1911 Gold Announces Mineral Resource Estimate Update for the True North Gold Project

1911 Gold Corporation (TSX-V: AUMB) (OTC: AUMBF) is pleased to report an updated underground Mineral Resource Estimate for the True North Gold Project, located within the Company’s 100% owned Rice Lake property in southeastern Manitoba, Canada.

Highlights

- Underground MRE defined for the True North Gold Project is reported within mineral resource constraining envelopes using a 2.25 grams per tonne Gold threshold. All blocks within the envelopes are reported and tabulate as:

- Indicated Mineral Resource of 3,516,000 t @ 4.41 g/t Au containing 499,000 ounces Au

- Inferred Mineral Resource of 5,490,000 t @ 3.65 g/t Au containing 644,000 oz Au

- The MRE highlights areas with exploration targets for resource expansion both down plunge and along strike to the modeled veins and within areas with historic drillholes that require drilling prior to including them in future resource estimates

- 1911 Gold has started a surface drill program with target areas that include:

- Gold mineralization intersected in historic drillholes that are in new target areas along strike from the resource and within 400 m of surface

- New targets identified during the vein modelling that are proximal to Au-bearing shear zones within favourable host rocks

- Management will hold a webinar on Tuesday, November 26, 2024, at 10:00am (EST) to present and review the results of this mineral resource estimate (details below)

Shaun Heinrichs, President and CEO of 1911 Gold, commented, “Validating the project database and remodeling the vein wireframes to support a Mineral Resource Estimate was a critical first step along the path to restarting production at the True North Gold mine. The resulting resource model now better reflects the shape of the veins, and the consolidated model will be important as we work closely with Eric Vinet on building a long term, sustainable development plan. We are particularly pleased with the areas that have been identified as having potential to expand the mineral resources with further drilling, in addition to the new targets generated. We continue to leverage off the work done by our predecessors as well as our enhanced knowledge gained from the re-interpretation work completed, which has identified numerous high priority resource expansion areas and new geological targets from our refined geological model.”

1911 Gold Executive Chaiman, Gary O’Connor, commented “We are pleased to have our updated Mineral Resource Estimate at the True North Gold project to produce a robust and solid high grade underground gold resource which will form the basis of our plans to generate a redevelopment plan with significant valuation for the past producing fully constructed and permitted gold mine. Significant potential to grow the new resource, as well as to discover and define new resource targets outside of the mineral resource areas, has been a major bonus from the reinterpretation and new resource modelling. We look forward to releasing the results of the current drill program and presenting the upside potential to grow and develop the project.”

Mineral Resource Estimate

The underground MRE resource is based on a drill hole database that was rebuilt by 1911 personnel (completed on July 31, 2024) containing a total of 11,632 drill holes, with a total core length of 1,520,700 m. Of these drillholes, 3,157 drill holes intersected the modelled vein solids and 30,525 samples, covering 15,838 m, were included in the resource estimation (Table 1).

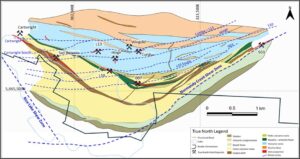

The updated resource is comprised of 66 modelled vein shapes. The geological interpretation of each vein incorporated the host lithologies, mineralization character, alteration style and structural features. The modelling was completed on cross-sections and level plans using drill hole data and detailed geology level maps drawn when the mine was in production. The level maps were also used to validate the vein traces and drill hole collar locations. The majority of the vein solids strike NW-SE or NE-SW (Figure 1) and plunge approximately 50 degrees to the NE or NW respectively. The mineralized gold trends tend to occur within shear zones and are hosted within favourable competent host rocks (gabbro, basalts and fragmental volcaniclastics). Three-dimension modelling of the vein solids was generated in “Leapfrog Geo”, a modelling software.

Figure 1: True North Gold Project simplified geology map with zone locations and surface vein projections (CNW Group/1911 Gold Corporation)

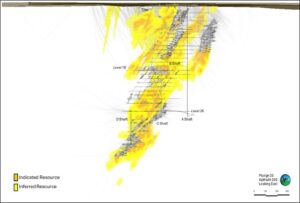

Figure 2: Cross section looking east of resource block model with underground mine workings and drill hole traces (CNW Group/1911 Gold Corporation)

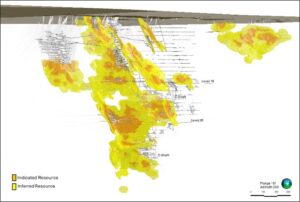

Figure 3: 3D view of resource block model looking southwest with underground mine workings and drill hole traces (CNW Group/1911 Gold Corporation)

The underground MRE was completed on November 13, 2024, and is reported within mineral resource constraining envelopes using a 2.25 g/t Au threshold. All blocks within the envelopes are included in the MRE results presented in Table 1.

Table 1: True North Gold Project: Underground Mineral Resource Estimate Reported within 2.25 g/t Au Mineral Resource Constraining Envelopes

| Mineral Resource | Tonnage | Gold Grade

|

Contained Gold

|

| (Category) | (t) | (g/t) | (oz) |

| Indicated Resources | 3,516,000 | 4.41 | 499,000 |

| Inferred Resources | 5,490,000 | 3.65 | 727,000 |

Notes:

- The effective date of the MRE is August 29, 2024, which is the date when all scientific and technical data was submitted to Lions Gate Geological Consulting (“LGGC”).

- The MRE follows the November 29, 2019, CIM Estimation of Mineral Resources and Mineral Reserves Best Practice Guidelines.

- Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. There is no certainty that all or any part of the Mineral Resources estimated will be converted into Mineral Reserves. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

- The CIM definitions were followed for the classification of Indicated and Inferred Mineral Resources. Indicated Mineral Resources were assigned for blocks with three drill holes within 30 m (100 feet “ft”) and inferred blocks were assigned for blocks with one drill hole within 46 m (150 ft).

- Ounces and tonnes have been rounded to the nearest 1,000 therefore sums in the table may not add-up due to rounding.

- Resource constraining envelopes were built around contiguous clusters of blocks at a nominal cut-off grade of 2.25 g/t Au. The mineral resources are reported at a 0.00 g/t Au cut-off within the envelopes. The gold grade threshold for the resource envelopes of 2.25 g/t Au is based on assumptions of a gold price of US$2,000/oz, an exchange rate of US$/C$ 0.75, mining operating costs of C$132/t, processing costs of C$34/t, G&A of C$12/t and average gold recoverability of 94%. The vein solids were built with a minimum width of 1.2 m. This same width was used for the mineral resource envelopes.

- A bulk density of 2.76 t/m3 (0.086 short tons/ft3) was used to convert volumes to tonnes for all blocks in the mineral resource estimation.

- The assay gold values were capped to 342.5 g/t Au (10 oz/short ton) and a restricted outlier strategy was applied to each vein to restrict local extreme grades to 15 m (50 ft) from the composite.

- Gold grades were estimated into a 4.6 m (15 ft) block model using inverse distance squared (ID2) method and 0.46 m (1.5 ft) composited data restricted within the vein solids.

The MRE was completed using HxGN MinePlanTM 3D software and includes the estimation of gold grades into a 4.6 m block model (15x15x15 ft) using Inverse Distance Squared (ID2) method. Composites from a minimum of two drill holes was required for a block to be interpolated with a gold grade.

Prior to estimating block grades, potentially anomalous outlier grades were identified and their influences on the grade model was controlled during interpolation through the use of traditional top‐cutting and outlier restrictions. The assay gold values were capped to 342.5 g/t Au (10 oz/short ton). The composites for each of the estimated veins were reviewed by histogram/probability plot and a restricted outlier strategy was employed to limit the influence of extreme gold grades to 15 m (50 ft) from a composite location.

The resource constraining envelopes were built around contiguous clusters of blocks at a nominal cut-off grade of 2.25 g/t Au. The mineral resources reported in Table 1 are reported at a 0.00 g/t Au cut-off within the resource constraining envelopes as required by CIM guidelines for declaring an underground mineral resource estimate. The sensitivity of the block values within the 2.25 g/t Au resource constraining envelopes to gold grade is included Table 2. The block tabulations included in Table 2 do not constitute mineral resource estimates and are included to illustrate block grade sensitivity only within the 2.25 g/t Au envelopes.

Indicated Mineral Resources were assigned if a block was within 30 m (100 ft) of three drill holes and Inferred Mineral resources if a block was within 46 m (150 ft) of one drill hole.

Table 2: Sensitivity of the Block Model to Different Gold Grade Thresholds within the 2.25 g/t Resource Constraining Envelopes

| Sensitivity Grade |

Gold GradeIndicatedInferredTonnageGold

Grade

Contained

GoldTonnageGold

Grade

Contained

Gold(g/t)(t)(g/t)(oz)(t)(g/t)(oz)2.002,781,0005.23468,0004,852,0003.96618,0002.252,530,0005.54451,0004,404,0004.14587,0002.502,255,0005.93430,0003,754,0004.45537,0003.001,751,0006.85386,0002,726,0005.10447,0003.501,368,0007.86346,0002,031,0005.75375,0004.001,093,0008.91313,0001,527,0006.42315,000

- The block tabulations included above do not constitute mineral resource estimates and are included to illustrate block grade sensitivity within the 2.25 g/t Au resource constraining envelopes

Mineral Resource Potential Discussion

The MRE has identified areas in the deposit where increased drill hole spacing could result in more blocks being interpolated with gold grades and increased levels of classification for some blocks. These areas lie close to the historic stopes in the mined areas of the project where blocks were not estimated due to uncertainty of the locations of the stope solids. 1911 Gold will undertake a thorough review and validation of the mined shapes in order to better define the potential for resources proximal to historic stopes.

The potential for adding mineral resources proximal to areas of known mineralization and at new emerging targets will be reviewed through updated vein and structural interpretations and refinement of the geological understanding of the True North Gold Project.

The Company is planning a review of the underground facilities at True North Project to define the most suitable areas for underground drilling to support a drilling campaign to potentially upgrade and expand the current resources inventory down plunge and along strike of the resource.

Future Plans

1911 Gold is currently completing first phase surface drilling within areas outside of the resource in near surface and near infrastructure areas where historical drill intercepts have already intersected significant mineralized veins, and the new geological model has identified significant new resource potential. Initially three prioritized target areas have been identified and are the target of the current drill program (see Company’s press release: “1911 Gold Initiates Surface Drill Program on New Exploration Targets at the True North Gold Mine”, dated October 3, 2024).

With the completion of the MRE the 1911 Gold geology team will define and prioritize resource expansion areas for further drilling to include in future resource updates. The prioritization of deep new targets is also underway and the drill targeting of these will also be prioritized. The Company has commenced work on a preliminary development and mine plan, working closely with Éric Vinet, recently engaged as a key technical advisor, focusing on identifying suitable mining methods, expected costs, and overall economics supporting the restart strategy.

Quality Assurance/Quality Controls (QA/QC) Procedures

All drill data that supports the mineral resource estimation were completed by previous operators and were drilled between 1994 and 2017. The majority of the drill holes were BQ sized core (1,895 DDHs) with a lesser number being AQ sized core (1,112 DDHs), NQ sized core (137 DDHs) and HQ sized core (11).

Both 1911 Gold and LGGC have reviewed the historical QAQC data that supports drilling and assay data and finds them acceptable to support the MRE.

About 1911 Gold Corporation

1911 Gold is a junior explorer that holds a highly prospective, consolidated land package totalling more than 63,036 hectares within and adjacent to the Archean Rice Lake greenstone belt in Manitoba, and also owns the True North mine and mill complex at Bissett, Manitoba, where it is reprocessing historic tailings on a seasonal basis. 1911 Gold believes its land package is a prime exploration opportunity, with potential to develop a mining district centred on the True North complex. The Company also owns the Apex project near Snow Lake, Manitoba and the Tully and Denton-Keefer projects near Timmins, Ontario, and intends to focus on both organic growth opportunities and accretive acquisition opportunities in North America.

1911 Gold’s True North complex and exploration land package are located within the traditional territory of the Hollow Water First Nation, signatory to Treaty No. 5 (1875-76). 1911 Gold looks forward to maintaining open, co-operative, and respectful communication with the Hollow Water First Nation, and all local stakeholders, in order to build mutually beneficial working relationships.

Qualified Person Statement

The MRE was completed by Susan Lomas, P.Geo. of LGGC with assistance from Bruce Davis, PhD, FAusIMM, each of whom is an Independent Qualified Person under NI 43-101 standards.

The technical information in this news release has been reviewed and approved by independent QP Susan Lomas, P.Geo.

An independent technical report prepared in accordance with the requirements of NI 43-101 will be completed within 45 days of this news release.

The scientific and technical information in this news release has been reviewed and approved by Mr. Michele Della Libera, Vice President Exploration of 1911 Gold Corporation. Mr. Della Libera is a Professional Geoscientist (P.Geo.) and Practising Member of the Engineers and Geoscientists of British Columbia, the Association of Professional Geoscientists of Ontario and a “Qualified Person” as defined under National Instrument 43-101.

Conference Call

The Company will host a conference call at 10:00 a.m. E.T. on Tuesday, November 26, 2024, at which time Shaun Heinrichs, President and CEO, Gary O’Connor, Executive Chairman, and Michele Della Libera, VP Exploration, will present the findings set out in this press release.

The conference call can be accessed as follows:

Topic: 1911 Gold Webinar to Discuss Updated Mineral Resource

When: November 26, 2024, 10:00 AM Eastern Time (US and Canada)

Please click the link below to join the webinar:

https://us02web.zoom.us/j/85125441318?pwd=q4S8CmbAn0sazUGcdgWpxprSgyoT0K.1

Passcode: 737616

Or One tap mobile:

+19292056099,,85125441318#,,,,*737616# US (New York)

+12532050468,,85125441318#,,,,*737616# US

Or Telephone:

Dial (for higher quality, dial a number based on your current location):

+1 929 205 6099 US (New York)

+1 301 715 8592 US (Washington DC)

+1 312 626 6799 US (Chicago)

+1 346 248 7799 US (Houston)

+1 780 666 0144 Canada

+1 204 272 7920 Canada

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE