Triple Flag to Acquire Orogen Royalties and Its 1.0% NSR Royalty on the Expanded Silicon Gold Project

Triple Flag Precious Metals Corp. (TSX: TFPM) (NYSE: TFPM) and Orogen Royalties Inc. (TSX-V: OGN) (OTCQX: OGNRF) announce that they have entered into a definitive agreement on April 21, 2025, in which Triple Flag will acquire all of the issued and outstanding common shares of Orogen pursuant to a plan of arrangement for total consideration of approximately C$421 million, or C$2.00 per share. The total consideration consists of approximately C$171.5 million in cash, approximately C$171.5 million in Triple Flag shares, and shares of a new company with an implied value of approximately C$78 million. Orogen Spinco will be led by Paddy Nicol, CEO of Orogen, and will hold all of Orogen’s mineral interests except for the 1.0% Expanded Silicon NSR royalty. Upon Orogen Spinco going public, Triple Flag has agreed to separately invest C$10 million to obtain an approximate 11% interest in Orogen Spinco.

“I am extremely pleased to announce this friendly transaction with Orogen, which will result in Triple Flag’s acquisition of a 1.0% NSR royalty on the Expanded Silicon project. This is a rare opportunity to acquire a gold asset located in a premier jurisdiction and operated by a top-tier operator, AngloGold Ashanti plc. Nevada is a prolific gold mining region and host to many of the world’s most successful producers. Given the rapid pace of resource growth demonstrated at Expanded Silicon, we believe that the long-term growth potential of this asset in an emerging new gold camp is unparalleled. This royalty is a great illustration of the value creation inherent in the royalty model, as we will benefit from future exploration expenditures and success, as well as the future capital expenditures to develop the project, at no further cost to Triple Flag,” said Sheldon Vanderkooy, CEO of Triple Flag. “We are also excited for our new strategic partnership with the Orogen Spinco team, led by Paddy Nicol. Orogen Spinco provides exposure to a portfolio of exploration-stage royalties as well as compelling upside potential from a management team that has an established track record of discovering district-scale assets from grassroots exploration, including Expanded Silicon.”

Paddy Nicol, President and CEO of Orogen said, “Today’s announcement validates the tremendous growth in value that our royalty on the Expanded Silicon project has provided our shareholders, and crystallizing that value is an important part of Orogen’s business strategy. We strongly believe in the long-term growth potential for Expanded Silicon, and Triple Flag is exactly the right home for such a royalty asset.

“Orogen will be spun-out as a new company and will continue its pursuit of organic royalty creation and royalty acquisition with the stability of the cash-flowing Ermitaño royalty, our treasury, our portfolio of exciting exploration-stage royalties, and various discovery opportunities through its exploration partnerships and alliances. We are also pleased to count Triple Flag as a new strategic investor and alliance partner and look forward to creating opportunities in western USA analogous to Expanded Silicon. Importantly, Orogen’s team that organically created the Ermitaño and Expanded Silicon royalties stays intact, as does our intent to develop new royalty opportunities with strong leverage to value creation.”

Terms of the Agreement

Pursuant to the Transaction, Orogen shareholders may elect to receive either C$1.63 in cash or 0.05355 of a Triple Flag share per each Orogen share held, and will also receive 0.25 shares in the newly created Orogen Spinco, representing approximately C$0.37 per each Orogen share. This represents a total consideration of C$2.00 per Orogen common share on a fully diluted basis, calculated using the closing price of Triple Flag shares on April 17, 2025 of C$30.44. The total consideration paid by Triple Flag (excluding the value of Orogen Spinco) is approximately C$343 million.

The shareholder election will be subject to pro-ration such that the cash and share portions of the consideration will represent 50% and 50% of the total consideration (excluding the value of Orogen Spinco), respectively. Orogen shareholders who do not elect to receive either Triple Flag shares or cash will be deemed to elect a default consideration of 0.05355 of a Triple Flag share per Orogen share, in addition to 0.25 shares in Orogen Spinco per Orogen share.

The total value of the transaction is approximately C$421 million, or C$2.00 per common share of Orogen on a fully diluted basis. Following the completion of the transaction, Orogen shareholders will own approximately 3% of Triple Flag. Triple Flag will finance the cash consideration from its existing undrawn $700 million credit facility.

The total consideration, including the implied value of Orogen Spinco, implies a premium of 38% based on the closing share prices of Triple Flag and Orogen on the Toronto Stock Exchange and TSX Venture Exchange, respectively, on April 17, 2025, and a premium of 32% based on the 20-day volume-weighted average share prices of Triple Flag and Orogen on the TSX and TSX.V as of April 17, 2025, respectively.

Strategic Rationale for Triple Flag

The Transaction will provide Triple Flag with exposure to one of the world’s most promising gold development assets and adds meaningful gold equivalent ounces to Triple Flag’s growth outlook beyond 2029. Key highlights include:

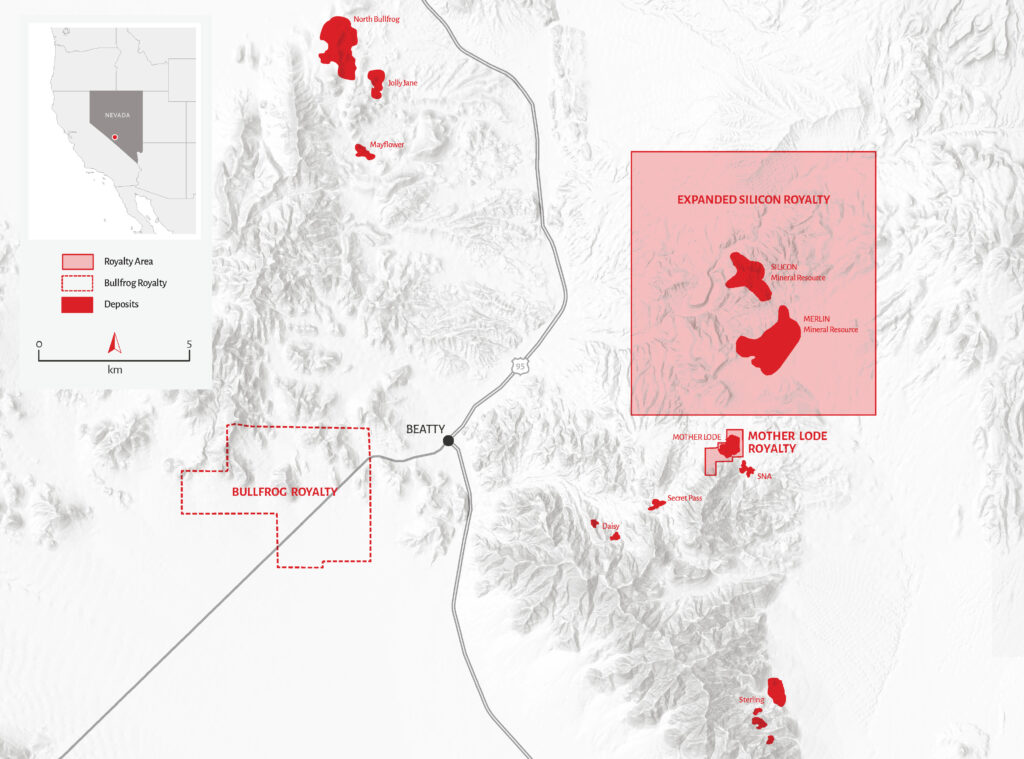

- A life-of-mine royalty on a Tier 1 gold asset in Nevada. The 1.0% NSR royalty on the Expanded Silicon gold project, which includes the cornerstone Merlin and Silicon deposits, is located in the Beatty District of Nevada and covers a 74 km2 area of interest. There are no caps, step-downs, or buydown provisions on the royalty. Nevada hosts some of the most prolific gold operations in the world, including Carlin and Cortez, operated by Nevada Gold Mines LLC, a joint venture between Barrick Gold Corporation and Newmont Corporation.

- North America’s largest new gold discovery with a track record of rapid growth. As stated by AngloGold Ashanti plc (“AngloGold”), the Expanded Silicon project represents the largest new gold discovery by resource in the United States in over a decade.

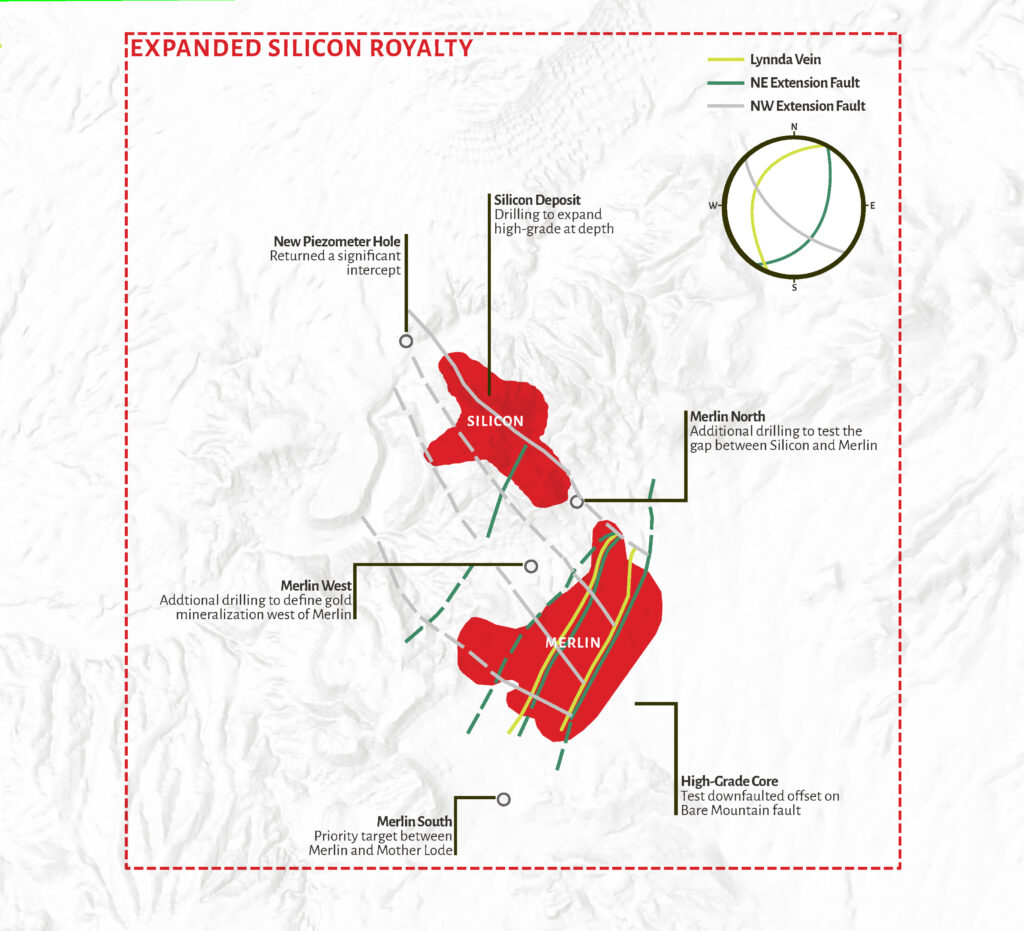

The asset has grown rapidly since AngloGold began drilling the target in 2018. A maiden inferred resource at Silicon of 120 million tonnes grading 0.87 g/t Au containing 3.4 million ounces was declared as of December 31, 2021i. Subsequent resource updates included the nearby Merlin deposit. As of December 31, 2024, inferred resources at Merlin totaled 355 million tonnes grading 1.06 g/t Au containing 12.1 million ouncesii. Resources at Silicon totaled 121 million tonnes grading 0.87 g/t Au containing 3.4 million ounces in the indicated category, and 36 million tonnes grading 0.70 g/t Au containing 0.8 million ounces in the inferred categoryii.

To date, 430 kilometers have been drilled at Expanded Silicon, including 132 kilometers at Merlin in 2024.

- A Tier 1 operator focused on delivering a pre-feasibility study in the near term. The Expanded Silicon project is 100% owned by AngloGold and is currently envisioned as a large oxide deposit with potential processing from heap leaching and milling. The processing of a high-grade core at Merlin is expected to drive stronger production earlier in the mine life.

AngloGold is a senior gold producer that is well capitalized and has the operating expertise to explore, permit, develop and operate Expanded Silicon. The Beatty District complex of assets represents a core tenet of AngloGold’s future, with the operator recently moving its corporate headquarters from Johannesburg to Denver and establishing a new primary share listing on the NYSE.

AngloGold’s stated key priorities for 2025 at Expanded Silicon are to advance a pre-feasibility study, continue infill drilling at Merlin to potentially upgrade resources to reserves, and execute strategic land and water acquisitions.

- Significant exploration potential. Drill rigs remain active on the property, focusing on infill and resource upgrade drilling. Notably, ongoing reporting by AngloGold has highlighted several significant intercepts in widely spaced drill holes located within the western part of the current conceptual pit that forms part of the Merlin mineralization, but such drilling may not yet be included in currently published resource estimates due to insufficient drill density. Additionally, there remains significant potential to extend mineralization in areas with limited to no drilling, including extensions to the north, west and east of Merlin, as well as to the northwest of Silicon. Notably, AngloGold has indicated the potential discovery of a downfaulted offset to Merlin to the southeast of the currently defined mineralized footprint.

With significant value already derived from the current and potential oxide footprint, longer-term potential exists from underground exploration. Mineralization remains open in multiple directions, with significant potential for deep, high-grade feeder structures within the sulphide zones.

- Enhances Triple Flag’s exposure to AngloGold’s complex of assets in the Beatty District. Triple Flag also owns a 2.0% NSR royalty on Mother Lode, which represents the third largest endowment of the currently defined total resources in the Beatty District owned by AngloGold, after Expanded Silicon and North Bullfrog. As of December 31, 2024, measured and indicated resources at Mother Lode totaled 60 million tonnes at a grade of 0.80 g/t Au containing 1.6 million ounces, and inferred resources totaled 10 million tonnes at a grade of 0.55 g/t Au containing 0.2 million ouncesii.

The drill testing of extensions to the south of Merlin would assess the potential for mineralization between Merlin and Mother Lode.

Separately, Triple Flag has a 0.5% to 5.5% NSR royalty on the Bullfrog project located six kilometers west of Beatty and operated by Augusta Gold Corp. As of December 31, 2021, measured and indicated resources at Bullfrog totaled 71 million tonnes at a grade of 0.53 g/t Au containing 1.2 million ouncesiii. Inferred resources totaled 17 million tonnes at a grade of 0.48 g/t Au containing 0.3 million ouncesiii. Bullfrog is currently envisioned as a heap leach operation and a pre-feasibility study is being advanced.

Benefits to Orogen Shareholders

This Transaction allows Orogen shareholders to crystallize the significant value that has been created through the Expanded Silicon 1.0% NSR royalty. This Transaction also allows Orogen shareholders to retain exposure through Orogen Spinco to the full suite of assets outside Expanded Silicon and the same Orogen team, led by Paddy Nicol, that created this value.

- Significant premium of approximately 38%, which includes the implied value of Orogen Spinco, and based on the closing share prices of Triple Flag and Orogen as of April 17, 2025, on the TSX and TSX.V, respectively, and a premium of 32% based on the 20-day volume-weighted average share prices of Triple Flag and Orogen on the TSX and TSX.V as of April 17, 2025, respectively

- Ongoing equity participation in the larger and more liquid Triple Flag shares, with significantly enhanced capital markets exposure

- Exposure to Triple Flag’s high-quality portfolio of diversified producing, development, and exploration assets, including Expanded Silicon

- Ongoing return of capital through participation in Triple Flag’s quarterly dividend

- Enhanced exposure through Orogen Spinco to the upside potential from the remainder of Orogen’s portfolio of operating, development and exploration royalty assets, as well as continued exposure to the top-tier Orogen management team

- Orogen Spinco fully endorsed by Triple Flag through its separate C$10 million investment, providing Orogen Spinco with significantly enhanced financial capacity

- New exploration alliance to be formed between Triple Flag and Orogen Spinco in respect of areas in the western United States

Orogen Spinco

Orogen Spinco will be led by Paddy Nicol and the current Orogen management and exploration team. Pursuant to the plan of arrangement, all of the assets and liabilities of Orogen other than the 1.0% NSR royalty on Expanded Silicon will be transferred to Orogen Spinco, the shares of which will be distributed to Orogen shareholders as part of the consideration. The following will be transferred to Orogen Spinco:

- Ermitaño 2.0% NSR royalty;

- Ermitaño is a producing gold and silver mine located in Mexico, operated by First Majestic Silver Corp. Royalty revenue generated by Ermitaño was C$7.9 million in 2024

- C$15 to C$20 million in working capital and no debt on a pro-forma basis after transaction costs and the Triple Flag placement

- A portfolio of 27 exploration-stage royalties, including the La Rica porphyry target in Colombia, the MPD South copper project in British Columbia, and the Spring Peak gold project in Nevada

- A pipeline of organic royalties created through exploration partnerships, including seven current option deals, four exploration alliances, and five available properties

Western United States Exploration Alliance

Orogen and Triple Flag have also agreed to negotiate the formation of a generative exploration alliance in the western United States, whereby Triple Flag will provide funding to Orogen Spinco for generating gold and silver targets considered geologically similar to the top-tier Expanded Silicon project. The initial $435,000 budget will focus on identifying prospective exploration opportunities for incoming exploration partners.

The commercial objective of the generative exploration alliance is to sell 100% of the interest in identified exploration opportunities in exchange for cash, equity and a retained royalty.

Transaction Conditions and Timing

Under the terms of the Agreement, the Transaction will be carried out by way of a court-approved plan of arrangement under the Business Corporations Act (British Columbia) and will require the approval at a special meeting of at least (i) 66 2/3% of the votes cast by the shareholders of Orogen and (ii) a majority of the votes cast by shareholders of Orogen excluding the votes attributable to certain members of management.

Altius Minerals Corporation, Adrian Day Asset Management, and Euro Pacific Asset Management, together with all of the officers and directors of Orogen, collectively control approximately 39.5% of the common shares of Orogen on a fully diluted basis and have entered into voting support agreements pursuant to which they have agreed to vote their shares in favor of the Transaction, subject to certain conditions.

Completion of the Transaction is also subject to regulatory and court approvals and other customary closing conditions, including the listing of Orogen Spinco on the TSX.V. The Agreement includes customary provisions, including non-solicitation by Orogen of alternative transactions, a right of Triple Flag to match superior proposals and an approximately $12.5 million termination fee, payable under certain circumstances.

Complete details of the Transaction will be included in a management information circular to be delivered to Orogen shareholders in the coming weeks. Subject to receiving requisite court approval, the special meeting of shareholders of Orogen is expected to be held in late June 2025, and the Transaction is expected to close in the third quarter of 2025. In connection with and subject to closing the Transaction, it is expected that the common shares of Orogen will be delisted from the TSX.V and that Orogen will cease to be a reporting issuer under Canadian and U.S. securities laws.

Board of Directors’ Recommendations

The Board of Directors of Triple Flag and the Board of Directors of Orogen have unanimously approved the Transaction and recommend that shareholders vote in favor of the Transaction.

National Bank Financial has provided a fairness opinion dated April 21, 2025, to the Board of Directors stating that, as of the date of such opinion, and based upon and subject to the assumptions, limitations and qualifications stated in such opinion, the consideration to be received by the shareholders of Orogen under the Transaction is fair, from a financial point of view, to such Orogen shareholders.

Scotiabank has provided a fairness opinion dated April 21, 2025, to the Board of Directors of Triple Flag stating that, as of the date of such opinion, and based upon and subject to the assumptions, limitations and qualifications stated in such opinion, the consideration to be paid by Triple Flag to the shareholders of Orogen under the Transaction is fair, from a financial point of view, to Triple Flag.

Advisors and Counsel

Scotiabank is acting as financial advisor to Triple Flag and Torys LLP is acting as legal counsel to Triple Flag. Scotiabank provided a fairness opinion to the Triple Flag Board of Directors.

National Bank Financial is acting as financial advisor to Orogen and Osler, Hoskin & Harcourt LLP is acting as legal counsel to Orogen. National Bank Financial provided a fairness opinion to the Orogen Board of Directors.

About Triple Flag

Triple Flag is a precious metals streaming and royalty company. We offer investors exposure to gold and silver from a total of 236 assets, consisting of 17 streams and 219 royalties, primarily from the Americas and Australia. These streams and royalties are tied to mining assets at various stages of the mine life cycle, including 30 producing mines and 206 development and exploration stage projects. Triple Flag is listed on the Toronto Stock Exchange and New York Stock Exchange under the ticker “TFPM”.

About Orogen

Orogen Royalties is focused on organic royalty creation and royalty acquisitions on precious and base metal discoveries in western North America. The Company’s royalty portfolio includes the Ermitaño gold and silver mine in Sonora, Mexico (2.0% NSR royalty) operated by First Majestic Silver Corp. and the Expanded Silicon project (1.0% NSR royalty) in Nevada, USA, being advanced by AngloGold Ashanti plc. The Company is well financed with several projects actively being developed by joint venture partners.

Qualified Person

James Lill, Director, Mining for Triple Flag Precious Metals and a “qualified person” under NI 43-101 has reviewed and approved the written scientific and technical disclosures contained in this press release.

Beatty District Royalty Coverage

Expanded Silicon Royalty

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE