Titan Mining Reports 37% Revenue Growth and Lower Costs in Q1 2025

Titan Mining Corporation (TSX: TI) (OTCQB: TIMCF) announced its financial and operating results for the quarter ended March 31, 2025. The Company delivered a 37% year-over-year revenue increase and a 4% reduction in all-in sustaining costs, supported by higher production and strong operational execution at the Empire State Mine.

Q1 25 HIGHLIGHTS:(1)

- Payable zinc production of 15.37 million pounds, up 5% from Q1 2024.

- Revenues of $16.02 million, a 37% increase year-over-year.

- C1 cash costs of $0.91/lb, down 6% from Q1 2024.

- AISC of $0.96/lb, down 4% from Q1 2024.

- Cash flow from operations of $2.7 million, up 922% from Q1 2024.

- Reduction in net debt by 29% from Q1 2024.

- Ending cash balance of $12.18 million, up 20% from December 31, 2024.

- 22 holes (9,213 ft) drilled in underground exploration drilling, across Mahler, New Fold, and Mud Pond.

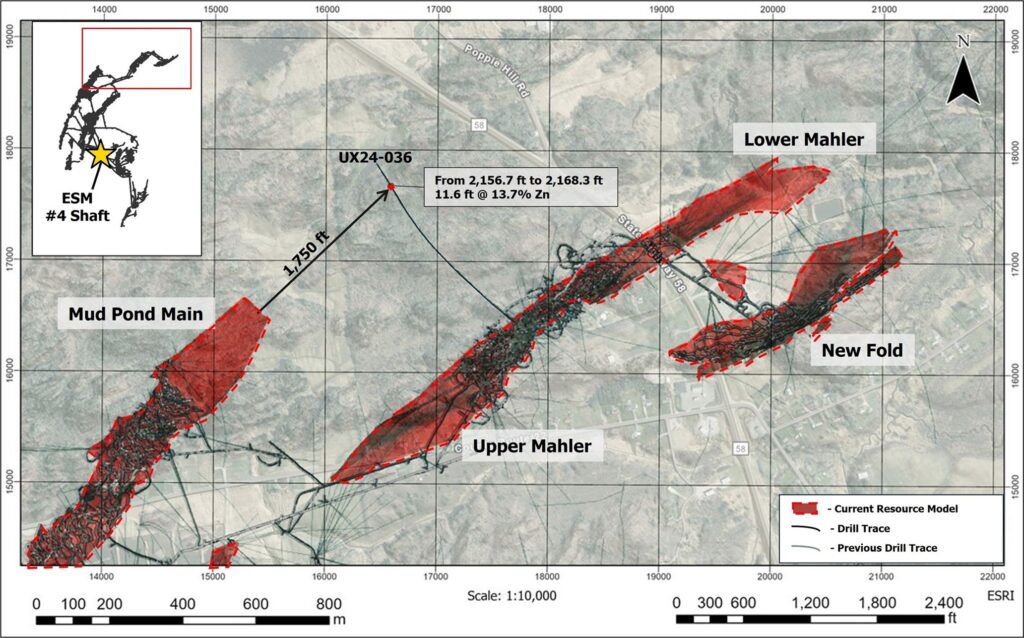

- UX24-036 at Mud Pond intersected 11.6 ft at 13.7% Zn. This is ~1,750 ft directly down plunge of the current mineral resource estimate, indicating significant expansion potential.

- Strong safety performance, with an injury frequency rate 70% below the U.S. national average.

- Kilbourne graphite project on track with final engineering complete for commercial demonstration facility.

(1) All amounts disclosed in this news release are in U.S. dollars unless otherwise stated.

Don Taylor, Chief Executive Officer of Titan, commented, “We started 2025 with good momentum, achieving strong production and lowering unit costs. This performance reflects the strength of our team and the efficiency of the Empire State Mine, which continues to deliver consistent, high-quality results. The quarter’s exploration results, including a high-grade intercept over 1,700 feet outside our current mineral resource model, point to meaningful mineral resource expansion and long-term potential across the district”.

Rita Adiani, President of Titan commented: “Titan’s Q1 results reinforce our strategy to grow responsibly while maintaining cost discipline. With zinc operations delivering robust cash flow and our graphite project advancing rapidly, we are executing on our dual-commodity growth plan and positioning Titan as a reliable U.S. supplier of critical minerals.”

TABLE 1 Financial and Operating Highlights

| 2025 | 2024 | ||||||

| Q1 | FY | Q4 | Q3 | Q2 | Q1 | ||

| Operating | |||||||

| Payable zinc produced | mlbs | 15.37 | 59.5 | 21.7 | 8.3 | 14.8 | 14.7 |

| Payable zinc sold | mlbs | 15.57 | 59.6 | 22.3 | 8.2 | 14.7 | 14.4 |

| Average Realized Zinc Price | $/lb | 1.29 | 1.23 | 1.28 | 1.27 | 1.30 | 1.11 |

| C1 Cost(1) | $/lb | 0.91 | 0.91 | 0.81 | 1.32 | 0.79 | 0.97 |

| AISC(1) | $/lb | 0.96 | 0.94 | 0.86 | 1.35 | 0.79 | 1.00 |

| Financial | |||||||

| Revenue | $m | 16.02 | 64.30 | 26.33 | 8.27 | 17.97 | 11.73 |

| Net Income (loss) after tax | $m | 0.35 | 6.73 | 11.60 | (4.86) | 2.62 | (2.63) |

| Earnings (loss) per share- basic |

$/sh | 0.00 | 0.05 | 0.08 | (0.04) | 0.02 | (0.02) |

| Cash Flow from Operating Activities before changes in non-cash working capital |

$m | 2.69 | 16.47 | 10.92 | (1.68) | 6.97 | 0.26 |

| Financial Position | |||||||

| Cash & Cash Equivalents | $m | 12.18 | 10.16 | 10.16 | 5.84 | 5.55 | 4.18 |

| Net Debt(1) | $m | 23.05 | 21.92 | 21.92 | 30.78 | 30.63 | 32.44 |

Note: The sum of the quarters in the table above may not equal the full-year amounts disclosed elsewhere due to rounding.

C1 Cash Cost, All-In Sustaining Cost (“AISC”) and Net Debt are non-GAAP measures. Accordingly, these financial measures are not standardized financial measures under IFRS and might not be comparable to similar financial measures disclosed by other issuers. These financial measures have been calculated on a basis consistent with historical periods. Information explaining these non-GAAP measures is provided below under “Non-GAAP Performance Measures”.

For further details the reader is directed to the Company’s Q1 2025 Financial Statements and Management Discussion and Analysis available on the Company’s website and www.sedarplus.ca.

OPERATIONS REVIEW

Mining activity in Q1 2025 focused on the Mahler, New Fold, and Mud Pond zones in the #4 mine. Deepening of the Mahler ramp enabled access to higher-grade ore, while long hole stoping in New Fold exceeded grade and tonnage targets. Production from the N2D zone is set to commence at 250 tons/day in Q2, increasing to 500 tons/day in Q3.

Titan has begun implementing production expansion from 1,750 to 2,250 tons/day anticipated for completion by year-end. Equipment purchases and workforce training are underway, with rehabilitation advancing to support increased output.

GRAPHITE UPDATE

The Kilbourne Graphite Project, located within ESM’s active permit area, continues to progress on schedule. Following positive Phase III metallurgy results, engineering for the commercial demonstration facility is nearing completion. The facility is expected to produce 1,000–1,200 tonnes of graphite concentrate per year. Subject to demand, funding and positive economic studies, the Company is targeting increasing graphite concentrate production to 40,000 tonnes per year. This will be the first fully integrated natural flake graphite production in the U.S. since 1956.

EXPLORATION UPDATE

As part of the underground drilling campaign, 22 holes totaling 9,213 feet were drilled in Q1, targeting Mahler, New Fold, and Mud Pond zones. A notable intercept from hole UX24-036 (11.6 ft at 13.7% Zn) was intersected approximately 1,750 ft outside the current mineral resource model along strike, indicating the potential to meaningfully expand the current mineral resource estimate.

Figure 1: Map showing the intercept in UX24-036 relative to the current resource model extents.

| Underground Exploration Drilling | |||||||

| Hole ID | From (ft) | To (ft) | Interval (ft) | From (m) | To (m) | Interval (m) | Zn% |

| UX24-036 | 2,156.7 | 2,168.3 | 11.6 | 656.1 | 659.6 | 3.5 | 13.7 |

| Collar | ||||||

| Hole ID | Length (ft) | Easting (ft) | Northing (ft) | Elevation (ft) | Azimuth | Dip |

| UX24-036 | 2,456 | 17,587.9 | 16,552.3 | -2,892.3 | 308 | -45 |

Quality Assurance and Quality Control

Core drilling was completed using ESM owned and operated drills which produced AWJ (1.374 in) size drill core. All core was logged by ESM employees. The core was washed, logged, photographed, and sampled. All core samples were cut in half, lengthwise, using a diamond saw with a diamond-impregnated blade and sampled on 5 ft intervals with adjustments made to match geological contacts. After a sample is cut, one half of the core was returned to the original core box for reference and long-term storage. The second half was placed in a plastic or cloth sample bag, labeled with the corresponding sample identification number, along with a sample tag. All sample bags were secured with staples or a draw string, weighed and packed in shipping boxes.

Shipping boxes are placed on pallets and shipped by freight to ALS Geochemistry, an independent ISO/IEC accredited lab located in Sudbury, Ontario, Canada. ALS prepares a pulp of all samples and sends the pulps to their analytical laboratory in Vancouver, B.C., Canada, for analysis. ALS analyzes the pulp sample by an aqua regia digestion (ME-ICP41 for 35 elements) with an ICP – AES finish including Cu (copper), Pb (lead), and Zn (zinc). All samples in which Cu (copper), Pb (lead), or Zn (zinc) are greater than 10,000 ppm are re-run using aqua regia digestion (Cu-OG46; Pb-OG46; and Zn-OG46) with the elements reported in percentage (%). Silver values are determined by an aqua regia digestion with an ICP-AES finish (ME-ICP41) with all samples with silver values greater than 100 ppm repeated using an aqua regia digestion overlimit method (Ag-OG46) calibrated for higher levels of silver contained. Gold values are determined by a 30 g fire assay with an ICP-AES finish (Au-ICP21).

Mr. Taylor has a fulsome staff of experts on-site that thoroughly review and verify ESM technical data on a regular basis, as described above. For this reason, Mr. Taylor has relied entirely on such verification procedures for verifying the scientific and technical data in this news release. Mr. Taylor has not identified any legal, political, environmental, or other risks that could materially affect the potential development of the mineral resources disclosed herein.

Qualified Person

The scientific and technical information contained in this news release has been reviewed and approved by Donald R. Taylor, MSc., PG, Chief Executive Officer of the Company. Mr. Taylor is a qualified person for the purposes of NI 43-101. Mr. Taylor has more than 25 years of mineral exploration and mining experience and is a Registered Professional Geologist through the SME (Registered Member #4029597).

About Titan Mining Corporation

Titan is an Augusta Group company which produces zinc concentrate at its 100%-owned Empire State Mine located in New York state. Titan’s goal is to deliver shareholder value through operational excellence, development and exploration. We have a strong commitment towards developing critical minerals assets which enhance the security of the domestic supply chain.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE