Rick Mills – “French uranium mining giant Orano to pump $2.2M into SYH drill program”

One of the largest uranium mining and nuclear energy companies in the world has made a substantial commitment to a uranium explorer operating in the highest-grade uranium district on Earth, Saskatchewan’s Athabasca Basin.

Last week Orano Canada Inc. – a subsidiary of Paris-based The Orano Group (formerly Areva) – said it has budgeted C$2.2 million to explore Skyharbour Resources’ (TSX-V:SYH) Preston property.

The two companies previously signed an earn-in agreement whereby Orano must spend C$8 million exploring the property over six years, in order to earn up to 70% of the project.

The $2.2 million will be put towards a 2019 exploration program at Preston including nearly 5,000 meters of diamond drilling.

According to Skyharbour CEO Jordan Trimble, “Orano Canada has a very knowledgeable technical team with a long history in the Athabasca Basin, which will help to unlock value at this strategic, district-scale property.”

Athabasca Basin

The Athabasca Basin is famous for its high grades – at over 20 times global averages. Some deposits are over 100x the world average including Cameco’s Cigar Lake which contains an average 17.8% uranium. In comparison the Priargunsky underground uranium mine in Russia has grades of just 0.15%. Or Rio Tinto’s Rossing open-pit mine in Namibia, with grades of 0.03%, compared to over 19% in Denison’s Phoenix deposit – a difference of 630x.

The Athabasca Basin produces about 15% of world uranium supply. Major mines include Cigar Lake, held jointly between Cameco, Orano and Tepco Resources, McArthur River and Rabbit Lake mines, both of which are currently on care and maintenance.

The Basin contains sedimentary rocks with high-grade, often low-tonnage “unconformity” bonanza-type deposits, located at the contact between the Athabasca sandstone and the underlying basement crystalline rock.

Notable discoveries in the Athabasca Basin include:

- Hathor’s Roughrider deposit in 2009, with grades up to 17%. Hathor was acquired by Rio Tinto in 2012 for US$641 million.

- Denison Mines and Cameco’s first resource estimate at the Wheeler project, in 2010, revealed grades exceeding 19%.

- Areva and UEX Uranium Exploration in 2010 released a mineral estimate on three properties at the Shea Creek property.

- Cameco and Areva in 2012 reported resources at Tamarck and Waterbury Lake, respectively.

- In 2013 Fission Uranium discovered Patterson Lake South, with mind-blowing grades up to 23%. The deposit was later named Triple R.

- Shortly after NexGen Energy made a high grade discovery at the Rook 1 property now containing its Arrow deposit, composed of a series of at least five mineralized shear zones. A PEA was released in 2017 followed by a PFS in 2018.

- Wheeler River’s Phoenix and Gryphon deposits are being developed by Denison Mines. Phoenix has indicated resources of 70.2 million pounds U3O8 at 19.1% grades, while Gryphon contains inferred resources of 43 million pounds at 2.3% U3O8. Recently a notable PFS was released on the project with ISR as the proposed mining method.

Orano in the Basin

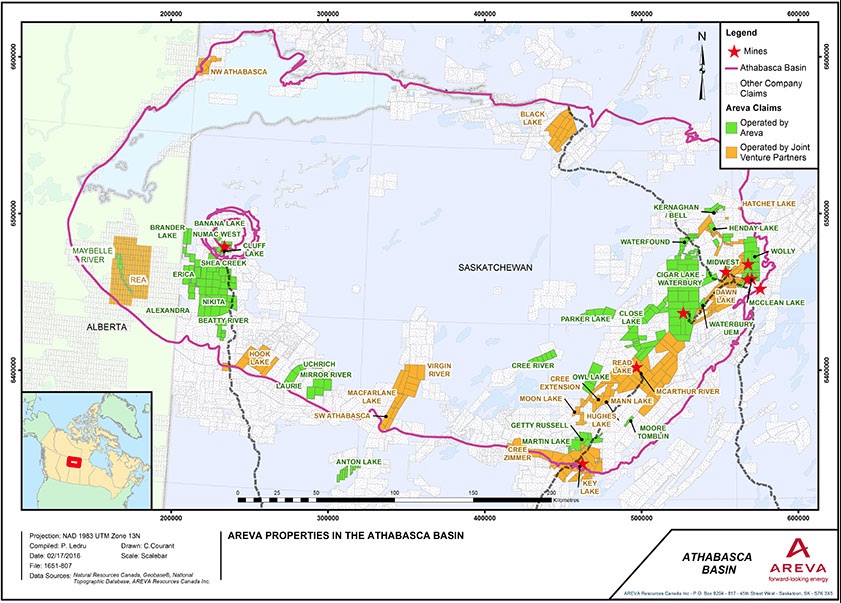

Orano currently operates 30 exploration projects in northern Saskatchewan and the Athabasca Basin, plus two in Nunavut. It is partnered in 16 joint venture projects in the Basin, including the option agreement with Skyharbour at Preston.

The company says over the last three years it has drilled over 120 kilometers of ground, and has explored more than 765,000 hectares in the Athabasca Basin since 1964.

Orano’s flagship Canadian operation is the McClean Lake uranium mill, which receives uranium ore at an average grade of 18% from Cameco’s Cigar Lake underground mine 80 km away. Cigar Lake is the world’s highest-grade uranium mine.

McClean Lake is majority-owned and run by Orano Canada (70%), with Denison Mines and Uranium Overseas Resources Development (UORD) having 22.5% and 7.5% stakes, respectively. The mill is licensed to produce 24 million pounds of U3O8 a year. According to Orano, 18 million pounds are being used to process all the ore from Cigar Lake, and the remaining 6 million pounds of capacity may be used for new ore from McClean Lake and other nearby uranium deposits.

Preston ownership & earn-ins

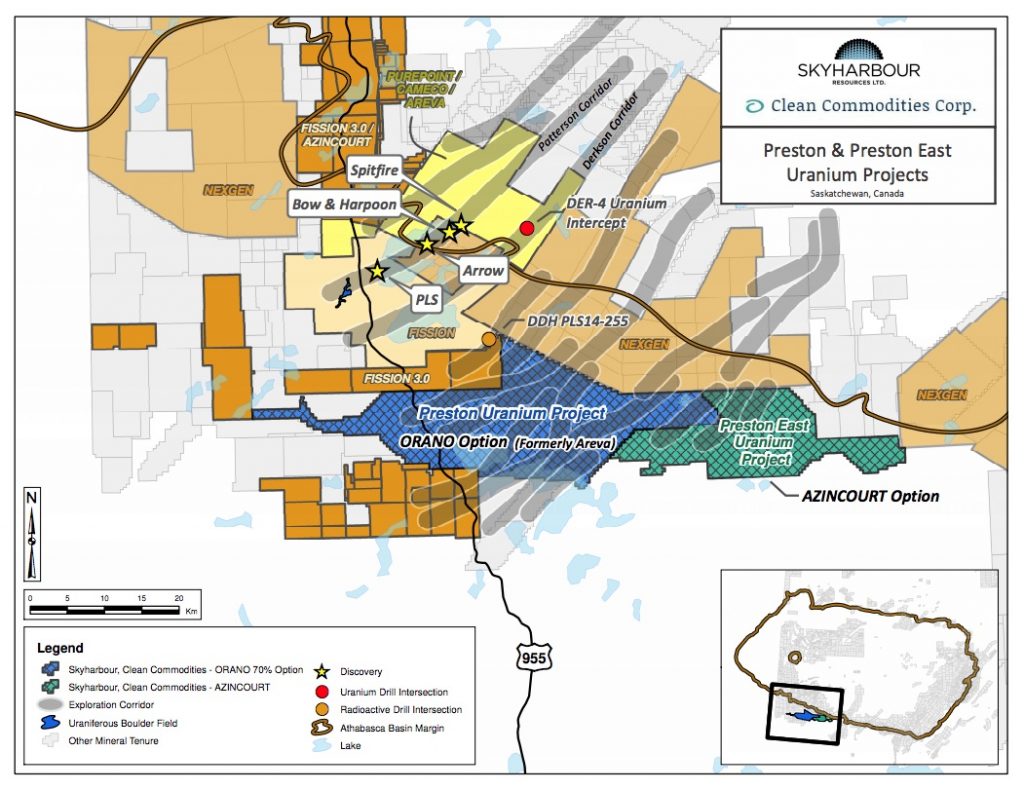

Skyharbour has a 50% interest in the Preston Project – one of the largest land packages (75,965 hectares) in the western side of the Basin – located near Fission Uranium’s Triple R and NexGen Energy’s Arrow deposits, both of which contain high-grade uranium. Under a March 2017 agreement, SYH optioned up to 70% of Preston to Orano. Assuming Orano completes the earn in, the other 30% is divided between Skyharbour and Clean Commodities.

Shortly thereafter, Skyharbour agreed with Azincourt Uranium to option 70% of another portion of Preston called the East Preston Property, with Azincourt issuing 4.5 million shares and spending $2.5 million in exploration expenditures and paying $1 million in cash over three years to Skyharbour and Clean Commodities.

The two agreements in total mean that for $11.5 million in exploration and cash payments plus 4.5 million Azincourt shares, 70% of the Preston and East Preston projects will be optioned off. These two deals are a part of Skyharbour’s prospect generator strategy, whereby the company seeks strategic partners to fund and advance it’s secondary projects while focussing on its main objective of making high-grade discoveries at its flagship Moore Project.

Preston exploration

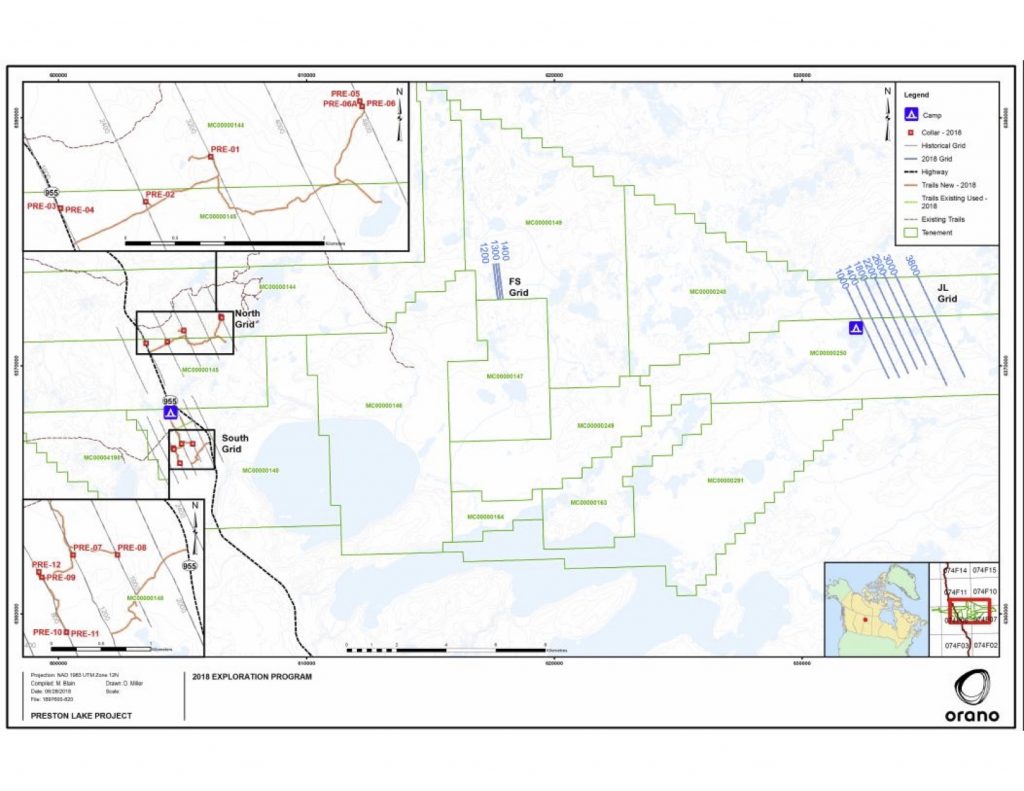

Entering into the second year of its option agreement with Skyharbour and Clean Commodities, Azincourt announced in August a 2018-19 drill program scheduled to begin later in 2018 / early in 2019. The program will involve between 2,000 and 2,500 meters of drilling at East Preston and is designed to test targets identified through a winter geophysical survey earlier this year.

Skyharbour and partner companies had spent about $4.7 million so far exploring the property, which has 15 priority areas and numerous drill targets. Orano completed initial exploration and drilling at Preston in 2017 and 2018, while Azincourt did a ground geophysical program at East Preston earlier this year, to refine drill targets over prospective conductor trends, with drilling planned for early 2019.

Historical ground gravity, airborne and ground electromagnetics, radon, soil, silt, biogeochemistry, lake sediment, and geological mapping surveys have also been completed generating high-priority drill targets on the properties.

As far as the 4,850m drill program announced last week by Orano, Skyharbour says the France-based company will punch 15 to 20 drill holes in early 2019 at Preston. The drilling will test targets defined by an electromagnetic (EM) survey done this year on the JL and FSA targets. A planned EM survey in the Canoe Lake area may also identify targets that could be drill-tested.

JL has not yet been drilled but field work done by Orano last year found several outcrops composed mostly of felsic to intermediate gneiss, with minor granite and pegamite. Click here for more about rocks that host uranium mineralization.

Twenty-one drill targets have been identified, including 8 basement conductors that are considered to be viable drill targets. Uranium explorers in the Athabasca Basin recently have found very high-grade uranium associated with structures and conductors in the basement crystalline rock including NexGen, Fission and Denison.

The FSA target has seen some historical drilling, in the western portion, where a follow-up to a lost drill hole encountered a graphite and pyrite-bearing shear at 179m depth. The core returned 1.8 parts per million (ppm) uranium over 1.0m, at 188m. Last year Orano detected a uranium anomaly in an outcrop. Two grab samples returned 47 ppm and 62 ppm uranium. Six drill targets have been identified.

Flagship high-grade Moore Project

Skyharbour’s summer/fall drill program at its flagship Moore property is aimed at testing new basement targets at the Maverick corridor.

Since mid-2000, the focus at Moore has been on the 4-kilometer Maverick structural corridor where pods of high-grade unconformity-type uranium mineralization have been discovered. During the winter and summer of 2017, just under 10,000 meters of drilling was completed. Highlights included 20.8% U3O8 over 1.5m, 9.12% U3O8 over 1.4m, and 2.23% over 9.3m U3O8, all at between 250 and 275m depth. About half of the 4-km corridor has been drill-tested. Stepping out 100m from the Maverick Zone, Skyharbour also discovered a new high-grade mineralized lens, where 9.12% U3O8 over 1.4m and 4.17% U3O8 over 4.5m at 278m depth was found.

In early 2018, a 3,400m, 9-hole winter drill program returned additional high-grade mineralization and successfully expanded known zones.

This year a drone survey was conducted along the corridor, flown at close 20m spacings at 35m elevation. This enabled Skyharbour to better define high-priority targets. As a result, the current 3,000m program is taking a different tack, drill-testing the Maverick corridor primarily below the unconformity in the relatively untested basement rocks.

Skyharbour’s earn-in agreement with Denison Mines on the Moore property required SYH to pay half a million in cash and issues shares within five years, and also spend $3.5 million in exploration expenditures. Skyharbour completed the earn-in nearly three years ahead of schedule, meaning it now owns 100% of the project.

The company optioned Moore from Denison Mines in 2016. Denison, listed on the TSX and NYSE, is Skyharbour’s largest strategic shareholder and its President Dave Cates is on Skyharbour’s board of directors.

Other projects

Skyharbour also owns 100% interests in the Falcon Point, Yurchison and Mann Lake uranium projects on the east side of the Basin. The Falcon Point property hosts an NI 43-101 mineral resource of 7 million pounds U3O8 inferred at an average grade of 0.03% U3O8 and 5.3 million pounds thorium dioxide inferred at an average grade of 0.023%.

Prospect generator model

While Skyharbour is a uranium explorer, the company is also a prospect generator, meaning its strategy is to ink option agreements on its secondary properties, thus allowing other companies to come in and incur exploration expenditures in return for earning stakes on those properties.

The prospect generator component is key with such a big collection of properties as SYH, because without regular exploration, the claims could expire, leaving the company exposed to poachers. It also benefits the company and its shareholders with annual cash and stock payments from the companies optioning the properties mitigating equity-dilution risk going forward.

Uranium price keeps rising

Skyharbour and partners are drilling their Athabasca Basin properties at the perfect time, considering a new bull market in uranium looks to be shaping up. On Nov. 5 the spot uranium price hit a two and a half-year high of $28.75 per pound, the highest it’s been since March 2016.

Price support is underpinned by a number of factors, including recent mine closures and production curtailments forcing major producers like Cameco to buy more uranium on the spot market to fulfill long-term contracts; China’s drive to build new nuclear plants as well as Japanese nuclear restarts; new funds and buyers of physical uranium entering the market like Yellow Cake and UTC; and the expectation of nuclear utilities’ uranium contracts expiring in the early 2020s, meaning they will need to start contracting again soon.

For more read our Why the uranium price must go up

Conclusion

Skyharbour Resources has an interesting strategy for advancing its Athabasca Basin uranium properties. It is a high-grade, discovery-driven company exploring its flagship Moore first and foremost. However, as a prospect generator, the company’s option agreements allow its partners to front the cash to conduct exploration on its other projects – which could become valuable assets in the company if resources are found and developed.

I’m awaiting results from the current exploration at Moore as I am eager to see what’s found in the basement rocks in this initial drill program testing the underlying feeder zones. This could be a significant catalyst going forward. The ball will continue to roll into next year, when Orano’s drilling program starts at Preston. Between the two, shareholders can look forward to months of news flow and potential stock catalysts. Meanwhile, the uranium price continues to rise, attracting interest and hopefully, investment capital to the hard-hit sector.

Palisade-research.com

The best leverage to a rising uranium price is a uranium junior, which is why I have SYH and its current and future exploration programs on my radar.

Richard (Rick) Mills

Ahead of the Herd is on Twitter

Ahead of the Herd is now on FaceBook

Ahead of the Herd is now on YouTube

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified.

Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Richard owns shares of Skyharbour Resources (TSX.V:SYH). SYH is an advertiser on his site aheadoftheherd.com

MORE or "UNCATEGORIZED"

Rupert Resources Reports Results From Project Drilling Including 120m at 6.2g/t Gold

Rupert Resources Ltd. (TSX:RUP) reports assay results from projec... READ MORE

West Red Lake Gold Announces Closing $33 Million Bought Deal Public Offering Including the Full Exercise of the Over-Allotment Option

West Red Lake Gold Mines Ltd. (TSX-V: WRLG) (OTCQB: WRLGF) is ple... READ MORE

Abitibi Metals Drills 13.15 Metres At 4.82% CuEq in Eastern Drilling At The B26 Deposit

Highlights: The Company has received results from drillholes 1274... READ MORE

Patriot Drills 122.5 m at 1.42% Li2O and 71.4 m at 1.57% Li2O at CV5

Highlights Continued strong lithium mineralization over wide inte... READ MORE

Argonaut Gold Announces First Quarter Financial and Operating Results

Argonaut Gold Inc. (TSX: AR) reported financial and operating res... READ MORE