VIZSLA COPPER INTERSECTS 0.90% COPPER EQUIVALENT OVER 66.1 METRES IN INITIAL DRILL HOLES FROM ITS ONGOING EXPLORATION PROGRAM AT THE WOODJAM PROJECT, CENTRAL BC

Vizsla Copper Corp. (TSX-V: VCU) (OTCQB: VCUFF) (FRANKFURT: 97E0) is pleased to report initial assay results from its summer core drilling program at the Woodjam copper-gold project in south-central BC.

HIGHLIGHTS

Drill holes SE23-101 and 102 at the Southeast zone intersected broad intervals of consistent copper mineralization confirming strong grade continuity in key areas of the deposit.

- Drill hole SE23-102:

- Intersected 0.61% copper equivalent (CuEq, 0.54% Cu, 0.05 g/t Au, 1.84 g/t Ag and 0.005% Mo) over 293.2 m from 136.9 to 430.1m (>0.2% Cu)1,2

- includes a high-grade interval of 0.90% CuEq (0.81% Cu, 0.08 g/t Au, 1.89 g/t Ag and 0.005% Mo) over 66.1m from 157.0 to 223.1m (>0.5% Cu)1,2

- Drill hole SE23-101:

- Intersected 0.60% CuEq (0.49% Cu, 0.07 g/t Au, 1.43 g/t Ag and 0.012% Mo) over 131.5 m from 177.0 to 308.5m (>0.2% Cu)1,2

- includes a high-grade interval of 0.76% CuEq (0.64% Cu, 0.10 g/t Au, 1.75 g/t Ag and 0.011% Mo) over 60.0m from 185.0 to 245.0m (>0.5% Cu)1,2

| Notes: | |

| 1. | Composite intervals are calculated above noted Cu cutoff grades and may include a maximum of 10m of internal waste. |

| 2. | Copper equivalent values are based on metal prices of $4.00/lb Cu, $1,800/oz Au, $22/oz Ag and $15/lb Mo. |

“These initial results support our view that Woodjam is an incredibly important copper project in a world that requires an ever-increasing amount of it,” commented Craig Parry, Executive Chairman. “I look forward to the rest of the results from our inaugural drilling program. With easy access, established infrastructure and an enormous endowment of metal, Vizsla Copper’s Woodjam Project is proving to be an outstanding asset.”

“Long, strong intervals of copper mineralization are a great way to start our first drill program at Woodjam,” commented Steve Blower, Vice President of Exploration. “I eagerly await assay results from the rest of the program, which includes several drill holes designed to extend mineralization at the Deerhorn and Takom deposits, plus explore new target areas at the Megaton and Megabuck East zones.”

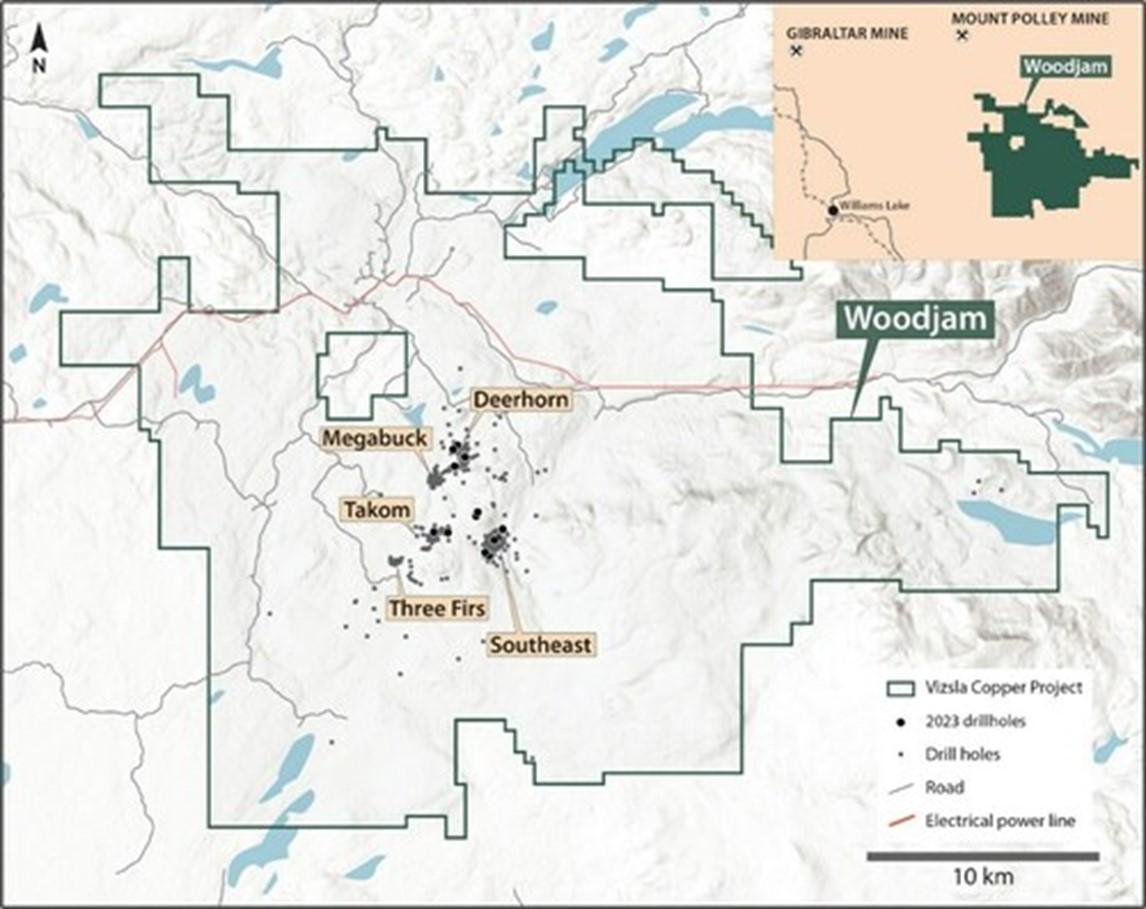

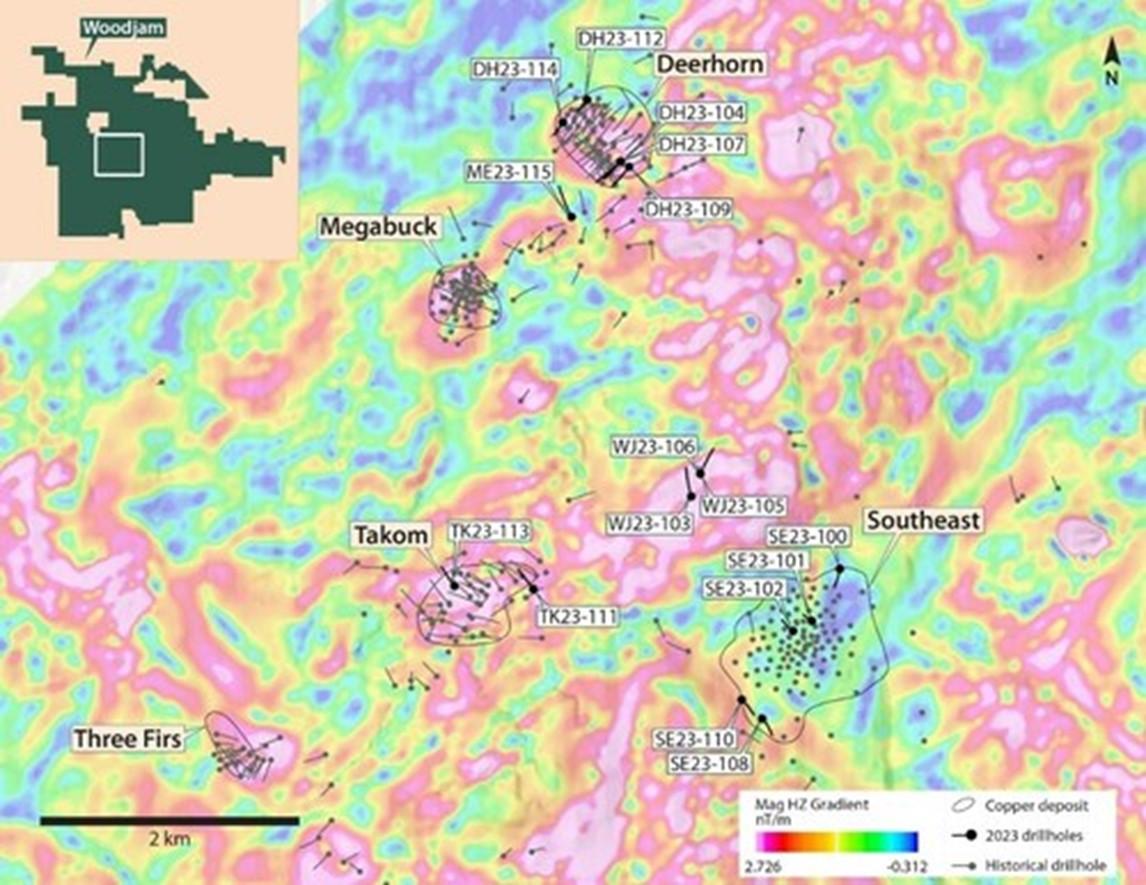

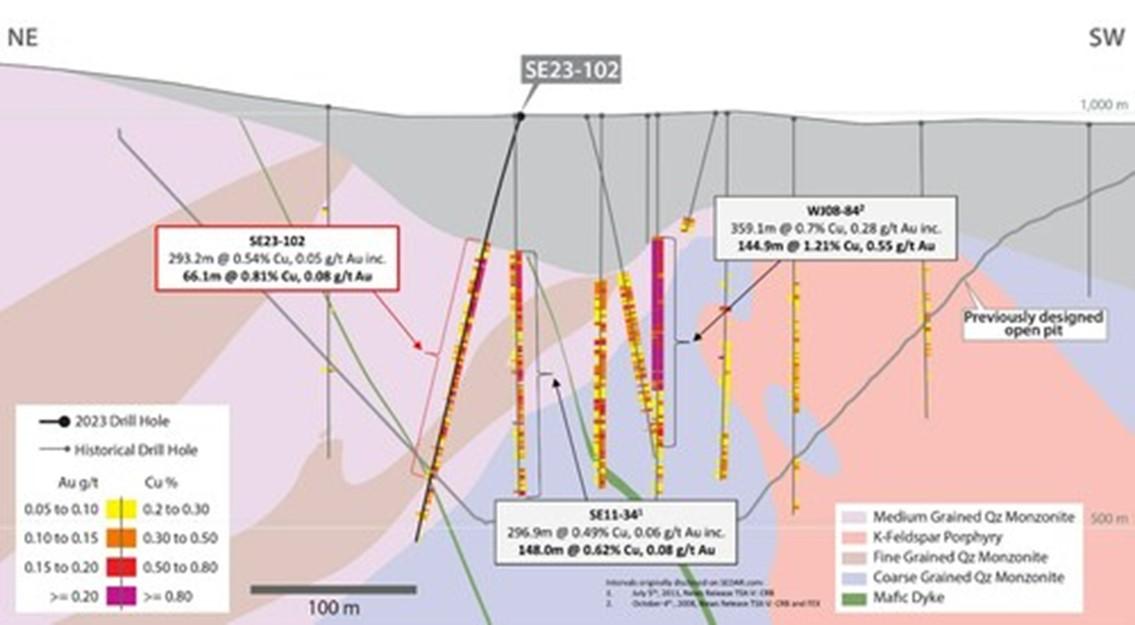

The Program

High-grade, copper-gold mineralization in and around the over 6-kilometer-long corridor of known porphyry-related mineralization at Woodjam is being targeted by this drill program (Figure 1). Initial drill holes successfully tested gaps in previous drilling at the Southeast deposit and confirmed strong grade continuity (Figure 2). Results from the first three drill holes are highlighted by hole SE23-102, an angled drill hole designed to fill a 120m gap on Figure 3. The hole intersected 0.61% CuEq (0.54% Cu, 0.05 g/t Au, 1.84 g/t Ag and 0.005% Mo) over 293.2m, including a high-grade interval of 0.90% CuEq (0.81% Cu, 0.08 g/t Au, 1.89 g/t Ag and 0.005% Mo) over 66.1m. See Table 1 for additional details on the intersections.

Table 1 – Woodjam 2023 Results

| Hole-ID | Area | Significant Intersections | |||||||

| From (m) | To (m) | Length (m) | Cu (%) | Mo (%) | Au (g/t) | Ag (g/t) | Cueq (%) | ||

| SE23-100 | Southeast | No significant intersections >0.20% Cu | |||||||

| SE23-101 | Southeast | 177.00 | 308.50 | 131.50 | 0.49 | 0.012 | 0.07 | 1.43 | 0.60 |

| includes | 185.00 | 245.00 | 60.00 | 0.64 | 0.011 | 0.10 | 1.75 | 0.76 | |

| and | 398.00 | 448.00 | 50.00 | 0.29 | 0.046 | 0.04 | 1.99 | 0.50 | |

| and | 487.00 | 497.00 | 10.00 | 0.79 | 0.215 | 0.37 | 10.25 | 1.92 | |

| SE23-102 | Southeast | 136.90 | 430.10 | 293.20 | 0.54 | 0.005 | 0.05 | 1.84 | 0.61 |

| includes | 157.00 | 223.10 | 66.10 | 0.81 | 0.005 | 0.08 | 1.89 | 0.90 | |

| and includes | 260.00 | 327.10 | 67.10 | 0.54 | 0.005 | 0.05 | 1.43 | 0.60 | |

| and | 442.00 | 481.10 | 39.10 | 0.34 | 0.013 | 0.03 | 1.50 | 0.42 | |

| Notes: | ||

| 1. | Composite intervals are calculated above 0.20% Cu (0.50% Cu for higher grade subintervals) and may include a maximum of 10m of internal waste. | |

| 2. | Copper equivalent values are based on metal prices of $4.00/lb Cu, $1,800/oz Au, $22/oz Ag and $15/lb Mo. |

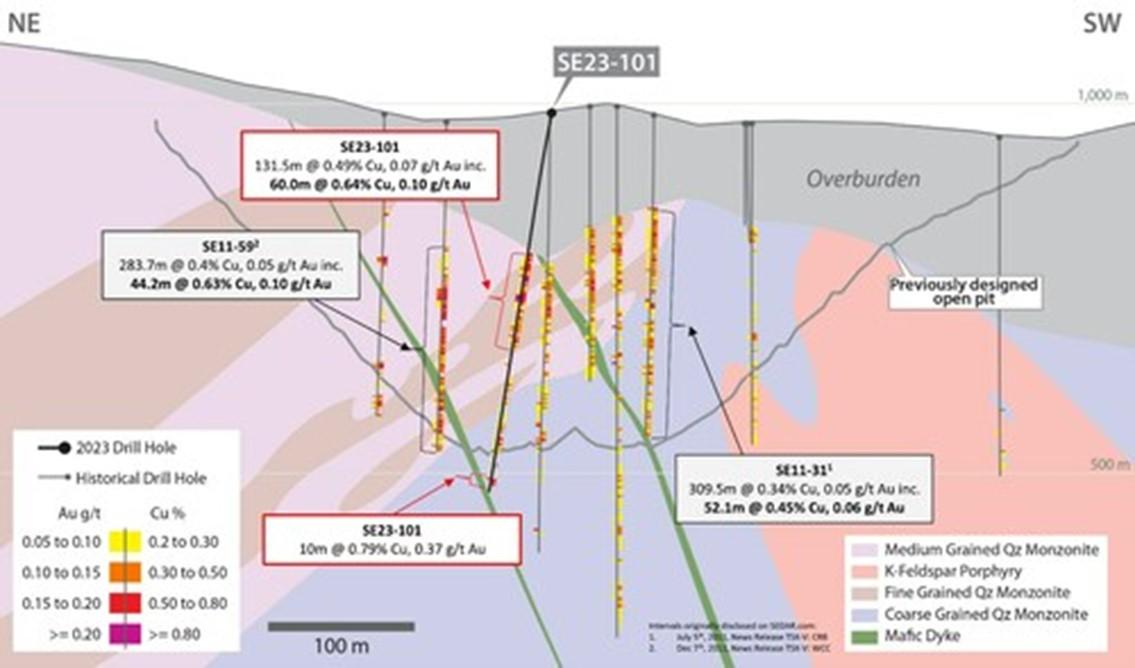

Drill hole SE23-101 successfully filled a 140m gap on Figure 4 with an intersection of 0.60% CuEq (0.49% Cu, 0.07 g/t Au, 1.43 g/t Ag and 0.012% Mo) over 131.5m, including a high-grade interval of 0.76% Cueq (0.64% Cu, 0.10 g/t Au, 1.75 g/t Ag and 0.011% Mo) over 60.0m. Copper mineralization at the Southeast deposit comprises chalcopyrite ± bornite-bearing veins and vein stockworks hosted in variably potassic altered monzonitic intrusive rocks of the Early Jurassic Takomkane batholith.

Drill hole SE23-100 was drilled on the northeastern fringe of the Southeast deposit and did not intersect any significant intervals greater than 0.20% Cu.

Approximately 5,970m of drilling has been completed to date in 14 drill holes with the total planned program consisting of approximately 8,000m in 18 drill holes. Assay results have now been received for the first three drill holes and all others are pending.

Figure 1 – Woodjam Property Map

Figure 2 – Drilling Target Area Locations

Figure 3 – Drill Hole SE23-102 Cross-Section

Figure 4 – Drill Hole SE23-101 Cross-Section

Table 2 – Collar locations for the currently reported drill holes.

| Hole ID | Hole size | Depth (m) | Azimuth (°) | Dip (°) | Easting | Northing | Elevation (m) |

| SE23-100 | NQ | 602 | 170 | -75 | 613285 | 5788697 | 978 |

| SE23-101 | NQ | 506 | 310 | -80 | 613078 | 5788290 | 973 |

| SE23-102 | NQ | 509 | 310 | -75 | 612935 | 5788211 | 977 |

| Notes: | ||

| 1. | Coordinates are given as North American Datum 1983, Universal Transverse Mercator Zone 10 North (NAD83 z 10N) |

Sampling, Chain of Custody, Quality Assurance and Quality Control

All sampling was conducted under the supervision of Vizsla’s geologists and the chain of custody from the sampling facility in Horsefly to the sample preparation facility, ALS Laboratories in Kamloops, BC, was continuously monitored.

Core samples were taken as ½ core, from a minimum of 0.3 m to a maximum of 2 m core length to account for lithological or alteration boundaries. Samples were then crushed, pulverised and sample pulps were analysed using industry standard analytical methods including a 4-Acid, ICP-MS multielement package (ALS code ME-MS61) and an ICP-AES method for high-grade copper samples (ALS code ME-OG62). Gold was analysed using a 30 g aliquot by fire assay with an ICP-AES finish (ALS code Au-ICP21).

Certified reference material was inserted every 10th sample. Coarse blank was inserted every 20th sample. For approximately 2.5% of core samples, the remaining ½ core was taken as a field duplicate. For 2.5% of core samples a preparation duplicate is taken after coarse crushing is complete at the laboratory.

In addition to Vizsla’s QA/QC program, additional blanks, reference materials and duplicates were inserted by ALS according to their internal procedures. Data verification of the analytical results included a statistical analysis of the standards and blanks that must pass certain parameters for acceptance to ensure accurate and verifiable results.

About Vizsla Copper

Vizsla Copper is a Cu-Au-Mo focused mineral exploration and development company headquartered in Vancouver, Canada. The Company is primarily focused on its flagship Woodjam project, located within the prolific Quesnel Terrane, 55 kilometers east of the community of Williams Lake, British Columbia. It has four additional copper exploration properties; Copperview, Redgold, Blueberry and Carruthers Pass, all well situated amongst significant infrastructure in British Columbia. The Company’s growth strategy is focused on the exploration and development of its copper properties within its portfolio in addition to value accretive acquisitions. Vizsla Copper’s vision is to be a responsible copper explorer and developer in the stable mining jurisdiction of British Columbia, Canada and is committed to socially responsible exploration and development, working safely, ethically and with integrity.

Vizsla Copper is a spin-out of Vizsla Silver Corp. (TSX-V: VZLA) (NYSE: VZLA) and is backed by Inventa Capital Corp., a premier investment group founded in 2017 with the goal of discovering and funding opportunities in the resource sector.

Qualified Person

The Company’s disclosure of technical or scientific information in this press release has been reviewed and approved by Ian Borg, P.Geo., Senior Geologist for Vizsla Copper. Mr. Borg is a Qualified Person as defined under the terms of National Instrument 43-101.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE