Under the Spotlight – Dustin Nanos CEO, Golden Goose Resources

Rick Mills, Editor/ Publisher, Ahead of the Herd:

Dustin, please tell us a little bit about your most recent history and how you came to be CEO of a resource company.

Dustin Nanos, CEO, Golden Goose Resources (CSE: GGR):

Okay. Back in 2019, I was doing corporate development for a lithium company. That’s where I met Ken Booth. Who is a director of the company.

We had gone to Chile and Argentina because we were going to spin out some of the lithium company’s assets, but we decided not to go the brine route. We ended up buying a 58,000-hectare land package off of a private Argentinian company and Latin Metals (CSE:LMS). The property had a past producing small tantalum mine and had really good lithium grades. That’s how I first got into the lithium market and became CEO of the Company.

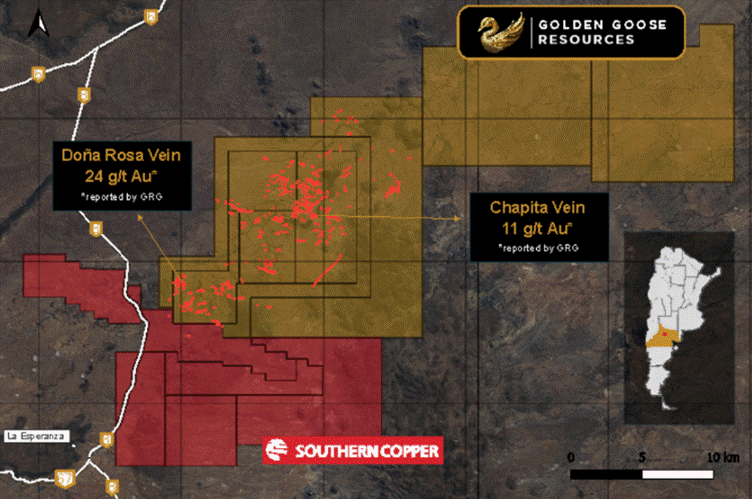

The lithium market has since cooled significantly so through our Argentinian contacts, we decided to look at gold opportunities in that country. From our review we were able to option a high-grade gold property called La Esperanza, which is in Argentina’s Rio Negro province.

That province was just opened up so it’s a new mining district. The property that we picked up has 44,000 hectares with some very good channel samples, 24 grams of gold per tonne over two metres and another vein with 11 grams of gold per tonne.

In addition to our review of gold opportunities in Argentina we looked at Quebec where we have good experience and contacts. We were successful in acquiring what is arguably one of the best strategic land positions in Quebec.

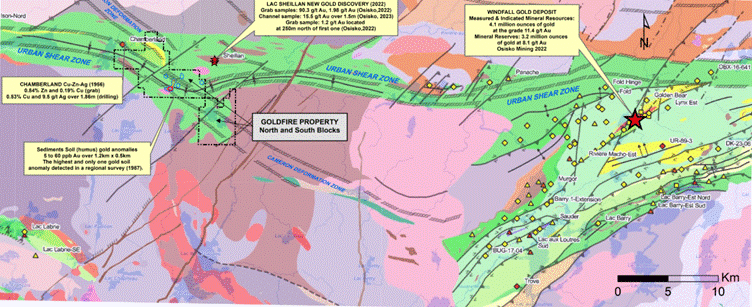

Golden Goose has the right to acquire 100% of the Goldfire property, a large property in the Urban Berry Greenstone Belt in the world class Abitibi Greenstone belt in Quebec. Contiguous to the east of Goldfire is the 4.3-million-ounce Windfall Mine that’s owned by Gold Fields (NYSE:GFI). Contiguous to the west of our claims is a 510,000-gold ounce resource also owned by Goldfields.

We’ve had a crew out there doing a sampling and mapping program. The samples are now at the lab.

RM: Through your experiences, what do you think is the most important part about being a CEO in a junior resource company?

DN: I think number one is transparency to the shareholders and building out a proper project. I’m a true believer in the process, the steps that need to be taken in order to be as successful as possible.

As a CEO, it’s my job to create value for the shareholders and find good assets that we believe that can eventually become mineable economic deposits.

RM: And with us today is Ken Booth, a director. Ken, where do you fit in?

Ken Booth, Director, Golden Goose Resources (CSE: GGR)

I’m a geologist by background and at this point in time, I’m working with Dustin, helping him on the Canadian stuff, our Goldfire Project.

We’ve got a really good team down in Argentina with probably one of the foremost experts on epithermal gold deposits in Argentina. He’s essentially the manager of our Argentinian operation. I leave him alone. He’s, as I said, an expert down there, so I help Dustin with the Canadian exploration.

The geologist for Goldfire that was out in the field for us running our program on Goldfire used to work for Osisko Mining which was taken over by Goldfields, and he worked on the Windfall property which adjacent to our property.

On top of that, we’ve been using a really good firm out of northern Quebec that does our logistics and provides all the equipment we need.

So, as far as the teams go, we’re very well positioned here in Canada and in Argentina.

RM: Your Goldfire Quebec project is situated between Gold Fields’ discoveries and their Windfall Mine. They own an enormous amount of the Urban Barry Greenstone Belt. And of course, that’s in the world-famous Abitibi. How did you manage to get such a coveted property? It’s a great location right on the Urban Berry Deformation Belt.

DN: We picked up the property because of our landman reached out and said, “Hey, would you be interested in this gold project?” So, Ken and I did a deep dive on it and saw who was surrounding us. And we actually tried to pick up 30 more claims at the end of August that were expiring. We got beaten by Gold Fields to extend those claims.

KB: Just a bit of a background of why this ground was sitting there as the donut hole in all of Osiskio’s, now Gold Fields property package.

Why does this donut hole sit there? So, our landman is based out of Val d’Or. He has worked in the industry for years as a prospector, landman, GIS person. He’s 70 years old.

His father was a prospector. He actually was in this area 60, 70 years ago prospecting. The father told a story about finding gold in this area, on this property which of course it wasn’t really a property back then and our landman always remembered it.

He got lucky, held it for probably five years and even managed to do some geophysics. He tapped out his own treasury to do things on his own, mapping, sampling, more geophysics, GIS. Than he began looking for a partner and Dustin was his first call.

The geology is the same as what’s at Windfall. So, great starting point. We’re in the right neighborhood. We think we’re actually even better. We’re on the right street.

As far as structures go, you’re right. what we can tell from the geophysics that’s been done on the property, both government and the property owners’ done, we’ve got a piece of the Urban Berry Deformation Belt.

And we’ve got the all-important cross cutting structures. In the Abitibi, you can’t really have a decent shot at gold mineralization without having the structures to act as a trap for the gold.

So, it’s early days, but we’re actually quite happy with what we’ve seen so far with respect to the deformation and the structure. It’s early, but we’re seeing structure and we’re seeing the right geology.

RM: A low market cap early-stage gold exploration project in the Urban Berry Greenstone Belt, within the world-famous Abitibi region of Quebec.

The right structure and geology. Goldfields and gold in the ground to the west, Goldfields and their 4M oz Windfall mine to the east. Just that alone is sufficient to attract attention.

In this area, you love structure. That’s just a fact.

KB: It is. Whether it’s Red Lake, Timmins, Kirkland Lake, Val d’Or, or this area here, you’re right. In the Abitibi, you need that structure.

Osisko, before they got bought out by Gold Fields, established drill roads and drill pads right up to our boundary. Just inside the claim boundary between our respective properties they had found a grab sample of 92g/t gold on their side, whether that sample had anything to do with the activity we just don’t know that yet.

But again, what it’s pointing to is, yes, we’re early, but we’ve got a lot of smoke here.

RM: What do you have planned for the rest of this year and what are you looking at doing next year on this property?

DN: We’re going to go back out there and do more prospecting at the end of October and then take all that data and do some more geophysics.

KB: I’m always an advocate of not drilling too soon because the best way to harm your company and the project is to drill it before you truly understand it. The program in the first phase was only about seven days on the ground. That was really to get in there, poke around, this next one will be longer.

I think what we’re going to see next year, as soon as we can get back on the ground, as soon as the snow goes is that we’ve got great access because recent logging has opened up the property immensely and then a fire went through there about three or four years ago.

We’ll go back in next year, based on the work this year and prioritize some targets to go have a real hard look at. And we’ll have a couple of areas to drill late summer next year. We’ve got lots of work to do to make sure we understand exactly what’s going on with the structures, but also the geology. So that when we pick those targets, we give ourselves a good shot.

RM: Well, it all comes back to quality of the work you’re going to do. You rush it and the quality’s not there. If you advance a project you want to get to the point where you hand it off to somebody else and those new hands are going to have to be able to look at the quality of work you’ve done and see that you’ve done it right. Or it’s just not going to be the deal that maybe shareholders think we should get.

KB: Yes. That’s why we’ve got a really good geologist who worked on the Gold Fields mine, exploring for Osisko. One, he knows the area really well, and two, he’s also a very good geologist. Very detail-oriented. I think the stuff we’ve seen out of him so far leads us to believe that we’ll get some good work done here.

RM: It is important to get those guys involved if you can, some of them went with Gold Fields. Some of them went with Vior and some found other work, but it’s great that a lot of them are sticking around on the Urban Barry because basically it’s what they know best, and it’s a huge vote of confidence in your property having him agree to work with you guys on it.

KB: That’s right.

RM: Your La Esperanza property is very interesting as well, 10 kilometers of surface gold veins in a brand-new area just recently opened up to mining.

DN: currently with the 10 kilometers of low-sulfidation, epithermal gold veins. We had some highlights of 2 meters at 24 grams, another 5 meters at 13.1 [g/t] channel samples, some high-grade rock chips at 24.4 grams. The property’s 44,000 hectares, all-year-round access, close to a highway, good elevation.

We’re very excited about this because you have the gold grades there already, Southern Copper (NYSE:SCCO) is currently drilling just south of us.

Anything to add to that, Ken.

KB: We can earn 100%. It’s not an expensive deal for us. The terms per year to do the work are great. It’s a good starting point for us.

RM: La Esperanza isn’t a Mexican epithermal.

KB: In general, the epithermal systems in Mexico tend to be more silver-base metal. And that’s just by virtue of where you are in the system. All these epithermal systems are the same, grade the same, the volatiles at the top being your mercury and arsenic. And as you get lower in the system, then you get into gold. Then when you get even lower, that’s when you’re getting into the silver-base metals. And that’s typically what you see in Mexico and Peru. You get these silver veins plus or minus gold and lead-zinc.

These ones we’re chasing are different. These tend to be more gold-rich epithermal systems. I don’t know really of anything in Argentina that’s comparable, expect the granddaddies like Cerro Negro, Cerro Vanguardia.

Those are gold with silver by-product, what we’re going to be working on. These haven’t got down into the depths and maybe they won’t find them, the silver-base metal, silver-lead zinc, which is what you see in Mexico and definitely you see in Peru. Another comparable to La Esperanza mineralization is the one down in Chile, Meridian had it, El Peñon.

It’s one of those projects where you’ve got a lot of targets to go after, but I think with our Argentinian team we will get focused in the right area.

RM: So, Comparable mineralization is Cerro Negro, Cerro Vanguardia in Argentina and El Peñon in Chile. Easy to go to work, easy permitting? Are they familiar in this area with mining?

DN: Yes, that’s why this is exciting, because Rio Negro province just approved its first gold mine.

It’s a new area that’s just turned pro-mining. The guys that we got the property from know the ministers quite well. They’ve already chatted about permitting and what-not.

KB: We’ve got to do our work and while we have lots of targets, when we get ready to drill, we will have picked the right targets.

And that’s where it’ll be a collaboration with us and our Argentinian technical team. But as Dustin said, this is low elevation, we’re not in the high Andes here. We can work this property year-round. Access is good. And as Dustin said, Rio Negro is open for the mining business, which is good. So, permitting to do surface work, not going to be a problem.

And then to get the drill permits is not going to be a problem.

RM: You can work all-year round. A lot of stocks that we have, Canadian stocks, they’re what we consider a northern stock.

Your Urban Barry property is not what I would consider a true northern stock. You can work that through the shoulders of winter. But you have a southern property, that opens up a whole new world for a junior when you consider that news is the lifeblood of any junior.

You can refocus and vector down to your Argentinian project. It opens up a whole new world for a junior in that now you’ve got news flow constantly and consistently through the year, which is probably, I think, one of the most important things that a company can do, generate quality news year-round.

KB: Yes. And in Dustin you have got a guy very good at the investing side of being CEO. He’s good at money raising. These two properties give him the ability to market Golden Goose essentially 12 months a year.

RM: This all leads back to the treasury. Dustin what’s our treasury stand at today?

DN: We’re sitting at $400,000 but we have an open private placement where we’re looking at raising $750,000, it’s a combination of flow-through and hard dollar, hard dollar is at $0.125 with a full two-year warrant at $0.25.

RM: And we’re going to use this money for?

DN: At the end of October, we’re going to head back out to the Goldfire project. Then in November, December we will be on Esperanza to do more mapping and sampling to really find out where the next drill targets are going to be for the drilling campaign next spring.

RM: Ken, is there anything we missed? Anything you want to expand on or cover?

KB: Dustin’s focus is on the Company. He’s put a lot of personal money in.

DN: Drew and I, he’s a cousin, we put in the first million at $0.10 to get this thing going when it was a private company.

And then the rest of the money before this raise was done at $0.30. There was about $2.5 million raised at $0.30. So, the people that are getting in now at $0.125, I think it’s very good value.

KB: We’re not going to see a flood of shares coming out, Dustin’s and Drew’s shares are all escrowed, and they are not seller’s any way’s.

I look at GGR and say, you’ve got two, and yes as you rightly pointed out the Goldfire property is early days, but good location. And the Argentinian one is, I think, a bit of a sleeper.

We’ve got a good team down in Argentina and we’re well taken care of in Quebec, repeatedly, according to the annual Fraser Institute survey of best places to mine in the world, one of the top places to mine anywhere in the world.

And it looks sure like we’ve tagged a good guy in Quebec to be our project geo.

RM: We talked about him, but we didn’t really talk about the guys you’ve got down in Argentina running this property. Could you give us a little bit more background on those guys? I think that’s hugely important, speaking Spanish and having the ability to know the mining laws and know the government and the people in the right places.

KB: I’ve known our Argentinian geologist for a long time.

He’s got his own consulting company that provides us the technical expertise. And so, you’ve got a PhD who specializes in epithermal Argentinian gold-silver deposits.

That’s just what he almost does as a favor to his alumni. He’s really out there in the field, he spots drill holes, he goes out and maps. And then he’s got a team of young geos behind them.

One of the guys that we also have is one of his PhD candidates. Both of these guys are of course fully bilingual. So, when it comes to having these guys on a call, their English is very good.

We think we’ve got a good team down there. We’re not asking a lithium geologist to go spot a gold drill hole. We’re not asking a porphyry copper guy to go map an epithermal system. We’ve got essentially one of the experts in Argentina.

Rick, you said this earlier on the call, it’s so important to have that local management. This is a guy who prides himself on finding things.

RM: So where do you guys see investors right now looking at this? Why would we buy this stock in the market or why would we take down a piece of your private placement?

KB: If you look at every other stock compared to ours, we’re still at a low-value market cap. And that’s just because we rebranded from SALi to Golden Goose (CSE:GGR) and we’re just starting to get the story out.

We have a tight structure. We have out of that 56 million shares, 11.9 million are escrowed. So low market cap, great tight structure.

We have two amazing prospects with the upcoming opening up of Rio Negro, amazing gold grades at surface. And then we have the Goldfire, which is situated between Gold Fields, 4 million ounces to the right of us, 500,000 to the left. We still have a 58,000-hectare land parcel with 10 big targets that have lithium, tantalum and cesium.

The outlook of gold, I believe that’s going to be strong. I also think lithium is due to correct and continue to go up over time. So, with the three properties, I believe that we can create great value for shareholders at the current market price that we’re at.

DN: If we deduct the 11.5 million shares in escrow, our market cap is basically $6 million, $5.5 million of available shares.

Not many people know about Goldfire. And of course, Esperanza, South American properties aren’t like Canadian properties where there’s a lot of eyes focused on the different gold belts within Ontario and Quebec. I think on the risk-reward spectrum, yes, it’s risky, but it’s a new story with two good properties that over the near term you’re going to get lots of good news coming out of this thing.

RM: Thanks, guys. It was a pleasure talking to you today.

DN: Likewise. Thanks for your time.

KB: Thanks Rick.

Subscribe to AOTH’s free newsletter

Richard does not own shares of Golden Goose (CSE: GGR). GGR is a paid advertiser on his site aheadoftheherd.com

This article is issued on behalf of GGR.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE