Under the Spotlight – Bruce Counts, CEO Storm Exploration

Rick Mills, Editor/ Publisher, Ahead of the Herd:

Bruce, why don’t you tell us about gold in banded iron formations.

Bruce Counts, CEO, Storm Exploration:

It is important to understand that gold is not deposited when a banded iron formation is forming. That happens later on, when the iron formation is being deformed by faulting and folding. Gold-rich fluids circulating through the rocks at the time of deformation react with the iron formation causing the precipitation of gold and sulphide minerals like arseno-pyrite.

Iron formations are a very hard and brittle rock. It fractures easily when under the stress of faulting and folding, creating the plumbing through which the gold-rich fluids flow. More fractures in the iron formation means there is more surface area available to react with the fluids, which, in turn means that there will be more gold.

So, that kind of sets up how you get the gold into the iron formation…it is a process generally associated with tectonic deformation.

RM: The folding is important.

BC: Absolutely. The nose of the fold can be particularly important since it is thicker and there tends to be a lot of fracturing. So, more plumbing to for the fluids to exploit and more surface area to react with those gold-bearing fluids.

The nose of the fold is not always going to be rich with gold, but it often can be. It’s one of the first places you would look if you’ve got a folded iron formation.

RM: BIF’s do have several attributes that make them stand out for both the junior that owns one, and a future potential miner.

BC: I can tell you what I like about them as an explorer.

First, they tend to be high-grade so, if you get an area that’s really well-endowed with gold, you can have a lot of ounces. A good example of that would be Back River, owned by B2Gold. That’s around 9 or 10 million ounces, at around 6 grams per tonne. So fantastic grades and lots of ounces.

Second, banded iron formations can extend for kilometers. Thus, there can be several deposits strung out along its length like a string of pearls. For example, there are 6 deposits at the Back River mine that will be accessed from a central facility.

RM: And this is consistent mineralization. It’s not nuggety, spotty or patchy.

BC: That is the third thing I like about banded iron formation hosted gold deposits. The grades tend to be very consistent throughout the deposit. So, from a producer’s perspective, they love them because how many ounces are they going to produce today, tomorrow, next week and next month. They’re very predictable. You don’t wind up with that nuggety effect. That consistency is very comforting, if you will, to a producer, right? So that’s why a junior, I mean, I like them, they’re high grade. You get a lot of ounces, and they tend to be very consistent in their grade.

The Lupin mine, which was located in the Northwest Territories, was 9 grams of gold per ton at surface. And at 3,000 meters, it was still 9 grams per ton. So, very consistent grades.

RM: I’ve always heard that if you have a banded iron formation, you’ve got gold; there’s just no doubt there’s gold in it. It’s just if it’s economic or not, or if you’re going to find it, but if you’ve got a banded iron, you’ve got gold. I’ve heard that frequently.

BC: Any gold in the fluids that interact with the iron formation you’re going to wind up with some gold in the system, so I think there’s probably some truth in that. Obviously, it’s about how much gold was in the fluids when it came through at the end of the day.

RM: The iron seems to play a huge part in it as a reducing agent for the fluids, right?

BC: That’s exactly right. It is the mineral-rich fluids reacting with the iron formation that drops the gold out of solution. Sulphide minerals are often deposited at the same time. So, you’ll get often a very strong correlation, for example, with arsenopyrite and gold. People use arsenopyrite as a pathfinder to finding gold in banded iron formation.

I think the other thing that’s important to note about a banded iron formation is that it tends to be fairly, and this is a generalization, so keep that in mind, but they can be very consistent in terms of your ability to process and get the gold out. It doesn’t require a complicated processing circuit.

It’s fairly straightforward minerology so the metallurgy is simple and you get very good recoveries. Another thing that producers really like, so you’ve got very consistent grades, you’ve got good recoveries, and you’ve got large footprints in terms of the ounces.

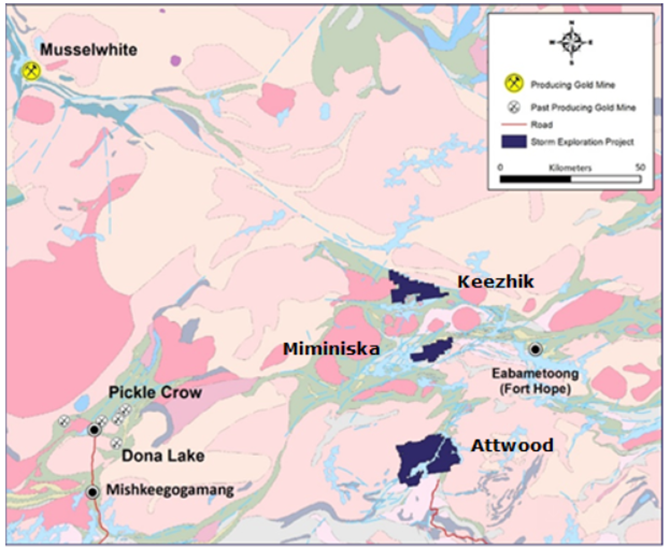

Another great example of a banded iron formation hosted gold deposit recently in the news is Orla Mining, which recently bought the Musselwhite gold mine in northwestern Ontario from Newmont. Orla paid $850 million for the 2 million ounces that was known to be in the ground.

I suspect that there’s a lot more gold there. I don’t know that for a fact but given how much they paid for it and the fact that these things often are very prolific, they may have ideas about where more gold was going to be located within that system.

RM: That seems like quite a confidence buy to me.

BC: Absolutely. You don’t pay that much money for 2 million ounces unless you’re really confident that you can get more out. That would be my opinion.

RM: If you multiply 2 million ounces of gold by, say $4,000, you come up with $8 billion, 10% is $800M. That’s quite a deal.

BC: Absolutely. It looks like a really good trade right now, for sure. The other thing that, as I’m sure you and your readers know, is that high grade, your value of your rock is really high. And so, your profit margins go up dramatically from say something like a bulk tonnage operation where you’re mining 1 or 2 grams, right? Or 1.5 grams.

RM: You just cut a deal with European Electric, you’re selling Miminiska, the project that we were going to work on first. I’d like to know more about the deal and what you like about it.

BC: Broadly, it’s a $5.8 million transaction, that’s the total consideration.

Those payments occur over a nine-month period. So right out of the gate, there’s a $200,000 non-refundable deposit that will be paid as soon as it is approved by the exchange, which we expect will happen any day.

The Exchange is going to set the conditions that are required for the closing of the transaction but, when closing happens, there’ll be an additional $1.8 million in cash.

There is also $1.5 million in European Electric Metals (TSX.V:EVX) stock. That is the company that is acquiring Miminiska. They’re soon to change their name to Canadian Goldfields Discovery Corporation.

They have about 50 million shares outstanding. We’re going to wind up with $1.5 million in stock at their current financing price, which is 20 cents. So, we will get 7.5 million shares of EVX, which is about 8% of the fully financed company.

Three months after the close Storm will get another million dollars in cash. Now we’re up to $3 million in cash that’s been paid.

After making that final payment, Storm will own 100% of Miminiska and Keezhik. Storm will immediately transfer ownership of Miminiska to European Electric Metals and retain the full ownership of Keezhik.

When the transaction closes, Storm will have 20.7 million shares outstanding, 100% ownership of three compelling projects, of which Keezhik arguably is the most advanced. In addition, Storm will have cash in the bank, and significant ownership of European Electric Metals.

RM: And Canadian Goldfields, whose behind that, who are the principals in European Electric and the new company.

BC: They are a well-respected team in the circles of mineral exploration. It’s the same people that put together K92 Mining, which was a very successful gold explorer-turned-producer in Papua New Guinea.

They have a lot of street cred. They’ve got a great technical group to work with and they have excellent access to cash and capital.

The CEO is a gentleman named John Booth, who currently is the chair of the board at Laramide Resources. John is a lawyer by training but has been involved in the mineral exploration business for many years.

On the corporate development side, Bryan Slusarchuk, who was instrumental in putting together K92. I know that their senior technical consultant will be a fellow named Dr. Mick Carew. He’s involved in Great Pacific Gold, which is looking to put a mine into production on New Britain Island. And then I, as I understand it, the largest shareholder in European Electric is a gentleman named Brian Paes Braga.

Brian is a young and very successful entrepreneur who previously worked with Frank Giustra at the Fiore Group. He works independently these days managing a large investment fund. So, a great group without question.

RM: Let’s get into the plans for next year, let’s start with Keezhik and what you plan on doing next year with that project.

BC: Sure. Keezhik’s a big project. It’s a little over 12,000 hectares in size and it is located about 25km north and in the same belt of rocks as Miminiska.

Looking at the big picture at Keezhik, we can see that there’s been a lot of disruption…faulting and folding…in the regional geology which important in the development of a good mineral district. And historical exploration demonstrates that Keezhik is highly prospective.

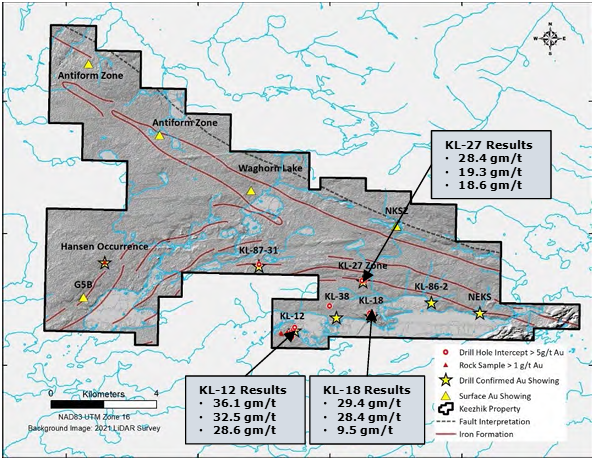

But it is under-explored. There hasn’t had any significant exploration work since the 1980s and what has been done is very limited. There has only been about 14,000 meters of drilling on the whole project but that resulted in eight separate drill-confirmed high-grade gold discoveries.

Just to give you some of the more interesting numbers from a couple of the targets, KL-27 returned 18.9 grams per tonne gold over 1.5 meters, and KL-12, 25.8 returned grams per tonne gold over 1.3 meters.

This belt of rocks is clearly well endowed with gold but there is more work to do to make sure we are focused on the best targets. For example, there are numerous surface gold showings, including in banded iron formation, that have never been followed up.

So, what’s the plan? The goal is to develop targets for a drill program in Q3 of 2026. To accomplish that, we will conduct a two-component exploration program.

We’re going to put people on the ground doing focused exploration on the known targets, like KL-27 and KL-12, with the aim of expanding the footprint. Work will likely include detailed mapping, soil sampling and ground geophysics.

In parallel with the target-focused work Storm will conduct a regional exploration program to evaluate the known gold showings and identify new ones. This entails prospecting, district-scale mapping and soil sampling as well as airborne geophysical surveys.

As I mentioned before, gold can often be associated with sulfides like arsenopyrite. These are conductive minerals so, an air electromagnetic survey, which measures the electrical conductivity of the rocks, can help identify potential targets. It’s not a silver bullet by any stretch, but it’s a really important tool in your toolbox in terms of identifying places to explore on this big property.

Keezhik is a really exciting project, and we’re quite eager to get to work on there. But Q3 is a long way away so we have Gold Standard in the meantime, and we can get to drilling at Gold Standard much more quickly.

RM: I’m looking at Gold Standard right now on your company presentation. It has had historical gold mining, and the mine grades are quite high.

Of course, none of us mind working around where the old guys worked, because they didn’t get everything. And if they were there, there was a reason and it was high grade.

BC: That’s right. And so, this is an interesting story. We acquired Gold Standard because of those old gold mines. They’re down in the southeast part of the property, and they were mined between 1901 and 1903. Their records are old, but what you gather is that they were mining gold at very high grades, above 50 grams per tonne. They went down about 30 meters, and then they would drift maybe 25 meters before losing the gold-bearing quartz vein.

There had been very little follow-up on any of this gold mining that had been done more than 120 years ago. And no drilling. So, that’s what drew us to the area.

We were looking around at what else has been done in this part of the world and saw that there were four holes that had been drilled in 1969 and 1970 by Inco. As I’m sure you and many of your readers know, Inco was a big Canadian base-metal producer back in the day, quite a famous company.

Inco was there for a reason. We didn’t know why they were there, but they drilled four holes. Now, these were drilled using a Winky drill. The core from a Winky is about the size of your thumb. And all the holes were less than 50 meters in length.

It was a very exploratory, small test. But what was interesting was that three of those four holes encountered zinc and copper mineralization. They didn’t assay the holes.

Basically, it’s handwritten notes that have been filed with the government for assessment. They talk about the fact that they see these copper and zinc sulfides in the core, and that’s it. So, we thought, well, look, for a couple of thousand dollars, let’s expand the property out of this gold zone and let’s just capture those holes.

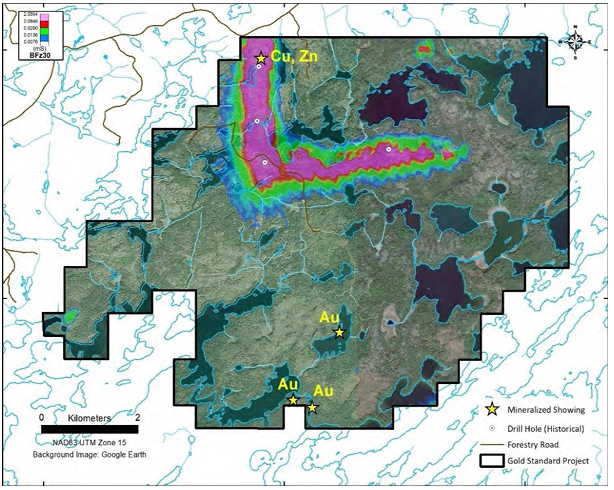

So that’s what we did. And then in 2022, we flew the area with an EM survey. And so, again, that’s measuring the conductivity of the rocks.

The initial purpose of the EM survey was to give us an idea of what was going on with the shear zone that hosts the gold. The primary goal was to extend those gold horizons.

To our surprise there was a very large electromagnetic anomaly that is directly associated with the four holes that Inco drilled. That anomaly quickly became the focus of exploration at Gold Standard.

RM: Okay, so how do you attack a property like this?

BC: Well, the first thing that we did was we just went to where those old gold mines were, and we started taking samples of the rocks right around there. We found grab samples that were very close that ran up to 166 grams per tonne gold.

That was our way of confirming that these are very high-grade gold-bearing rocks. Other than that, there was nothing to really confirm that historical record.

Those airborne systems really help you understand what’s going on with the rocks in terms of the faulting and the folding and the different kinds of lithologies or rock types that you have.

What really jumped out was that big electromagnetic anomaly in the north. It follows a fold in the rocks with one limb that is north-south and the other points to the east-northeast.

That EM anomaly is a big conductivity zone that extends for about 5 kilometers. And its coincident with those old holes from Inco. So, when you look at that from a geological perspective, what we think is it may very well represent a VMS system. So that’s a potential volcanogenic massive sulfide deposit.

They often carry copper and zinc sulfide mineralization, which is what Inco found. Now, Inco probably knew about this EM anomaly, that’s what they were testing, but it was the ‘60s and ‘70s. Technology was a lot different back then.

They may not have known the extent or where to drill properly. We don’t know. There’s no information about why they drilled where they drilled.

So, this anomaly is located along an all-weather on a forestry road. It won’t cost a lot to get out there, do a little bit of prospecting, walk along that EM anomaly and then poke 5 to 10 holes to see what it is. The anomaly is 50 meters across and goes for 5 kilometers. If it is a VMS system with grade, it could be a very important discovery.

We don’t know, it’s still fairly high risk, but we can get to drilling on this very quickly. Again, because there’s road access, it won’t be expensive to drill. Certainly, for under $500,000, you can get in here and drill that five to 10 holes to test this thing.

You want to do a little bit of work ahead of time just to make sure you know where you’re drilling on this 5-kilometer strike length. But that’s easy to do. Before the end of Q2, we should be able to pop a few holes in it.

RM: Storm has agreements with the two First Nations in whose traditional territory Gold Standard is located.

BC: Yes, the Nigigoonsiminikaaning and the Naicatchewenin First Nations.

The Naicatchewenin have been working with Detour Gold, and they have agreements with drill companies. So, they can competitively bid on putting a drill on this project.

Again, access to equipment, to the project, and to getting the work done is fantastic here. So that’s a near-term drill play. If that EM anomaly turns out to be a volcanogenic massive sulfide deposit, and it’s got grade, we’re off to the races with that on its own.

RM: It sure is interesting. It looks like an arm bent at the elbow. VMS are interesting deposits because where you find one VMS pod, you’re going to find another. It almost always comes in bunches.

BC: Yes, that’s right. Mineral exploration has been conducted all around this part of Ontario, but in this specific area, really very little has been done. If this thing turns out to be something that’s of interest, it could lead to a lot more exploration in the area. That’s for certain.

RM: Did you want to talk about Attwood? It’s pretty much a grassroots project.

BC: It is very much grassroots and won’t get an enormous amount of attention. We really want to focus on where we can put drills into the ground because that’s the catalyst that moves the value needle.

But we will do some work at Attwood. Attwood is also very prospective. There’s an all-copper showing from the 1960s on the project, but we acquired the property because there was a report written by a government geologist in 1981 who mapped in the area, and he noted that the banded iron formation included arsenopyrite.

When there is arsenopyrite in banded iron formation there almost always some gold around.

But the other thing is, as a government geologist, he’s mapping regionally. That means that if it’s just a little bit of arsenopyrite in one place, he might make a note of it but it’s not going to really make it into a report. It has to be significant enough to be included in the report that he’s written about the area. So, look, it’s qualitative at the end of the day.

There’s copper around there and there’s banded iron formation with arseno in it. And again, there’s a lot of disruption in the geology at the district scale. The rocks have been folded and faulted which is good for fluid flow and there’s clearly mineralization around.

At 22,000 hectares, Attwood is a massive project but there are just 19 drill holes on the whole property. So, again, an underexplored part of the world.

The other great part about Attwood is that it is right at the terminus of an all-weather road called the Ogoki Forestry Road. It comes within about 5 kilometers of the property. So, our access to this project is fantastic.

For a couple of hundred thousand dollars, we can put some boots on the ground, do a little bit of prospecting and some sampling, and develop targets for 2027.

Again, the focus is going to be on Keezhik and Gold Standard. Those are more advanced, that’s where we can put drills on the ground in 2026. But Attwood is also a really interesting project and deserves a look.

Not a big chunk of our budget, but enough to keep the interest going and figure out where it is we would want to look in the future.

RM: Will we have the money in the treasury to do all three properties, after the deal, as you’ve laid out without having to finance?

BC: I wouldn’t say we have enough to do all three; drilling isn’t cheap. We certainly have enough to do the work at Gold Standard and start the work at Keezhik. I will look to raise some flow-through in the future. But that’s something for later.

There’s certainly enough money that’s coming into the treasury in the short term to cover our needs and move exploration forward. Of course, the best time to be looking for money is when you don’t need money.

The market is more receptive to financing when your back’s not against the wall. And when there’s interest in what you’re doing.

I will be on the road beginning in early 2026 making sure the market understands the value proposition in Storm. We have a $4.5 million market cap, 20.7 million shares outstanding, 100% ownership of three fantastic properties and a significant position in the company acquiring Miminiska.

RM: We can afford to raise a little bit of money on that.

BC: Absolutely. And flow-through, particularly charity flow-through, you get a nice premium on charity flow-through.

We have a lot of shareholders that are based in Europe and the US. They’re very receptive to being the back end of a charity flow-through raise. And charity flow-through doesn’t come back at you in the same way than it can if it’s a regular flow-through fund here in Canada. That’s not to disparage flow-through funds, but charity flow-through just tends to go into longer-term-view hands, if you will.

RM: We’ve got a problem though, one that’s good to have. We’ve got an awful lot of shares of a company that could very well be worth a lot of money down the road. What do you do with those shares?

BC: Let me preface my answer by saying that the shares that we’re getting in European Electric will be held in escrow over a period of 16 months. So, every four months, 25% will be released to us.

I’m not opposed to the idea of dividend; it’s something that we will look at once the shares start to come free trading to us as a company.

You need to be sophisticated in the way that you address that. But obviously we’re not in the business of owning stock. And so, at some point, if there’s a lot of success and the company still holds the shares, we’ll look to sell some of those, but we’ll work with EVX if that’s the case.

RM: I’m a shareholder and I look at it as non-dilutive financing. Personally, I’d like to see us advancing our projects.

We, in my opinion, should be using the money from selling them to advance the company, and its projects, to where we don’t need to do a financing.

BC: I have every confidence that the management of Canadian Goldfields Discovery are going to have great success at Miminiska. And so, there’s a great opportunity for us to participate in that and have the company rewarded and use it as a non-dilutive financing or some combination of the two, right?

Those are all things that will be decided in the future, and they won’t be decided in a vacuum, Rick. Certainly, the board will be very involved. And I always talk to my big shareholders about what their opinion is. At the end of the day, the decision is the board’s and mine, but I like to hear from shareholders. I want to know what they think.

RM: Spending that money on drilling, potential discovery, will pay us back many times more than owning divvied out shares in Electric Metals. The more we can drill on quality projects and go for the discovery, that’s where money’s made.

BC: At the end of the day, that is the business we’re in.

RM: I believe so. That’s why we’re here is to get on a good property and drill it and see what the truth machine tell us because discoveries are the best reward you can get in this business with juniors.

BC: Absolutely, and it’s the end of the business I like the most. The discovery is where you get the big lift in the share price. And it’s obviously very exciting. The risks that go along with early-stage exploration are obviously apparent, but if you make the discovery, the winnings eclipse any losses that might have occurred elsewhere in this space.

RM: Exactly. The team put Miminiska into what sounds like a really great company.

But we’re also chasing the rainbow. We’re looking for discovery.

BC: They’re also operating in the same neck of the woods as us. So, there’s probably synergies in terms of operating together to save money on getting people on the ground and drills on the ground.

RM: What would you like to say in closing? If you’re talking to a shareholder, why do you think they should speculate on Storm and your projects and this management team?

BC: I think there’s a couple of straightforward points. People invest in these ventures ultimately to make money, right? So, what’s the value proposition that we’re bringing to the table? I think there’s a few. A lot of experience in the management and the advisors that we’re working with, we’re a very lean company, so the money that we do have, and raise, will go into the ground.

Storm is planning two drill programs on its own and has a very tight share structure. I mean, 20.7 million shares outstanding at this stage. And a low market cap of $4.5 million. Plus, we’re exposed to the drilling that will be done at Miminiska.

Storm stands out when compared with other early-stage explorers. At a $4.5 million market cap, there is a lot of upside with Storm’s assets and share structure.

RM: We do have a really nice metals market; discoveries are being rewarded as is news advancing good projects. Timing could not be better.

BC: We’ve been quiet for a couple of years while we sorted through our First Nations issues and getting the company’s share structure fixed up and dealing with our treasury. So, it’s been a long time coming. And during that prolonged process, we haven’t been out marketing the company that much.

So not a lot of people know about us. That’s another thing that we’re going to focus on in 2026…getting out there and making sure people understand what we have and what we’re doing.

RM: Just one thing on Keezhik. I noticed it says on your website that the property has the same regional shear zone that hosts Newmont’s 6-million-ounce Musselwhite mine. Could you expand on that a little bit? How close is it to Musselwhite?

BC: When I say regional, I mean big. This is a structure that goes for 150 kilometers, I think Musselwhite’s about 115 kilometers to the northwest along this massive structure. You can see that there’s a big structure that comes along there.

You can see where we’ve drawn in the iron formation and that long structure trends northwest southeast along the northeast edge of the property there.

So, it’s a massive structure and obviously a big terrain change. That just means there’s been a lot of movement.

And again, that’s all about that disruption and moving of rocks and getting fluids flowing into those rocks.

RM: It’s nice to have all that structure.

BC: Yes, absolutely. Again, there’s a lot of gold that’s been found through drilling and through prospecting on this property and really almost no work since the 1980s. It’s wide-open country.

It’s super exciting, I love this stage of exploration where you’re out effectively treasure hunting, right? We’re looking for that big discovery and we’re going to use all the tools in the toolbox to make it happen.

RM: Thank you, Bruce, STRM’s future looks bright.

BC: That’s great, thank you.

Subscribe to AOTH’s free newsletter

Richard does own shares of Storm Exploration Inc. (TSX-V:STRM). STRM is a paid advertiser on his site aheadoftheherd.com This article is issued on behalf of STRM.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

MORE or "UNCATEGORIZED"

First Phosphate Receives Conditional Approval for up to $16.7 Million Non-Repayable Contribution from the Government of Canada

First Phosphate Corp. (CSE: PHOS) (OTCQX: FRSPF) (OTCQX ADR: FPHOY) (FSE: KD0) has been cond... READ MORE

Gold X2 Drills 117m of 1.21 g/t Au, Including 10m of 4.37g/t Au; High-Grade Zone Intersected 280m Beneath the Resource Pit Demonstrating Underground Potential at the Moss Gold Deposit

Gold X2 Mining Inc. (TSX-V: AUXX) (OTCQB: GSHRF) (FWB: DF8), is pleased to announce initial drilling... READ MORE

Tectonic Raises Over C$92 Million; Completes Upsized Private Placement With Full Over-Allotment Exercised

Tectonic Metals Inc. (TSX-V: TECT) is pleased to announce the successful closing of the Company’s ... READ MORE

Cerro de Pasco Resources Enters Project Development Funding Agreement with U.S. International Development Finance Corporation for Quiulacocha

Cerro de Pasco Resources Inc. (TSX-V: CDPR) (OTCQB: GPPRF) (BVL: CDPR) announces that it has ... READ MORE

NorthWest Announces Updated Mineral Resource at Kwanika Reflecting Strategic Shift to Higher-Grade Copper-Gold Focus

NorthWest Copper Corp. (TSX-V: NWST) is pleased to announce an updated mineral resource estimate for... READ MORE