West Red Lake Gold Confirms High-Grade Continuity at Rowan with First Round of Infill Drilling Results

West Red Lake Gold Mines Ltd. (TSX-V: WRLG) (OTCQB: WRLGF) is pleased to announce drill results from its fully funded infill and conversion drilling program at the 100% owned Rowan Project located in the Red Lake Mining District of Northwestern Ontario, Canada.

A total of thirty-eight (38) holes for approximately 6,000 meters are being drilled at Rowan in the current drilling program. Thirty-three (33) holes have been completed to date with five (5) holes remaining. Fire assay gold results have been received for seven (7) holes. Fire assay results are pending for thirteen (13) holes with thirteen (13) holes currently being logged and prepared for sample shipment.

ROWAN DRILLING HIGHLIGHTS:

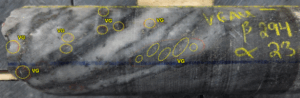

- Hole RLG-25-192b Intersected Vein 013 with 1m @ 141.5 grams per tonne gold, from 76.1m to 77.1m. This high-grade intercept was complimented by visible gold spatially associated with quartz veining and strong silicification (Figure 1). Hole -192b also intercepted Vein 011 with 1m @ 17.55 g/t Au, from 27.6m to 28.6m.

Figure 1. Multiple instances of visible gold in hole RLG-25-192b within a sheared smoky quartz vein. Drill core is HQ (63.5mm) diameter.

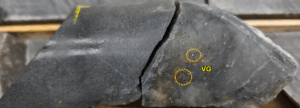

- Hole RLG-25-190 Intersected Vein 006 with 1m @ 55.8 g/t Au, from 109.5m to 110.5m. This high-grade intercept was complimented by visible gold spatially associated with quartz veining and strong silicification (Figure 2). Hole -190 also intercepted Vein 013 with 1m @ 12.5 g/t Au, from 75m to 76m.

Figure 2. Multiple instances of visible gold in hole RLG-25-190 within a sheared smoky quartz vein. Drill core is HQ (63.5mm) diameter.

- Hole RLG-25-187 Intersected Vein 013 with 1m @ 28.5 g/t Au, from 116.25m to 117.25m. This high-grade intercept was complimented by visible gold spatially associated with quartz veining and strong silicification (Figure 3).

Figure 3. Multiple instances of visible gold in hole RLG-25-190 within a sheared smoky quartz vein. Drill core is HQ (63.5mm) diameter.

Will Robinson, Vice President of Exploration, stated, “It’s great to be back drilling at Rowan and we are very encouraged with the results from this first batch of assays. Our updated mineralized domain model that was completed in April 2024 has been holding true with veins and mineralized zones being intercepted where expected. The main targets for this program are Veins 001, 004, 006b and 013, but we are also intercepting mineralization along trend of other modeled veins in the system. These intercepts are expected to provide meaningful data points to inform an updated Mineral Resource Estimate at Rowan planned for Q2 2026. Additionally, the larger diameter HQ drill core we are using for this program is providing excellent grade representation and larger volume samples, with instances of visible gold being commonly observed by the core logging geologists. Based on the early success in this program and the clear expansion potential at Rowan we have added an additional 1,000 m of drilling to continue extending the Vein 001 zone along strike to the west in areas previously un-drilled.”

TABLE 1. Significant intercepts (>1 g/t Au) from drilling at Rowan Deposit.

| Hole ID | Target | Domain | From (m) | To (m) | Length (m)* | Au (g/t) | VG |

| RLG-25-187 | Rowan | Unmodeled | 45.50 | 47.00 | 1.50 | 1.09 | |

| AND | Rowan | V013 (fw) | 116.25 | 117.25 | 1.00 | 28.50 | X |

| AND | Rowan | V006 | 149.90 | 150.75 | 0.85 | 1.49 | |

| AND | Rowan | V006 (fw) | 156.65 | 160.50 | 3.85 | 2.71 | X |

| Incl. | Rowan | 158.65 | 159.50 | 0.85 | 5.75 | ||

| AND | Rowan | Unmodeled | 167.50 | 168.50 | 1.00 | 1.01 | |

| RLG-25-188 | Rowan | Unmodeled | 32.00 | 33.00 | 1.00 | 2.34 | X |

| AND | Rowan | V013 | 107.80 | 108.80 | 1.00 | 1.56 | X |

| AND | Rowan | V013 | 115.00 | 116.00 | 1.00 | 1.98 | X |

| AND | Rowan | V018 (hw) | 122.50 | 123.25 | 0.75 | 6.54 | |

| AND | Rowan | V018 | 129.00 | 130.00 | 1.00 | 2.95 | |

| AND | Rowan | V006 | 158.50 | 159.50 | 1.00 | 2.29 | |

| RLG-25-189 | Rowan | Unmodeled | 101.00 | 102.00 | 1.00 | 1.39 | |

| AND | Rowan | V013 | 166.25 | 168.25 | 2.00 | 3.74 | X |

| Incl. | Rowan | 166.25 | 167.25 | 1.00 | 5.88 | X | |

| AND | Rowan | V018 | 185.50 | 186.50 | 1.00 | 1.09 | |

| AND | Rowan | V018 | 188.00 | 189.00 | 1.00 | 4.29 | |

| AND | Rowan | V006 | 214.00 | 215.00 | 1.00 | 1.01 | |

| AND | Rowan | V007 | 232.00 | 233.00 | 1.00 | 1.40 | |

| RLG-25-190 | Rowan | V011 (fw) | 57.70 | 59.70 | 2.00 | 5.21 | |

| Incl. | Rowan | 58.70 | 59.70 | 1.00 | 9.55 | X | |

| AND | Rowan | V013 | 75.00 | 76.00 | 1.00 | 12.50 | X |

| AND | Rowan | V006 (hw) | 109.50 | 110.50 | 1.00 | 55.80 | X |

| RLG-25-191 | Rowan | V011 | 19.25 | 21.25 | 2.00 | 3.67 | X |

| Incl. | Rowan | 19.25 | 20.25 | 1.00 | 6.30 | ||

| AND | Rowan | Unmodeled | 36.25 | 37.25 | 1.00 | 1.29 | |

| AND | Rowan | V013 | 56.00 | 57.00 | 1.00 | 1.01 | |

| AND | Rowan | V013 (fw) | 59.00 | 59.60 | 0.60 | 1.10 | |

| AND | Rowan | V006 | 101.70 | 102.70 | 1.00 | 4.09 | X |

| RLG-25-192b | Rowan | V011 | 27.60 | 28.60 | 1.00 | 17.55 | X |

| AND | Rowan | V011 (fw) | 47.07 | 48.00 | 0.93 | 11.55 | |

| AND | Rowan | V013 (hw) | 65.00 | 66.00 | 1.00 | 1.08 | |

| AND | Rowan | V013 | 76.10 | 77.10 | 1.00 | 141.50 | X |

| RLG-25-193 | Rowan | V004 | 240.30 | 241.30 | 1.00 | 11.65 | X |

| AND | Rowan | V001 | 262.10 | 263.10 | 1.00 | 5.85 | X |

*The “From-To” intervals in Table 1 are denoting overall downhole length of the intercept. True thickness has not been calculated for these intercepts but is expected to be ≥ 70% of downhole thickness based on intercept angles observed in the drill core. Internal dilution for composite intervals does not exceed 1m for samples grading <0.1 g/t Au. The “VG” column indicates the presence of Visible Gold as observed by the core logging geologist. The (hw) and (fw) notes under “Domain” column are indicating position of grade intercept “hangingwall” or “footwall”, respectively, to primary vein domain. Vein intercepts currently defined as “Unmodeled” may be incorporated into new vein domains in upcoming MRE update for Rowan.

TABLE 2: Drill collar summary for holes reported in this News Release.

| Hole ID | Target | Easting | Northing | Elev (m) | Length (m) | Azimuth | Dip |

| RLG-25-187 | Rowan | 422010 | 5657799 | 367 | 182.20 | 357 | -45 |

| RLG-25-188 | Rowan | 422021 | 5657804 | 367 | 191.50 | 7 | -51 |

| RLG-25-189 | Rowan | 422053 | 5657761 | 372 | 245.50 | 358 | -51 |

| RLG-25-190 | Rowan | 421992 | 5657829 | 366 | 118.00 | 358 | -49 |

| RLG-25-191 | Rowan | 421980 | 5657845 | 367 | 125.50 | 0 | -50 |

| RLG-25-192b | Rowan | 421979 | 5657845 | 367 | 92.50 | 357 | -67 |

| RLG-25-193 | Rowan | 422159 | 5657811 | 366 | 305.50 | 334 | -53 |

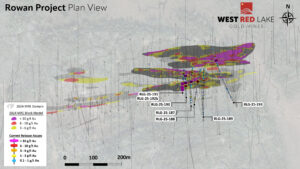

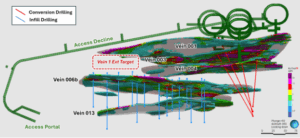

FIGURE 4. Deposit-scale plan map of Rowan project area showing traces and intercepts for holes highlighted in this News Release.

Mineral resources are estimated at a cut-off grade of 3.80 g/t Au and a gold price of US$1,800/oz. Please refer to the technical report entitled “Rowan Project NI 43-101 Technical Report and Preliminary Economic Assessment, Ontario, Canada”, prepared by Fuse Advisors Inc., and dated June 30, 2025. A full copy of the report is available on the Company’s website and on SEDAR+ at www.sedarplus.ca.

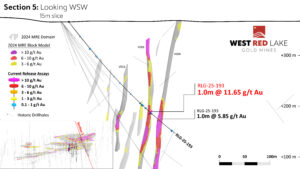

FIGURE 9. Rowan drill section showing assay highlights for Hole RLG-25-193.

Mineral resources are estimated at a cut-off grade of 3.80 g/t Au and a gold price of US$1,800/oz. Please refer to the technical report entitled “Rowan Project NI 43-101 Technical Report and Preliminary Economic Assessment, Ontario, Canada”, prepared by Fuse Advisors Inc., and dated June 30, 2025. A full copy of the report is available on the Company’s website and on SEDAR+ at www.sedarplus.ca.

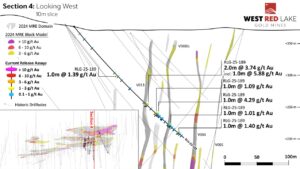

FIGURE 8. Rowan drill section showing assay highlights for Hole RLG-25-189.

Mineral resources are estimated at a cut-off grade of 3.80 g/t Au and a gold price of US$1,800/oz. Please refer to the technical report entitled “Rowan Project NI 43-101 Technical Report and Preliminary Economic Assessment, Ontario, Canada”, prepared by Fuse Advisors Inc., and dated June 30, 2025. A full copy of the report is available on the Company’s website and on SEDAR+ at www.sedarplus.ca.

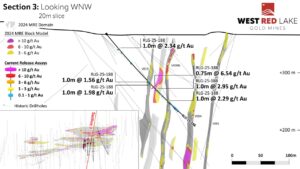

FIGURE 7. Rowan drill section showing assay highlights for Hole RLG-25-188.

Mineral resources are estimated at a cut-off grade of 3.80 g/t Au and a gold price of US$1,800/oz. Please refer to the technical report entitled “Rowan Project NI 43-101 Technical Report and Preliminary Economic Assessment, Ontario, Canada”, prepared by Fuse Advisors Inc., and dated June 30, 2025. A full copy of the report is available on the Company’s website and on SEDAR+ at www.sedarplus.ca.

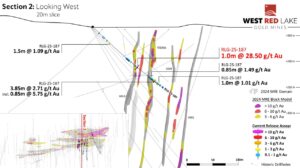

FIGURE 6. Rowan drill section showing assay highlights for Hole RLG-25-187.

Mineral resources are estimated at a cut-off grade of 3.80 g/t Au and a gold price of US$1,800/oz. Please refer to the technical report entitled “Rowan Project NI 43-101 Technical Report and Preliminary Economic Assessment, Ontario, Canada”, prepared by Fuse Advisors Inc., and dated June 30, 2025. A full copy of the report is available on the Company’s website and on SEDAR+ at www.sedarplus.ca

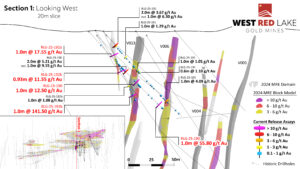

FIGURE 5. Rowan drill section showing assay highlights for Holes RLG-25-190, -191 and -192b.

Mineral resources are estimated at a cut-off grade of 3.80 g/t Au and a gold price of US$1,800/oz. Please refer to the technical report entitled “Rowan Project NI 43-101 Technical Report and Preliminary Economic Assessment, Ontario, Canada”, prepared by Fuse Advisors Inc., and dated June 30, 2025. A full copy of the report is available on the Company’s website and on SEDAR+ at www.sedarplus.ca.

ROWAN PROGRAM SUMMARY

West Red Lake Gold announced results for a Preliminary Economic Assessment for the Rowan Project on July 8, 2025 which demonstrates robust preliminary economics for an underground mine at Rowan producing an average of 35,230 ounces per year over a 5-year mine life at an average grade of 8.0 g/t Au (a copy of this news release can be viewed HERE1).

The drill program at Rowan (Figure 10) will now consist of around 6,000 m of HQ diameter diamond drilling including conversion drilling on Veins 001 and 004 to support the potential upgrade of Inferred resources to Indicated2 and infill drilling on Veins 006b and 013 to provide data that may enable mine design consideration ahead of a planned combined Pre-Feasibility Study (“PFS”) for the Madsen Mine and Rowan projects. This planned study will evaluate the potential for developing the two projects using shared infrastructure and integrated mine planning, with the goal of identifying possible operational and economic synergies3.

FIGURE 10. Plan view showing Rowan Veins 001, 003, 004, 006b and 013 with proposed infill and conversion drilling and current PEA underground mine design[2]. Vein 1 west extension target outlined in red.

Conversion drilling2 at Rowan is focused on Veins 001 and 004, with the objective to bring Inferred resources to an Indicated category. These veins account for the majority of PEA production tonnes. Approximately 63% of the tonnes and 72% of the ounces were already in the Indicated category in the Rowan PEA.

Infill drilling is focused on Veins 006b and 013 to provide data for potential inclusion in the planned combined PFS. Integration of Veins 006b and 013 could not only extend mine life at Rowan, but may also allow for ore extraction to begin approximately 6 months sooner due to closer proximity to the access portal. Accessing and mining mineralization earlier at Rowan has the potential to positively impact the net present value (“NPV”) of the project. Inclusion of Veins 006b and 013 in future mine plans and the impact such inclusion could have is subject to the results of the drill program and the outcome of the combined PFS as reviewed by a Qualified Person.

Further geotechnical, metallurgical and engineering studies are also underway at Rowan to inform the planned PFS. These studies will be completed in conjunction with ongoing permitting efforts to advance Rowan towards Advanced Exploration status, which is required for bulk sample extraction. Permits to support Advanced Exploration activities, including underground mine development, are targeted for 2027, subject to regulatory review and consultation.

The Advanced Exploration permit is targeted for approval in 2027, a timeline supported by the recent launch of the One Project, One Process mine permitting framework in Ontario that aims to cut review times within the mine permitting process in half for Designated Projects, a status the Company is pursuing at Rowan.4

ADDITIONAL OPPORTUNITIES

There are multiple opportunities to potentially expand and upgrade the resource and mine plan at Rowan.

The Rowan resource comprises 26 domains that capture multiple parallel veins. Three of those veins – 001, 003 and 004 – are mined in the PEA. A fourth vein with strong gold grades, called 006b, is the third largest contributor of tonnes and ounces in the current mineral resource estimate but was not included in the PEA mine plan because its data stems largely from historic drilling, which suffers from unsampled intervals. Vein 013 runs adjacent and sub-parallel to Vein 006b and may demonstrate similar resource upgrade potential, subject to confirmation drilling and subsequent resource estimation by a Qualified Person.

Historic operators often only sampled and assayed drill core with quartz veining containing visible gold. Surrounding rock, including vein margins, narrow gaps between veins, and adjacent wall rock, was typically not sampled. During the MRE estimation process those unsampled intervals were assigned a value of half detection limit equal to 0.0025 g/t Au. This excessively diluted those areas in the resource model, which was constructed on 2-metre minimum composites for longhole stoping design consideration. During the 2023 drill campaign, WRLG demonstrated that gold mineralization regularly persists into the altered wall rock adjacent to high-grade gold veins. Selective sampling would have missed mineralization of this type. Additionally, most of the drilling on Veins 006b and 013 is from the 1980’s utilizing very small 27-millimeter diameter AQ drill core with no existing competent historic core available for resampling. The 2025-2026 drilling program is being completed with 63.5-millimeter diameter HQ drill core and with an aim to infill the gaps in the historic analytical data set on Veins 006b and 013, with the goal of bringing these veins back into consideration for mine design.

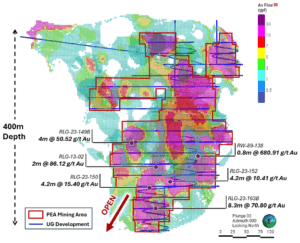

The next layer of opportunity at Rowan is based on expanding the deposit. Notably, the highest-grade intercept ever drilled at Rowan was achieved during the 2023 drill campaign when hole RLG-23-163B returned 70.8 g/t Au over 8.3 metres. This intercept came from the deeper portion of Vein 001 and indicates potential for mineralization to continue at depth. The Rowan vein system has only been defined down to approximately 400 metres and remains wide open for expansion at depth (Figure 11). The Rowan deposit also remains open along strike to the east and west.

FIGURE 11. Long section of Rowan block model at 1 g/t Au cutoff showing PEA mine design (blue) and outline of areas planned for long hole stoping on Veins 001, 003 and 004 (red outline). Notable assay intercepts have been highlighted to indicate the strength of gold mineralization and expansion potential at depth. Intercepts are reported as core length unless otherwise stated.

Mineral resources are estimated at a cut-off grade of 3.80 g/t Au and a gold price of US$1,800/oz. Please refer to the technical report entitled “Rowan Project NI 43-101 Technical Report and Preliminary Economic Assessment, Ontario, Canada”, prepared by Fuse Advisors Inc., and dated June 30, 2025. A full copy of the report is available on the Company’s website and on SEDAR+ at www.sedarplus.ca.

ABOUT WEST RED LAKE GOLD MINES

West Red Lake Gold Mines Ltd. is a gold miner development company that is publicly traded and focused on advancing and developing its flagship Madsen Gold Mine and the associated 47 km2 highly prospective land package in the Red Lake district of Ontario. The highly productive Red Lake Gold District of Northwest Ontario, Canada has yielded over 30 million ounces of gold from high-grade zones and hosts some of the world’s richest gold deposits. WRLG also holds the wholly owned Rowan Property in Red Lake, with an expansive property position covering 31 km2 including three past producing gold mines – Rowan, Mount Jamie, and Red Summit.

ON BEHALF OF WEST RED LAKE GOLD MINES LTD.

“Shane Williams”

Shane Williams

President & Chief Executive Officer

FOR FURTHER INFORMATION, PLEASE CONTACT:

Gwen Preston

Vice President Communications

Tel: (604) 609-6132

Email: investors@wrlgold.com or visit the Company’s website at https://www.westredlakegold.com

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE