Under the Spotlight – Simon Ridgway, CEO Rackla Metals

Rick Mills, Editor/Publisher, Ahead of the Herd:

Simon, I would really like to talk about the results from the BiTe Zone and the Grad Project, its future and what’s next for Rackla Metals.

I was for the drill program, based on the fact that the bismuth carries the gold in these RIRGS [Reduced Intrusive-Related Gold System]; gold is associated with the bismuth. But it seems like the numbers that were reported, maybe the decimal point should have been a point or two to the left.

Simon Ridgway, CEO, Rackla Metals:

Let me touch on that, so basically the bismuth numbers in the BiTe Zone were obviously correct enough for where the gold was. The geological mapping of the core and the amount of bismuth which we were seeing in the core, I agree, the geos overestimated the amount of bismuth in the core and part of that is because we were using the XRF, it showed bismuth. But the bismuth was in with the lead.

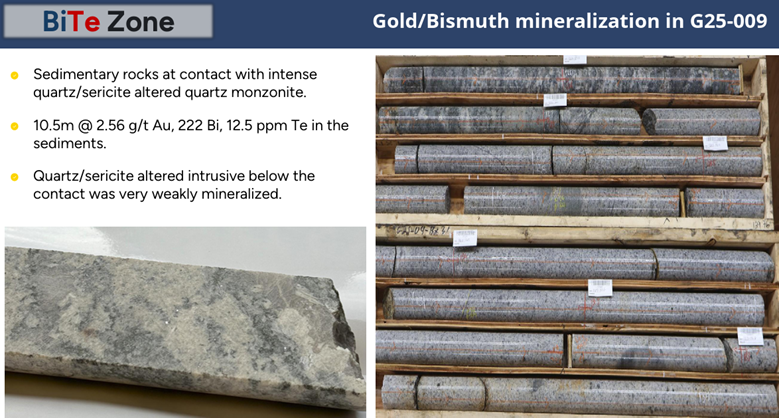

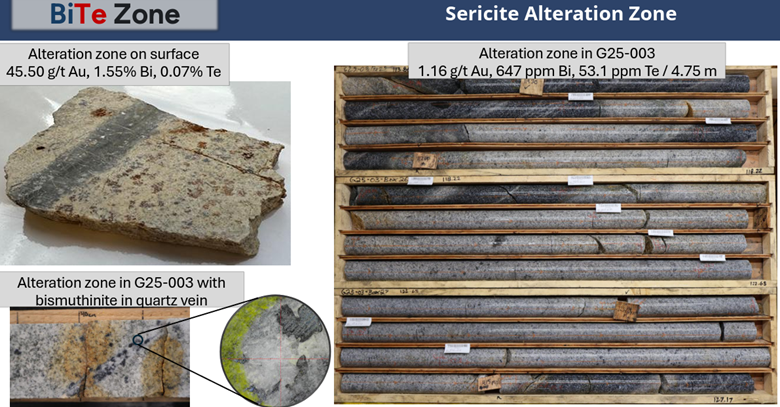

In some of the core, especially in the areas that we have that intense quartz sericite alteration, we had silvery bismuth disseminated in the core — it looked very similar to the high-grade zones we had on the BiTe Zone. It was impossible to think that one of them was going to run 45 grams and the other was going to run 0.08.

I mean the percent of bismuth amount that we were seeing in the core was less, but it certainly wasn’t less to that kind of degree. I’ve got that up on the website now, some pictures where you can see the bismuth in the veins.

You can see the bismuth disseminated in the intrusive where we have that intense quartz sericite alteration. But was the BiTe Zone the less to that degree? No. We get the results and we still are getting 300-400 ppm in the bismuth and that comes in with 0.08 gold in that quartz sericite zone.

So yeah, I think the bismuth was overestimated, the people logging the core, they started out looking at the BiTe zone and then their estimates were wrong, but is there bismuth in the veining? Yes, but the veining is not carrying the gold.

We hit a lot of veining in all of the drill holes. Sheeted veining the same that we see in the BiTe Zone, but it just didn’t carry. We did a lot of surface sampling. We did chip channel something, with saw cuts outside of the BiTe Zone. The geochemistry in that is different, I look at it now and all of the rock sampling and there’s no surface enrichment. We’re chip channeling the granite in the BiTe Zone. So, this is certainly not surface enrichment when we’re getting all those high-grade results.

Two things I noticed so far, now we have all the holes and we can use them to do a lot more work on the background geochemistry, but what I’m seeing myself right up just a simple interpretation of all the numbers you got in the BiTe Zone is that all of the rock samples we took in that zone they have very low aluminum, like it’s less than 1%.

And in all of the drilling and in all of the sampling we did outside of the BiTe Zone, even in the quartz sericite alteration zones the aluminum and the K-feldspar are running up somewhere between 5 and 10%. So, is it a different alteration in that BiTe Zone or is it a different intrusive?

Is it a flat-lying sill that is outcropping there? I think we need to understand that a lot more.

RM: Is Grad still a viable target after all the work, 10 holes drilled and with these results?

SR: Is there a target left at the Grad property? I’m not sure yet.

There were a couple of areas where we’ve seen that same intense alteration up on that west face, it’s a very narrow west face, but I’m having a hard time understanding where we could fit a deposit in.

I think the program that we did was the right approach. We would’ve spent a whole summer sampling, as we did. The mountaineering geos ended up rock sampling the north face and the south face. I’m doing those big, long chip channels in the granite, all of which came in fairly barren, but even if we’d have done that, we still would have had to drill.

RM: I started by saying I thought your approach was right. I think if you hadn’t drilled based on what you thought you knew regarding the bismuth grades, and typical RIRGS models, we’d have drilled next year and basically ended up with the same result but a whole year later.

SR: Everybody I took there whether it be Quinton Hennigh, Michael Gray or Tom Garrigan all have got quite a bit of experience in these systems, they all came away as excited as I was. Excited as my geos were.

So, the Grad Project itself, I don’t see the room there to fit it to a deposit. You’ve got to be mindful we’ve got that whole mountain sitting on top of us, right, that is intensely altered, lots of veining in it, but it’s just not carrying.

RM: Vein density is typically an indication of grade within the RIRGS, but at Grad that was not a determining factor.

SR: Hole 10 was a typical example of that, the intensity of the veining in hole 10, even after we had all the results in, all the way to hole 8, I still believed that hole 9 and hole 10 were going to have good grades. You know, pull some life back into the project again and hole 10 had zero, right? It didn’t have anything over a gram in the whole drill hole of 500 meters.

Within there was an area that went from the sediments into the intrusive. Then it hit another block of sediments. Once you got past that second block of sediments, the veining was very intense. And you had a fair amount of bismuth that we can check with the XRF.

Now when we get the results of that back, it’s a lot less than we expected because I think what we’re seeing there is the XRF is giving us a strong bismuth number but it’s a lead-bismuth compound, it’s got mostly lead. But you hit it with the XRF, and it says 1,000 ppm. You look at that one spot and it says 1,000 ppm bismuth. But when we get the results of the core back it’s not there. We get, you know, 200-300 ppm.

How do we get that intensity of veining in a system like that with bismuth in the veins and it’s still not running better than 0.08 gold? Maybe there’s just not that kind of gold in the system. How we got that in the BiTe Zone and where else that could be I have no idea.

Like I said, playing with the Geochem may answer some questions for us, we may see that it is a small dike or like I said, a sill that’s dipping back into the mountain there. But I know those numbers are repeatable. I took some of those samples myself.

I did the two channels and got 6 grams and 10 grams. But we didn’t do anything like that in the drill core. The one hit we did get that was above a couple of grams was in hole 9 and it was right at the contact. So right at the contact we got 10 meters of 2.5 grams with a couple of 3 grams and an 8-grammer. But then we went right into that quartz sericite alteration zone for the next 50 meters, and it was dead. No gold at all in there. So very confusing.

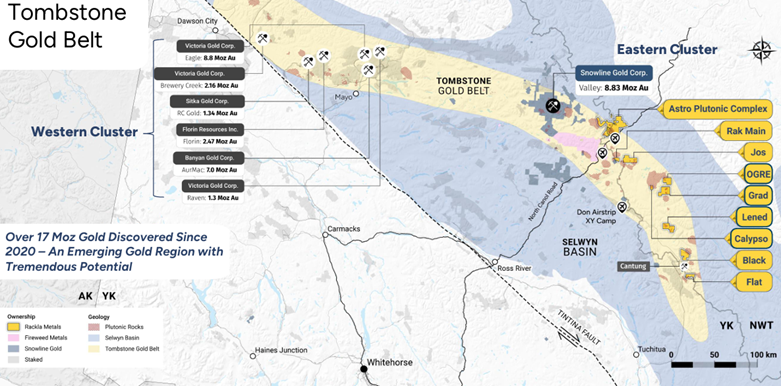

RM: Assay results for specific samples from Snowline Gold’s (TSX:SGD) Valley RIRGS project have shown values for bismuth up to 98.6 ppm.

Do you think this kind of rewrites the model that we’ve all been using on the RIRGS?

SR: I don’t think so. I’ve looked through all the other, whether it be Banyan Gold. I mean Banyan it’s all in the sediments it’s a bit of a different story, but I look at Sitka Gold, their gold is with the veining, right? Where the veining is intense, they’re getting it, but we don’t get anything in the veining.

Is it just a gold-poor system? I guess that’s what a decision on it would have to be. So how do we get that BiTe Zone? I mean look at the talus. Look at the gold we’re getting in the talus. We got 250 meters that’s right under the BiTe Zone, that was averaging a couple of grams, 2.5 grams in the talus. So where did that gold drip from?

RM: If it’s in the talus it would have had to come from above.

SR: Yes, it would have to come from above. We did have channel samples, not just on the top of the ridge where I did the sampling myself, it was arsenic, so there was no bismuth up there. It was sheeted veining with arsenic. We just thought as we come down the mountain it will transfer from the arsenic, which is anemic to the sediments, and we’ll get into the bismuth zone.

We had those mountaineer geos doing big, long-chip channels on the face. No gold. It didn’t get better. I mean there is an area of a couple of meters in the middle that was not sampled because they didn’t get that far down, and we couldn’t get that far up. But could you make a deposit in there? From what I’m seeing, I don’t see jumping back under the ground to drilling it.

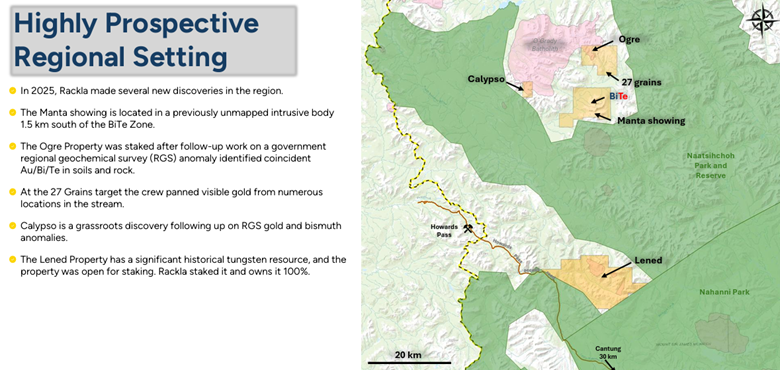

RM: There’s so many other targets you could work but they are pretty much back to basic Greenfields exploration looking for drill targets.

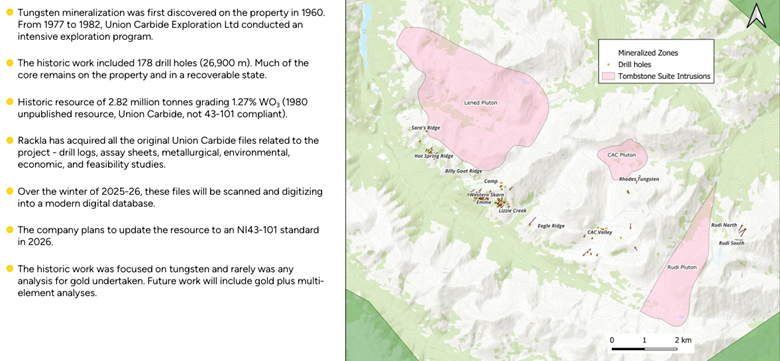

I’ve been doing some research on tungsten; it’s doubled in price over ‘25. China controls 80% of it and I thought ok, we’ve got a non-compliant 43-101 resource on the Lened, it’s 2.82 million tonnes of 1.7% WO3 [tungsten oxide].

I like it, here’s the thing, with Lenard you’re going to hit the ground running.

SR: So, we staked the Lened property, when I was up at the geoscience conference in the Yukon I met with Ron Berdahl, Scott’s (Snowline Gold’s CEO), father, and he had nine boxes of all the data of Union Carbide that did all the work.

So, he’s got all of the drill data, all of the information, so we took those boxes and I’ve sent them out to get the whole thing digitized. While that’s being done, we found more recent reports by Union Carbide. It looks very interesting

There is gold with the Lened system. We’ve got all of the data of all the work that was done. All of the core is still on site, so we staked that, we’ve increased the size of the land position we had because when we went in there to do the staking, we took a lot of some heavy minerals in the creek down from the Lened and we got a lot of some very interesting Geochem results.

So, there’s a lot of work to be done at Lened. That will be certainly be part of our focus in 2026.

I don’t know how much the market will like that right now, but the focus is going to be where I can get out there and get some good work done and start putting some value behind the shares of the company. Not just the share price, but some real value.

RM: The largest, highest-grade tungsten mine in the world is supposedly in the northwestern province of Gangwon, South Korea.

They say it holds one of the largest tungsten, highest-grade resources in the world. Total reserves are 7.9 million tonnes averaging 0.47% WO3. 3.7 million contained metric tons. It’s now owned, since the end of ’24, by Almonty Industries (TSX:AII).

SR: Grad was a great target, it didn’t work out. I’ve never had a miss like that before; it’s just shocking to me. We need to work the Geochem more and just see, so we have a better explanation of what happened.

RM: Tom Brady says a quarterback has to know when the trip is over, meaning instead of keeping scrambling trying to extend the play, sometimes you got to throw the ball out of bounds or drop to the ground.

SR: We’ve just got to make sure that we don’t walk away from something, where somebody puts a couple of holes in it and hits the big one. So, we need to understand what went wrong. Is there still an opportunity there? I’m not seeing it, but we need to keep looking.

RM: Thank you for your time today, Simon.

SR: Thanks for the call.

Subscribe to AOTH’s free newsletter

Richard does own shares of Rackla Metals Inc (TSX-V:RAK). RAK is a paid advertiser on his site aheadoftheherd.com This article is issued on behalf of RAK

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE