrow), Gold in nominal terms could rally back to $2000 or even $2050.

Another thing that will help Gold is the lack of bullish positioning and speculation in the market.

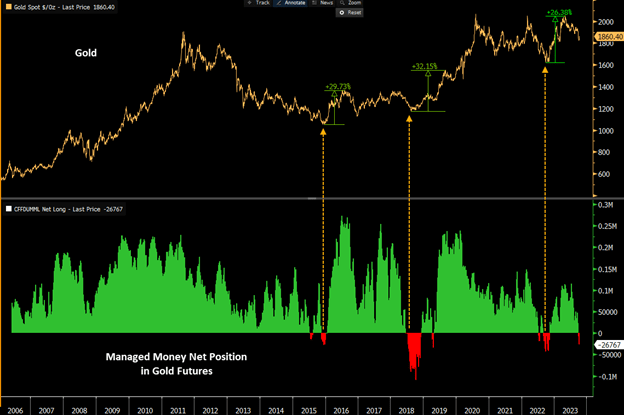

The chart below from Jason Goepfert of Sentimentrader.com plots Gold and Managed Money’s net position. Managed Money is part of the Commitment of Traders Report (CoT).

Hedge Funds (otherwise known as Managed Money in this instance) were net short Gold as of a week ago. Gold, then, was only 9% from an all-time high.

This is a potentially dangerous time for Gold bears.

Ongoing secular bull markets in the stock market and the US Dollar, in addition to the second strongest tightening cycle in modern history, have kept Gold from breaking out.

However, Gold remains within spitting distance of that breakout. It is only 7% from a new all-time high, and selling pressure over the weeks ahead should be more limited than during last spring and the spring of 2022.

Technicians have a saying. From false moves come fast moves.

Gold could digest its gains for a while, but pushing up to $ 2,000 soon could lead to an imminent breakout. That breakout is what all miners and juniors need.

I continue to focus on finding high-quality gold and silver juniors with 500% to 1000% upside potential over the next few years. To learn the stocks we own and intend to buy, with at least 5x upside potential in the coming bull market, consider learning about our premium service.

MORE or "UNCATEGORIZED"

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 Kilometres West of Eureka; Follow-Up Drill Program Underway

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 ... READ MORE

Silver One Announces Closing Of Final Tranche Of $32 Million Financing

Silver One Resources Inc. (TSX-V: SVE) (OTCQX: SLVRF) (FSE: BRK1)... READ MORE

SAGA Metals Achieves 100% Drilling Success in 2025—Reports Final Assays from Trapper South at Radar Critical Minerals Project in Labrador

Exceptional grades of Titanium, Vanadium and Iron in all 15 drill... READ MORE

Near Surface Intersection Yields 6.58 g/t gold over 10.35 metres

Intersection is within 33 metres from surface and contained in a ... READ MORE

Alamos Gold Provides Three-Year Operating Guidance Outlining 46% Production Growth by 2028 at Significantly Lower Costs

Further production growth to one million ounces annually expected... READ MORE