Peter Krauth – “Optimal Silver Allocations”

It looks like recession is now all but a sure thing.

A soft landing engineered by the Fed is highly unlikely.

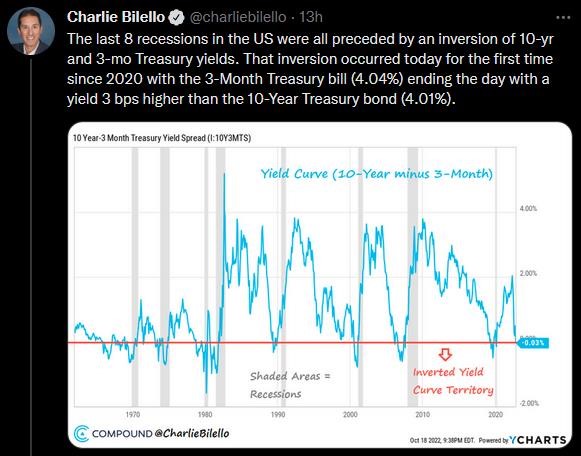

I say that because the market, although not perfect, is usually a pretty good predictor. Here’s a recent post on Twitter that says it all.

That was October 18th. As I write, the 3-month Treasury is at 4.07%, while the 10-year is at 3.99%. Though only slightly, it’s an even bigger spread than 10 days ago.

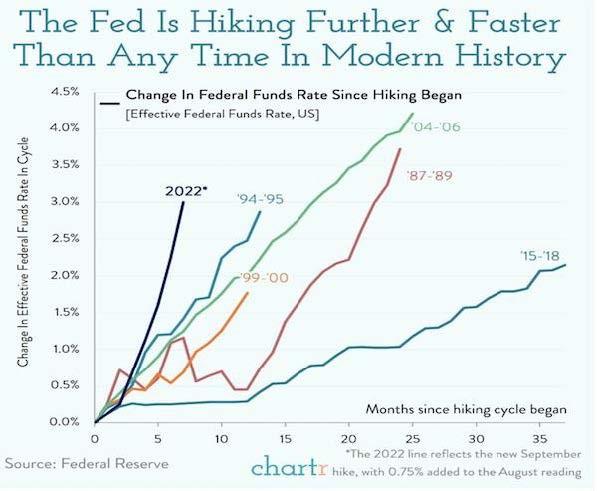

That’s a result of the Fed’s slow reaction to what it called “transitory inflation”, which is still above 8%. So their rate hiking cycle, the fastest in modern history, has brought us here.

Stocks and bonds have both taken big hits since the start of this year. The S&P 500 is down 19%, while long term bonds are down 33% year-to-date. That has to have investors looking for alternatives.

And yet, the Fed is signaling the beginning of the end of rate hikes. Some regional Fed presidents are saying the Fed should start slowing the pace of rate hikes. In all likeliness, the Fed will hike 0.75% at its November meeting, then follow with a couple more hikes of perhaps 0.50% each. That would bring the rate to about 4.75%. I’m not sure it will get even that far without something breaking in the markets, causing the Fed to at least pause before that level. We’ll see. After that, look for a pause (or not), then rate cuts when it sees it’s gone too far too fast.

Meanwhile, with signals the end in hikes could be a quarter of two away, that has stocks and even bonds looking ahead. We could see a rally in both for awhile from here. That would not surprise me.

What’s more, the European Central Bank is only starting to hike rates in a serious way. That has the market starting to price in a potential top in the US dollar index, along with a possible rally in the euro, which I look at in more detail in my technical analysis later in this issue.

So what does all this suggest for silver? Well, sentiment continues to weigh, but the silver price appears to have been forming a bottom over the last 4 months. A weaker dollar would very likely help push silver prices higher.

At the recent London Bullion Market Association’s Global Precious Metals Conference, delegates were asked where they see gold and silver within a year. They expect gold to be around $1,830.50 per ounce, or almost 12% higher. But for silver, they expect the metal to reach about $28.30 by next October, a huge increase of almost 54% higher!

Meanwhile, the tightness in physical silver markets has only worsened. Incredibly, one-ounce American Silver Eagle coins are now selling at 100% premiums over the spot price! That means buyers are paying double the cost of the spot price for silver!

In the case of the Silver Eagles, supply tightness has been exacerbated by the U.S. Mint’s “management” of this product. So far this year, the Mint has only supplied 11.6 million ounces of this coin, half of the amount supplied through the first seven months compared with previous years with strong demand. In fact, supply is so tight with demand so strong, that bullion dealers are offering huge buyback premiums. APMEX is offering $10 over spot, while SD Bullion is offering $11 over spot.

In this issue, I give a detailed look at some fascinating research by Oxford Economics and The Silver Institute, which determined the optimal allocation to silver in a diversified portfolio. They first look at the last 23 years, then look forward at the next 10 years. Right now, the average investment portfolio is woefully low on silver, given its return-enhancing benefits.

And recently, I was in New York at the 121 Mining Investment Conference. I gave a talk on silver and participated in a panel on the outlook for precious metals. You can view both here:

Precious Metals Panel Discussion

In my talk, I make the case for silver and especially silver junior stocks. That’s because the demand for silver keeps growing at a rapid clip, while supply is falling or flat at best.

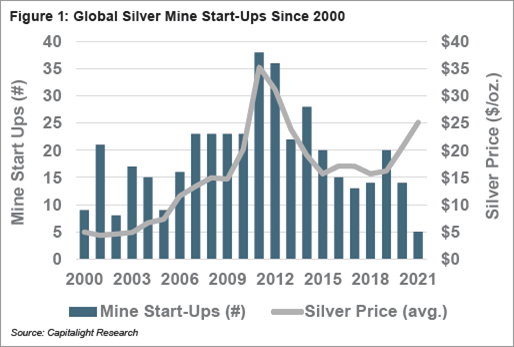

Recent research shows that despite average silver prices having risen in the last three years, global silver mine startups have actually fallen.

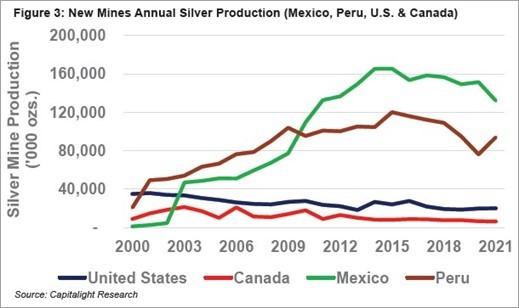

Even more concerning is that supply from two of the world’s largest silver producers, Mexico and Peru, has been falling on balance for the past 6 years.

These drivers, and a lot more, are all covered in my recent book The Great Silver Bull.

If you haven’t picked up a copy yet, it’s easy. CLICK HERE to order The Great Silver Bull.

Given this clearly favourable outlook for silver on a supply/demand, relative price, and macro level with inflation and debt soaring, the case for silver in your portfolio is stronger than ever.

Courtesy of the Silver Stock Investor

MORE or "UNCATEGORIZED"

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 Kilometres West of Eureka; Follow-Up Drill Program Underway

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 ... READ MORE

Silver One Announces Closing Of Final Tranche Of $32 Million Financing

Silver One Resources Inc. (TSX-V: SVE) (OTCQX: SLVRF) (FSE: BRK1)... READ MORE

SAGA Metals Achieves 100% Drilling Success in 2025—Reports Final Assays from Trapper South at Radar Critical Minerals Project in Labrador

Exceptional grades of Titanium, Vanadium and Iron in all 15 drill... READ MORE

Near Surface Intersection Yields 6.58 g/t gold over 10.35 metres

Intersection is within 33 metres from surface and contained in a ... READ MORE

Alamos Gold Provides Three-Year Operating Guidance Outlining 46% Production Growth by 2028 at Significantly Lower Costs

Further production growth to one million ounces annually expected... READ MORE