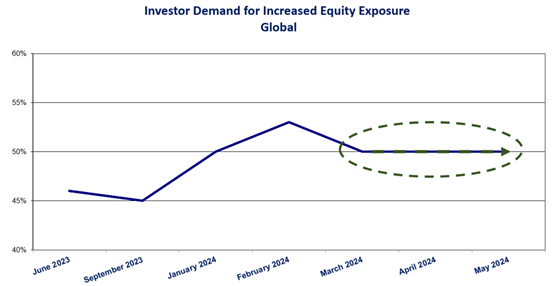

Worldwide Investor Poll Demand For Equity Exposure Remains Level – Less Investors Expect 2024 Recession

| Are you planning to be a net buyer in the near term 3 months? (Net buyer means own more $ in equities than you do today.)

Yes = 50% (At February 21st 2024 – 50%) No = 50% (At February 21st 2024 – 50%)

If you are not planning to be a net buyer, are you planning to be a net seller in the near term 3 months? (Net seller means own less $ in equities than you do today.)

March 4th 2024 = 38% (At February 21st 2024 – 40%)

Likelihood Of A 2024 Recession

March 4th 2024 = 35% (At February 21st 2024 – 38%)

|

|

Rising/falling demand for stocks is estimated through Brendan Wood’s daily personal debriefs with big cap investors. Approximately 2000 yearly discussions with managers overseeing +/-$60 trillion, estimate quality and demand, stock by stock, across 1400 large cap investment targets. The aggregated findings aim to broadly anticipate the forthcoming net increasing or decreasing demand.

Microsoft Corp.

|

|

About Brendan Wood International:

Brendan Wood International (BWI), formed in 1970, is a private advisory group which originates performance investigation programs in the capital markets. Brendan Wood Partners debrief large institutional investors worldwide on a daily basis. There are 2000+ live consultations with professionals overseeing +/- $60 trillion invested in the +/- 1400 big cap companies on the BWI Index. Relying on its real time performance intelligence, BWI advises public companies, institutional and activist investors, investment banks and broker dealers on strategy, performance and recruitment of TopGun talent. The firm’s partners have formally presented at 1000+ C level strategy meetings and corporate off-sites in fifty cities. Brendan Wood founded the exclusive TopGun Club, a performance based institution. Brendan Wood International is the research provider and sub-advisor to the Brendan Wood TopGun ETF (Ticker: BWTG) |

MORE or "UNCATEGORIZED"

Doubleview Gold Corp. Reports Updated Mineral Resource Estimate as of February 25, 2026 Including a Copper Equivalent Mineral Resource: 609 (Mt) of Measured and Indicated Resources at 0.43% CuEq containing CuEq 5.82 Billion lbs. 503 (Mt) of Inferred Resources at 0.41% CuEq containing CuEq 4.57 Billion lbs

Doubleview Gold Corp (TSX-V: DBG) (OTCQB: DBLVF) (FSE: 1D4) is pleased to announce the update... READ MORE

NexGold Intersects 9.30 g/t Gold Over 11.0 Metres and 2.31 g/t Gold Over 21.5 Metres at the Goldlund Deposit, Ontario

NexGold Mining Corp. (TSX-V: NEXG) (OTCQX: NXGCF) is pleased to provide additional results f... READ MORE

Canterra Minerals Extends Lundberg Deposit with 86m of 0.91% CuEq at Buchans Project, Newfoundland

Canterra Minerals Corporation (TSX-V:CTM) (OTCQB: CTMCF) (FSE:DXZB) is pleased to announce drill re... READ MORE

Osisko Intersects 694 Metres Averaging 0.31% Cu at Gaspé

Osisko Metals Incorporated (TSX: OM) (OTCQX:OMZNF) (FRANKFURT: 0B51) is pleased to announce new dri... READ MORE

West Red Lake Gold Reports 219.73 g/t Au over 4.8m, 148.36 g/t Au over 3m and 133.13 g/t Au over 2.5m in Austin 904 Complex – Madsen Mine

West Red Lake Gold Mines Ltd. (TSX-V: WRLG) (OTCQB: WRLGF) is pleased to report drill results from i... READ MORE