U.S.-Based Energy Fuels Poised to Produce Six of the Seven Rare Earth Oxides Now Subject to Chinese Export Controls at Scale

Energy Fuels has successfully developed the technical ability it believes is required to commercially produce samarium, gadolinium, dysprosium, terbium, lutetium, yttrium, and other oxides, at scale through expansion of its existing REE production capability in Utah, at the same time President Trump commences Section 232 investigation on imports of processed critical minerals, including the rare earth, uranium, and vanadium oxides produced by Energy Fuels.

Energy Fuels Inc. (NYSE American: UUUU) (TSX: EFR) a leading U.S. producer of uranium, rare earth elements and other critical minerals, today announced that it has successfully developed the technology it believes is required to produce six (6) of the seven (7) rare earth oxides, at scale, that are now subject to newly enacted Chinese export controls, amid increasing trade tensions between the U.S. and China. Energy Fuels’ White Mesa Mill in Utah currently has the commercial capacity to process monazite ore concentrates into separated neodymium-praseodymium (“NdPr“) oxide. Through its ongoing testwork at the White Mesa Mill, the Company believes it now has the technical knowhow to design, construct, and commission the expansion of its existing infrastructure to produce these six (6) rare earth oxides1 from monazite relatively quickly with appropriate U.S. government support and/or market conditions.

| 1 Monazite does not have significant quantities of scandium (Sc), which is another metal subject to Chinese export controls that is often considered a “rare earth.” Therefore, due to a lack of Sc in monazite, Energy Fuels has not advanced its ability to produce Sc oxide at this time. | ||

In a related development, on April 15, 2025, President Trump signed an Executive Order, entitled Ensuring National Security and Economic Resilience Through Section 232 Actions on Processed Critical Minerals and Derivative Products, directing Commerce Secretary Howard Lutnick to initiate an investigation under Section 232 of the Trade Expansion act of 1962 to evaluate the effects on national security of imports of processed critical minerals and their derivative products, including the import of the same rare earth, uranium and vanadium oxides that are produced by Energy Fuels in the U.S. The Company believes this action by the President has the strong potential to strengthen domestic supply chains for critical minerals and enable increased domestic production with well-designed trade remedies and price support.

Mark S. Chalmers, President and CEO of Energy Fuels stated: “Energy Fuels is uniquely positioned to quickly help fill many of the gaps President Trump identifies in his Critical Mineral Executive Order. We have a long history of producing uranium and vanadium oxides at our White Mesa Mill in Utah, and last year we successfully launched commercial rare earth processing capacity at the Mill, showing the world that our technology and infrastructure works at scale. We now have the data, knowledge and much of the infrastructure in place to produce ‘light’, ‘mid’ and ‘heavy’ rare earth oxides at scale at the White Mesa Mill. We encourage the U.S. government to showcase its commitment to American rare earth manufacturing with focused support to proven companies like Energy Fuels that have made significant investments in the critical mineral space and demonstrated their ability to commercially produce the critical minerals our country needs.”

Since 2020, Energy Fuels has developed “light”, “mid”, and “heavy” REE production capabilities at its White Mesa Mill in Utah, in addition to maintaining its uranium and vanadium production capacity. Therefore, Energy Fuels believes it is one of the only U.S. companies capable of delivering on President Trump’s executive order in the relative short-term on these critical elements.

Since Energy Fuels began performing lab- and pilot-scale REE separations in 2021 and commissioned commercial-scale NdPr separation in 2024 (up to 1,000 tonnes per year NdPr capacity), the Company has developed significant real-time data, experience, and knowhow applicable to separating REE oxides, including the “mid” and “heavy” oxides subject to the Chinese export controls. Based on this work, Energy Fuels believes it is now technically capable of designing, constructing, and operating the solvent extraction (“SX“) circuits, and performing all of the hydrometallurgical steps, necessary to perform the REE separations to applicable specifications, at scale, at the White Mesa Mill in Utah, including the production of samarium (“Sm“), gadolinium (“Gd“), dysprosium (“Dy“), terbium (“Tb“), lutetium (“Lu“) and yttrium (“Y“) oxides, within as early as a twelve-month period, given appropriate government support.

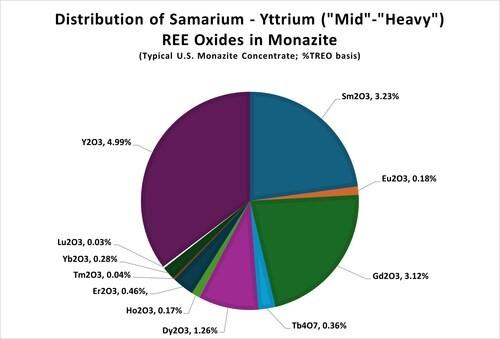

Energy Fuels focuses on “monazite,” which is a mineral the Company believes has a superior REE content and other benefits. First, monazite has excellent distributions of “light”, “mid” and “heavy” REE oxides versus other REE minerals. Monazite also has advantages over other REE minerals, as it is currently produced as a low-cost byproduct of heavy mineral sands mines located in the U.S. and allied nations. In addition, typical monazite concentrates from HMS mines can be very high-grade with ~55% total REE oxides including 14% concentrations of the “heavy” (Sm+) REE oxides (on a %TREO basis). Since 2021, Energy Fuels has purchased monazite concentrates from HMS mines owned by The Chemours Company in Florida and Georgia. During 2023 and 2024, Energy Fuels secured its own low-cost, future supply of monazite by acquiring three (3) large-scale HMS mines in the Southern Hemisphere that the Company believes are capable of supplying large quantities of monazite concentrates to the White Mesa Mill for processing into REE oxides for decades. Additional monazite concentrates are potentially available from mines in allied nations.

Energy Fuels has the current commercial capacity to process up to 10,000 tonnes of monazite concentrate and produce up to 1,000 tonnes of NdPr oxide per year, along with a “heavy”, Sm+ concentrate, at the White Mesa Mill in Utah. Energy Fuels expects to increase its capacity to be able to process 60,000 tonnes of monazite per year in the coming years. The Company is in the process of updating its 2024 prefeasibility study (“PFS“) to a feasibility study (“FS“) on the planned expansion of REE processing at the White Mesa Mill. The table below shows the estimated quantities of REE oxides Energy Fuels could produce under the 10,000 tonne and 60,000 tonne per year monazite scenarios:

|

Estimated REE Oxide Production Capability

(Tonnes per annum upon receipt of typical monazite concentrates at below quantities) |

||

| Rare Earth Oxide | Current Monazite Processing Capacity (10,000 tpa) |

Future Monazite Processing Capacity (60,000 tpa) |

| Lanthanum (La2O3) | 905 | 5,427 |

| Cerium (CeO2) | 1,933 | 11,599 |

| Praseodymium (Pr6O11) | 222 | 1,334 |

| Neodymium (Nd2O3) | 826 | 4,957 |

| Samarium (Sm2O3) | 138 | 829 |

| Europium (Eu2O3) | 8 | 46 |

| Gadolinium (Gd2O3) | 134 | 801 |

| Terbium (Tb4O7) | 14 | 81 |

| Dysprosium (Dy2O3) | 48 | 286 |

| Holmium (Ho2O3) | 5 | 32 |

| Erbium (Er2O3) | 14 | 83 |

| Thulium (Tm2O3) | 1 | 7 |

| Ytterbium (Yb2O3) | 8 | 50 |

| Lutetium (Lu2O3) | 1 | 6 |

| Yttrium (Y2O3) | 126 | 753 |

While the Company has secured what it believes to be world-class HMS projects that will be able to supply monazite to the White Mesa Mill for decades, those properties are in various stages of exploration, permitting and development, with production expected in the 2028 time frame, subject to the receipt of all permits, government approvals, financing and development. There can be no assurance that these properties will ultimately be put into production. At this time, processing at the White Mesa Mill prior to 2028 will require purchases of monazite from third parties, which cannot be guaranteed.

About Energy Fuels

Energy Fuels is a leading US-based critical minerals company, focused on uranium, rare earth elements, heavy mineral sands, vanadium and medical isotopes. Energy Fuels, which owns and operates several conventional and in-situ recovery uranium projects in the western United States, has been the leading U.S. producer of natural uranium concentrate for the past several years, which is sold to nuclear utilities that process it further for the production of carbon-free nuclear energy. Energy Fuels also owns the White Mesa Mill in Utah, which is the only fully licensed and operating conventional uranium processing facility in the United States. At the Mill, Energy Fuels also produces advanced rare earth element products, vanadium oxide (when market conditions warrant), and is evaluating the potential recovery of certain medical isotopes from existing uranium process streams needed for emerging Targeted Alpha Therapy cancer treatments. Energy Fuels is also developing three (3) additional heavy mineral sands projects: the Toliara Project in Madagascar; the Bahia Project in Brazil; and the Donald Project in Australia in which Energy Fuels has the right to earn up to a 49% interest in a joint venture with Astron Corporation Limited. Energy Fuels is based in Lakewood, Colorado, near Denver, with its heavy mineral sands operations managed from Perth, Australia. The primary trading market for Energy Fuels’ common shares is the NYSE American under the trading symbol “UUUU,” and its common shares are also listed on the Toronto Stock Exchange under the trading symbol “EFR.” For more information on all Energy Fuels does, please visit http://www.energyfuels.com

Existing commercial-scale solvent extraction (“SX”) circuit and other REE infrastructure at the White Mesa Mill (Utah). (CNW Group/Energy Fuels Inc.)

One (1) tonne ‘supersacks’ of finished NdPr oxide produced at Energy Fuels’ White Mesa Mill in Utah. (CNW Group/Energy Fuels Inc.)

(CNW Group/Energy Fuels Inc.)

MORE or "UNCATEGORIZED"

Critical Metals Corp. Proudly Announces the Highest Re-Assay TREO Results From Inception From (33) Drill Holes Results

Also Indicates Massive Geological Upside at the Hill Deposit at F... READ MORE

GoldHaven Confirms Gold Mineralization in Bedrock at Copeçal West Target, Including 39m of Mineralization in First-Ever Drilling

GoldHaven Resources Corp. is pleased to report results from four ... READ MORE

Erdene Expands Mineralization at Zuun Mod Molybedenum-Copper Project

Highlights: Drilling from surface to 150 metres depth returned mu... READ MORE

Supreme Critical Metals Announces Closing Of Second and Final Tranche Of LIFE Offering

Supreme Critical Metals Inc., (CSE: CRIT) (FWB: VR6) is pleased t... READ MORE

Osisko Development Provides Infill Drilling Update on Its 13,000-Meter Lowhee Program at Cariboo Gold Project; Intercepts Include 596.40 g/t Gold Over 2.0 Meters from 6.1 Meters Downhole, Including 2,293.56 g/t Gold Over 0.5 Meters from 6.6 Meters Downhole

HIGHLIGHTS 11,025 m of infill drilling completed (5,043 m new res... READ MORE