Jordan Roy-Byrne – “Gold Set to Correct but Internals Remain Bullish”

Last week we wrote that near-term risk in precious metals (Gold and GDX especially) was rising and a correction could begin soon.

As Gold nearly reached major resistance at $1550/oz, the miners already began to correct. That negative divergence is an ominous signal for the sector in the short term.

However, the good news is, at least at present, Gold remains very strong in real and intermarket terms.

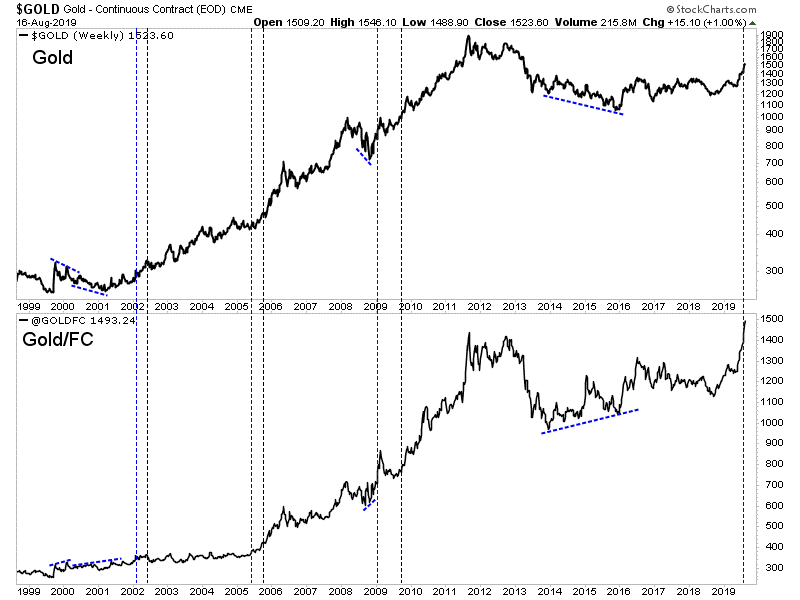

The first example of that is Gold’s strength against foreign currencies (Gold/FC). Gold/FC made a new all time high a few weeks ago and is now 4% above the previous all time high.

In the chart below we mark the points when Gold/FC made a new high first in blue and Gold’s new highs in black. Note that when Gold/FC makes a new high first, Gold tends to follow.

Also, we should note that Gold’s false new high in 1996 and cyclical bull market from 1985 to 1987 were never confirmed by Gold/FC, which showed a negative divergence both instances.

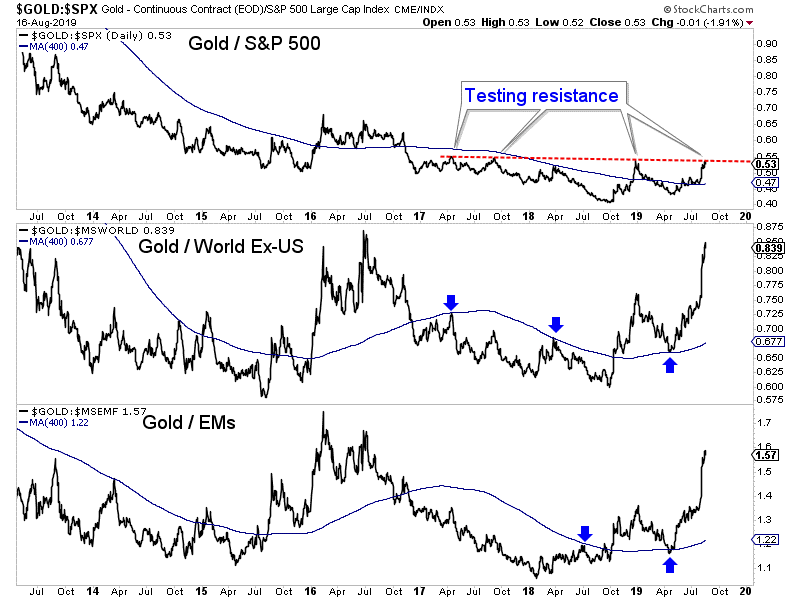

Elsewhere, Gold is very strong against global equity markets and has reached important resistance relative to the S&P 500.

In all of these charts, including Gold against the S&P 500, the market is well above long-term moving averages and support. We do expect Gold to correct soon in both nominal and real terms but it does have plenty of breathing room.

Unlike in 2016, Gold against foreign currencies is at an all time high and the Federal Reserve has started a new cycle of rate cuts.

However, be advised that even within primary uptrends Gold and gold stocks have often consolidated and corrected for several months.

If you missed the recent run, then it is best to be patient, buy value and wait for weakness in the high quality juniors that appear extended. The best time to buy the leaders is during a correction. New opportunities will also emerge. To learn the stocks we own and intend to buy during this weakness that have 3x to 5x potential, consider learning more about our premium service.

MORE or "UNCATEGORIZED"

Koryx Copper Intersects 338.61 Meters At 0.38% Cu Eq Including 230.61 Meters At 0.45% Cu Eq and Multiple 2 Meters Intersections Over 1.00% Cu Eq

Significant copper and molybdenum intersections include: HM09: 13... READ MORE

Aya Gold & Silver Reports Q1-2024 Results; Maintains Guidance; Zgounder Expansion on Track

Aya Gold & Silver Inc. (TSX: AYA) (OTCQX: AYASF) is pleased t... READ MORE

Silver Mountain Delivers Positive Preliminary Economic Assessment For Its Reliquias Project, Peru; Pre-Tax NPV 5% Of C$107 million, Pre-Tax IRR Of 57%, And Payback Of 1.8 Years

Key Highlights – Preliminary Economic Assessment Pre-Tax Net Pr... READ MORE

ARIS MINING REPORTS Q1 2024 RESULTS WITH SEGOVIA GENERATING $13.8 MILLION IN OPERATING CASH FLOW

Aris Mining Corporation (TSX: ARIS) (NYSE-A: ARMN) announces its ... READ MORE

Orla Mining Reports First Quarter 2024 Results

Orla Mining Ltd. (TSX: OLA) (NYSE: ORLA) announces the results fo... READ MORE