West Red Lake Gold Intercepts 84.3 g/t Au over 1m, 14.4 g/t Au over 5.5m and 24.4 g/t Au over 1.5m at Rowan

West Red Lake Gold Mines Ltd. (TSX-V: WRLG) (OTCQB: WRLGF) is pleased to announce drill results from its fully funded infill and conversion drilling program at the 100% owned Rowan Project located in the Red Lake Mining District of Northwestern Ontario, Canada.

Shane Williams, President & CEO, stated, “We continue to view Rowan as a key piece in our vision for creating a district-scale hub and spoke operation in Red Lake and the assay results received to date from the current drilling program are further reinforcing our confidence in this high-grade satellite deposit. While the current drill program at Rowan is focused on infill to prepare for the upcoming planned Pre-Feasibility Study, our Geology team sees excellent potential for continuing to expand this deposit along strike and at depth. Red Lake gold systems have deep roots and we believe the vein system at Rowan will continue to grow with additional drilling. West Red Lake is fortuitous to have a portfolio of 100% owned quality assets in a premier jurisdiction that will support our vision of becoming a 100,000 ounce per year gold producer in Red Lake by 2028.”

The results featured in this new release are focused on the high-grade Rowan vein system and are in addition to the intercepts recently announced on January 29, 2026 which highlighted 141.5 grams per tonne gold over 1 metre, 55.8 g/t Au over 1m and 28.5 g/t Au over 1m.

A total of thirty-eight (38) holes for approximately 6,300m were completed at Rowan in the current drilling program. Fire assay gold results have been reported for fourteen (14) holes. Results are pending for nineteen (19) holes with five (5) holes currently being logged and prepared for sample shipment.

ROWAN DRILLING HIGHLIGHTS:

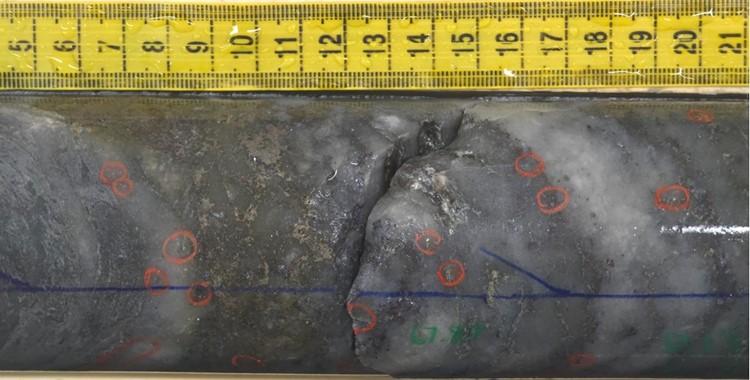

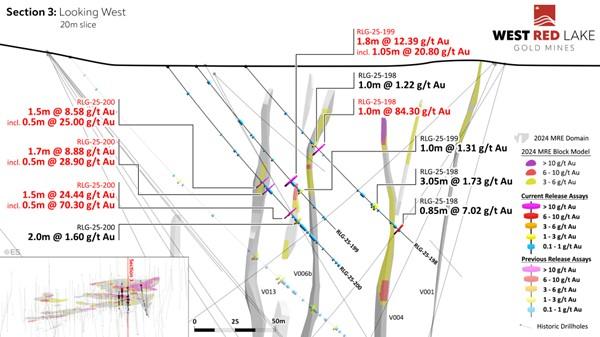

- Hole RLG-25-198 Intersected Vein 006b footwall with 1m @ 84.3 grams per tonne gold, from 67.35m to 68.35m. This high-grade intercept was complimented by visible gold spatially associated with quartz veining and strong silicification (Figure 1).

Figure 1. Multiple instances of visible gold in hole RLG-25-198 associated with pyrrhotite and pyrite within a sheared smoky quartz vein. Drill core is HQ (63.5mm) diameter.

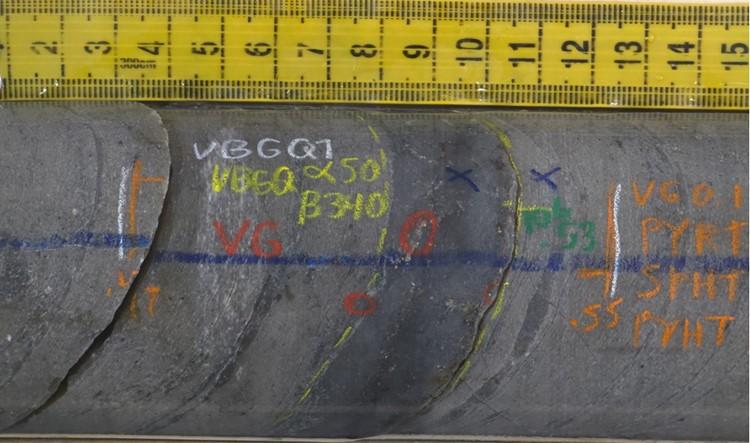

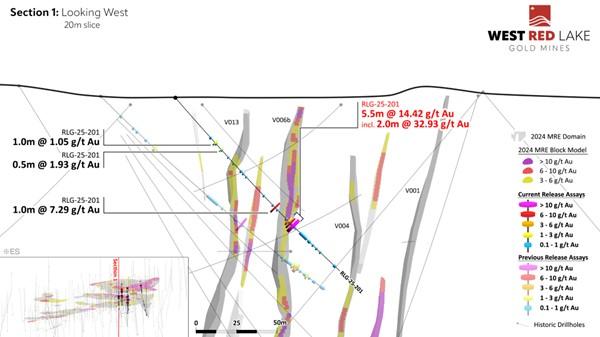

- Hole RLG-25-201 Intersected Vein 006b with 5.5m @ 14.42 g/t Au, from 102.25m to 107.75m; Including 2m @ 32.93 g/t Au, from 105.75m to 107.75m. This high-grade intercept was complimented by visible gold spatially associated with quartz veining and strong silicification (Figure 2).

Figure 2. Multiple instances of visible gold in hole RLG-25-201 within a sheared smoky quartz vein. Drill core is HQ (63.5mm) diameter.

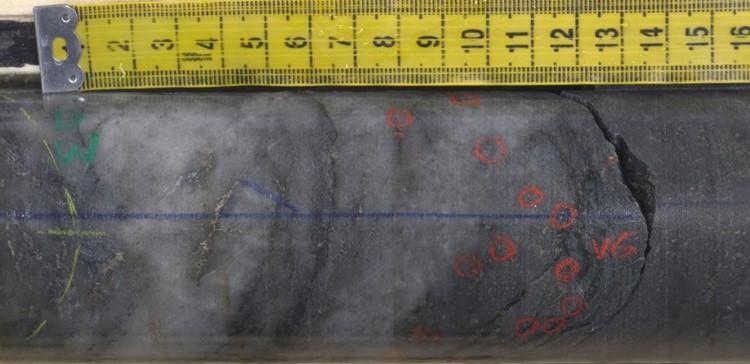

- Hole RLG-25-200 Intersected Vein 018 hangingwall with 1.5m @ 24.44 g/t Au, from 116.4m to 117.9m; Including 0.5m @ 70.3 g/t Au, from 116.9m to 117.4m. This high-grade intercept was complimented by visible gold spatially associated with quartz veining and strong silicification (Figure 3).

Figure 3. Multiple instances of visible gold in hole RLG-25-200 within a sheared smoky quartz vein. Drill core is HQ (63.5mm) diameter.

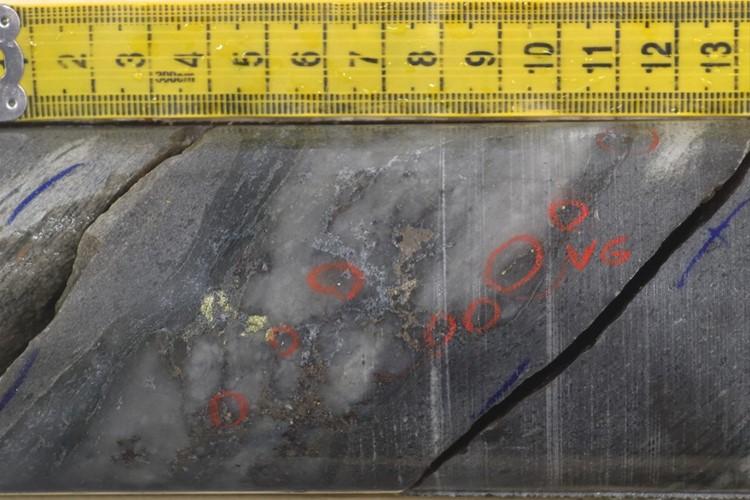

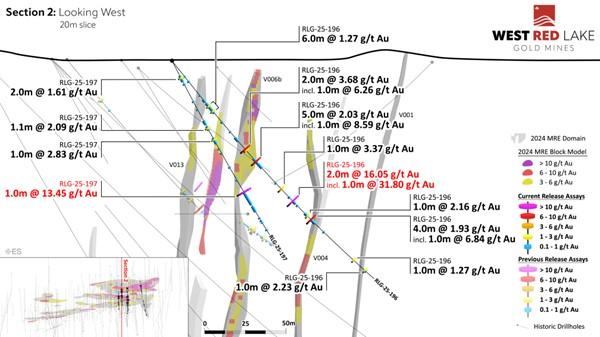

- Hole RLG-25-196 Intersected an unmodeled vein with 2m @ 16.05 g/t Au, from 113.15m to 115.15m; Including 1m @ 31.8 g/t Au, from 113.15m to 114.15m. This high-grade intercept was complimented by visible gold spatially associated with quartz veining and strong silicification (Figure 4).

Figure 4. Multiple instances of visible gold in hole RLG-25-196 associated with pyrrhotite and chalcopyrite within a sheared smoky quartz vein. Drill core is HQ (63.5mm) diameter.

TABLE 1. Significant intercepts (>1 g/t Au) from drilling at Rowan Deposit.

| Hole ID | Target | Vein | From (m) | To (m) | Length (m)* | Au (g/t) | VG |

| RLG-25-194 | Rowan | V004 (fw) | 230.50 | 232.50 | 2.00 | 1.99 | X |

| AND | V001 | 244.50 | 245.50 | 1.00 | 6.15 | ||

| RLG-25-195 | Rowan | NA | Assays Pending | ||||

| RLG-25-196 | Rowan | Unmodeled | 34.50 | 40.50 | 6.00 | 1.27 | |

| AND | Rowan | V006b | 70.00 | 72.00 | 2.00 | 3.68 | |

| Incl. | 70.00 | 71.00 | 1.00 | 6.26 | |||

| AND | Rowan | V006b (fw) | 78.00 | 83.00 | 5.00 | 2.03 | |

| Incl. | 80.00 | 81.00 | 1.00 | 8.59 | |||

| AND | Rowan | Unmodeled | 103.00 | 104.00 | 1.00 | 3.37 | |

| AND | Rowan | Unmodeled | 113.15 | 115.15 | 2.00 | 16.05 | X |

| Incl. | 113.15 | 114.15 | 1.00 | 31.80 | X | ||

| AND | Rowan | V004 (hw) | 126.00 | 127.00 | 1.00 | 2.16 | |

| AND | Rowan | V004 | 129.00 | 133.00 | 4.00 | 1.93 | |

| Incl. | 129.00 | 130.00 | 1.00 | 6.84 | |||

| AND | Rowan | V001 (hw) | 165.15 | 166.15 | 1.00 | 1.27 | X |

| AND | Rowan | V001 | 174.50 | 175.50 | 1.00 | 2.23 | |

| RLG-25-197 | Rowan | Unmodeled | 11.50 | 13.50 | 2.00 | 1.61 | |

| AND | Rowan | V013 (fw) | 46.50 | 47.60 | 1.10 | 2.09 | |

| AND | Rowan | V018 (hw) | 54.50 | 55.50 | 1.00 | 2.83 | |

| AND | Rowan | V006b | 91.40 | 92.40 | 1.00 | 13.45 | X |

| RLG-25-198 | Rowan | V006b | 63.50 | 64.50 | 1.00 | 1.22 | |

| AND | Rowan | V006b (fw) | 67.35 | 68.35 | 1.00 | 84.30 | X |

| AND | Rowan | Unmodeled | 115.20 | 118.25 | 3.05 | 1.73 | |

| AND | Rowan | V004 (fw) | 136.65 | 137.50 | 0.85 | 7.02 | |

| RLG-25-199 | Rowan | V018 | 90.55 | 92.35 | 1.80 | 12.39 | |

| Incl. | 90.55 | 91.60 | 1.05 | 20.80 | |||

| AND | Rowan | V018 | 99.50 | 100.50 | 1.00 | 1.31 | |

| RLG-25-200 | Rowan | V013 | 90.50 | 92.00 | 1.50 | 8.58 | |

| Incl. | 91.50 | 92.00 | 0.50 | 25.00 | |||

| AND | Rowan | V013 (fw) | 95.80 | 97.50 | 1.70 | 8.88 | X |

| Incl. | 97.00 | 97.50 | 0.50 | 28.90 | X | ||

| AND | Rowan | V018 (hw) | 116.40 | 117.90 | 1.50 | 24.44 | |

| Incl. | 116.90 | 117.40 | 0.50 | 70.30 | |||

| AND | Rowan | V004 | 122.50 | 124.50 | 2.00 | 1.60 | |

| RLG-25-201 | Rowan | Unmodeled | 36.50 | 37.50 | 1.00 | 1.05 | |

| AND | Rowan | Unmodeled | 42.20 | 42.70 | 0.50 | 1.93 | |

| AND | Rowan | V006b (hw) | 90.50 | 91.50 | 1.00 | 7.29 | |

| AND | Rowan | V006b | 102.25 | 107.75 | 5.50 | 14.42 | X |

| Incl. | 105.75 | 107.75 | 2.00 | 32.93 | X | ||

*The “From-To” intervals in Table 1 are denoting overall downhole length of the intercept. True thickness has not been calculated for these intercepts but is expected to be ≥ 70% of downhole thickness based on intercept angles observed in the drill core. Internal dilution for composite intervals does not exceed 1m for samples grading <0.1 g/t Au. The “VG” column indicates the presence of Visible Gold as observed by the core logging geologist. The (hw) and (fw) notes under “Domain” column are indicating position of grade intercept “hangingwall” or “footwall”, respectively, to primary vein domain. Vein intercepts currently defined as “Unmodeled” may be incorporated into new vein domains in upcoming MRE update for Rowan. Hole RLG-25-195 has assays pending due to mineralized intervals from that hole being sent out for geotechnical testing.

TABLE 2: Drill collar summary for holes reported in this News Release.

| Hole ID | Target | Easting | Northing | Elev (m) | Length (m) | Azimuth | Dip |

| RLG-25-194 | Rowan | 422160 | 5657811 | 366 | 284.50 | 346 | -51 |

| RLG-25-195 | Rowan | 422160 | 5657811 | 366 | 269.50 | 358 | -52 |

| RLG-25-196 | Rowan | 422022 | 5657869 | 366 | 182.50 | 358 | -52 |

| RLG-25-197 | Rowan | 422023 | 5657869 | 366 | 122.50 | 359 | -64 |

| RLG-25-198 | Rowan | 422053 | 5657868 | 366 | 149.50 | 359 | -51 |

| RLG-25-199 | Rowan | 422057 | 5657838 | 366 | 131.50 | 359 | -53 |

| RLG-25-200 | Rowan | 422054 | 5657820 | 366 | 161.50 | 357 | -45 |

| RLG-25-201 | Rowan | 422005 | 5657845 | 366 | 146.50 | 358 | -49 |

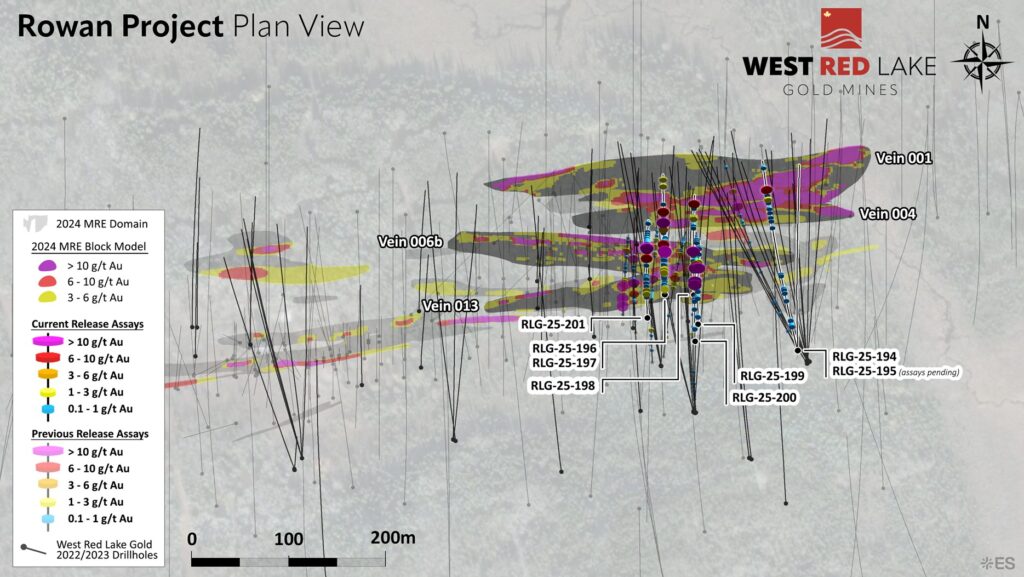

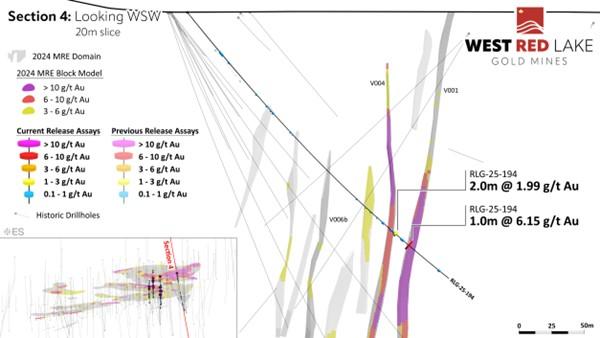

FIGURE 5. Deposit-scale plan map of Rowan project area showing traces and intercepts for holes highlighted in this News Release[1].

[1] Mineral resources are estimated at a cut-off grade of 3.80 g/t Au and a gold price of US$1,800/oz. Please refer to the technical report entitled “Rowan Project NI 43-101 Technical Report and Preliminary Economic Assessment, Ontario, Canada”, prepared by Fuse Advisors Inc., and dated June 30, 2025. A full copy of the report is available on the Company’s website and on SEDAR+ at www.sedarplus.ca.

FIGURE 6. Rowan drill section showing assay highlights for Hole RLG-25-201[1].

[1] Mineral resources are estimated at a cut-off grade of 3.80 g/t Au and a gold price of US$1,800/oz. Please refer to the technical report entitled “Rowan Project NI 43-101 Technical Report and Preliminary Economic Assessment, Ontario, Canada”, prepared by Fuse Advisors Inc., and dated June 30, 2025. A full copy of the report is available on the Company’s website and on SEDAR+ at www.sedarplus.ca.

FIGURE 7. Rowan drill section showing assay highlights for Hole RLG-25-196 and -197[1].

[1] Mineral resources are estimated at a cut-off grade of 3.80 g/t Au and a gold price of US$1,800/oz. Please refer to the technical report entitled “Rowan Project NI 43-101 Technical Report and Preliminary Economic Assessment, Ontario, Canada”, prepared by Fuse Advisors Inc., and dated June 30, 2025. A full copy of the report is available on the Company’s website and on SEDAR+ at www.sedarplus.ca.

FIGURE 8. Rowan drill section showing assay highlights for Hole RLG-25-198 to -200[1].

[1] Mineral resources are estimated at a cut-off grade of 3.80 g/t Au and a gold price of US$1,800/oz. Please refer to the technical report entitled “Rowan Project NI 43-101 Technical Report and Preliminary Economic Assessment, Ontario, Canada”, prepared by Fuse Advisors Inc., and dated June 30, 2025. A full copy of the report is available on the Company’s website and on SEDAR+ at www.sedarplus.ca.

FIGURE 9. Rowan drill section showing assay highlights for Hole RLG-25-194[1].

[1] Mineral resources are estimated at a cut-off grade of 3.80 g/t Au and a gold price of US$1,800/oz. Please refer to the technical report entitled “Rowan Project NI 43-101 Technical Report and Preliminary Economic Assessment, Ontario, Canada”, prepared by Fuse Advisors Inc., and dated June 30, 2025. A full copy of the report is available on the Company’s website and on SEDAR+ at www.sedarplus.ca.

ROWAN PROGRAM SUMMARY

West Red Lake Gold announced results for a Preliminary Economic Assessment for the Rowan Project on July 8, 2025 which demonstrates robust preliminary economics for an underground mine at Rowan producing an average of 35,230 ounces per year over a 5-year mine life at an average grade of 8.0 g/t Au (a copy of this news release can be viewed HERE1).

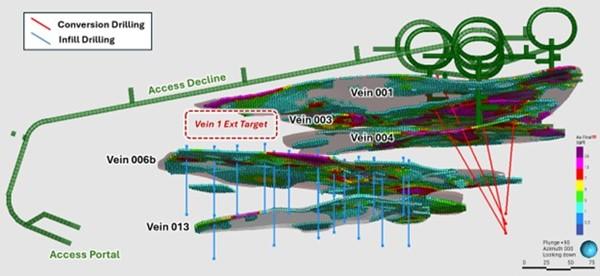

The drill program at Rowan (Figure 10) will now consist of around 6,300 m of HQ diameter diamond drilling including conversion drilling on Veins 001 and 004 to support the potential upgrade of Inferred resources to Indicated2 and infill drilling on Veins 006b and 013 to provide data that may enable mine design consideration ahead of a planned combined Pre-Feasibility Study (“PFS”) for the Madsen Mine and Rowan projects. This planned study will evaluate the potential for developing the two projects using shared infrastructure and integrated mine planning, with the goal of identifying possible operational and economic synergies3.

FIGURE 10. Plan view showing Rowan Veins 001, 003, 004, 006b and 013 with proposed infill and conversion drilling and current PEA underground mine design[2]. Vein 1 west extension target outlined in red.

Conversion drilling2 at Rowan is focused on Veins 001 and 004, with the objective to bring Inferred resources to an Indicated category. These veins account for the majority of PEA production tonnes. Approximately 63% of the tonnes and 72% of the ounces were already in the Indicated category in the Rowan PEA.

Infill drilling is focused on Veins 006b and 013 to provide data for potential inclusion in the planned combined PFS. Integration of Veins 006b and 013 could not only extend mine life at Rowan, but may also allow for ore extraction to begin approximately 6 months sooner due to closer proximity to the access portal. Accessing and mining mineralization earlier at Rowan has the potential to positively impact the net present value of the project. Inclusion of Veins 006b and 013 in future mine plans and the impact such inclusion could have is subject to the results of the drill program and the outcome of the combined PFS as reviewed by a Qualified Person.

Further geotechnical, metallurgical and engineering studies are also underway at Rowan to inform the planned PFS. These studies will be completed in conjunction with ongoing permitting efforts to advance Rowan towards Advanced Exploration status, which is required for bulk sample extraction. Permits to support Advanced Exploration activities, including underground mine development, are targeted for 2027, subject to regulatory review and consultation.

The Advanced Exploration permit is targeted for approval in 2027, a timeline supported by the recent launch of the One Project, One Process mine permitting framework in Ontario that aims to cut review times within the mine permitting process in half for Designated Projects, a status the Company is pursuing at Rowan.4

_________________________

1 The PEA is preliminary in nature; it includes Inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves; there is no certainty that the PEA results will be realized.

2 There can be no assurance that drilling at Rowan will result in the conversion of Inferred resources to Indicated; any such upgrade will depend on the results of the drill program and subsequent resource estimation by a Qualified Person.

3 There can be no assurance that the planned combined PFS will support the development of the Madsen Mine and Rowan projects as a single operation or using common infrastructure. Any such determination will depend on the outcome of such PFS and subsequent technical and economic studies.

4 https://news.ontario.ca/en/release/1006621/ontario-implements-one-project-one-process-to-build-mines-faster

ADDITIONAL OPPORTUNITIES

There are multiple opportunities to potentially expand and upgrade the resource and mine plan at Rowan.

The Rowan resource comprises 26 domains that capture multiple parallel veins. Three of those veins – 001, 003 and 004 – are mined in the PEA. A fourth vein with strong gold grades, called 006b, is the third largest contributor of tonnes and ounces in the current mineral resource estimate but was not included in the PEA mine plan because its data stems largely from historic drilling, which suffers from unsampled intervals. Vein 013 runs adjacent and sub-parallel to Vein 006b and may demonstrate similar resource upgrade potential, subject to confirmation drilling and subsequent resource estimation by a Qualified Person.

Historic operators often only sampled and assayed drill core with quartz veining containing visible gold. Surrounding rock, including vein margins, narrow gaps between veins, and adjacent wall rock, was typically not sampled. During the MRE estimation process those unsampled intervals were assigned a value of half detection limit equal to 0.0025 g/t Au. This excessively diluted those areas in the resource model, which was constructed on 2-metre minimum composites for longhole stoping design consideration. During the 2023 drill campaign, WRLG demonstrated that gold mineralization regularly persists into the altered wall rock adjacent to high-grade gold veins. Selective sampling would have missed mineralization of this type. Additionally, most of the drilling on Veins 006b and 013 is from the 1980’s utilizing very small 27-millimeter diameter AQ drill core with no existing competent historic core available for resampling. The 2025-2026 drilling program is being completed with 63.5-millimeter diameter HQ drill core and with an aim to infill the gaps in the historic analytical data set on Veins 006b and 013, with the goal of bringing these veins back into consideration for mine design.

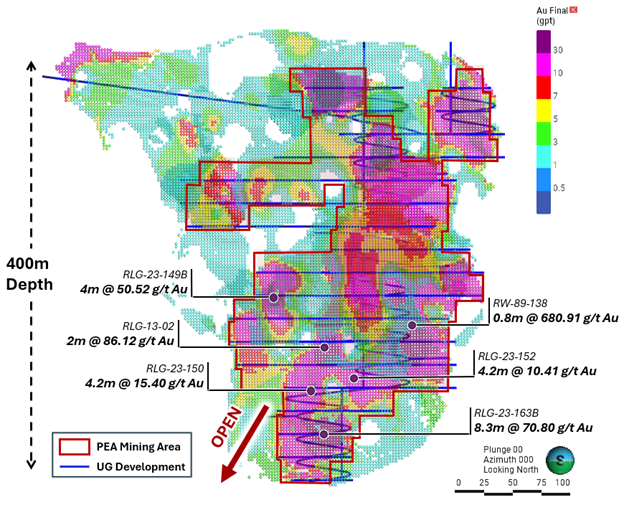

The next layer of opportunity at Rowan is based on expanding the deposit. Notably, the highest-grade intercept ever drilled at Rowan was achieved during the 2023 drill campaign when hole RLG-23-163B returned 70.8 g/t Au over 8.3 metres. This intercept came from the deeper portion of Vein 001 and indicates potential for mineralization to continue at depth. The Rowan vein system has only been defined down to approximately 400 metres and remains wide open for expansion at depth (Figure 11). The Rowan deposit also remains open along strike to the east and west.

FIGURE 11. Long section of Rowan block model at 1 g/t Au cutoff showing PEA mine design (blue) and outline of areas planned for long hole stoping on Veins 001, 003 and 004 (red outline). Notable assay intercepts have been highlighted to indicate the strength of gold mineralization and expansion potential at depth. Intercepts are reported as core length unless otherwise stated [2].

[2] Mineral resources are estimated at a cut-off grade of 3.80 g/t Au and a gold price of US$1,800/oz. Please refer to the technical report entitled “Rowan Project NI 43-101 Technical Report and Preliminary Economic Assessment, Ontario, Canada”, prepared by Fuse Advisors Inc., and dated June 30, 2025. A full copy of the report is available on the Company’s website and on SEDAR+ at www.sedarplus.ca.

QUALITY ASSURANCE/QUALITY CONTROL

Drilling completed at the Rowan Property consists of oriented HQ-sized diamond drill core. All drill holes are systematically logged, photographed, and sampled by a trained geologist at WRLG’s Mt. Jamie core processing facility. Minimum allowable sample length is 0.5m. Maximum allowable sample length is 1.5m. Standard reference materials and blanks are inserted at a targeted 5% insertion rate. The drill core is then cut lengthwise utilizing a diamond blade core saw along a line pre-selected by the geologist. To reduce sampling bias, the same side of drill core is sampled consistently utilizing the orientation line as reference. For those samples containing visible gold (“VG”), a trained geologist supervises the cutting/bagging of those samples, and ensures the core saw blade is ‘cleaned’ with a dressing stone following the VG sample interval. Bagged samples are then sealed with zip ties with additional security tags, and transported by freight courier to ALS Thunder Bay, Ontario for assay.

Samples are then prepped by ALS, which consists of drying at 105°C and crushing to 70% passing 2mm. A riffle splitter is then utilized to produce a 250g course reject for archive. The remainder of the sample is then pulverized to 85% passing 75 microns from which 50g is analyzed by fire assay and an atomic absorption spectroscopy (AAS) finish. Samples returning gold values > 100 g/t Au are reanalyzed by fire assay with a gravimetric finish on a 50g sample. Samples with visible gold are also analyzed via metallic screen analysis (ALS code: AU-SCR24). For multi-element analysis, samples are sent to ALS’s facility in Vancouver, British Columbia and analyzed via four-acid digest with a mass spectroscopy (ICP-MS) finish for 48-element analysis on 0.25g sample pulps (ALS code: ME-MS61). ALS Geochemistry analytical laboratories operate under a single Global Geochemistry Quality Manual that complies with ISO/IEC 17025:2017.

The Rowan Mine deposit presently hosts a National Instrument 43-101 – Standards of Disclosure for Mineral Projects Indicated resource of 478,707 tonnes containing 196,747 ounces of gold grading 12.78 g/t Au and an Inferred resource of 421,181 tonnes containing 118,155 oz of gold grading 8.73 g/t Au. Mineral resources are estimated at a cut-off grade of 3.80 g/t Au and a gold price of US$1,800/oz. Mineral resources that are not mineral reserves do not have demonstrated economic viability. Please refer to the technical report entitled “Rowan Project NI 43-101 Technical Report and Preliminary Economic Assessment, Ontario, Canada”, prepared by Fuse Advisors Inc., and dated June 30, 2025. A full copy of the report is available on the Company’s website and on SEDAR+ at www.sedarplus.ca.

The technical information presented in this news release has been reviewed and approved by Will Robinson, P.Geo., Vice President of Exploration for West Red Lake Gold and the Qualified Person for exploration at the West Red Lake Project, as defined by NI 43-101. Mr. Robinson is not independent of WRLG. The PEA and Mineral Resource disclosure summarized herein is derived from the independent technical report prepared by Fuse Advisors Inc.

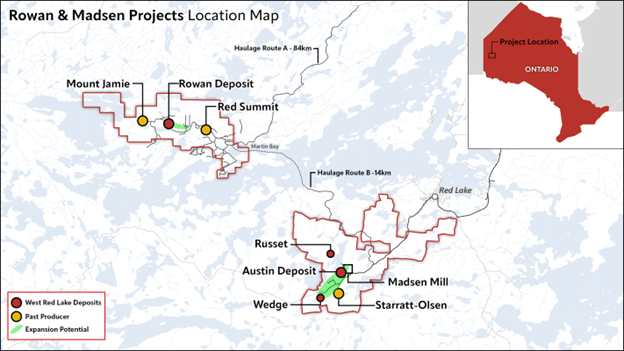

ABOUT WEST RED LAKE GOLD MINES

West Red Lake Gold Mines Ltd. is a gold miner development company that is publicly traded and focused on advancing and developing its flagship Madsen Gold Mine and the associated 47 km2 highly prospective land package in the Red Lake district of Ontario. The highly productive Red Lake Gold District of Northwest Ontario, Canada has yielded over 30 million ounces of gold from high-grade zones and hosts some of the world’s richest gold deposits. WRLG also holds the wholly owned Rowan Property in Red Lake, with an expansive property position covering 31 km2 including three past producing gold mines – Rowan, Mount Jamie, and Red Summit.

MORE or "UNCATEGORIZED"

Aldebaran Announces Closing of Concurrent Private Placement

Aldebaran Resources Inc. (TSX-V: ALDE) (OTCQX: ADBRF) is please... READ MORE

QGold Reports Results from Its Drilling Campaigns at Its Mine Centre Gold Project

Presented are results of the June and November 2025 drilling camp... READ MORE

NevGold Drills 8.51 g/t Oxide AuEq Over 10.6 Meters (8.11 g/t Au And 0.10% Antimony) Within 2.32 g/t Oxide AuEq Over 86.8 Meters (1.94 g/t Au And 0.10% Antimony); Discovers High-Grade Oxide Gold-Antimony “Armory Fault” Structure At Bullet Zone

NevGold Corp. (TSX-V:NAU) (OTCQX:NAUFF) (Frankfurt:5E50) is ple... READ MORE

Aya Gold & Silver Reports High-Grade Silver Results at Zgounder

Extends Mineralization Near Western Fault Aya Gold & Silve... READ MORE

Magna Mining Announces Initial Mineral Reserves for the McCreedy West Mine in Sudbury, Ontario

Magna Mining Inc. (TSX-V: NICU) (OTCQX: MGMNF) (FSE: 8YD) is plea... READ MORE