Yorbeau Reports Assay Results from the Cinderella and Augmitto Areas on the Rouyn Project, Québec

Yorbeau Resources Inc. (TSX: YRB) is pleased to report that its partner IAMGOLD Corporation has received all the assay results from its 2021 exploration diamond drilling program completed on the Cinderella and Augmitto areas at the Rouyn Project. IAMGOLD holds a purchase option with Yorbeau for the Rouyn Project which is located 4 km south of Rouyn-Noranda, Québec, and approximately 45 kilometers southwest of IAMGOLD’s Westwood operation.

The Company is reporting assay results from twenty-eight (28) diamond drill holes from which three were abandoned due to excessive deviation. This part of the 2021 drilling program has totaled 10,418 metres. This program tested a segment of the Cadillac Fault located approximately 1 to 3 kilometres west of the Lac Gamble zone.

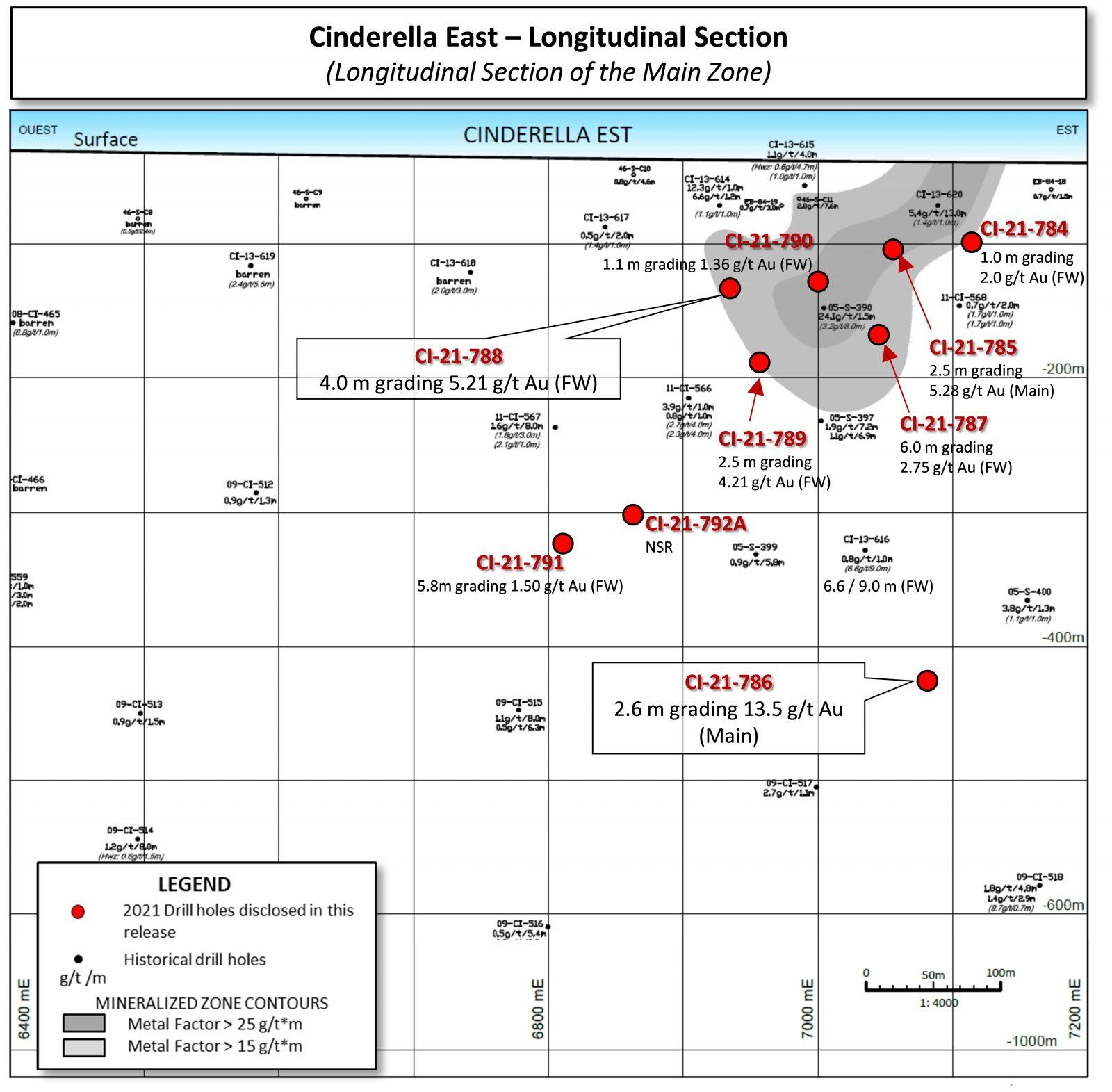

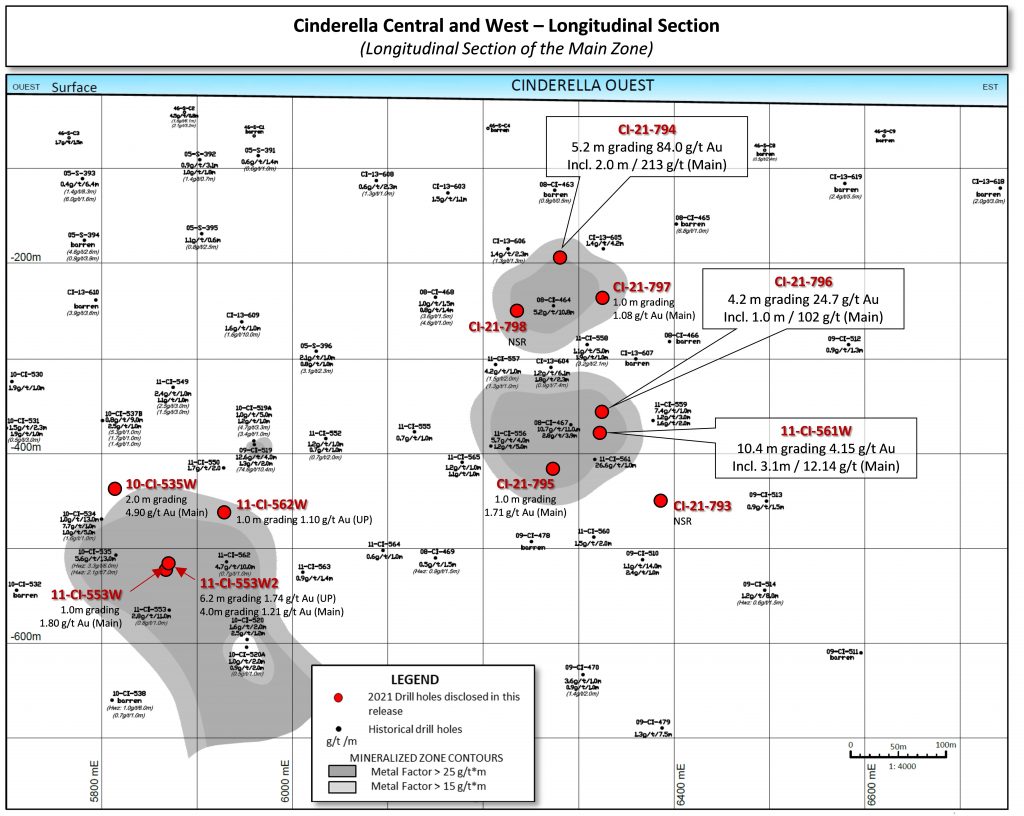

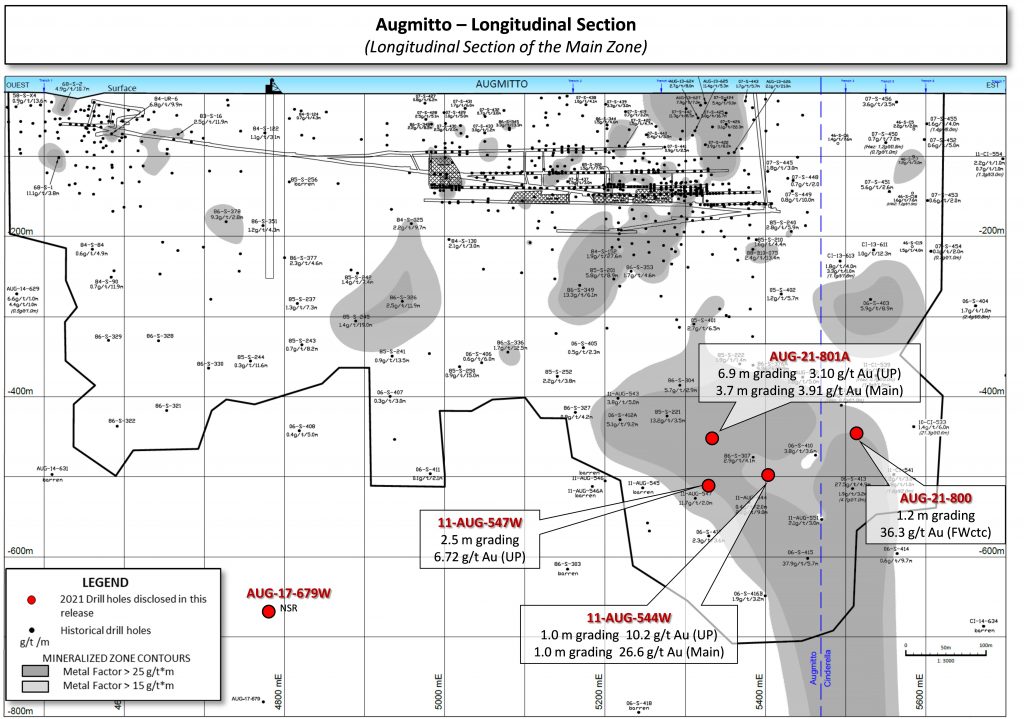

The assay results reported herein are provided in Table 1, and include the following highlights that are also illustrated on a series of longitudinal sections attached to this news release:

Cinderella East sector:

- Drill hole CI-21-786: 2.6 metres grading 13.54 g/t Au in the Main zone

- Drill hole CI-21-788: 4.0 metres grading 5.21g/t Au in the Footwall Contact zone

Cinderella Central sector:

- Drill hole CI-21-794: 5.2 metres grading 84.0 g/t Au in the Main zone

- includes: 2.0 metres grading 213 g/t Au

- Drill hole CI-21-796: 4.2 metres grading 24.7 g/t Au in the main zone

- includes: 1.0 metres grading 102 g/t Au

- Drill hole 11-CI-561W: 10.4 metres grading 4.15 g/t Au in the main zone

- includes: 3.1 metres grading 12.14 g/t Au

Augmitto sector:

- Drill hole AUG-21-800: 1.2 metres grading 36.3 g/t Au in the Footwall Contact zone

- Drill hole AUG-21-801A: 6.9 metres grading 3.10 g/t Au in the Upper zone

- Drill hole 11-AUG-544W: 1.0 metre grading 26.6 g/t Au in the Main zone

The diamond drilling program had for main objective to test further areas where previous drilling identified zones of mineralization and to evaluate its continuity with potential to outline a resource. All drill holes successfully intersected the targeted sheared Cadillac-Piché corridor, which hosts several mineralized structures emplaced at different levels in the stratigraphy.

The Upper and Main zones are associated with alteration varying from several metres to greater than ten metre in width, hosted in the ultramafic rocks of the Piché Group, exhibiting variable carbonatization, fuchsite, silicification, and crosscut by a network of white quartz and brown tourmaline stockwork veins and breccias. Gold mineralization occurs as small specks of visible free gold associated with minor sulphides in quartz-tourmaline veinlets.

At the south contact of the Piché Group with the sedimentary sequence, another mineralization style (the Footwall contact zone) is frequently intersected and is characterized by grey quartz veinlets containing rare visible gold and up to 10% disseminated to narrow massive bands of Arsenopyrite adjacent to the veins. Occasionally similar mineralization is also observed further away from the contact and exclusively hosted in the sediments. This zone is referred to as the Footwall zone.

Results in the Cinderella Central sector seems to demonstrate a certain continuity of the High-Grade mineralization.

Next Steps

This drilling program has been conducted in the second half of 2021 and long delays to receive the assay results were experienced. These results are now integrated with the existing geological, geochemical and structural information to support the development and refinement of preliminary deposit models to support a future potential maiden resource estimate targeted for the end of 2022.

An additional exploration drilling phase was also recently completed and tested the extensions to the east and to the west of the Lac Gamble zone. A total of 6,456 metres were drilled in eleven holes including two holes abandoned for technical problems. These assay results will be reported and integrated to the current database when received, validated and compiled.

Technical Information and Quality Control Notes

The drilling results contained in this news release have been prepared in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects.

Mr. Laurent Hallé, P.Geo, Consulting geologist and qualified person for the purposes of NI 43-101 with respect to the technical information being reported on has read and approved this press release.

The design of the drilling program and interpretation of results is under the control of IAMGOLD’s and Yorbeau’s geological staff, including QPs employing strict protocols consistent with NI 43-101 and industry best practices. The sampling of, and assay data from, the drill core is monitored through the implementation of a quality assurance – quality control program. Drill core (NQ size) is logged and samples are selected by geologists and then sawn in half with a diamond saw at the project site. Half of the core is retained at the site for reference purposes. Sample intervals may vary from 0.5 to 1.5 metres in length depending on the geological observations.

Half-core samples are packaged and transported in sealed bags to either AGAT laboratories in Val d’Or, Québec, and Mississauga, Ontario, or to ALS Minerals Laboratory located in Val-d’Or, Québec. A formal chain-of-custody procedure was adopted for security of samples until their delivery at the laboratory. Samples are coarse crushed to a -10 mesh and then a 1,000 grams split is pulverized to 95% passing -150 mesh. AGAT prepare analytical pulps at their facilities located in Val-d’Or and processed the pulps at their Mississauga laboratory which is ISO / IEC 17025:2005 certified by the Standards Council of Canada. ALS processes analytical pulps directly at their facilities located in Val-d’Or which is ISO / IEC 17025 certified by the Standards Council of Canada. Samples are analyzed using a standard fire assay with a 50 grams charge with an Atomic Absorption (AA) finish. For samples that return assay values over 3.0 grams (for AGAT) or 5.0 grams per tonne (for ALS), another pulp is taken and fire assayed with a gravimetric finish. Core samples showing visible gold or samples which have returned values greater than 10.0 grams per tonne are processed with a protocol involving fine grinding of the entire sample, followed by metallic screen analysis of the entire pulverized material. Insertion of duplicate, blanks and certified reference standards in the sample sequence is done in all drill holes for quality control.

About the Rouyn Gold Project

The Rouyn Gold Property is located about 4 km south of Rouyn-Noranda, Quebec. With a long history of mining, the city of Rouyn-Noranda offers many advantages for mining and exploration, including political and social stability, good access and infrastructure, skilled mining personnel, and one of the most mining friendly jurisdictions in the world. The property covers a 12-kilometre stretch of the Cadillac-Larder Lake Break and contains four known gold deposits along the 6-km Augmitto-Astoria corridor situated on the western portion of the property. Two of the four deposits, Astoria and Augmitto, benefit from established underground infrastructure and have been the subject of technical reports that include resource estimates that were previously filed in accordance with Regulation NI 43-101.

The Lac Gamble zone is located between the Augmitto and the Astoria deposits. The exploration target potential at Lac Gamble is interpreted to be between 400,000 and 600,000 ounces of gold at a grade between 7.0 and 8.5 g/t Au. The potential quantity and grade of the exploration targets referred to are conceptual in nature and insufficient exploration work has been completed to define a mineral resource. The property may require significant future exploration to advance to a resource stage and there can be no certainty that the exploration target will result in a mineral resource being delineated. The exploration targets are consistent with similar deposits in the area, deposit models or derived from initial drilling results.

IAMGOLD holds a purchase option with Yorbeau for the Rouyn Project. Under the terms of the purchase option agreement, IAMGOLD can acquire a 100% interest in the project by completing remaining scheduled cash payments totaling C$0.75 million and remaining exploration totaling approximately C$1.2 million by December 2022 (as of March 31, 2022). By the end of the expenditure period, IAMGOLD must complete a resource estimate in accordance with NI 43-101, after which IAMGOLD, at its election, can purchase a 100% interest in the project, subject to a 2% net smelter return, by paying Yorbeau the lesser of C$15 per resource ounce or C$30 million.

About Yorbeau Resources Inc.

The Rouyn Property, wholly-owned by the Company, is subject to a definitive agreement signed in December 2018, whereby IAMGOLD has the option to acquire a 100% interest in the Rouyn property. In 2015, the Company expanded its exploration property portfolio by acquiring strategic base metal properties in prospective areas of the Abitibi Belt of Quebec that feature infrastructure favourable for mining development. The newly acquired base metal properties include the Scott Project in Chibougamau, which bears important mineral resources (see the press release dated March 30, 2017) and on which a positive Preliminary Economic Assessment was recently completed.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE