West Red Lake Gold Closes US$35-Million Credit Facility with Nebari and Announces Drawdown of US$15 Million

West Red Lake Gold Mines Ltd. (TSX-V: WRLG) (OTCQB: WRLGF) is pleased to announce that on December 31, 2024 it entered into a completed credit agreement with Nebari Natural Resources Credit Fund II LP pursuant to which the Company will borrow up to a maximum principal amount of US$35 million to be issued in three tranches of : (i) US$15 million, (ii) US $15 million, and (iii) US$5 million. Tranche 1 was drawn down on December 31, 2024.

The Credit Facility was first announced on October 17, 2024, when the Company and Nebari had entered into a non-binding term sheet. West Red Lake Gold and Nebari have worked closely over the last 2.5 months through a detailed due diligence process that investigated all aspects of West Red Lake Gold and the Madsen Mine project.

“Closing this transaction with Nebari is a major de-risking step and gives West Red Lake access to up to USD$35M of non-dilutive capital, at highly favorable repayment terms which offers us solid operational flexibility going forward and allows the Company to sustain the momentum as we push to restart the Madsen project. I would like to thank Nebari for working with us to realize the opportunity in the high-grade gold, infrastructure, permits, and upside potential at Madsen. With this Credit Facility in place, West Red Lake Gold is well funded to restart the Madsen Mine in 2025.”

Richard Gaze, Managing Director of Nebari, commented: “Nebari is excited to partner with West Red Lake Gold to support the restart of the Madsen project. We have high confidence in the dedication and professionalism of the West Red Lake Gold team and look forward to the successful restart of commercial gold production at Madsen.”

The proceeds from the Credit Facility will be used for: 1) completing the remaining capital costs to restart the Madsen Mine, and 2) other corporate, exploration and working capital expenses.

Repayment of 50% of principal outstanding via fixed straight-line amortization commences on the 15th month following the draw-down of Tranche 1. The remaining 50% of borrowed funds are due on the maturity date. The Credit Facility may be repaid prior to maturity at any time subject to the additional payment of a make-whole threshold.

Interest will accrue on the advanced outstanding principal amount of the loan based on a floating rate per annum equal to the sum of: (i) the three-month term SOFR reference rate administered by CME Loan Party Benchmark Administration Limited (CBA), as determined on the first date of each calendar month; and (ii) 8.0% per annum, provided that, if the Term SOFR is less than 4.0%, it shall be deemed to be 4.0%.

In addition, the Company is paying to Nebari an administration fee of $30,000 per annum and an arrangement fee in the amount of 1.5% of the funded amount for each Tranche, further details set out in the Loan Agreement.

No finder’s fees are payable in connection with the Credit Facility.

The maturity date of the Credit Facility will be the date that is 42 months following the closing of Tranche 1. Nebari is at arms-length to the Company and currently owns no securities of the Company.

The Company will issue on the closing of each Tranche a number of non-transferable common share purchase warrants equal to:

- Tranche 1: The Company has issued 5,867,376 Loan Bonus Warrants at an exercise price of CAD$ 0.73 (using a USD/CAD exchange rate of 1.436) per common share, which will expire on the date that is 42 months from the date of issuance. The Loan Bonus Warrants are subject to a statutory hold period of four months and one day under applicable securities laws; and

- Tranches 2 and 3: for each, the Canadian equivalent of 20% of the loan amount being drawn in respect of each Tranche divided by a Canadian dollar amount equal to a 30% premium to the lower of: (A) the lowest 20-day VWAP of the Company’s share price prior to: (i) the date which the Company issues its request for the advance in respect of each Tranche ; (ii) the date of the first public announcement regarding the Company’s intention to draw the loan each Tranche; and (iii) the closing date of the advance of each Tranche, and (B) the common share price of the most recent equity raise, subject to compliance with TSXV policies.

Each Loan Bonus Warrant will entitle the holder to purchase one common share of the Company until the date that is 42 months following the closing of Tranche 1 with such term subject to a pro-rata reduction if the funded amount is prepaid in whole or in part, then a pro rata number of the total Loan Bonus Warrants issued in relation to such Tranche will have their term reduced to the later of one year from the date of issuance of the Warrants and 30 days from the reduction, in accordance with TSXV policies. The Lender will receive cash compensation for any pro-rata reduction.

The Loan is also guaranteed by the Company’s wholly-owned subsidiaries, West Red Lake Gold Mines (Ontario) Ltd. and Red Lake Madsen Mine Ltd. The Guarantors and the Company have entered into security arrangements with the Lender while also initially securing the Loan by way of: (i) a pledge of 100% of all shares of the Guarantors; and (ii) a registered, perfected first priority senior security interest in, lien on and pledge of all intercorporate debt between the Company and the Guarantors.

With this Credit Facility in place, West Red Lake Gold will continue its detailed mine ramp up schedule, which in the coming months includes:

- Test mining to generate bulk samples pulled from four stopes within two resource areas, batch stockpiled.

- Continued increase in daily development meterage.

- Starting up of the mill late in the first quarter and processing the bulk sample in a batch campaign, enabling reconciliation between expected and actual grades.

- Production mining and milling ramp up starting in Q2 2025.

ABOUT WEST RED LAKE GOLD MINES

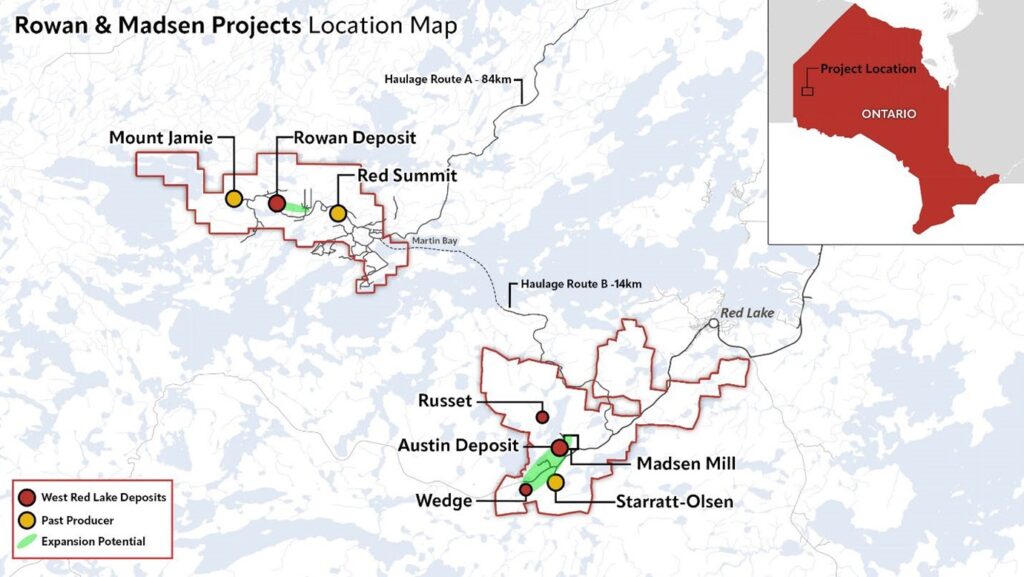

West Red Lake Gold Mines Ltd. is a mineral exploration company that is publicly traded and focused on advancing and developing its flagship Madsen Gold Mine and the associated 47 km2 highly prospective land package in the Red Lake district of Ontario. The highly productive Red Lake Gold District of Northwest Ontario, Canada has yielded over 30 million ounces of gold from high-grade zones and hosts some of the world’s richest gold deposits. WRLG also holds the wholly owned Rowan Property in Red Lake, with an expansive property position covering 31 km2 including three past producing gold mines – Rowan, Mount Jamie, and Red Summit.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE