Uranium Energy Corp Acquires Portfolio of Canadian Uranium Exploration Projects in Saskatchewan’s Athabasca Basin from Rio Tinto Exploration Canada Inc.

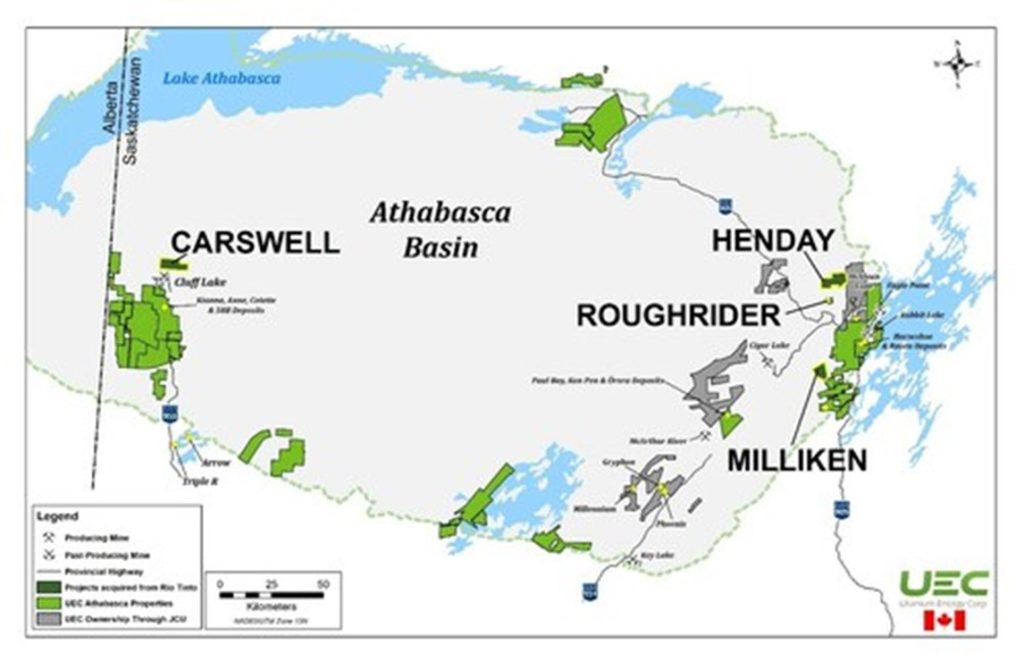

Uranium Energy Corp (NYSE American: UEC) is pleased to announce that the Company has closed a purchase agreement with Rio Tinto Exploration Canada Inc., a subsidiary of Rio Tinto Inc. to acquire a portfolio of exploration-stage projects in the Athabasca Basin, Saskatchewan, Canada for $1,500,000 (CAD). The Company has acquired a 60% equity stake in the Henday Lake joint venture, 100% of the Milliken project, and a 50% equity stake in the Carswell joint venture project. With this Transaction, UEC has added an additional 44,444 acres (17,986 Ha) of prospective ground in the Athabasca Basin (See Figure 1) to its existing portfolio of 1,091,639 acres (441,771 Ha).

Transaction Components

- Henday project is less than five kilometers north of the Roughrider project and close to support infrastructure offering regional synergies with Roughrider (acquired 10/17/22) and the other projects in the Eastern Athabasca Hub that UEC has assembled over the last 12 months as part of the UEX acquisition (completed 8/25/2022).

- Carswell project is located just north of the past-producing Cluff Lake operation and has uranium showings in drill holes, trenches, outcrop, and boulders that are consistent with the mineralization types found at the former Cluff Lake operation. Carswell is in close proximity to Shea Creek where the Company has a 49.075% interest in the Shea Creek deposits (Anne, Kianna, 58B, and Collette).

- Milliken project represents the western extension of UEC’s Hidden Bay project’s Wolf Lake trend that has multiple uranium showings over 19 km.

- The $1,500,000 (CAD) Transaction was fully funded with UEC’s cash on hand. UEC had $125.4 million of cash and liquid assets, no debt, as of the Company’s latest quarterly filing for the period ending April 30, 2023.

Canadian Growth Strategy

In the last 12-months, key milestones achieved in the Company’s Canadian growth strategy include:

- The acquisition of the 100%-owned Roughrider1 from Rio Tinto and completion of a TRS for the project2.

- The commencement of an economic study for Roughrider that includes a modern environmental baseline and updated economic factors for the project.

- The acquisition of UEX1 and its portfolio of 29 uranium projects covering key areas of the producing eastern side and development western side of prolific Athabasca basin.

- Operating joint venture partners on advanced resource stage projects including Shea Creek, Kiggavik, Millennium, and Wheeler River.

- The acquisition of Rio Tinto’s Athabasca Exploration project portfolio includes 60% of Henday, 100% of Milliken, and 50% of Carswell.

- Discovery of a new mineralization zone at Christie Lake with some of the highest grades reported in the basin this year1 including 68.7% eU3O8 over 2.1 meters and 21.6% eU3O8 over 2.3 meters.

- The acquisitions in the past year have increased UEC’s total attributed current resources by 109.9 Mlbs of Indicated resources and 71.0 Mlbs of Inferred resources attributed to the Roughrider, Christie Lake, Horseshoe-Raven, Shea Creek, and Millennium projects. Individual project disclosure is outlined in Table 1 below.

- Assembled an Athabasca land portfolio of 1,136,083 acres (459,757 Ha) for exploration and further growth opportunities.

Amir Adnani, President and CEO of UEC stated: “This is our third acquisition in the Athabasca Basin in the last 12-months and builds on the landmark acquisitions of UEX and the Roughrider project. This acquisition represents an important component in our strategy to assemble a premier North American uranium portfolio, featuring near-term US production, Canadian development-stage projects including joint ventures, and a pipeline of exploration projects with excellent growth potential. Since the acquisitions of Roughrider and UEX last year, the Canadian team has issued technical reports on the Roughrider, Horseshoe-Raven, and the Shea Creek deposits. We have also added James Hatley as Vice President Production, Canada to the team to augment the advancement of our Canadian assets towards production.”

Chris Hamel, Vice President Exploration, Canada stated: “UEC is pleased to add these strategically important projects to our existing Athabasca portfolio. All three projects exhibit the features we seek when acquiring quality exploration assets, including uranium anomalism and hydrothermal alteration. In addition, these projects exhibit excellent prospective geology with minimal to no sandstone cover that will result in lower exploration costs and shorter timelines to discovery. With our operator status and the data already collected on Henday, Carswell, and Milliken, these projects offer strong potential synergies to our existing portfolio in the Athabasca Basin.”

About the Henday Lake Project

The Henday project is 17,801 acres (7,204 Ha) in an area, less than five kilometers north of Roughrider, and like Roughrider is within the prolific Wollaston-Mudjatik transition zone that is host to many of the eastern Athabasca deposits. UEC will acquire 60% of the project and act as the operator of Henday project in a joint venture with Forum Energy Metals, who owns the remaining 40%. The Company’s technical evaluation of the project revealed uranium up to 1,750 ppm associated with altered basement rocks that has yet to be followed up with additional drilling. The project is host to several compelling exploration targets identified by previous operators and the Company’s technical team.

About the Carswell Project

The Carswell project is 16,771 acres (6,787 Ha) and just 1.6 km north of the now mined out Claude Deposit at Cluff Lake. The Carswell project lies within the Carswell Structure, the location of a meteorite impact that has brought the basement rocks and uranium mineralization much closer to the surface than in the surrounding area. Carswell is a project with multiple uranium showings in drill holes, trenches, boulders, and outcrop that together suggest similar controls on the mineralization as seen at the past-producing and now decommissioned Cluff Lake Mine. Some of the mineralization revealed in trenches is described as “radioactive Cluff Breccia veins”3. Exploration in the area dates to 1958, with the nearby Cluff Lake Mine operating from 1981 to 2002 with both underground and open pit mines. UEC will be the operator of the Carswell project and ALX Resources is the other owner with a 50% interest in the project.

About the Milliken Project

Milliken is 9,872 Acres (3,995 Ha) and is located along strike of the Company’s Wolf Lake trend on its Hidden Bay project. Milliken represents a large early-stage project that hosts similar geology to that of the Collins Bay / Rabbit Lake Fault system. The Company has acquired 100% of Milliken and will be the operator.

| 1 – Additional Information available in related news releases on UEC’s website at www.uraniumenergy.com/news and through the Company’s profiles on SEDAR+ and EDGAR. |

| 2 – Technical Report Summaries for each project are available on UEC’s website at www.uraniumenergy.com and by reference in UEC’s 2022 Form 10-K Annual Report filing on EDGAR. |

| 3 – Saskatchewan SMDI 1155, https://applications.saskatchewan.ca/Apps/ECON_Apps/dbsearch/MinDepositQuery/default.aspx?ID=1155 |

|

Table 1 – Canadian Uranium Oxide Mineral Resources

|

|||||||

| Project | Indicated | Inferred | |||||

| Tonnes (‘000’s) |

Grade (% U3O8) |

Pounds U3O8 (‘000’s) |

Tonnes (‘000’s) |

Grade

(% U3O8) |

Pounds U3O8 (‘000’s) |

||

| Roughrider (1) | 389 | 3.25 % | 27,842 | 359 | 4.55 % | 36,043 | |

| Christie Lake (2) | 488 | 1.57 % | 16,836 | ||||

| Horseshoe-Raven (3) | 10,353 | 0.16 % | 37,426 | ||||

| Shea Creek (4) | 1,009 | 1.49 % | 33,176 | 616 | 1.01 % | 13,776 | |

| Millennium (5) | 217 | 2.39 % | 11,423 | 62 | 3.19 % | 4,364 | |

| (1) | Item 1302 of Regulation S-K1300 Technical Resource Summary Report (the “TRS”) prepared in accordance with S-K 1300 and was filed on May 2, 2023 with the Securities and Exchange Commission (“SEC”) through EDGAR on Form 8-K and is also available on SEDAR as a “Material Document” filed on May 2, 2023. The TRS was prepared on behalf of the Company by SRK Consulting (UK) Ltd. |

||||||

| (2) | Christie Lake Project resources as stated in UEC’s 2022 Form 10-K Annual Report filing available on EDGAR. | ||||||

| (3) | Horseshoe-Raven Project, Saskatchewan, effective date October 31, 2022 (https://www.sec.gov/Archives/edgar/data/1334933/000143774923001598/ex_465792.htm | ||||||

| (4) | Shea Creek Project, Saskatchewan, effective date October 31, 2022 (https://www.sec.gov/Archives/edgar/data/1334933/000143774923000881/ex_462410.htm) | ||||||

| (5) | Cameco 2023 Annual Information Form (https://www.sedarplus.ca/csa-party/viewInstance/resource.html?node=W1388&drmKey=0f27ae5cfb1f8b90&drr=ss960cc95c85ab4982f33206be9b4a44bf7179dfa98d640902014d6cdcdde 7744917d7cc3c5b56668387cb45d6d554ee6cux&id=0c11f8b7998bcd96b5c614c17cd6d1a457534ad648cf0291) | ||||||

The technical information in this news release have been reviewed and approved by Chris Hamel, P.GEO., Vice President Exploration, Canada for the Company, being a Qualified Person as defined by Regulation S-K 1300.

About Uranium Energy Corp

Uranium Energy Corp is the fastest growing supplier of fuel for the green energy transition to a low carbon future. UEC is the largest, diversified North American focused uranium company, advancing the next generation of low-cost, environmentally friendly In-Situ Recovery mining uranium projects in the United States and high-grade conventional projects in Canada. The Company has two production-ready ISR hub and spoke platforms in South Texas and Wyoming. These two production platforms are anchored by fully operational central processing plants and served by seven U.S. ISR uranium projects with all their major permits in place. Additionally, the Company has diversified uranium holdings including: (1) one of the largest physical uranium portfolios of U.S. warehoused U3O8; (2) a major equity stake in Uranium Royalty Corp. (NASDAQ: UROY, TSX: URC), the only royalty company in the sector; and (3) a pipeline of resource stage uranium projects. The Company’s operations are managed by professionals with decades of hands-on experience in the key facets of uranium exploration, development and mining.

Figure 1 – UEC’s Athabasca project portfolio with newly acquired projects (CNW Group/Uranium Energy Corp)

MORE or "UNCATEGORIZED"

First Phosphate Receives Conditional Approval for up to $16.7 Million Non-Repayable Contribution from the Government of Canada

First Phosphate Corp. (CSE: PHOS) (OTCQX: FRSPF) (OTCQX ADR: FPHOY) (FSE: KD0) has been cond... READ MORE

Gold X2 Drills 117m of 1.21 g/t Au, Including 10m of 4.37g/t Au; High-Grade Zone Intersected 280m Beneath the Resource Pit Demonstrating Underground Potential at the Moss Gold Deposit

Gold X2 Mining Inc. (TSX-V: AUXX) (OTCQB: GSHRF) (FWB: DF8), is pleased to announce initial drilling... READ MORE

Tectonic Raises Over C$92 Million; Completes Upsized Private Placement With Full Over-Allotment Exercised

Tectonic Metals Inc. (TSX-V: TECT) is pleased to announce the successful closing of the Company’s ... READ MORE

Cerro de Pasco Resources Enters Project Development Funding Agreement with U.S. International Development Finance Corporation for Quiulacocha

Cerro de Pasco Resources Inc. (TSX-V: CDPR) (OTCQB: GPPRF) (BVL: CDPR) announces that it has ... READ MORE

NorthWest Announces Updated Mineral Resource at Kwanika Reflecting Strategic Shift to Higher-Grade Copper-Gold Focus

NorthWest Copper Corp. (TSX-V: NWST) is pleased to announce an updated mineral resource estimate for... READ MORE