West Red Lake Gold Highlights Bulk Sample Learnings

West Red Lake Gold Mines Ltd. (TSX-V: WRLG) (OTCQB: WRLGF) is pleased to report how learnings from the test mining and bulk sample program at its 100% owned Madsen Mine in the Red Lake Gold District of Northwestern Ontario, Canada, are translating directly into a detailed mine plan with generally larger stopes, greater mining efficiencies, and lower cost mining methods than anticipated.

The test mining and bulk sample program had two goals:

- To confirm that the geologic, engineering, and mining workflow at Madsen enables the Company to model and mine mineralization accurately.

- To test various mining scenarios and use the results to enable confident mine design that maximizes economic extraction.

The bulk sample results (reported on May 7) achieved the first goal. Close reconciliation between expected and actual tonnes, grade, and contained ounces across six stopes in three areas of the resource validates the Company’s ability to mine at Madsen according to plan.

The Company also succeeded with the second goal. Test mining demonstrated the ability to mine up against historic stopes, which reduced barriers in stope design and unlocked some resource potential.

Test mining also highlighted the efficiency of mining larger stopes and mining clusters of proximal stopes (known as mining complexes), two notable opportunities that are developing at Madsen because mine design is both a technical and economic exercise.

The workflow that leads to detailed mine design at Madsen is as follows:

- Each resource area is definition-drilled to a drill hole spacing averaging 7 meters.

- The in-house, short-term model is updated to incorporate the new drill data.

- Stopes are engineered based on the updated model to maximize economic extraction of mineralization, at an assumed gold price.

Gold mineralization at Madsen often comprises high-grade lenses surrounded by lower-grade mineralized halos. The above workflow is designed in part to define high-grade lenses of gold mineralization that can go unnoticed with wider-spaced data sets. Recent high-grade drill results from the South Austin area (see news releases from May 27, May 13, and February 26) demonstrate this potential. Definition drilling also enables accurate modeling of lower-grade halo mineralization ahead of stope design.

West Red Lake Gold is currently using the consensus long-term price of US$2,350 per ounce in mine design, compared to a gold price of US$1,680 per oz. used for the mine plan in the Madsen Mine Pre-Feasibility Study [1]. The relatively low gold price in the PFS led to a mine plan with 60% of the mining being small, high-grade stopes requiring the use of cut-and-fill mining, the more selective and higher cost of the two mining methods outlined for use at Madsen [1a]. In addition, the need to drive accesses between multiple small stopes contributed to relatively high sustaining capital needs over the mine life.

The PFS mine plan generated strong economics that supported the restart decision. However, using a higher gold price in stope design effectively lowers the cutoff grade for resource inclusion, bringing additional resource tonnes and more overall ounces into consideration for mine planning.

When lower grade tonnes prove to be economic, it can result in larger stopes encompassing one or several high-grade gold lenses with surrounding halo mineralization. It can also define new mining shapes around proximal areas of mineralization that were not previously considered. This is especially possible where definition drilling has defined or expanded high-grade lenses, which have the potential to mitigate the impact on head grade of including lower grade tonnes over the life of mine.

Figure 1: Visible gold in sill access development on 1 Level McVeigh.

Larger stopes and clusters of proximal stopes, known as mining complexes, have potential to increase a mine’s economic benefit and scale as compared to smaller, isolated stopes because they can positively impact three key economic drivers:

- Mining cost: Larger stopes can generally be mined via long hole stoping. Long hole stoping is significantly lower cost per tonne compared to cut and fill mining [1b]. The Madsen Mine bulk sample was mined exclusively by long hole stoping methods with a very high success rate and the majority of the 18-month detailed mine plan is long hole mining.

- Cost of access development per tonne mined: Larger stopes and stopes clustered in mining complexes spread the cost of developing access to a mining area over more ounces produced from that area, reducing the cost impact of access development.

- Flexibility and efficiency: The ability for a mine to focus on few large mining complexes at any given time rather than multiple isolated stopes greatly supports efficiency in equipment, personnel, and material movement planning. The Company is experiencing this efficiency advantage already at site.

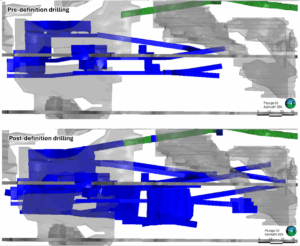

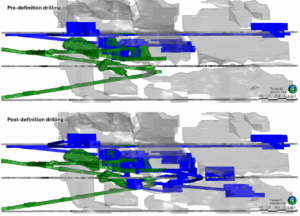

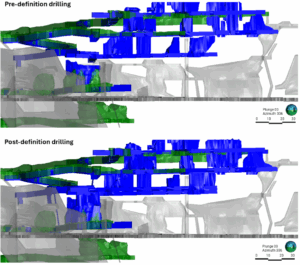

Figures 2 through 4 below highlight a few examples of mining complexes where the tonnage and ounce profile increased through the definition drilling, resource model updating, and economic stope design workflow.

Figure 2. Image showing South Austin 4447 stope complex (blue). This area realized a 212% increase in tonnage and 320% increase in contained ounces mainly driven by definition drilling.

Figure 3. Image showing Austin 1099/1100 stope complex (blue). This area realized a 204% increase in tonnage and 222% increase in contained ounces mainly driven by definition drilling.

Figure 4. Image showing McVeigh 1453 stope complex (blue). This area realized a 32% increase in tonnage and 18% increase in contained ounces mainly driven by definition drilling.

A more global potential benefit from mining larger stopes at Madsen is mining more of the resource. A mine plan based on a gold price of US$1,680 per oz. depletes the deposit relatively quickly, which is evident in a PFS probable reserve of only 478,000 ounces in 1.87 million tonnes grading 8.2 g/t gold mined in 7 years [1c], from a deposit with a total indicated resource of 1.65 million ounces of gold hosted in 6.9 million tonnes of rock averaging 7.4 g/t gold (the combined indicated resource for the Austin, South Austin, McVeigh, and 8 Zones) [1d]. The Madsen Mine PFS described the potential for more of the resource to be considered for mining if a higher gold price was used [1e].

A gold price environment that allows mine design to convert more of the resource into reserve suggests a longer mine life than outlined in the PFS, which is expected to have a positive impact on long-term profitability and overall project economics.

Close reconciliation between expected and actual tonnes and grade in the bulk sample suggests that the Company’s approach – appropriate definition drilling, responsive mine engineering, and disciplined, efficient mining – is creating the ability to mine at Madsen according to plan. The mine engineering and design process is a technical and economic exercise that responds to the price of gold. This will remain the Company’s practice at the Madsen Mine.

Other News

The Company has received and accepted the resignation of Jasvir Kaloti as Corporate Secretary. The management and board of directors of the Company wish to thank Ms. Kaloti for her service and wish her well in the future.

Efforts are in progress to identify a suitable Corporate Secretary candidate and Harpreet Dhaliwal, Chief Financial Officer, will hold this position in the interim.

Footnotes

- Please refer to the technical report entitled “NI 43-101 Technical Report and Prefeasibility Study for the Madsen Mine, Ontario, Canada”, prepared by SRK Consulting (Canada) Inc. and dated January 7, 2025. A full copy of the SRK report is available on the Company’s website and on SEDAR+ at www.sedarplus.ca.

- See PFS Section 16.5.3 Mining Methods – Underground Mining Methods – Planned Mining Methods.

- See PFS Report Section 21.3.2 Capital and Operating Costs – Operating Cost Estimates – Mining.

- Mineral reserve estimates based on a gold price of US$1,680/oz and an exchange rate of 1.31 C$/US$. Longhole stope cut-off grade of 4.30 gpt Au based on an estimated operating cost of C$287.34/t including mining, plant and G&A. Mechanized Cut and Fill stope cut-off grade of 5.28 gpt Au based on an estimated operating cost of C$354.90/t including mining, plant and G&A. Incremental development cut-off grade of 1 gpt Au. A small amount of incremental longhole tonnes were included at a cut-off grade of not less than 3.4 gpt Au, these must be immediately adjacent to economic stopes that will pay for the capital to access area.

- Mineral resources are estimated at a cut-off grade of 3.38 g/t Au and a gold price of US$1,800/oz. Mineral resources are not considered mineral reserves as they have not demonstrated economic viability.

- See Section 24.1 Other Relevant Data – Gold Price Sensitivity.

The technical information presented in this news release has been reviewed and approved by Will Robinson, P.Geo., Vice President of Exploration for West Red Lake Gold and the Qualified Person for exploration at the West Red Lake Project, and by Maurice Mostert, P.Eng., Vice President of Technical Services for West Red Lake Gold and the Qualified Person for technical services at the West Red Lake Project, as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

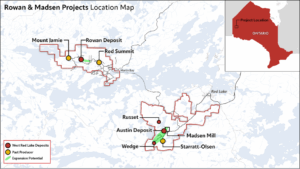

ABOUT WEST RED LAKE GOLD MINES

West Red Lake Gold Mines Ltd. is a mineral development company that is publicly traded and focused on advancing and developing its flagship Madsen Gold Mine and the associated 47 km2 highly prospective land package in the Red Lake district of Ontario. The highly productive Red Lake Gold District of Northwest Ontario, Canada has yielded over 30 million ounces of gold from high-grade zones and hosts some of the world’s richest gold deposits. WRLG also holds the wholly owned Rowan Property in Red Lake, with an expansive property position covering 31 km2 including three past producing gold mines – Rowan, Mount Jamie, and Red Summit.

MORE or "UNCATEGORIZED"

First Phosphate Receives Conditional Approval for up to $16.7 Million Non-Repayable Contribution from the Government of Canada

First Phosphate Corp. (CSE: PHOS) (OTCQX: FRSPF) (OTCQX ADR: FPHOY) (FSE: KD0) has been cond... READ MORE

Gold X2 Drills 117m of 1.21 g/t Au, Including 10m of 4.37g/t Au; High-Grade Zone Intersected 280m Beneath the Resource Pit Demonstrating Underground Potential at the Moss Gold Deposit

Gold X2 Mining Inc. (TSX-V: AUXX) (OTCQB: GSHRF) (FWB: DF8), is pleased to announce initial drilling... READ MORE

Tectonic Raises Over C$92 Million; Completes Upsized Private Placement With Full Over-Allotment Exercised

Tectonic Metals Inc. (TSX-V: TECT) is pleased to announce the successful closing of the Company’s ... READ MORE

Cerro de Pasco Resources Enters Project Development Funding Agreement with U.S. International Development Finance Corporation for Quiulacocha

Cerro de Pasco Resources Inc. (TSX-V: CDPR) (OTCQB: GPPRF) (BVL: CDPR) announces that it has ... READ MORE

NorthWest Announces Updated Mineral Resource at Kwanika Reflecting Strategic Shift to Higher-Grade Copper-Gold Focus

NorthWest Copper Corp. (TSX-V: NWST) is pleased to announce an updated mineral resource estimate for... READ MORE