Rick Mills – “Survival of the Richest”

Inequality is one of the most volatile aspects of contemporary society, and it is getting worse. As the gap between the haves and the have-nots widens, and the middle class shrinks, the chances of social upheaval increase.

History tells us that a state’s failure to redress rampant inequality can result in bloody revolution.

In the United States and around the world, the rich are getting richer and the poor are getting poorer. According to The Conversation, in every major region of the world outside Europe, extreme wealth is becoming concentrated in a handful of people.

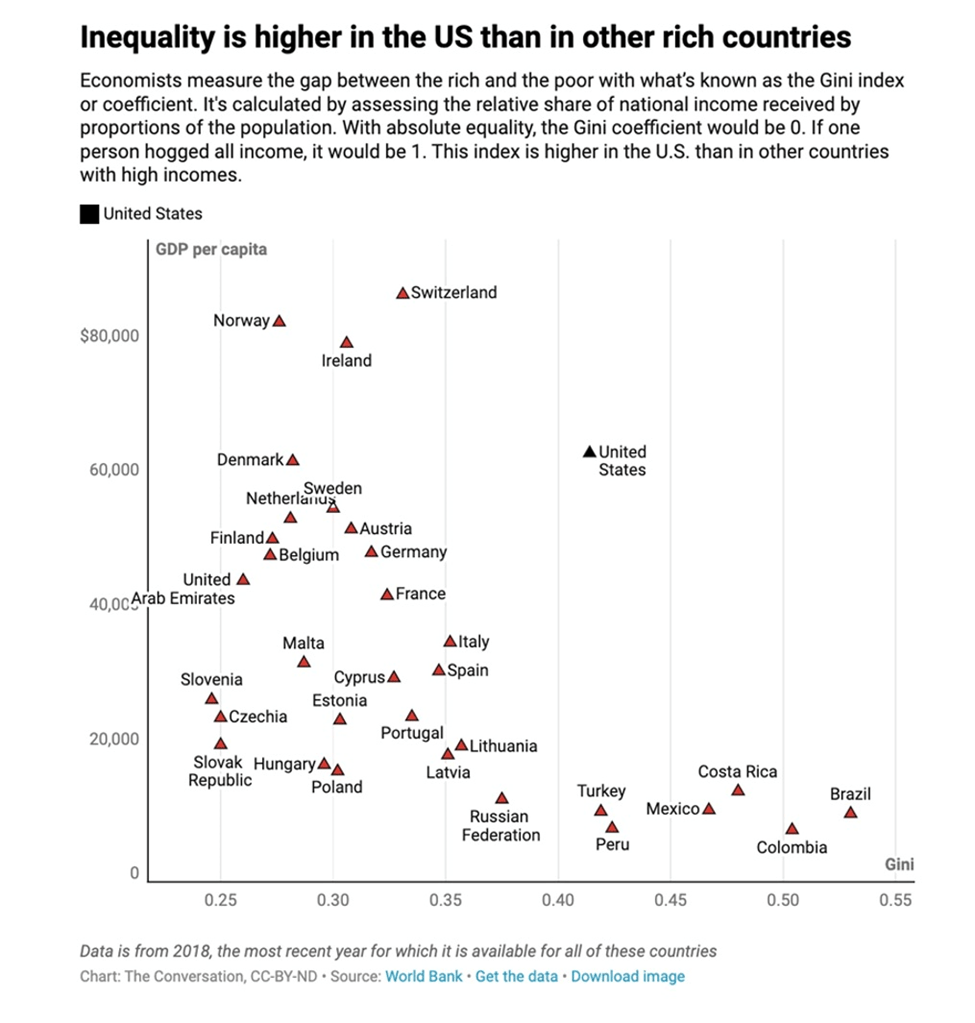

Gini coefficient

The Gini coefficient is the way economists measure the income gap. It is calculated by assessing the relative share of national income received by proportions of the population. A society with perfect equality would have a Gini coefficient of 0, whereas a nation with one individual hoarding every penny of its wealth would have a Gini of 1.

Inequality tends to be greater in developing countries than developed ones. The exception is the United States, which in 2021 had a Gini coefficient of 0.494, 1.2% higher than 0.488 a year earlier. The US Gini is quite a bit higher than Denmark’s, which stood at 0.28 in 2019, and France, whose Gini was 0.32 in 2018, according to Census Bureau data.

Source: The Conversation

The Conversation points out that the inequality picture is even worse when looking beyond income (what people earn) to wealth (what they own). In the United States, the richest 1% of Americans own 34.9% of the country’s wealth, while average Americans in the bottom half had USD$12,065. The disparity is greater in the US than in other industrial nations, such as Germany, where the richest 1% own 18.6% of the wealth, or in the UK, where they own 22.6%.

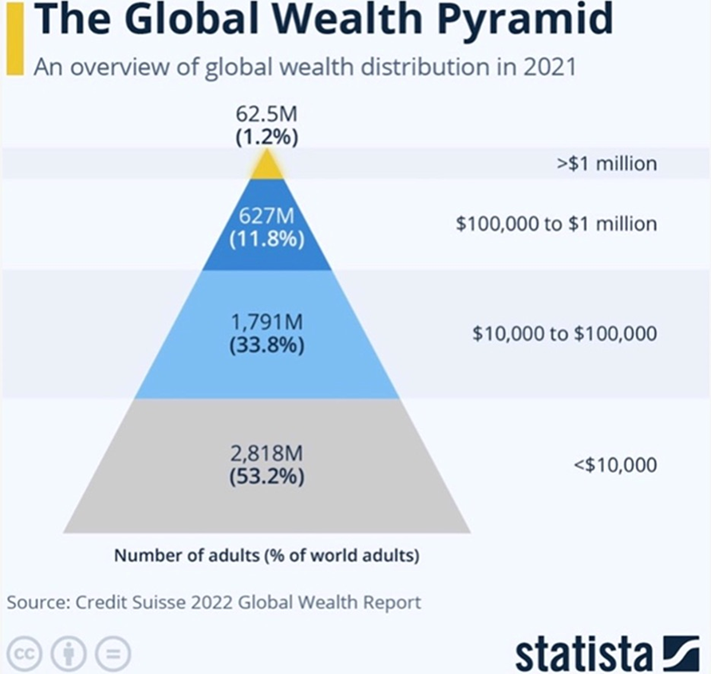

A Credit Suisse report finds nearly half of global household wealth (47%) is in the hands of just 1.2% of the world’s population. These 62.5 million individuals control a staggering $221.7 trillion.

At the bottom of the pyramid, 2.8 billion people share a combined wealth of $5 trillion, an amount representing only 1.1% of the global wealth total.

How’s that for the rich getting richer?

Household wealth declines

Given all the layoffs and business closures, readers may be surprised to learn that the pandemic was a period of wealth accumulation for global households. According to Oxfam, during the pandemic a new billionaire was created every 30 hours!

Less surprising is the decline in household wealth that has accompanied rampant global inflation and interest rate hikes. Both hit the poor and working poor, who struggle to pay bills and often carry hefty credit card balances, especially hard.

“Wealth evolution proved resilient during the COVID-19 era and grew at a record pace during 2021,” said Nannette Hechler-Fayd’herbe, the global head of economics and research at Credit Suisse (via Bloomberg) — acquired by UBS Group AG earlier this year.

“But inflation, rising interest rates and currency depreciation caused a reversal in 2022.”

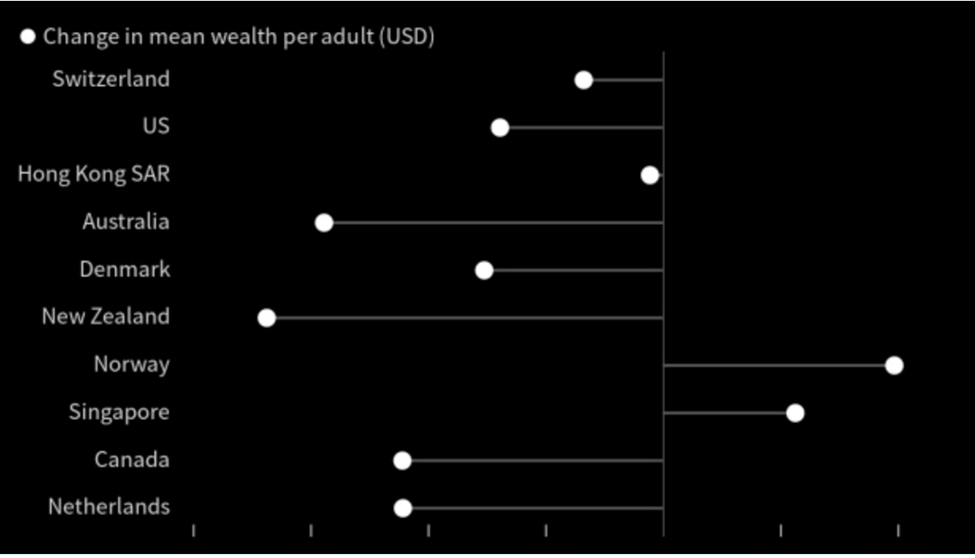

According to the company’s global wealth study, household wealth fell last year for the first time since the financial crisis, with inflation and the higher US dollar wiping out $11.3 trillion of assets. Total net private wealth decreased by 2.4% to $454.4 trillion. Most of the decline was in North American and European households, which lost a combined $10.9 trillion.

Another surprising finding: despite Western sanctions, Russia saw a large wealth increase last year, adding 56 millionaires. Latin America’s wealth also increased in 2022, helped by an average 6% currency appreciation against the US dollar, states the report.

Note in the graphic below that the United States and Canada both saw declines in wealth per adult.

Source: UBS-Credit Suisse Global Wealth Report

26 million more millionaires

While the global economy last year reduced the number of millionaires by 3.5 million, and the richest one percent’s share of global wealth fell to 44.5% from 47%, the study predicts that 2022 will be a blip in the overall projection of wealth growth. Bloomberg reports:

Globally, it is set to increase by $629 trillion by 2027, or 38%. And the number of millionaires could reach 86 million by 2027 from about 60 million in 2022.

Never mind millionaires. Let’s talk billionaires. According to the World Economic Forum, the average billionaire has gained around $1.7 million for every $1 of wealth gained by a person in the bottom 90%. The collective wealth of the super-rich is increasing by $2.7 billion a day. Over the last 10 years, the number and wealth of billionaires has doubled.

Other depressing stats, courtesy of the WEF:

- At least 1.7 billion workers live in countries where inflation is outstripping wages.

- More than 820 million peopleare going hungry, most of them women who have to eat last and least. In addition, 339 million people now need humanitarian aid – the most ever. This means emergency food rations, clean water and shelter.

- Poor countries are so indebted, including to predatory private lenders, they are having to spend four times more on debt repaymentsthan on healthcare.

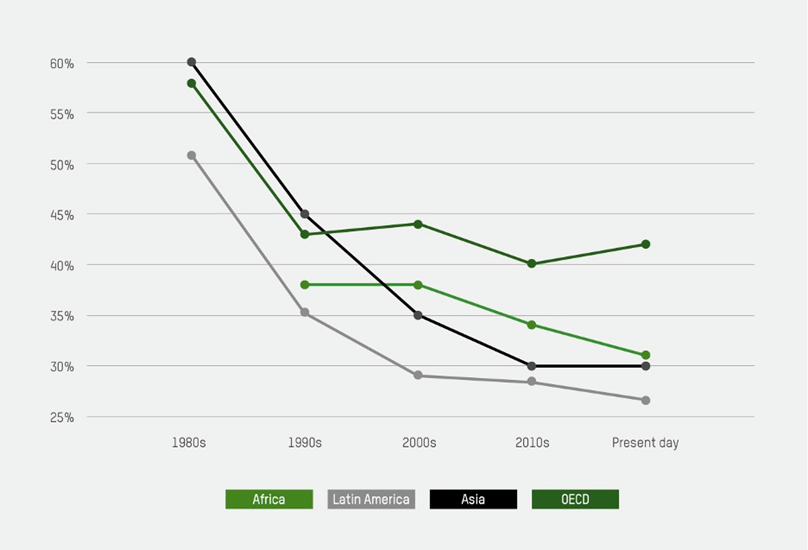

- Over the last 40 years, there has been a systematic race to the bottom on the taxation of the richest, driven by economic ideology and the capture of politics by rich elites. Elon Musk, one of the world’s richest men, paid a “true tax rate” of about 3%from 2014 to 2018. Jeff Bezos paid less than 1%.

- Half of the world’s billionaires live in countries with zero inheritance tax for direct descendants. They have a $5 trillion tax-free treasure chest to pass seamlessly onto the next generation, building tomorrow’s elite.

In the last decade, the top income tax rate in every region of the world has decreased. Source: World Economic Forum. Image: Oxfam

Conclusion

It’s part of inequality for those in upper-income brackets to dismiss these findings and carry on as usual. But this would be short-sighted. A concentration of income and wealth reduces demand in the economy because rich households spend less of their income than poorer ones. This leads to lower economic growth.

There also evidence to prove that rising inequality is eroding trust in democracy and fostering the spread of authoritarian and nativist movements, such as the election of Donald Trump, and right-wing leaders in Britain and Europe.

Without government intervention to address inequality — through for example higher taxes on the rich and redistributive policies, both of which are opposed by a large percentage of Americans (and Canadians) — it is likely to persist or rise even further. The Council on Foreign Relations notes that climate change, artificial intelligence, and new waves of digital technologies and automation, could all widen the gap between the rich and the poor.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE