West Red Lake Gold Defines New High-Grade Shoot at Upper 8 Target – Madsen Property

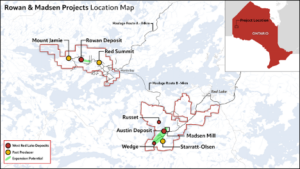

West Red Lake Gold Mines Ltd. (TSX-V: WRLG) (OTCQB: WRLGF) is pleased to report additional drill results from the Upper 8 Target at its 100% owned Madsen Property located in the Red Lake Gold District of Northwestern Ontario, Canada.

These results follow-up on the significant Upper 8 intercepts previously announced on October 2, 2024, where drilling returned 44.17 g/t Au over 1.3 meters and 20.63 g/t Au over 0.5m.

UPPER 8 HIGHLIGHTS:

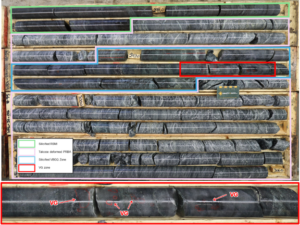

- Hole WRL24-017 Intersected 1.5m @ 21.44 g/t Au, from 297.7m to 299.2m, Including 0.5m @ 52.17 g/t Au, from 298.2m to 298.7m – this high-grade 0.5m interval is complimented by approximately 30 specks of visible gold (Figure 1).

- Hole WRL24-021 Intersected 2m @ 7.41 g/t Au, from 340.25m to 342.25m, Including 0.5m @ 23.74 g/t Au, from 340.25m to 340.75m.

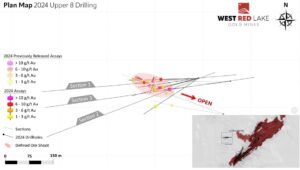

- WRLG has now successfully defined a new ore shoot at Upper 8 that is approximately 30m wide and 130m along plunge – this new zone of mineralization remains open at depth (Figure 4).

- The plunge line on the Upper 8 ore shoot has been constrained to an orientation at approximately 110°/-40° (azimuth/plunge), which is very similar to the orientation of the deeper 8 Zone deposit – this increases WRLG’s confidence in the potential to grow Upper 8 down plunge with additional drilling.

Shane Williams, President and CEO, stated, “The initial results we received from Upper 8 were very encouraging and motivated our team to add a second drill to focus solely on this new high-grade area. Upper 8 was already a shallow geologic analog to the deeper 8 Zone, but with the exceptional grades and visible gold showings we’re now encountering this target is becoming truly reminiscent of the high-grade gold mineralization Red Lake is known for. It’s still early days, but we believe the Upper 8 target has the potential to become the next new significant discovery in the Red Lake gold camp and supports the likelihood for the presence of more high-grade deposits like 8-Zone yet to be discovered across the Madsen property.”

Figure 1. Visible gold showings within 0.5m (core length) zone of blue-grey quartz veining (VBGQ) grading 52.17 g/t Au. Overall VBGQ zone is 1.8m core length. Note the spatial association between the high-grade interval and the Russet Lake Mafic Intrusive (RSMI). PRBA denotes “Biotite-Altered Peridotite” and is the signature 8-Zone-style gold bearing alteration package within the Russet Lake Ultramafic. Diamond drill core in this photo is NQ diameter (47.6 millimeters).

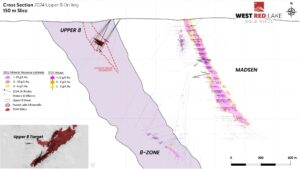

The drill results featured in this news release are focused on the Upper 8 target, which is a shallower geologic analog to the well known high-grade 8-Zone. The Upper 8 target is hosted within the same lithologic unit (Russet Lake Ultramafic) approximately 750m up-plunge from the main 8-Zone deposit (Figure 3). Its location in ultramafic rocks, its style of mineralization, and its exceptionally high grades make the 8 Zone geologically unique from the main Madsen deposit. The 8 Zone currently contains an Indicated mineral resource of 87,700 ounces grading 18 grams per tonne gold, with an additional Inferred resource of 18,200 oz grading 14.6 g/t Au.

Plan maps and sections for the Upper 8 drilling outlined in this release are provided in Figures 2 through 7.

TABLE 1. Significant intercepts (>1 g/t Au) from drilling at Upper 8 Target.

| Hole ID | Target | From (m) | To (m) | Length (m)* | Au (g/t) |

| WRL24-010 | Upper 8 | 217.90 | 222.00 | 4.10 | 1.25 |

| WRL24-011 | Upper 8 | 281.20 | 282.00 | 0.80 | 8.03 |

| AND | Upper 8 | 286.50 | 287.85 | 1.35 | 1.20 |

| WRL24-012 | Upper 8 | 269.20 | 270.20 | 1.00 | 1.40 |

| WRL24-013 | Upper 8 | No Assays > 1 g/t Au | |||

| WRL24-014 | Upper 8 | 254.50 | 255.00 | 0.50 | 1.87 |

| AND | Upper 8 | 269.85 | 272.45 | 2.60 | 3.01 |

| Incl. | 270.45 | 270.95 | 0.50 | 8.62 | |

| AND | Upper 8 | 283.50 | 284.00 | 0.50 | 1.53 |

| WRL24-016 | Upper 8 | 292.50 | 293.00 | 0.50 | 1.22 |

| WRL24-017 | Upper 8 | 274.90 | 277.90 | 3.00 | 1.17 |

| AND | Upper 8 | 287.00 | 287.50 | 0.50 | 4.90 |

| AND | Upper 8 | 291.20 | 294.70 | 3.50 | 1.82 |

| AND | Upper 8 | 297.70 | 299.20 | 1.50 | 21.44 |

| Incl. | 298.20 | 298.70 | 0.50 | 52.17 | |

| AND | Upper 8 | 302.20 | 302.70 | 0.50 | 1.46 |

| WRL24-021 | Upper 8 | 335.70 | 336.25 | 0.55 | 1.40 |

| Incl. | 335.75 | 336.25 | 0.50 | 4.27 | |

| AND | Upper 8 | 340.25 | 342.25 | 2.00 | 7.41 |

| Incl. | 340.25 | 340.75 | 0.50 | 23.74 | |

| AND | Upper 8 | 342.75 | 343.25 | 0.50 | 1.50 |

| AND | Upper 8 | 344.25 | 346.25 | 2.00 | 3.24 |

| Incl. | 345.75 | 346.25 | 0.50 | 8.27 | |

*The “From-To” intervals in Table 1 are denoting overall downhole length of the intercept. True thickness has not been calculated for these intercepts but is expected to be ≥ 70% of downhole thickness based on intercept angles observed in the drill core. Internal dilution for composite intervals does not exceed 1m for samples grading <0.1 g/t Au.

TABLE 2: Drill collar summary for holes reported in this News Release.

| Hole ID | Target | Easting | Northing | Elev (m) | Length (m) | Azimuth | Dip |

| WRL24-010 | Upper 8 | 434836 | 5646692 | 397 | 335.8 | 254 | -49 |

| WRL24-011 | Upper 8 | 434836 | 5646692 | 396 | 350.5 | 265 | -67 |

| WRL24-012 | Upper 8 | 434836 | 5646692 | 396 | 347.6 | 235 | -53 |

| WRL24-013 | Upper 8 | 434835 | 5646692 | 396 | 329.5 | 260 | -54 |

| WRL24-014 | Upper 8 | 434835 | 5646692 | 396 | 320.5 | 264 | -50 |

| WRL24-016 | Upper 8 | 434835 | 5646692 | 396 | 314.5 | 268 | -45 |

| WRL24-017 | Upper 8 | 434835 | 5646692 | 396 | 345.0 | 254 | -67 |

| WRL24-021 | Upper 9 | 434935 | 5646683 | 406 | 406.4 | 261 | -57 |

DISCUSSION:

Drilling on the Upper 8 target is designed to test the projected, near-surface extension of the mineralized shear corridor that hosts the highly prospective 8-Zone. The Upper 8 target horizon was intercepted in only a few historic drill holes, which encountered a zone of strong shearing, alteration and quartz veining equivalent to 8-Zone style mineralization.

The Upper 8 shear domain is hosted within the Russet Lake Ultramafic, which also hosts the 8-Zone deposit, and the angle of shear emplacement of Upper 8 is sympathetic to the structural orientation observed at 8-Zone. Recognition that the gold mineralization at the Upper 8 target is comprised of transposed quartz veinlets within a definable and recognizable shear corridor provides excellent opportunity for additional drilling and expansion potential.

Recent drilling on the Upper 8 target by WRLG has shown that gold mineralization is similar in geological setting and style as the deeper 8-Zone deposit. Elevated gold at Upper 8 is shown to occur within deformed and recrystalized blue-grey quartz and quartz-sulphide veinlets. These veinlets are hosted within shear domains, which are easily recognizable by their locally intense deformation fabrics, and the presence of silica, biotite, potassium feldspar, and amphibole alteration.

A spatial association with mafic intrusives (Russet Lake Mafic Intrusives, or “RSMI”) has also been recognized, which is interpreted as being a more mafic equivalent to the spatial association seen at Madsen between mineralized domains and quartz-porphyry (“QZPY”) dikes. At Upper 8, the high-grade vein zones tend to be positioned footwall to the RSMI units. This spatial relationship between gold mineralization and syn-contemporaneous intrusives has been well documented at other significant deposits in the Red Lake district (Eg. Madsen, Rowan, F2/Bateman, etc).

High resolution versions of all the figures contained in this press release can be found at the following web address: https://westredlakegold.com/upper-8-news-release-maps/

FIGURE 3. Sectional View of Upper 8 Target relative to 8-Zone and Madsen deposits.[1] Note the similarity in orientation of the Upper 8 shear boundary relative to orientation on the 8-Zone – suggests potential for sub-parallel structures between 8-Zone and Upper 8.

[1] Mineral resources are estimated at a cut-off grade of 3.38 g/t Au and a gold price of US1,800/oz. Please refer to the technical report entitled “Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada”, prepared by SRK Consulting (Canada) Inc. and dated June 16, 2023, and amended April 24, 2024. A full copy of the SRK report is available on the Company’s website and on SEDAR+ at www.sedarplus.ca.

FIGURE 4. Upper 8 Target plan view showing size, extent and orientation of currently defined high grade shoot. Note the similar orientation of the Upper 8 ore shoot relative to 8 Zone.

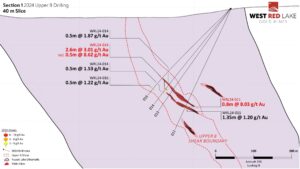

FIGURE 5. Upper 8 Target section view showing assay highlights for Holes WRL24-011, -013, -014, -016, interpreted Upper 8 shear boundary and RSMI dikes.

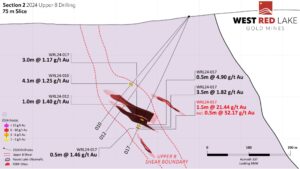

Figure 6. Upper 8 Target section view showing assay highlights for Holes WRL24-010, -012, -017, interpreted Upper 8 shear boundary and RSMI dikes.

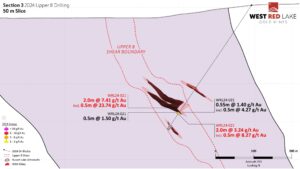

Figure 7. Upper 8 Target section view showing assay highlights for Hole WRL24-021, interpreted Upper 8 shear boundary and RSMI dikes.

Madsen Mine Pre-Feasibility Study Update

The Pre Feasibility Study for the Madsen Mine is nearing completion. The final phase of this study involves optimizing underground development and infrastructure sequencing and refining the associated operating and capital costs. West Red Lake Gold is working with SRK Consulting on these optimization opportunities, a process that is expected to take an additional few weeks to complete. As such the PFS is now targeted for release early in 2025.

Change of Year-End

The Company also announces that it has changed its fiscal year-end from November 30 to December 31.

QUALITY ASSURANCE/QUALITY CONTROL

Exploration drilling completed on surface at the Madsen Mine consists of oriented NQ-sized diamond drill core. All drill holes are systematically logged, photographed, and sampled by a trained geologist at the Madsen Mine core processing facility. Minimum allowable sample length is 0.5m. Maximum allowable sample length is 1.5m. Control samples (certified standards and uncertified blanks), along duplicates, are inserted at a target 5% insertion rate. Results are assessed for accuracy, precision, and contamination on an ongoing basis. The BQ-sized drill core is whole core sampled. The NQ-sized drill core is then cut lengthwise utilizing a diamond blade core saw along a line pre-selected by the geologist. To reduce sampling bias, the same side of drill core is sampled consistently utilizing the orientation line as reference. For those samples containing visible gold, a trained geologist supervises the cutting/bagging of those samples, and ensures the core saw blade is ‘cleaned’ with a dressing stone following the VG sample interval. Bagged samples are then sealed with zip ties and transported by Madsen Mine personnel directly to SGS Natural Resource’s Facility in Red Lake, Ontario for assay.

Samples are then prepped by SGS, which consists of drying at 105°C and crushing to 75% passing 2mm. A riffle splitter is then utilized to produce a 500g course reject for archive. The remainder of the sample is then pulverized to 85% passing 75 microns from which 50g is analyzed by fire assay and an atomic absorption spectroscopy (AAS) finish (SGS Code GO-FAA50V10). Samples returning gold values > 10 g/t Au are reanalyzed by fire assay with a gravimetric finish on a 50g sample (SGS Code GO_FAG50V). Samples with visible gold or returning gold values > 30 g/t Au are also analyzed via metallic screen analysis (SGS code: GO_FAS50M). For multi-element analysis, samples are sent to SGS’s facility in Burnaby, British Columbia and analyzed via four-acid digest with an atomic emission spectroscopy (ICP-AES) finish for 33-element analysis on 0.25g sample pulps (SGS code: GE_ICP40Q12). SGS Natural Resources analytical laboratories operates under a Quality Management System that complies with ISO/IEC 17025.

The Madsen Mine deposit presently hosts a National Instrument 43-101 – Standards of Disclosure for Mineral Projects Indicated resource of 1.65 million ounces of gold grading 7.4 g/t Au and an Inferred resource of 0.37 Moz of gold grading 6.3 g/t Au. Mineral resources are estimated at a cut-off grade of 3.38 g/t Au and a gold price of US1,800/oz. Mineral resources that are not mineral reserves do not have demonstrated economic viability. Please refer to the technical report entitled “Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada”, prepared by SRK Consulting (Canada) Inc. and dated June 16, 2023, and amended April 24, 2024 (the “Madsen Report”). The Madsen Resource Estimate has an effective date of December 31, 2021 and excludes depletion of mining activity during the period from January 1, 2022 to the mine closure on October 24, 2022 as it has been deemed immaterial and not relevant for the purpose of the Madsen Report. A full copy of the Madsen Report is available on the Company’s website and on SEDAR+ at www.sedarplus.ca.

The technical information presented in this news release has been reviewed and approved by Will Robinson, P.Geo., Vice President of Exploration for West Red Lake Gold and the Qualified Person for exploration at the West Red Lake Project, as defined by NI 43-101 “Standards of Disclosure for Mineral Projects”.

ABOUT WEST RED LAKE GOLD MINES

West Red Lake Gold Mines Ltd. is a mineral exploration company that is publicly traded and focused on advancing and developing its flagship Madsen Gold Mine and the associated 47 km2 highly prospective land package in the Red Lake district of Ontario. The highly productive Red Lake Gold District of Northwest Ontario, Canada has yielded over 30 million ounces of gold from high-grade zones and hosts some of the world’s richest gold deposits. WRLG also holds the wholly owned Rowan Property in Red Lake, with an expansive property position covering 31 km2 including three past producing gold mines – Rowan, Mount Jamie, and Red Summit.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE