LAHONTAN DRILLS 35 METRES GRADING 1.05 g/t Au Eq incl. 4.6 METRES GRADING 3.14 Au Eq at SANTA FE

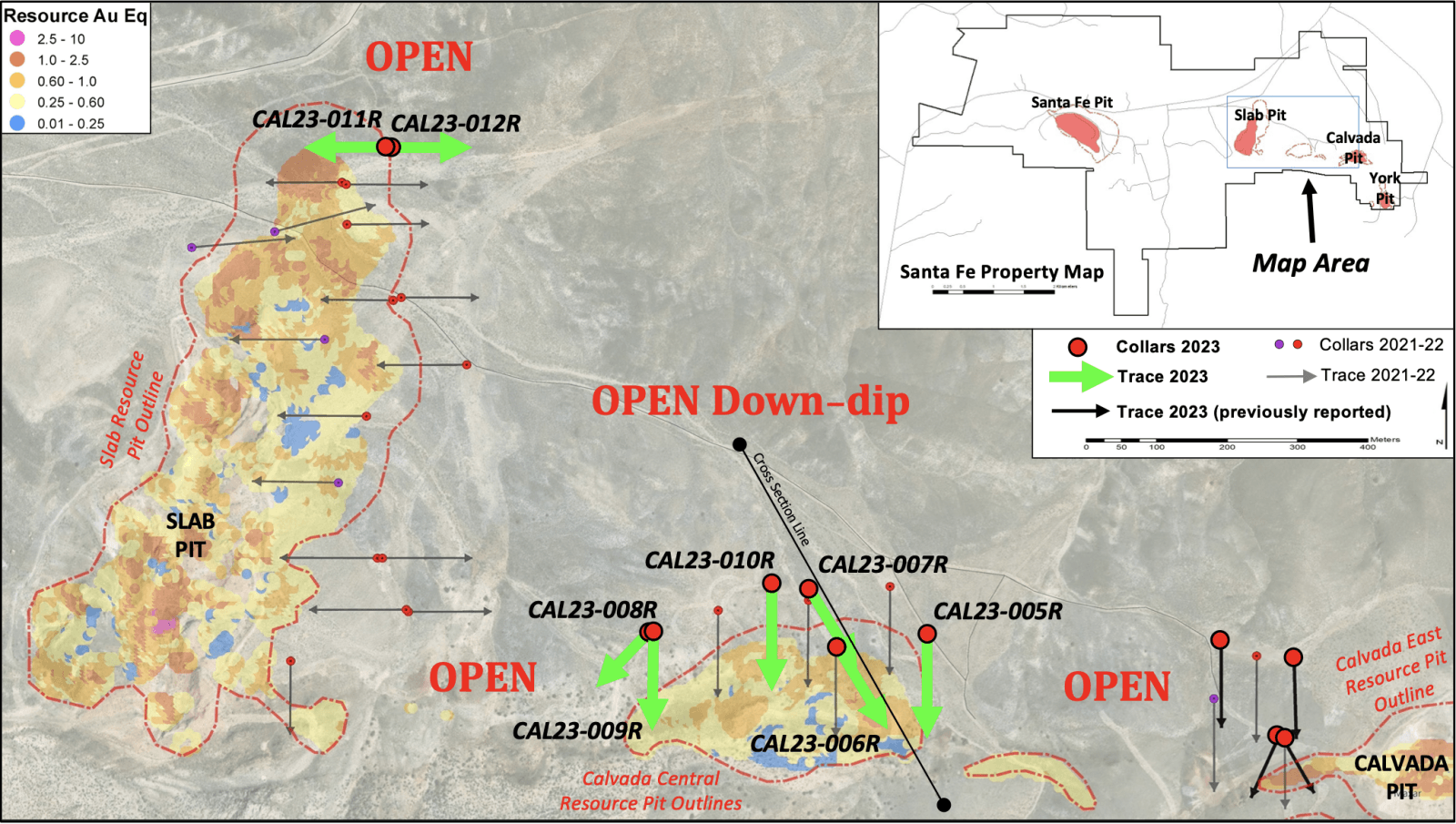

Lahontan Gold Corp (TSX-V:LG) (OTCQB:LGCXF) is pleased to announce results from an additional eight reverse-circulation rotary drill holes from the Company’s 2023 Phase Three drilling campaign at the Company’s 19 km2 Santa Fe Mine Project in Nevada’s Walker Lane. These drill holes were completed in the Slab-Calvada Complex at the Santa Fe Mine where previous Lahontan drilling had outlined significant oxide domain gold and silver resources (Canadian NI 43-101 compliant) that remained open along strike and down-dip*. The eight drill holes reported herein, totaling 1,533 metres, targeted potential extensions to these gold and silver resources. Highlights include:

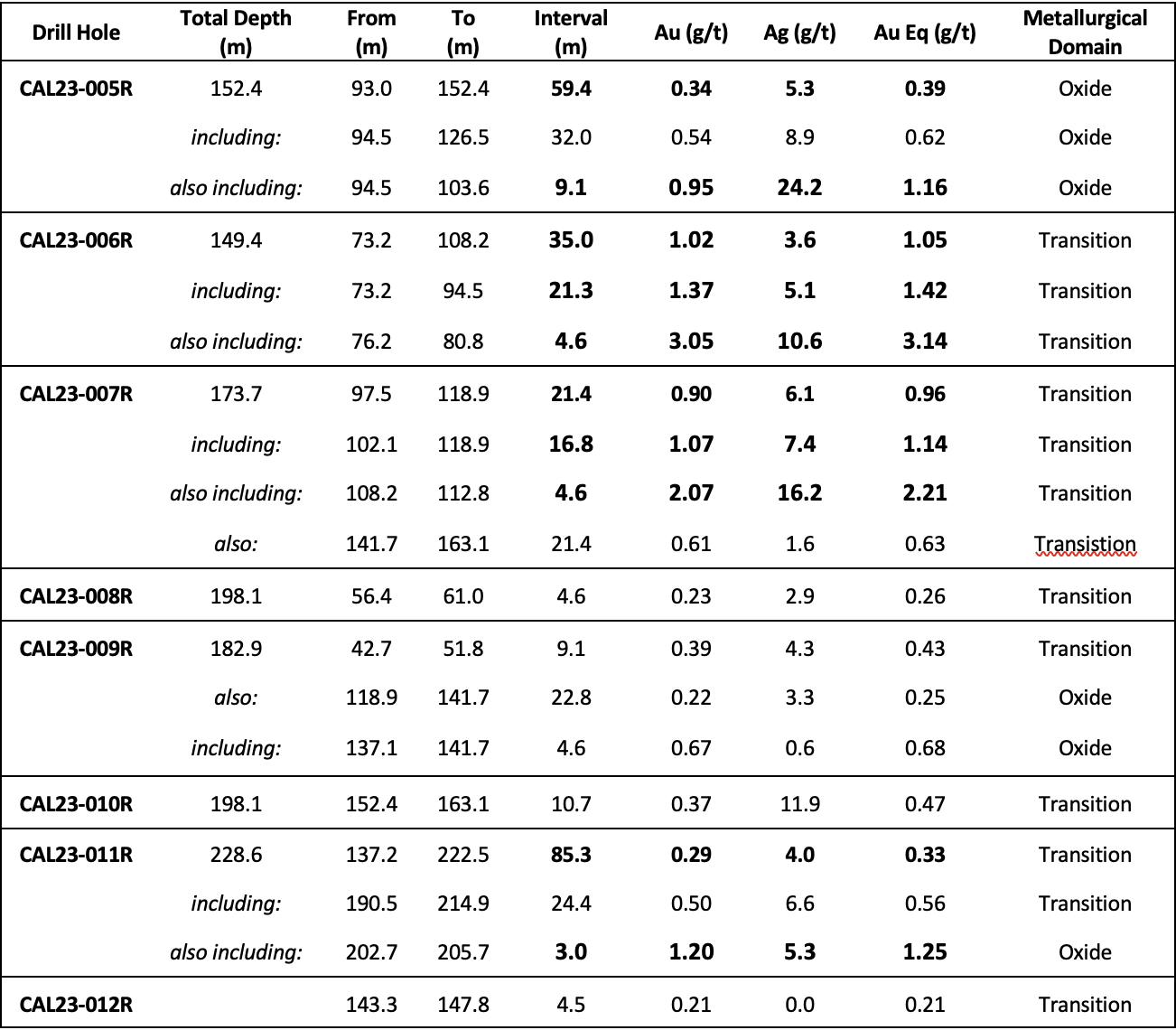

- 35.0 metres grading 1.02 g/t Au and 3.6 g/t Ag (1.05 g/t Au Eq) of shallow mineralization in drill hole CAL23-006R including 21.3 metres grading 1.37 g/t Au and 5.1 g/t Ag (1.42 g/t Au Eq) also including 4.6 metres grading 3.05 g/t Au and 10.6 g/t Ag (3.14 gpt Au Eq). This drill hole, and others completed by Lahontan (e.g. CAL23-006R highlighted below), intercepted significant widths of oxide and transition metallurgical domain gold and silver mineralization below the Mineral Resource Estimate conceptual pit shell at Calvada Central. These drill holes should expand the scale of the conceptual pit shell used to constrain mineral resources in future resource estimates (please see location map, cross section, and table below).

- A shallow intercept of 21.4 metres grading 0.90 g/t Au and 6.1 g/t Ag (0.96 g/t Au Eq) in drill hole CAL23-007R including 16.8 metres grading 1.07 g/t Au and 7.4 g/t Ag (1.14 g/t Au Eq) also including 4.6 metres grading 2.07 g/t Au and 16.7 g/t Ag (2.21gpt Au Eq). This drill hole bottomed in gold and silver mineralized rock and demonstrates that mineralization remains unconstrained by drilling at depth in the Calvada Central area and further opens the Calvada Fault area for resource expansion.

Kimberly Ann, Lahontan Founder, CEO, President, and Director commented: “The Calvada Central drill holes (CAL23-005 through -010) successfully expanded the footprint of disseminated gold and silver mineralization along the Calvada Fault, complimenting the excellent drill results from earlier this year on the eastern portion of the structure (press release dated June 27, 2023). The Calvada Central drill holes hit thick intervals of shallow +1.0 gpt Au Eq rock along with higher grade intercepts (e.g., 4.6m grading 3.14 gpt Au Eq (CAL23-005R, 76.2-80.8m) that are remarkably continuous from drill hole to drill hole. The high-grade zones are enveloped with substantial intervals of +1.1 gpt Au Eq mineralization that potentially can provide opportunities for pit optimization during the resource estimation and Preliminary Economic Assessment process. It is important to note that every drill hole reported today hit gold mineralization, at or above potential cut-off grades. The Company is planning a MRE update and a PEA for early next year while continuing to advance our newly acquired West Santa Fe Project to the drill-ready stage.”

Two drill holes completed at the north end of the Slab resource (see plan map below), both intercepted gold mineralization. Hole CAL23-011R cut a thick zone of gold mineralized rock (85.3m grading 0.33 gpt Au Eq) and shows that the Slab resource extends to the north and remains open for further expansion.

Plan view of the Calvada Central and Slab pit area, Santa Fe Mine, Nevada. The outline of the MRE conceptual pits are shown in dashed red, which encompass both the current Slab and Calvada East pits. Resource blocks are color-coded for Au Eq grade in g/t. The eight drill holes reported herein are shown with heavy green drill hole traces, the line of the cross section (below) is also shown. The plan view map shows only Au Eq blocks that are within the conceptual pit and therefore included in the MRE.

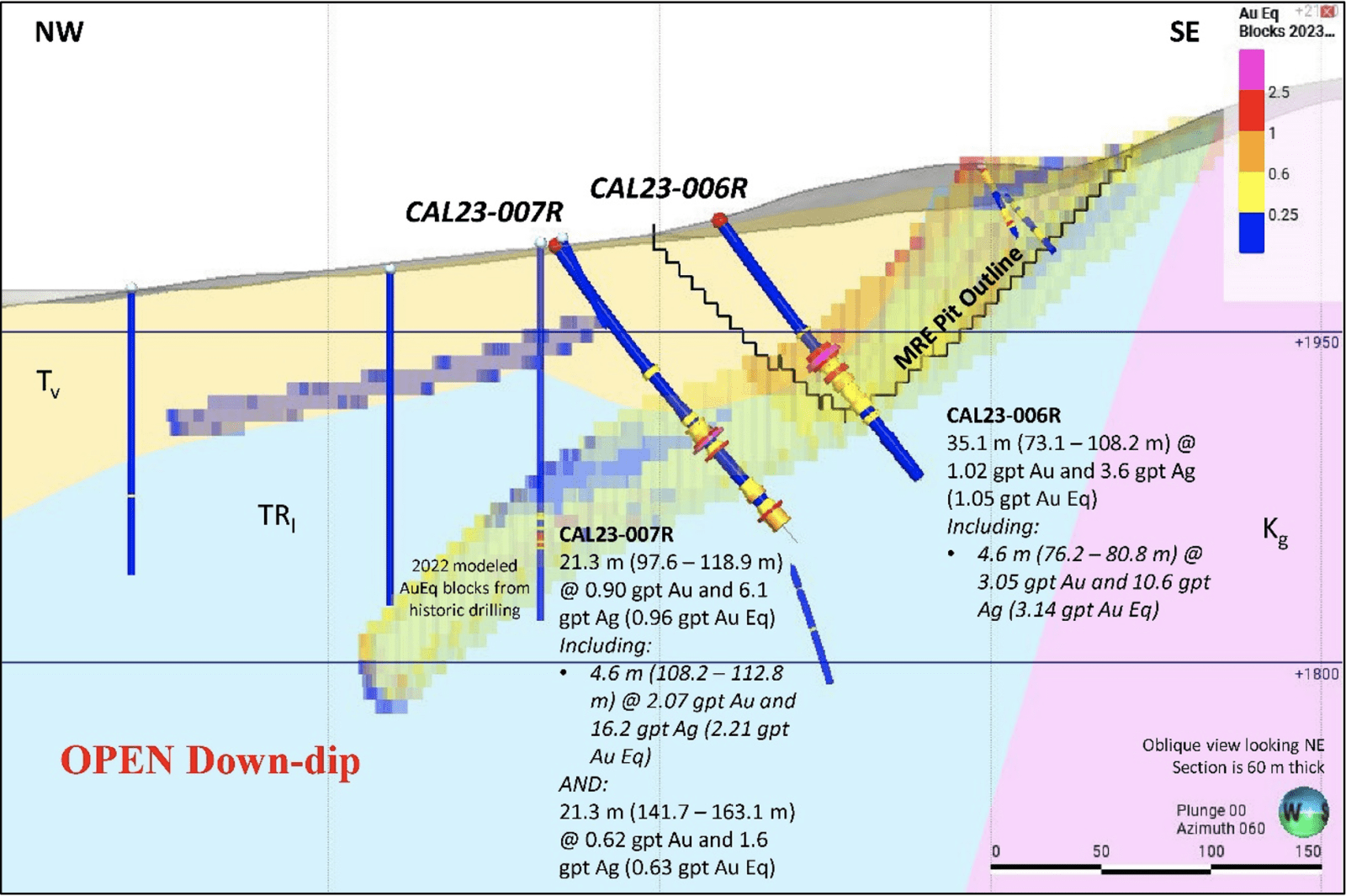

The cross section above shows all Au Eq blocks modeled from historic drilling, both within and outside of the conceptual pit shell. The drill hole coloration in the cross section uses the same grades as the resource blocks, but the value only includes g/t Au rather than Au Eq. Historic drill holes (thinner trace with white collars) use the same coloration as reported drill holes.

The cross section demonstrates that gold and silver mineralization remains open down-dip from the high-grade intercepts in CAL23-007R providing an excellent opportunity for resource expansion at Calvada.

Notes: Au Eq equals Au (g/t) + ((Ag g/t/75)*0.66). Ag grade for calculating Au Eq is adjusted to consider historic metallurgical recovery as described in the Santa Fe Project Technical Report*. True thickness of the intercepts is estimated to be 80-90% of the drilled interval. Numbers may not total precisely due to rounding.

|

|

MORE or "UNCATEGORIZED"

Q2 Metals Discovers High Grade Zone with 170.2 Metre Intercept of 1.99% Li₂O, Including 40.1 m of 2.89% Li₂O at the Cisco Lithium Project

Highlights: CS25-063: 13 separate intervals, including: 75.4 m at... READ MORE

Aya Gold & Silver Identifies New Parallel Structure at Boumadine and Reports High-Grade Exploration Results

Additional Boumadine Mining Licence Secured Aya Gold & Sil... READ MORE

OR Royalties Announces Acquisition of Additional Royalties on Spring Valley in Nevada

OR Royalties Inc. (TSX:OR) (NYSE:OR) is pleased to announce that ... READ MORE

Gold X2 Mining Defines Additional High Grade Corridors with Intersects of 87.0m of 1.75 g/t Au and 83.0m @ 1.56 g/t Au at QES Zone Grade Control Drilling

Gold X2 Mining Inc. (TSX-V: AUXX) (OTCQB: GSHRF) (FWB: DF8), is ... READ MORE

Goliath Reports Numerous High-Grade Intercepts Including 24.16 g/t AuEq Over 7.00 Meters, Grade Values Increased By 19.6 % In 56 Gold Equivalent Drill Results, And Expands Vast Stacked Vein System At Surebet Discovery, Golden Triangle, B.C.

Accounting for Silver, Copper, Lead and Zinc within these 56 dril... READ MORE