Shareholder Conviction Index 67%

Stock by Stock Buyer Conviction Down 18% YTD

27% Of Big Cap Investors Say A Corporate Tax Hike Will

Lessen Their Equity Exposure

“The YTD decrease stock by stock across 1400 big cap names on the BWI index signals a general slow down of the growth of global buy-side demand. Combined with a decrease in net buyers, absent a reversal of conviction, proportionate slowdown in price growth would be a natural outcome.” Brendan Wood & Partners

The Brendan Wood Index polls the buying intentions of 2000 portfolio managers running $50+ trillion worldwide and reports on a weekly basis.

Are you planning to be a net buyer in the near term 3 months? (Net buyer means own more $ in equities than you do today.)

Yes = 67% (66% last week) (83% August 3rd 2021) (66% September 2020) (95% April 2020)

No = 33% (34% last week) (17% August 3rd 2021) (34% September 2020) (5% April 2020)

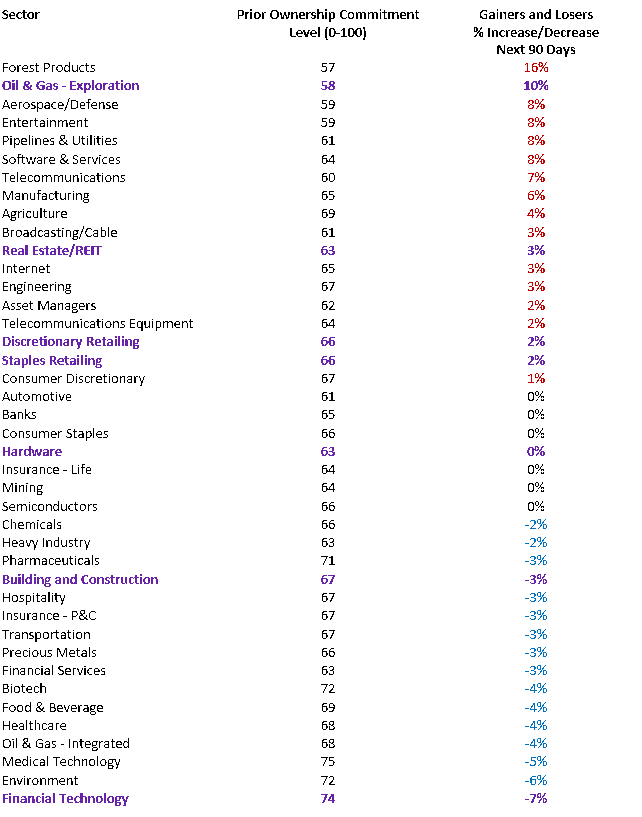

Planned Sector Gainers and Losers

Purple Color = Change in Ownership Commitment Level Week over Week

*Based on investor demand for stocks in sector

What Will Influence Investors’ Exposure to Equities?

- Proposed US Corporate Income Tax Increase (to 28%)

Greatly Increase = 0% (0% last week)

Increase = 14% (12% last week)

Neutral = 59% (60% last week)

Decrease = 26% (27% last week)

Greatly Decrease = 1% (1% last week) - Proposed US Personal Capital Gains Tax Increase (to 39.5%)

Greatly Increase = 0% (0% last week)

Increase = 12% (10% last week)

Neutral = 73% (73% last week)

Decrease = 14% (16% last week)

Greatly Decrease = 1% (1% last week) - Proposed Major US Government Spending Increase

Greatly Increase = 3% (1% last week)

Increase = 38% (39% last week)

Neutral = 50% (51% last week)

Decrease = 8% (8% last week)

Greatly Decrease = 1% (1% last week) - Increased US Trade Imbalance vs China

Greatly Increase = 1% (1% last week)

Increase = 14% (14% last week)

Neutral = 71% (70% last week)

Decrease = 13% (14% last week)

Greatly Decrease = 1% (1% last week) - Increased/Prolonged Inflation

Greatly Increase = 6% (6% last week)

Increase = 40% (36% last week)

Neutral = 33% (38% last week)

Decrease = 21% (20% last week)

Greatly Decrease = 0% (0% last week)

Impact on Big Ticket Investors’ Exposure to Equities Legend (Greatly Decrease (-10%+), Decrease (0% to -10%), Neutral (0%), Increase (0% to 10%), Greatly Increase (10%+)):

Looking for a Report on your company or more information about the BWI Shareholder Confidence Index please contact the undersigned.

About Brendan Wood International:

Brendan Wood International (BWI), formed in 1970, is a private advisory group which originates performance investigation programs in the capital markets. Brendan Wood Partners debrief large institutional investors worldwide on a daily basis. There are 2000 investors in the investor panel collectively managing + $50 trillion invested in the 1400 companies on the BWI Index. Relying on its real time performance intelligence, BWI advises public companies, institutional and activist investors, investment banks and broker dealers on strategy, performance and recruitment of TopGun talent. The firm’s partners have formally presented at 1000+ C level strategy meetings and corporate off sites in fifty cities. Brendan Wood founded the exclusive TopGun Club, a performance based institution.

MORE or "UNCATEGORIZED"

Koryx Copper Intersects 338.61 Meters At 0.38% Cu Eq Including 230.61 Meters At 0.45% Cu Eq and Multiple 2 Meters Intersections Over 1.00% Cu Eq

Significant copper and molybdenum intersections include: HM09: 13... READ MORE

Aya Gold & Silver Reports Q1-2024 Results; Maintains Guidance; Zgounder Expansion on Track

Aya Gold & Silver Inc. (TSX: AYA) (OTCQX: AYASF) is pleased t... READ MORE

Silver Mountain Delivers Positive Preliminary Economic Assessment For Its Reliquias Project, Peru; Pre-Tax NPV 5% Of C$107 million, Pre-Tax IRR Of 57%, And Payback Of 1.8 Years

Key Highlights – Preliminary Economic Assessment Pre-Tax Net Pr... READ MORE

ARIS MINING REPORTS Q1 2024 RESULTS WITH SEGOVIA GENERATING $13.8 MILLION IN OPERATING CASH FLOW

Aris Mining Corporation (TSX: ARIS) (NYSE-A: ARMN) announces its ... READ MORE

Orla Mining Reports First Quarter 2024 Results

Orla Mining Ltd. (TSX: OLA) (NYSE: ORLA) announces the results fo... READ MORE