ValOre Enters into Definitive Agreement to Acquire South Atlantic Gold to Create a 99,924 Hectare Precious Metals District in Ceara State, Brazil

ValOre Metals Corp. (TSX-V: VO) (OTCQB: KVLQF) (Frankfurt: KEQ0) and South Atlantic Gold Inc. (TSX-V: SAO), today announced that further to the February 17, 2025 joint news release, the companies have entered into an amalgamation agreement on March 26, 2025, pursuant to which ValOre will acquire all of the issued and outstanding common shares in the capital of South Atlantic and other securities of South Atlantic. Pursuant to the terms of the Agreement, South Atlantic and 1529317 B.C. Ltd. a wholly-owned subsidiary of ValOre, will amalgamate under the Business Corporations Act (British Columbia). Upon completion of the Proposed Transaction, the company resulting from the Amalgamation will be a wholly-owned subsidiary of ValOre.

Jim Paterson, ValOre Chairman and C.E.O. stated: “We would like to thank all SAO stakeholders for their efforts to get this transaction to its current stage. We’re very excited to start exploration programs on the combined and expanded Pedra Branca project area once the deal has been completed. Prior to this happening, the shareholders of South Atlantic must approve the transaction at an upcoming SAO shareholder meeting, so we encourage their participation and request their support of the deal.”

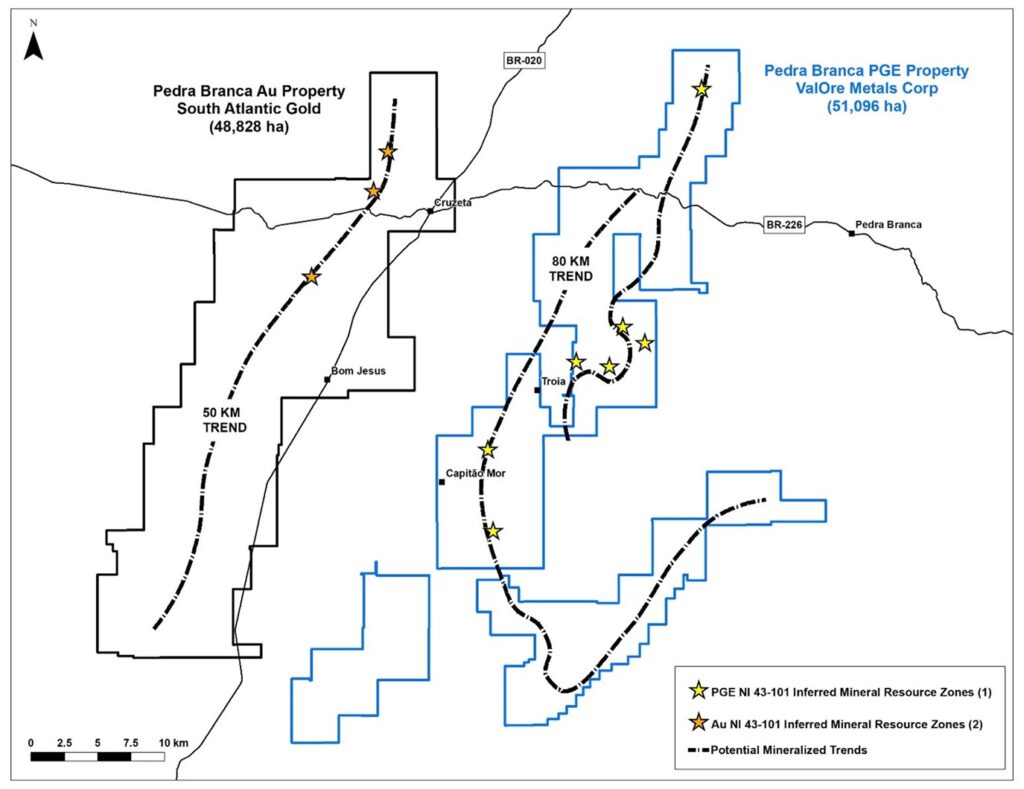

Figure 1: Pedra Branca PGE and Pedra Branca Au property map

(1) Independent Technical Report – Mineral Resource Update on the Pedra Branca PGE Project, Ceará State, Brazil (Effective date: March 8, 2022)

(2) NI 43-101 Technical Report – Mineral Resource Estimation for the Pedra Branca Gold Project Ceará State – Brazil (Effective date: March 16, 2021)

Transaction Details

Under the terms of the Agreement, which was approved unanimously by each of the boards of directors of ValOre and South Atlantic, (i) South Atlantic and ValOre Subco will amalgamate under the Business Corporations Act (British Columbia) to form Amalco; (ii) all outstanding South Atlantic restricted share units and deferred share units, if any, will be settled for South Atlantic Shares immediately prior to the Amalgamation, (iii) each issued and outstanding South Atlantic Share will be cancelled and replaced with that number of common shares in the capital of ValOre equal to the quotient obtained by dividing 38,500,000 by the number of South Atlantic Shares issued and outstanding immediately prior to the Amalgamation, (iv) all outstanding South Atlantic stock options will be cancelled and replaced with options to acquire such number of ValOre Shares multiplied by the Exchange Ratio, (v) each issued and outstanding common share of ValOre Subco will be replaced by a common share of Amalco, and (vi) as consideration for the issuance of the ValOre Shares to effect the Proposed Transaction, Amalco will issue ValOre one common share of Amalco for each ValOre Share so issued. No fractional ValOre Shares will be issued in exchange for South Atlantic Shares and the aggregate number of ValOre Shares issued to a holder of South Atlantic Shares will be rounded down to the nearest whole ValOre Share.

It is estimated that there will be an aggregate of approximately 267,540,439 ValOre Shares issued and outstanding immediately following completion of the Proposed Transaction, resulting in: (i) the holders of South Atlantic Shares immediately prior to completion of the Proposed Transaction, holding approximately 38,500,000 (~14.4%) ValOre Shares (equating to approximately $2.88 million based on the closing price of the ValOre Shares on March 26, 2025), and (ii) current holders of ValOre Shares holding approximately 229,060,439 (~85.6%) ValOre Shares.

The Amalgamation Agreement contains customary provisions including non-solicitation and “right to match” provisions, as well as a $150,000 termination fee payable to ValOre under certain circumstances and, in certain other customary circumstances, expense reimbursement to ValOre or South Atlantic (as applicable).

In addition to South Atlantic Shareholder approval (see below for further details), the completion of the Proposed Transaction is subject to approval of the TSX Venture Exchange as well as other customary closing conditions for transactions of its nature. Subject to the satisfaction of such conditions, the Proposed Transaction is expected to be completed during the second quarter of 2025. The Proposed Transaction cannot close until the required shareholder approvals are obtained and there can be no assurance that the Proposed Transaction will be completed as proposed or at all.

Investors are cautioned that, except as disclosed in South Atlantic’s management information circular to be prepared in connection with the Proposed Transaction, any information released or received with respect to the Proposed Transaction may not be accurate or complete and should not be relied upon.

Following completion of the Proposed Transaction, it is expected that the South Atlantic Shares will no longer be listed on any public market and South Atlantic will cease to be a reporting issuer under Canadian securities laws.

South Atlantic Shareholder Meeting and Board of Directors’ Recommendations

In connection with the Proposed Transaction, it is expected that South Atlantic will hold a special meeting of its shareholders to, among other annual items of business, approve the Amalgamation which will require the approval of: (i) two-thirds of the votes cast on the resolution by shareholders of South Atlantic at the South Atlantic Shareholder Meeting, and (ii) a simple majority of the votes cast on the resolution by South Atlantic Shareholders at the South Atlantic Shareholder Meeting, excluding votes from certain South Atlantic Shareholders, as required under Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions. The South Atlantic Shareholder Meeting is expected to be held during the second quarter of 2025.

The Amalgamation Agreement has been unanimously approved by the boards of directors of each of ValOre and South Atlantic. The South Atlantic board of directors unanimously recommends that the South Atlantic Shareholders vote in favour of the Proposed Transaction. All officers and directors of South Atlantic have entered into voting support agreements whereby they have agreed to vote all South Atlantic Shares held by them in favour of the Proposed Transaction.

About ValOre Metals Corp.

ValOre Metals Corp. is a Canadian company with a team aiming to deploy capital and knowledge on projects which benefit from substantial prior investment by previous owners, existence of high-value mineralization on a large scale, and the possibility of adding tangible value through exploration and innovation.

ValOre is a proud member of Discovery Group

About South Atlantic Gold Inc.

South Atlantic is an exploration company engaged in acquiring and advancing mineral properties in the Americas.

Additional Information about the Proposed Transaction and Where to Find It

Further details regarding the terms of the Proposed Transaction are set out in the Agreement, which will be publicly filed on ValOre’s and South Atlantic’s respective SEDAR+ profiles at www.sedarplus.ca. Additional information regarding the terms of the Agreement, the background to the Proposed Transaction and how the South Atlantic Shareholders can participate in and vote at the South Atlantic Shareholder Meeting will be provided in the management information circular which will be mailed to the South Atlantic Shareholders and also filed on the South Atlantic’s SEDAR+ profile at www.sedarplus.ca. South Atlantic Shareholders are urged to read these and other relevant materials when they become available.

No Offer or Solicitation

This document does not constitute an offer to sell, or the solicitation of an offer to buy, any securities in any jurisdiction pursuant to or in connection with the Proposed Transaction or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law.

Qualified Person

The technical information in this news release has been prepared in accordance with Canadian regulatory requirements set out in NI 43-101 and reviewed and approved by Thiago Diniz, P.Geo., ValOre’s QP and Vice President of Exploration.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE