WEST RED LAKE GOLD MINES LTD. TO ACQUIRE MADSEN GOLD MINE IN TRANSFORMATIVE TRANSACTION

West Red Lake Gold Mines Ltd. (TSX-V: WRLG) (OTC: WRLGF) is pleased to announce that it has entered into a binding letter agreement with Pure Gold Mining Inc. and Sprott Resource Lending Corp. to acquire the Madsen Gold mine and associated land package through the acquisition of all of the issued and outstanding shares of Pure Gold, subject to approval of the British Columbia Supreme Court in Pure Gold’s ongoing proceedings pursuant to the Companies Creditors Arrangement Act. WRLG has agreed to pay $6.5 million in cash, issue 28,460,000 common shares and grant a 1.0% secured Net Smelter Royalty on the Madsen Mine as consideration for the Acquisition, as well as make up to US$10.0 million in deferred consideration payments. The share and NSR consideration is expected to accrue to Sprott as a fund managed by Sprott is the senior secured lender to Pure Gold. In conjunction with the Acquisition, WRLG has entered into an engagement letter with Canaccord Genuity in respect of a “bought-deal” private placement of subscription receipts for gross proceeds of $20,000,050 and an underwriter’s option of $5,000,100. Following the transaction, WRLG will become a leading, debt-free, and well-capitalized explorer and developer of high-grade gold in the historic Red Lake gold camp.

Madsen Mine Highlights

- As a flagship asset, the Madsen Mine commanded a peak market capitalization of >$1.15 billion in 2021

- Madsen is a past-producing mine that has benefited from >$350M historical investment

- Brownfields site with permits to restart production, existing infrastructure including a 800+ tonne per day mill, double ramp access, significant underground mine development, 1,275 metre shaft, tailings management facility, water treatment facility, all-season access and nearby workforce

- Historical Indicated Mineral Resources* of approximately 1.7 million oz Au @ 7.4 g/t and Historical Inferred Mineral Resources* of approximately 0.4 million oz Au @ 6.3 g/t . (See Table 1 below for information on the date and source of the historical estimates.)

- Located in Red Lake, one of the world’s most prolific mining districts with >30Moz of gold produced to date. Madsen is strategically surrounded by major producers Evolution Mining (ASX:EVN), Kinross Gold (TSX:K) and Barrick Gold (TSX:ABX)

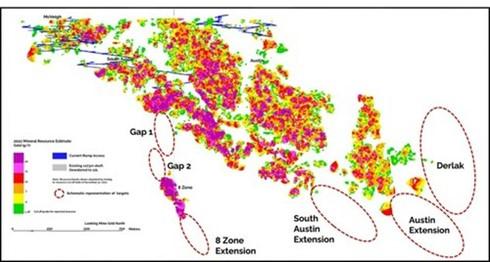

- Opportunities to expand existing Mineral Resource inventory with multiple untested near-mine exploration target areas

- Significant exploration potential along the regional structures controlling mineralization

Benefits to WRLG Shareholders

- Post transaction WRLG emerges debt-free and well capitalized.

- $59.4M post money valuation.

- $19.9M in treasury

- Robust mineral inventory with historical resource of ~1.7M oz Au Indicated* and ~0.4M oz Au Inferred* at Madsen Mine, and a current mineral resource of 0.8M oz Au Inferred at Rowan

- 80 Km2 strategically located combined land package in the heart of the Red Lake District

- Further strengthened shareholder registry with significant institutional ownership

- Improved capital markets profile and access to further capital

*These are historical estimates and WRLG is not treating these as current mineral resources as no qualified person retained by WRLG has done sufficient work to classify the historical estimate as a current mineral resource. See Table 1 below for information on the source and date of the historical estimates. Following closing of the Transaction WRLG intends to update the resource calculation to become NI 43-101 compliant, taking into account, among other matters, material that has been mined since December 31, 2021.

Tom Meredith, CEO and Director of WRLG, stated, “The acquisition of the Madsen Mine is a major step, and positions us as a leader in Red Lake gold exploration and development. This transaction is highly accretive to WRLG shareholders. The path forward involves defining a critical mass of high-grade reserves and resources, optimizing the project for sustainable cash flow, and executing on the vision. This includes conducting infill drilling, resource expansion, regional exploration, underground development, restart planning, engineering studies, and maintaining a strong focus on operability, community benefits, and investment in people and infrastructure. With a wealth of targets near the Madsen Mine, alongside regional prospects and those within our existing Rowan Project, we are confident that the brightest days for our consolidated portfolio are just ahead.”

Mining investor Frank Giustra, who owns 18.1% of WRLG shares and has committed to lead the proposed Financing, commented, “I am proud to be supporting the company that continues the work of past generations at the Madsen Mine. The acquisition appeals to me due to its high-grade resources, modern infrastructure, potential, and strategic location. I look forward to contributing to the company’s growth and energizing this iconic Canadian gold camp for future generations.”

Transaction Details

The Acquisition will be completed pursuant to a reverse vesting order obtained in the CCAA Proceedings. WRLG has agreed to pay $6.5 million in cash, issue 28,460,000 common shares and grant a 1.0% secured NSR on the Madsen Mine in consideration of the Acquisition. The share and royalty consideration is expected to accrue to Sprott as a fund managed by Sprott is the senior secured lender to Pure Gold. In addition, up to US$10.0 million in deferred consideration is payable upon a change of control of WRLG and WRLG has the right to pay down any part of the deferred consideration prior to any change of control of WRLG. Sprott shall have the right to nominate and appoint a director to WRLG’s board, as long as Sprott or an affiliates owns 15% or more of the issued and outstanding shares of WRLG. Upon closing of the Acquisition and the concurrent financing, it is anticipated that Sprott will own approximately 24% of the outstanding shares of the Company. Sprott may, at its election, convert such portion of the US$10 million deferred consideration into WRLG common shares as is necessary to maintain such interest, upon completion of any future equity , merger, acquisition or other corporate transaction. Sprott has advised WRLG of its intention to convert a sufficient portion of the deferred consideration to maintain its 24% interest following the currently contemplated financings. Maintaining such interest assuming the completion of $25.6 million in financings would require issuance of up to 12,270,677 WRLG common shares to Sprott at $0.35 per share, which would result in a reduction in the deferred consideration amount by $4,294,737.

Closing of the Acquisition is subject to various conditions precedent including receipt of all required regulatory approvals including the approval of the TSX Venture Exchange, receipt of the reverse vesting order from the Supreme Court of British Columbia and the parties entering into a definitive agreement for the Acquisition by no later than May 1, 2023.

Pursuant to the binding letter agreement referenced above Frank Giustra and a group of associates agreed to guarantee the initial $6.5 million cash payment for the Acquisition and in consideration for that guarantee will receive warrants to purchase 3,750,000 shares of WRLG exercisable at $0.42 per share for five years. Fiore Management and Advisory Corp. has acted as advisor in connection with the Transaction and will receive 5% in advisory fees.

Concurrent Financing

In connection with the Acquisition, WRLG has entered into a “bought deal” engagement letter with Canaccord Genuity Corp. for a private placement of 57,143,000 subscription receipts at a price of $0.35 per Subscription Receipt for aggregate gross proceeds of $20,000,050. The Underwriter has been granted an option to sell up to an additional 14,286,000 Subscription Receipts for additional gross proceeds of $5,000,100. Closing of the Offering is expected to occur on or before May 9, 2023, with the gross proceeds from the Offering to be placed into escrow pending satisfaction of certain escrow release conditions, including satisfaction of all conditions to completion of the Acquisition. Upon the escrow release conditions being met, each Subscription Receipt will automatically convert, for no additional consideration, into one common share of WRLG. In the event that the escrow release conditions are not satisfied within 90 days of the closing of the Offering, the proceeds of the Offering will be returned to the holders of the Subscription Receipts and the Subscription Receipts will be cancelled.

The net proceeds from sale of the Subscription Receipts will be used to satisfy the initial cash consideration payable in connection with the Acquisition and for working capital purposes.

WRLG has also agreed to complete a non brokered private placement of $600,000 of flow through shares to Frank Giustra at a price of $0.35 share.

Mr. Giustra owns 18.1% of WRLG’s outstanding shares and as such is a related party pursuant to MI 61-101, Protection of Minority Security Holders in Special Transactions. It is also expected that other related parties of WRLG will participate in the Offering. Participation by Mr. Giustra and other related parties in the concurrent private placements constitute a related party transaction as defined under MI 61-101. However, such participation is exempt from the formal valuation and minority shareholder approval requirements of MI 61-101 as neither the fair market value of the shares subscribed for, nor the consideration paid for the shares, exceeds 25% of the Company’s market capitalization.

The securities issued in connection with the Offering (including the common shares issuable on the conversion of the Subscription Receipts) and the non-brokered private placement are subject to TSX Venture Exchange approval and all securities will be subject to a four-month statutory hold period following the closing of the Offering.

Madsen Property

In September 2022, SRK Consulting (Canada) Inc. (“SRK”) prepared a resource estimate for Madsen (see below). WRLG is not treating this estimate as a current mineral resource as no qualified person retained by WRLG has done sufficient work to classify the historical estimate as a current mineral resource. Following closing of the Transaction WRLG intends to update the resource calculation to become NI 43-101 compliant, taking into account, among other matters, material that has been mined since December 31, 2021.

Table 1: August 2022 Madsen Resources Estimate (prepared by SRK)

| Classification | Deposit – Zone | Tonnes | Gold Grade

(g/t) |

Gold Troy

Ounces |

| Indicated | Madsen – Austin | 4,147,000 | 6.9 | 914,200 |

| Madsen – South Austin |

1,696,000 | 8.7 | 474,600 | |

| Madsen – McVeigh |

388,700 | 6.4 | 79,800 | |

| Madsen – 8 Zone | 152,000 | 18.0 | 87,700 | |

| Fork | 123,800 | 5.3 | 20,900 | |

| Russet | 88,700 | 6.9 | 19,700 | |

| Wedge | 313,700 | 5.6 | 56,100 | |

| Total Indicated | 6,909,900 | 7.4 | 1,653,000 | |

| Inferred

|

Madsen – Austin | 504,800 | 6.5 | 104,900 |

| Madsen – South Austin |

114,100 | 8.7 | 31,800 | |

| Madsen – McVeigh |

64,600 | 6.9 | 14,300 | |

| Madsen – 8 Zone | 38,700 | 14.6 | 18,200 | |

| Fork | 298,200 | 5.2 | 49,500 | |

| Russet | 367,800 | 5.8 | 68,800 | |

| Wedge | 431,100 | 5.7 | 78,700 | |

| Total Inferred | 1,819,300 | 6.3 | 366,200 |

The historical resource estimate referenced above in Table 1 and elsewhere in this news release is contained in an independent technical report entitled “Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the Pure Gold Mine, Canada” with an effective date of December 31, 2021 and a signature date of September 23, 2022 prepared by SRK for Pure Gold Mining Inc. A full copy of the report is available on Pure Gold’s SEDAR site with a filing date of September 23, 2022. WLRG is not treating these estimates as current mineral resources as no qualified person retained by WRLG has done sufficient work to classify the historical estimate as current mineral resources.

Rowan Property

WRLG’s Rowan Property presently hosts a National Instrument 43-101 inferred mineral resource of 2,790,700 tonnes (“t”) at an average grade of 9.2 grams per tonne Au (“g/t Au”) containing 827,462 ounces of gold with a cut-off grade of 3.8 g/t Au (NI 43-101 Technical Report authored by John Kita, P.Eng., filed December 31, 2022). The inferred resource is located in the area of the historic underground Rowan Mine site and situated within a 1.8 kilometer strike length portion of the regional scale Pipestone Bay St Paul Deformation Zone.

The technical information presented in this news release has been reviewed and approved by Will Robinson, P.Geo., Vice President of Exploration for WRLG and the Qualified Person for exploration at the West Red Lake Project, as defined by National Instrument 43-101 “Standards of Disclosure for Mineral Projects”.

ABOUT WEST RED LAKE GOLD MINES LTD.

WRLG is a mineral exploration company that is publicly traded and dedicated to creating value for its shareholders by discovering new gold mines in the highly productive Red Lake Gold District of Northwest Ontario, Canada. This district has yielded 30 million ounces of gold from high-grade zones and hosts some of the world’s richest gold deposits. WRLG holds an extensive property position spanning 3,100 hectares in West Red Lake, including three former gold mines – Rowan, Mount Jamie, and Red Summit. The West Red Lake Project covers a 12-km strike length along the Pipestone Bay St. Paul Deformation Zone and WRLG plans to continue exploring this property along strike and to depth in 2023.

Figure 1: Near Mine Exploration Potential – long section looking west (CNW Group/West Red Lake Gold Mines Ltd.)

Figure 2: Madsen Mine mill and processing facilities (CNW Group/West Red Lake Gold Mines Ltd.)

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE