Under the Spotlight – Jason Weber CEO, Silver North

Rick Mills, Editor/ Publisher, Ahead of the Herd:

Our readers would like to know a little bit more about you and how you came to be CEO of Silver North (TSX-V:SNAG). Could you give us your background and how you got involved with Silver North?

Jason Weber, President and CEO, Silver North Resources: TSX-V:SNAG

I’m a geologist by training, I did a UBC geology degree and basically started my career doing early-stage exploration in northern BC and the Yukon.

That was largely with consulting groups like Archer Cathro, which is a pretty stalwart group in the Yukon, still operating today. And then Equity Exploration Services. It was known as Equity Engineering back in the day.

I worked for those two groups, sort of cut my teeth in running programs in early-stage exploration. And through the discovery-stage work, I was involved with the discovery of the Wolverine deposit in Yukon in the early ‘90s. It was that discovery that led us at Equity to think, “we generated this idea of the potential for VMS deposits in this part of the Yukon – we should do this for ourselves in a public company.

We had sold the Wolverine idea to a company called Atna Resources and then helped bring in Westmin Resources to partner with them on it. This was done during slow times, one of the ways we’d generate work for ourselves. So, when a discovery was made on a project that had been generated internally within the group, it’s like, “Hm, maybe we should start our own publicly traded company.”

So, we did. We started a company called Rimfire Minerals that I ended up going on as the investor relations guy, went straight from the field to doing IR.

This was the late 1990’s – It was a terrible market. But it turned out that it was a good time to learn. And I rose up through the ranks in Rimfire and ended up becoming the CEO in, I think it was 2007.

So that was the transition from being a field geo to more into the corporate world. And I think one of the things that was appealing for our group at the time was me being technical and doing IR. I could talk to investors. I could talk to potential partner companies. I could speak to the whole spectrum of people who might be interested in what Rimfire was doing. So that helped me cut my teeth and get that training to do what I do now.

Once I was CEO of Rimfire, we merged with another group to form a company called Kiska Metals that was working on the Whistler porphyry gold-copper deposit in Alaska. I bring that up because that was a more advanced-stage project. So, it really brought the early-stage work that I’d normally been doing together with what a more advanced project looks like.

It was fantastic training, doing resource estimates, looking at the early stages of starting a PEA, that sort of thing. So, it was excellent training. And after I left that group in 2013, I ended up bumping into Mark Brown.

We had talked about working together for years. And he said, “I’ve got a company that needs a CEO.” I ended up in Mark’s shop, taking over as CEO for a company called Estrella Gold, which eventually became Silver North Resources. So, kind of a brief history of my career and how I got here.

With my technical background I’m really focused on early-stage exploration, making discoveries. That’s where I’m the most comfortable. I think it’s where the most fun is, taking something that’s a concept or maybe only has a hole or two into it. You’re not quite there yet but you have that opportunity of making that discovery into something that could be a bona fide economic deposit.

For me in our business there’s not much else that can compare to it. So that’s why Silver North is focused on those discovery-stage opportunities, it fits in with what I like to do best.

RM: What did you learn from all of this that helps make you a better CEO and what makes a good junior resource company in your opinion?

JW: Obviously you’re shooting for success, that’s where you’re going to make money. All your shareholders are going to make money. That’s the optimal place to be. But you have to account for the fact that you might fail.

It’s about where are you going to fail along the exploration timeline. You want to fail really early so that you can write something off and say, “You know what, that idea just didn’t make sense.” Or you want it to fail on something that’s beyond the exploration realm.

So, you’re into the engineering, it’s guys that have a totally different expertise than I do. I’m going to go find a deposit that looks like it might be economic and maybe it doesn’t make it because of metallurgy or something else. That’s obviously beyond my control.

But I want to find, I want to understand what I’m looking for. The most common occurrence is when you drill a project or you’re taking samples, you get results that are just kind of middle of the road. You want great results, or you want terrible results. Because if they’re in the middle, the trap that geologists fall into and junior companies fall into is that they chase mediocre results because they still think there’s hope.

“It hasn’t killed my idea completely.” So, I’m going to keep chasing this and you can keep chasing and chasing and throwing good money after bad. Whereas if the results are bad, you walk away.

RM: So, over the years, you’ve come to understand that you have to know when to walk away.

JW: Exactly. We almost approach it from the perspective of we’re going to drill this thing to kill it.

And if it survives that, it’s a good project. Every phase of work, if it survives that round of work, then yeah, let’s continue on.

RM: Can you give us a brief acquisition history and a rundown on each of the projects and where we stand right now? Let’s go with the Veronica and the GDR area first.

JW: We picked those up last year from a little prospecting syndicate, couple of geos and a prospector that Rob Duncan our VP Exploration and I have known forever.

Class guys and they do good work. And they had projects in the Silver Tip area and brought them to us a couple of years ago. And then just with the momentum that was coming around with Coeur working at our Tim project right next door to Veronica, we got a little momentum to do a deal with them.

They’re great, they’re reasonable guys, they understand exploration, they allowed us to structure a deal that if we’re successful on it, they’re going to be successful. So back end weighted deal, success-based payments, that sort of thing.

So, it’s a fantastic scenario for us. And again, this sweet spot of what we like, it had a soil geochem anomaly on it that had never been followed up. Nice silver and lead numbers, but they had never gotten a chance to go back and do any work on it.

A previous partner had optioned it from them but had focused on the other two projects in the GDR package, which is the two off to the north. This stuff never got followed up, so it was perfect opportunity, this is our wheelhouse, we can go in and grab this project, it’s in an area that we know we’re working already, and it can augment our land position there.

RM: Yes, it’s good to see a company picking up more ground in the area they are working. Big boost of confidence for investors.

JW: Yes, the GDR Project is right next to our Tim project, which is under option to Coeur Mining (NYSE:CDE). Coeur is spending $3.5 million and can earn 51% of the project, but then to take it to an 80% interest, they have to fund exploration right through to a positive feasibility study. And the great thing there is that, of course, Coeur’s got their Silver Tip mine 19 kilometers to the south of us.

It’s the same kind of target as what we’re exploring for at Tim. And they’ve been building this new CRD district, doing some great work under the radar. It’s only recently that our community has really started understanding the significance of what they were doing.

So that provided us an opportunity to get involved with Coeur, have their expertise on Tim, applying that knowledge that they’ve gained at their project and working elsewhere in the region, and then hopefully using that to make a discovery at Tim. So, the first drill program there was last year. They didn’t hit high-grade silver but did hit some silver in the right stratigraphic positions, just not the high grades that we’d hope to see.

But we feel that there’s a vectoring component that we can build off of. We know from what they saw that there was a CRD system active at Tim at some point. So that’s really positive that we know that there is potential for that silver-lead-zinc mineralization to be present there as well.

As an aside, just from the little bit of work we’ve done at Veronica, we’re feeling pretty confident that we’re in the right stratigraphic position there as well. And we did find some galena on surface. Galena is the mineral that largely hosts the silver mineralization in this district.

So, we’re just awaiting results on that. Between these two projects, it’s an exciting emerging CRD district that nobody’s really talking about because Coeur controls most of it.

From what we’ve seen we think that Coeur will at least take a look at Veronica now.

RM: These CRDs, they can be such massive systems you have to have a big land package, even if you only have one, you’ve got to make sure you’ve got it all and are protected around the edges. And a lot of times you have to have successive passes with the drill to properly vector into the mineralization you want to see.

JW: Exactly.

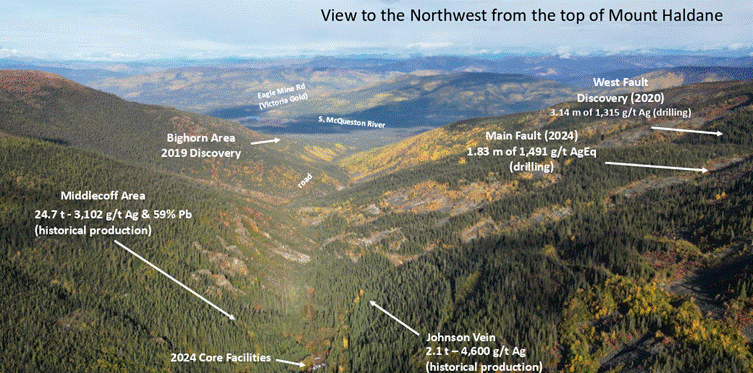

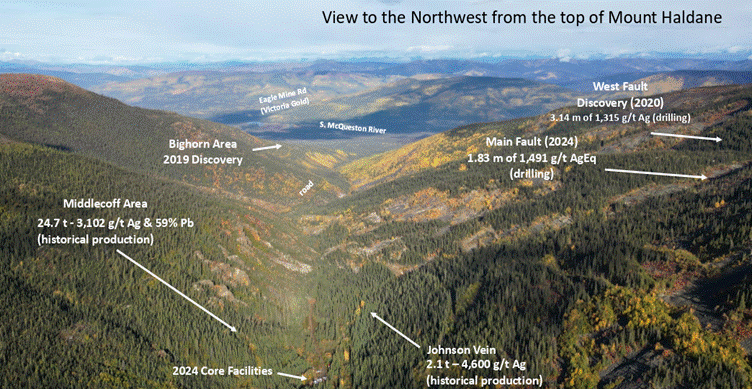

RM: Tell us about the Haldane silver project. It’s got some very interesting facets to it, using the Banyan Gold (TSXV:BYN) camp for access, where you stay and fuel storage. And then you’ve got Hecla Mining (NYSE:HL), the United States’ largest silver miner, next door to you.

From what we’ve seen we think that Coeur will at least take a look at Veronica now.

RM: These CRDs, they can be such massive systems you have to have a big land package, even if you only have one, you’ve got to make sure you’ve got it all and are protected around the edges. And a lot of times you have to have successive passes with the drill to properly vector into the mineralization you want to see.

JW: Exactly.

RM: Tell us about the Haldane silver project. It’s got some very interesting facets to it, using the Banyan Gold (TSX-V:BYN) camp for access, where you stay and fuel storage. And then you’ve got Hecla Mining (NYSE:HL), the United States’ largest silver miner, next door to you.

You’ve got the fact that you’re a pure silver play.

You’ve got the Haldane silver project and that is a pure silver play. There are very few pure silver plays listed on the TSX Venture. So, tell us about your Haldane and what you’re doing up there. You’ve got a program running now, it’s been running for six weeks. Tell us about that.

JW: I’ll take it a step back. We acquired Haldane in 2018. I knew of Haldane because I knew the geologist, Murray Jones, who had run some programs at it in 2011, 2012 and 2013 for another junior explorer.

I remember thinking it was really interesting that they were looking for Keno Hill-style silver-lead-zinc veins.

There hadn’t been really any work done on the property since the 1960s. I was really intrigued by that. And then as we looked into it, we found that Mount Haldane is at the western edge of the Keno Hill District.

The work we’re doing is concentrated in two drainages. If you’re in the Keno Hill District, say you’re standing on one of Hecla’s mines and looked down the valley towards Mt Haldane, it would on the backside of the mountain. And it occurred to me, this is why not much work’s been done here. If you found anything at Haldane in the ‘60s or even back in the 1920s, 1918, when they first discovered mineralization here, it would have been extremely difficult to get it over to Elsa where they would process the ore.

That’d be a 20-25-kilometer haul from there. So, it’d either have to be extremely high-grade ore, or it’s just not going to make sense. The other aspect to it was that the old timers, when they first went in here, they found the mineralization that came to surface right down in the valley bottoms where the creeks had eroded away most of the weathered rock above.

These veins in Keno, you can walk right over them at surface just because of the way they weather, they tend to be softer. We call it recessive. They kind of hide. You have these big, blocky quartzite, which are just basically silica rocks around it that collapse in, and they can hide a vein that might have just weathered away underneath.

Well, at Haldane, we can have 80 meters of weathering above the veins. And this is because at Haldane, the glacier came down the McQuiston River valley through the Keno district and scraped off a lot of that weathered rock on the surface and exposed fresher mineralization.

At Haldane, the glacier kind of split and stopped. And so, you’ve only got a little bit of valley glaciation in the very bottoms of the valley, but anything up on the hillside, like say where we’re drilling now, you haven’t had that glaciation to scrape the rotten rock with. So that made it extremely difficult for the old timers.

They wouldn’t have found any of the mineralization that we’re drilling today because it’s buried under all this overburden, this weathered material that when this stuff weathers, because these aren’t faults, it just goes to a clay mess. We’ll drill into these things and we can look at it and say, “Yeah, that was a Keno vein, but it’s so weathered, it’s basically just clay now and some other oxide minerals that there might be some silver there, there might be a little bit of lead and a little bit of zinc, but it’s mostly gone.” I can’t describe it any other way, but it’s just gone.

RM: It’s great for us, makes Haldane very prospective for discoveries.

JW: Well, we have to hit these things deeper where you start to get some more competency to the vein as far as fresh rock and fresh sulphide. Again, the main host of this silver mineralization is the lead sulphide mineral galena. And so, this all conspired so that the Haldane project, 100 years after mining started in the Keno district, this mineralization is still sitting there and available to make new Keno-style vein discoveries, which we’ve done.

We’ve made three new vein discoveries at the project. We’re on our 20th hole right now. I think our hit rate somewhere in the neighborhood of 75, 80%, that might even be a little bit low, which is phenomenal to get, essentially targets that are 80, 100 meters below surface. And we’re able to hit these things on our first or second hole. So, it’s a really exciting place to be.

RM: You’re either very good, very lucky or both, and there seems to be a lot of mineralized veins still left to find that the OG’s never had a chance to mine.

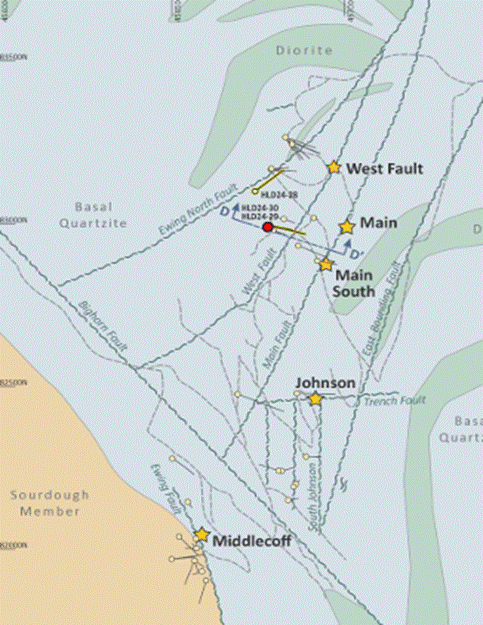

JW: We’ve got our Main Fault discovery that we made last year, the initial first two holes into it. We completed it last year in our three-hole program there. That was really exciting.

We’re spending probably our full budget this year, 2 million bucks will be spent at Main Fault, just drilling that out, seeing what its extents are both down dip and laterally. When we look at something like this, there was probably six holes that tried to test the Main Fault historically. One of them looks like it got through, and they got a little bit of silver mineralization, but it hit too close to surface.

And then the other five holes, they could not get through the overburden and difficult drilling down to the target depth. Fortunately, we were able to do that, and lo and behold we made the Main Fault discovery.

I think it’s a pretty special area where you can walk into a brownfield district where there’s active mining and still make brand-new discoveries somewhat near surface. I think it just speaks to the tenor of the district itself.

And when you roll in, we’re right next door to Banyan Gold’s 7m oz deposit. You’ve got power, you’ve got an airstrip, all that infrastructure is there already and that’s at your disposal.

RM: The Main Zone is your major discovery on the property so far, but you have so much upside discovery potential.

Tell us a little bit about what you like about the rest of the project and interesting areas you’re looking at to potentially add ounces.

JW: We have our West Fault, which looks like it’s a parallel structure to the Main Fault, a few hundred meters laterally from the Main Fault. That’s a target that we’ve got nine holes into it. We’ve got it over a 100-meter by 90-meter area. So that’s another target that we could build out on. So that makes two.

We’ve got Middlecoff, which is one that the old timers actually went underground on in the ‘60s. I think they took out 25 tonnes of ore, out of that that was in the 3,000 grams per tonne silver range, mostly hand cobb. So, it’s probably been selected ore. It’s been upgraded a little bit, but regardless, it’s a target that they were able to go underground on. We’ve done two holes there ourselves. There’s more drilling that can be done there.

Probably one of the most exciting targets for me though is 3 kilometers away we have our Bighorn Vein, which is an area that the old timers never looked at. There was no reason for them to look at it. You don’t see any surface expression of this mineralization.

We found it through soil geochemical surveys, identified a nice high-grade core to the geochem, stepped back, drilled a hole, and we hit Keno-style veins. In fact, four parallel narrow veins that are up to a couple meters wide running 100 to 200 grams silver, which for us was interesting, but we asked ourselves “what does it really mean?”

When we talked to the people at Keno about it, they’re like, yeah, you have to follow that up. That’s a discovery. Fifty meters away you could have ore-grade mineralization. That’s exactly the kind of thing you’ve got to follow up on. So, it was pretty exciting for us to hear, because it’s a little bit of different style mineralization. It’s very quartz rich.

Most of the mineralization we normally drill is dominantly a carbonate vein with some quartz, and the silver-lead-zinc mineralization. Bighorn a lot of quartz with the carbonate and the silver-lead-zinc minerls. As the Keno guys put it, one of their highest-grade mines was actually almost all quartz vein with sulfide style of mineralization.

Just because there’s not much carbonate there, it doesn’t reflect poorly on it at all. That Bighorn target is obviously one we want to get back to, but because it’s 3 km away, it’s not in the core of where we’re working, it’s the one that always gets pushed to the end of the program. We were going to go drill that last year, but because we made the discovery at Main Fault, we decided we’ve got to do another hole there and that didn’t leave room to fit a Bighorn hole in.

And so, Bighorn didn’t get its second hole into it. I’m trying to get our last hole to be at Bighorn this year, but it really just depends on how things go. That’s an example of 3 km away, we’ve got another vein system, but on the ones, we’ve identified, there’s 12 kilometers of cumulative vein strike there.

We’ve tested that vein strike maybe a kilometer, so a lot left to test.

RM: When you start, you have to have some idea of where you want to end up and work towards that goal.

You envision what a mine might look like.

JW: You do and here the topography works for us, we’re up on the hillside, 200 meters up the hill, drilling these holes and hitting mineralization at depth. That mineralization is about the same elevation as the valley floor, like when we come down to where our core shack is, say.

So, what you’re going to be doing is putting in a decline from the valley floor into these prospective ore bodies. They’d lend themselves quite nicely to underground operations. Most of the mines in the Keno district are underground.

There was, in the ‘80s, a push when United Keno Hill Mines was running into financial troubles. They open-pitted the top of a bunch of these deposits. Just trying to, the cheapest way possible, get some silver ore through the mill. So, when you go out there and you see all these little open pits, you say, oh, these are all open pit mines, but most of the mineralization is mined underground. And in fact, Hecla today is making new discoveries, at hundreds of meters depth, 600, 800 meters down.

RM: The average size of a Keno silver mine historically was about 30 million ounces.

How hard would it be to drill off that amount of silver in the average vein width and grade your finding?

JW: We are targeting 25–30-million-ounce deposits, that’s in the back of our minds, that’s what is driving our targeting. When you look at these things, the footprint of them is tiny because they’re so high grade. We’re talking a few hundred meters of strike, a few hundred meters of depth, and a meter to five meters wide.

Sometimes they blow up to 20 meters thick, I don’t know what the average width is, five meters, let’s say. So, we use 3 to 5 meters of 500 grams silver. If we hit that drilling, that’s the kind of thing that would go through the mill at Keno.

As we drill these targets we can, using the metrics above, assess whether an intersection is potentially an ore grade intersection. You put enough of these together and hopefully you can start to wrap your arms around our initial target of 25, 30 million ounces. That’s why we’re keyed in on the Main Zone right now, there’s two showings on surface where the fault actually comes to the surface.

You can sample, albeit low-grade silver mineralization, Keno-style vein mineralization that’s somewhat preserved there, over 300 meters of strike. So, 250-300 meters strike.

With that length, if this zone was 5m wide and it was a couple hundred meters depth, you’re starting to get into the realm of a 30-million-ounce deposit.

RM: The way I look at this, and I’m looking at a picture of the valley now, and I’m just picturing the length of the valley. And on the one side, you’ve got a series of veins in the side of the mountain, maybe three, four, who knows.

And a number of them each has a decline into it. And you’re mining one after another. Is that right? Would it be a series of declines down the valley?

JW: Yeah, that’s essentially it, it’s well documented elsewhere in the Keno district that on the same vein, you can have multiple high-grade chutes. So, if you’ve got enough strike length to work with, you could get one chute and it’ll die out, and then you move along strike on it, and then you can hit another high-grade chute.

And so that’s where that 12 kilometers of cumulative strike length is important to us because we don’t think the Main Fault is going to be ore-grade mineralization along its complete 5 km or whatever we end up defining that fault as. But within that, there’s potential for multiple chutes.

RM: And as you just said, because it’s so high-grade, it doesn’t take a long chute to make up your minimum number of ounces that you need to make it worthwhile going after it.

JW: Exactly.

RM: How important is Banyan’s camp to the area and to you in particular?

JW: Oh, it’s very convenient for us. It allows us to take some of the headaches off the table that running a camp entail. They (Banyan) look after making sure the heat works, the showers have hot water, and the kitchen staff keep the camp personnel fed. I don’t have to think about that. Its worth the fee we pay Banyan for the room and board!

If we can use an existing camp, we’re minimizing our disturbance or footprint. We don’t have to store fuel onsite at Haldane in large volumes because I can do that at Banyan where it’s all set up properly. And then the other part of the equation is we can get fuel up to Banyan’s camp in bulk, which is much cheaper than hauling it by 45-gallon drums up the road to Haldane because we can’t get a bulk tanker up the Haldane Road.

It really does make working up there so much easier to have Banyan and Hecla so close.

RM: I was going to ask you about Hecla, working with the largest silver producer in the US.

They bought out the former operators, and they put that mill and mine back into production. So, you’ve got Hecla working and mining right beside your Haldane, but you’ve also got another mid-tier miner, Coeur, as a partner down on your CRD project, Tim.

Obviously, you’ve got quite a bit of land next to two operating mines by two mid-tier miners. That must be a good feeling having that confidence that your projects are quality and should be considered by investors not to be shrugged off. They’re actually very important partners and neighbours.

JW: Yes, and I think that for an investor, it’s just another check mark, right? It’s hard for an investor to look at all these companies that are out there, exploring all over the world really and to pick the ones that are going to have the best chance.

There’s that old saying, “Your best chance to find a new mine is in the shadow of a head frame.” Well, we’re not exactly in the shadow of a head frame, but we’re in the same rocks, same district and the fact that Coeur’s partnered on one and Hecla’s close to us both geographically and is collaboratively. I think for an investor, that’s a check mark that we’re going about it the right way.

RM: I think so and pure silver plays are hard to find. They’re scarce and you’re concentrating on silver, even down south in the Veronica and the GDR and the Tim project, that’s a silver-heavy project and obviously up north in the Haldane, that’s silver-heavy. So, to me you’re a pure silver play.

JW: Well, at Haldane silver accounts for roughly 80% of the gross value in our intersections. I think you’re probably going to see similar kind of numbers out of what we’ve seen on surface at Tim. It’s probably going to be as silver-dominant.

You can look at some of the other silver explorers out there and the bulk of their “silver equivalent” is actually from secondary metals in the mineralization. In some cases it’s one of the more minor components, could be 25 or 30% and the rest is from the lead-zinc and maybe there’s some low-grade gold there as well. If you’re a silver investor, I think that puts us more top of the heap as far as pure-play silver companies to look at.

RM: It does. Silver North is a silver play.

JW: You’re exactly right.

RM: If you were a retail investor and you’re looking at Silver North, Jason, as the CEO, why don’t you tell us what the investment opportunity is here in Silver North?

JW: Well, I think if you’re familiar with the Lassonde curve, which is Pierre Lassonde came up with a time vs share price graph of the idealized life cycle of a mining company where it shows this company from its initial start up, conducting its early-stage exploration which eventually leads to drilling and a discovery.

Through this process the share price may not appreciate significantly, but upon a discovery that share price can move up rapidly. This continues as the company drills out that discovery, defines its ultimate size, and then it enters into a permitting/ engineering phase, where the share price comes off as the speculation is removed from the market. As the company enters the construction phase, the share price ramps back up again as they start up production and investors see cash flow on the horizon.

But if you look at that curve, the biggest percentage-basis gains are made at discovery. So, for me, that’s where I want to be. That’s where I want our investors to be rewarded, by making a discovery where we can quickly add a tremendous amount of value to a company that essentially has none. If we can make that discovery in a bull market as we are seeing today, the speculation factor combined with strong silver price sentiment can really push the value of the company.

In can result in a huge amount of value that’s added to a company in a very short period of time. That’s where we want to play.

And we believe we can do that at Haldane; we think we can do it at any one of the four targets that we’ve been drilling on. Moving forward, as we start to put together potential ounces, that’s going to add value. And if we’re in a silver bull market, that’s going to add value quickly.

We can do the same thing at Tim, through the drilling conducted by Coeur. And as Veronica comes along, if we define a drill target there, we can do the same thing. And so that’s the upside, that big win, that huge return on investment that our investors can and could see from multiple drilling opportunities.

With where we are trading recently, even near 52-week highs, our market cap is still pretty small, under $25 million. It doesn’t take much to move a small market-cap like ours up quickly.

RM: Good talking to you.

JW: Thanks, Rick.

Richard (Rick) Mills

aheadoftheherd.com

Subscribe to AOTH’s free newsletter

Richard owns shares of Silver North Resource (TSX-V:SNAG). SNAG is a paid advertiser on his site aheadoftheherd.com This article is issued on behalf of SNAG.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE