Thor Explorations Announces Q3 2025 Operating Update

Thor Explorations Ltd. (TSX-V: THX) (AIM: THX) is pleased to provide its third quarter 2025 interim operational update for the Segilola Gold mine, located in Nigeria, and for the Company’s mineral exploration properties located in Nigeria, Senegal, and Côte d’Ivoire, for the three months to September 30, 2025.

Segilola Q3 Highlights

- Q3 gold poured of 22,617 ounces

- Gold sales in Q3 of 19,650 oz at an average realized price of US$3,535 resulting in revenue of US$69.5 million

- Gold produced from 250,459 tonnes milled at an average grade of 3.11 grammes per tonne of gold and process plant recovery at 94.3%

- Mine production of 386,558 tonnes at an average grade of 2.26 g/t of gold for 28,029 oz

- Ore stockpile increased by 2,977 oz to 44,069 oz of gold at an average grade of 0.83 g/t

- Gold in circuit, increased by 995 oz to 4,398 oz of gold

- Gold bullion inventory of 122 oz and gold doré inventory of 5,668 oz at September 30, 2025

FY 2025 Outlook and Catalysts

- FY 2025 production guidance range maintained at 85,000 to 95,000 oz of gold

- FY 2025 All-in Sustaining Cost guidance range maintained at $800 to $1,000 per ounce

- Drilling programs across all the Company’s exploration portfolio:

- Segilola: continuation of ongoing underground drilling program

- Nigeria: continuation of scout drilling programs on identified near-mine and regional targets

- Senegal (Douta Project):

- Drilling programs at Baraka 3 will be extended with an additional RAB and RC drilling rig commencing in October at the start of the dry season

- Initial RAB drilling program at the Bousankhoba Project (“Bousankhoba”) to commence in the new year

- Côte d’Ivoire:

- Exploration being advanced on the Guitry, Marahui, and Boundiali licenses

- Further drilling at Guitry and initial drilling at Marahui to commence in Q4 2025 following completion of the national elections

- Maiden Mineral Resource Estimate at the Guitry Project by end of 2025

- Updated Mineral Resource Estimate and Pre-Feasibility Study (“PFS”) at the Douta Project by the end of 2025

Dividend

- The Group will maintain the dividend policy announced on April 8, 2025, with the third quarterly dividend payment scheduled for November 14, 2025

- Dividends for the Quarter will be paid at an amount of C$0.0125 per share

Proposed dividend timetable

| Event | Date |

| Ex-Dividend date | 24 October, 2025 |

| Record date | 24 October, 2025 |

| Last day for currency election | 31 October, 2025 |

| Date of exchange rate used for Pounds Sterling | 3 November, 2025 |

| Announcement of exchange rate in Foreign Designated Currencies | 3 November, 2025 |

| Payment date | 14 November, 2025 |

The below outlines the payment treatment for shareholders

- Depository Interest holders registered in London will be paid in British Pounds, with an option to elect for United States Dollar payment

- Canadian Registered holders will be paid in Canadian Dollars, with an option to elect for United States Dollar payment

Segun Lawson, President & CEO, stated:

“I am pleased to report continued strong operational performance for the third quarter of the year, meaning we are on track to meet our production and cost guidance for 2025. By choosing to remain unhedged, we have been able to take full advantage of the high prevailing gold prices, resulting in an average realised price of US$3,535 per ounce, maximising the benefit for our shareholders. At the end of the Quarter, our inventory contained just under 6,000 ounces of gold in bullion and doré that remained unsold and was exposed to higher prevailing gold prices.

“During the Quarter, we also completed the major strategic milestone of consolidating our ownership position in the Douta Project, reinforcing our commitment to its long-term development and simplifying the pathway for project execution. In line with this strategic focus in Senegal, we have further strengthened the growth potential of Douta by advancing exploration activities at Baraka 3 and securing the Bousankhoba licence, which lies contiguous to the existing Douta project permits. These initiatives are targeted to significantly expand our long-term resource inventory and further support our ambitious growth strategy.

“Drilling at Segilola has continued, providing further support to our geological model. We successfully drilled several high grade, mineable intersections beneath the current open pit design. The drilling will continue through the year and is planned to target the potential extension of mineralisation, both in the north and the south, at greater depth where mineralised shoots continue to be defined and remain open at depth.

“Exploration campaigns across the Company’s portfolio slowed during the wet season, and I am eagerly awaiting the planned re-start of programs at Baraka 3 in Senegal, Guitry in Cote d’Ivoire, and commencement of our maiden program at Marahui in Côte d’Ivoire.”

Exploration Q3 2025 Highlights

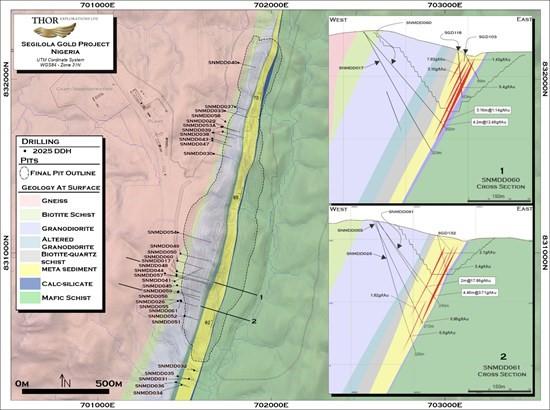

Nigeria (Segilola)

- A diamond drilling program that commenced in 2024 continues to test the continuity of mineralisation following the down-plunge trend to the south. To date, a total of 74 holes have been completed for 20,496 metres. Drilling has focused on two main areas:

- Northern Zone: Targeted mineralisation is confined to a discrete, west-dipping, 100m long shoot with an apparent pronounced steep southerly plunge.

- Southern Zone: Mineralisation appears to have a shallow-plunging flat geometry.

- The Company is pleased to announce continued further positive drilling results from this ongoing diamond drilling program. Significant drill results in the Quarter include:

| Hole ID | East | North | RL | Depth (m) |

Dip | Azi-muth | From (m) |

To (m) |

Interval (m) |

Grade (g/tAu) |

True Width (m) |

| SNMDD062 | 4092 | 11784 | 326 | 272 | -60 | 90 | 240.6 | 242.0 | 1.4 | 9.71 | 0.9 |

| SNMDD067 | 4040 | 10976 | 362 | 287.6 | 292.0 | 4.4 | 2.96 | 3.9 | |||

| SNMDD068 | 4000 | 11089 | 366 | 338 | -60 | 90 | 306.0 | 310.9 | 4.85 | 4.61 | 4.3 |

| SNMDD070 | 4090 | 11694 | 327 | 227 | -60 | 90 | 191.6 | 193.0 | 1.4 | 7.48 | 1.1 |

| SNMDD072 | 4155 | 10669 | 322 | 188 | -60 | 90 | 146.9 | 149.0 | 2.1 | 3.51 | 1.9 |

| SNMDD073 | 4025 | 10932 | 362 | 307.3 | 308.9 | 1.55 | 2.82 | 1.4 | |||

| SNMDD076 | 4118 | 10711 | 341 | 302 | -60 | 90 | 244.0 | 247.0 | 3 | 2.87 | 2.0 |

| SNMDD079 | 4082 | 10780 | 355 | 271.7 | 273.9 | 2.2 | 10.40 | 1.8 |

Table 1: Significant Drillhole Intersections

(>3gram-metres, 0.5g/tAu cut off, Min. length 0.5m, Max. internal dilution 1m)

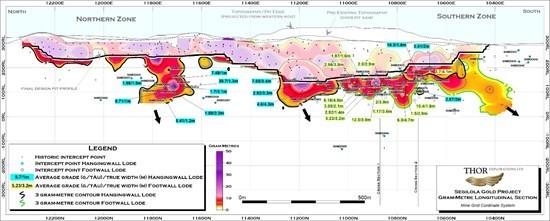

- Significant drill results exceeding 3 gram-metres (calculated as average grade multiplied by true width) are highlighted in the Longitudinal section (Figure 1) and detailed in Table 3, underscoring the strong mineralisation identified during this campaign. A comprehensive list of all recent results can be found in Table 4.

Figure 1: Longitudinal Section Showing Gram-Metre Contours and Drill Intercepts

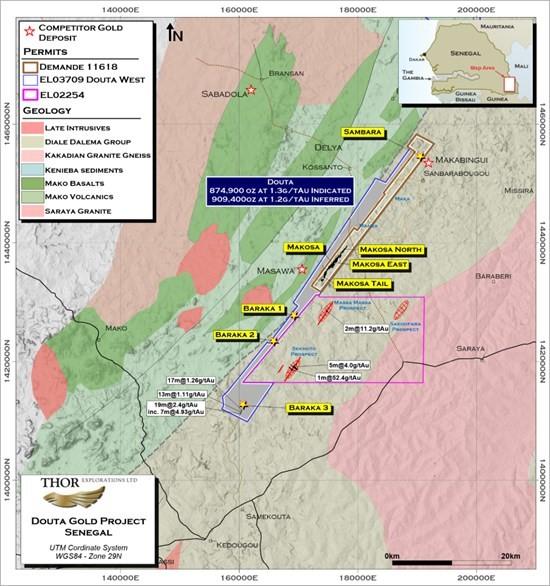

Senegal (Douta)

- During the Quarter, the Company secured full ownership of the Douta Project by entering into a binding sale and purchase agreement with International Mining Company SARL to acquire the remaining 30% minority equity interest. With this acquisition, subject to standard conditions precedent, the Company will hold 100% of the permit.

- In accordance with the Senegal Mining Code, upon issuance of the Douta Mining Concession (Concession Minière), the State of Senegal will be granted a 10% free carried interest in the operating company.

- The extended drilling program at Baraka 3 was completed during the Quarter, and metallurgical testwork is nearing completion. It is anticipated that a Baraka 3 resource will be included in an updated Douta Resource and Douta PFS.

- Additional exploration drilling programs at Baraka 3 are scheduled to resume in October, aligning with the beginning of the dry season. To accelerate the evaluation of the numerous identified geochemical targets, our contractor has imported an additional RAB rig. This additional rig will supplement the current fleet which includes two RC rigs and one multi-purpose diamond / RC rig already on site.

- In addition to the IMC acquisition, the Company has also acquired an initial 65% interest in the Bousankhoba Exploration Permit EL02254, an early-stage gold exploration permit contiguous to the east of the Company’s Douta West permit (see Figure 2). Bousankhoba contains several continuous soil geochemical anomalies, with some areas having undergone historical early-stage drilling yielding encouraging results.

- Management considers Bousankhoba to be highly prospective and has the potential to deliver satellite resources that will enhance the Douta Gold Project, representing another promising opportunity as has been identified at Baraka 3.

- A large-scale RAB drilling campaign is being planned for Bousankhoba and is scheduled to commence early next year, following the completion of a similar program at Baraka 3.

- Douta PFS work streams are continuing, with the aim of completing the PFS in Q4 2025.

Figure 2: Douta Project Location Map

Côte d’Ivoire

Guitry Project

- During the Quarter, the Company completed a successful maiden drilling program comprising 4,604 m in 41 holes. This drilling campaign has intersected and confirmed previously untested deeper bedrock mineralisation, which remains open.

- In the final quarter of the year following conclusion of the rainy season, the Company intends to implement the following plan.

- Additional step-out drilling programs.

- Orientated core diamond drilling to confirm and further understand the structural geology of the underlying formations.

- A comprehensive permit-wide auger drilling campaign to investigate the previously identified soil anomalies, thereby enhancing our understanding of the project’s broader mineral potential.

Marahui Project

- Exploration activities progressed, featuring extensive geological mapping and consistently encouraging results from both rock chip and soil geochemical sampling.

- A preliminary drilling program totalling 9,000 m has been planned. The initial drill pads are already prepared, and drilling operations are set to commence following conclusion of the national elections.

PRODUCTION SUMMARY

| Units | Q3 2025 | Q2 2025 | Q1 2025 | Q4 2024 | Q3 2024 | |

| Mining | ||||||

| Total Mined | Tonnes | 2,511,593 | 2,756,363 | 2,874,533 | 3,781,881 | 4,024,002 |

| Waste Mined | Tonnes | 2,125,035 | 2,513,901 | 2,602,158 | 3,398,182 | 3,668,487 |

| Ore Mined | Tonnes | 386,558 | 242,461 | 272,375 | 383,699 | 355,515 |

| Grade | g/t Au | 2.26 | 3.02 | 2.42 | 2.30 | 2.01 |

| Processing | ||||||

| Ore Processed | Tonnes | 250,459 | 238,425 | 231,825 | 247,075 | 201,958 |

| Grade | g/t Au | 3.11 | 3.12 | 3.23 | 3.08 | 3.22 |

| Recovery | % | 94.3 | 93.1 | 93.7 | 89.2 | 88.5 |

| Gold Recovered | oz | 23,612 | 22,229 | 22,594 | 21,827 | 18,496 |

| Gold Poured | oz | 22,617 | 22,784 | 22,790 | 24,662 | 20,110 |

Table 2: Production Summary

SELECTED SEGILOLA EXPLORATION RESULTS

| Hole ID | East | North | RL | Depth (m) | Dip | Azi-muth | From (m) |

To (m) |

Interval (m) |

Grade (g/tAu) |

True Width (m) |

| SNMDD029 | 4083 | 11757 | 328 | 270 | -67 | 90 | 223.4 | 226.0 | 2.6 | 1.87 | 2.1 |

| SNMDD031 | 4272 | 10304 | 292 | 47.8 | 49.6 | 1.8 | 3.13 | 1.5 | |||

| SNMDD032 | 4289 | 10358 | 307 | 33.1 | 35.0 | 1.9 | 3.22 | 1.6 | |||

| SNMDD038 | 4040 | 11710 | 346 | 305 | -66 | 90 | 274.0 | 276.9 | 2.9 | 1.90 | 2.4 |

| SNMDD045 | 4067 | 10806 | 357 | 326 | -65 | 91 | 305.2 | 310.0 | 4.8 | 1.17 | 3.9 |

| SNMDD048 | 4047 | 10866 | 359 | 300.0 | 301.9 | 1.9 | 2.00 | 1.7 | |||

| SNMDD053A | 4078 | 11755 | 328 | 290 | -74 | 91 | 260.7 | 262.5 | 1.8 | 5.41 | 1.3 |

| SNMDD056 | 4083 | 10769 | 355 | 318 | -66 | 91 | 291.8 | 295.4 | 3.55 | 1.50 | 2.9 |

| SNMDD057 | 4049 | 10859 | 359 | 305 | -53 | 91 | 286.5 | 289.2 | 2.7 | 2.05 | 2.5 |

| SNMDD059 | 4083 | 10774 | 355 | 316 | -66 | 91 | 291.0 | 296.9 | 5.9 | 6.00 | 4.7 |

| SNMDD060 | 4044 | 10883 | 360 | 302 | -49 | 91 | 284.0 | 287.2 | 3.15 | 1.14 | 3.0 |

| SNMDD060 | 4044 | 10883 | 360 | 294.8 | 299.0 | 4.2 | 12.48 | 3.9 | |||

| SNMDD061 | 4114 | 10725 | 344 | 245 | -54 | 91 | 195.5 | 197.5 | 2 | 17.86 | 1.8 |

| SNMDD061 | 4114 | 10725 | 344 | 222.1 | 226.6 | 4.46 | 3.71 | 4.1 | |||

| SNMDD062 | 4092 | 11784 | 326 | 272 | -60 | 90 | 240.6 | 242.0 | 1.4 | 9.71 | 0.9 |

| SNMDD067 | 4040 | 10976 | 362 | 287.6 | 292.0 | 4.4 | 2.96 | 3.9 | |||

| SNMDD068 | 4000 | 11089 | 366 | 338 | -60 | 90 | 306.0 | 310.9 | 4.85 | 4.61 | 4.3 |

| SNMDD070 | 4090 | 11694 | 327 | 227 | -60 | 90 | 191.6 | 193.0 | 1.4 | 7.48 | 1.1 |

| SNMDD072 | 4155 | 10669 | 322 | 188 | -60 | 90 | 146.9 | 149.0 | 2.1 | 3.51 | 1.9 |

| SNMDD073 | 4025 | 10932 | 362 | 307.3 | 308.9 | 1.55 | 2.82 | 1.4 | |||

| SNMDD076 | 4118 | 10711 | 341 | 302 | -60 | 90 | 244.0 | 247.0 | 3 | 2.87 | 2.0 |

| SNMDD079 | 4082 | 10780 | 355 | 271.7 | 273.9 | 2.2 | 10.40 | 1.8 |

Table 3: Significant Drillhole Intersections

(>3gram-metres, 0.5g/tAu cut off, Min. length 0.5m, Max. internal dilution 1m)

| Hole ID | East | North | RL | Depth (m) | Dip | Azi-muth | From (m) |

To (m) |

Interval (m) | Grade (g/tAu) |

True Width (m) |

| SNMDD062 | 4092 | 11784 | 326 | 272 | -60 | 90 | 240.6 | 242.0 | 1.4 | 9.71 | 0.9 |

| SNMDD063 | 4049 | 10834 | 359 | 316 | -60 | 90 | 292.5 | 293.4 | 0.9 | 0.84 | 0.8 |

| SNMDD063 | 296.9 | 298.0 | 1.1 | 2.02 | 1.0 | ||||||

| SNMDD064 | 4158 | 10611 | 315 | 209 | -60 | 90 | 163.0 | 164.5 | 1.55 | 0.67 | 1.2 |

| SNMDD064 | 179.0 | 181.3 | 2.25 | 0.74 | 1.7 | ||||||

| SNMDD064 | 187.7 | 190.0 | 2.3 | 1.05 | 1.8 | ||||||

| SNMDD065 | 4021 | 11022 | 363 | 318 | -60 | 90 | Nsr | ||||

| SNMDD066 | 4036 | 11715 | 346 | 311 | -60 | 90 | Nsr | ||||

| SNMDD067 | 4040 | 10976 | 362 | 305 | -60 | 90 | 284.6 | 286.0 | 1.45 | 0.83 | 1.3 |

| SNMDD067 | 287.6 | 292.0 | 4.4 | 2.96 | 3.9 | ||||||

| SNMDD068 | 4000 | 11089 | 366 | 338 | -60 | 90 | 306.0 | 310.9 | 4.85 | 4.61 | 4.3 |

| SNMDD069 | 4156 | 10681 | 323 | 228 | -60 | 90 | Nsr | ||||

| SNMDD070 | 4090 | 11694 | 327 | 227 | -60 | 90 | 191.6 | 193.0 | 1.4 | 7.48 | 1.1 |

| SNMDD072 | 4155 | 10669 | 322 | 188 | -60 | 90 | 146.9 | 149.0 | 2.1 | 3.51 | 1.9 |

| SNMDD072 | 168.0 | 169.0 | 1 | 1.16 | 0.9 | ||||||

| SNMDD072 | 171.0 | 174.0 | 3 | 0.76 | 2.6 | ||||||

| SNMDD072 | 176.4 | 177.4 | 1 | 1.73 | 0.9 | ||||||

| SNMDD073 | 4025 | 10932 | 362 | 329 | -60 | 90 | 304.0 | 306.0 | 2 | 0.91 | 1.8 |

| SNMDD073 | 307.3 | 308.9 | 1.55 | 2.82 | 1.4 | ||||||

| SNMDD075 | 4048 | 10858 | 359 | 335 | -60 | 90 | pending | ||||

| SNMDD076 | 4118 | 10711 | 341 | 302 | -60 | 90 | 244.0 | 247.0 | 3 | 2.87 | 2.0 |

| SNMDD079 | 4082 | 10780 | 355 | 296 | -60 | 90 | 248.1 | 249.1 | 1 | 0.65 | 0.8 |

| SNMDD079 | 271.7 | 273.9 | 2.2 | 10.40 | 1.8 | ||||||

| SNMDD079 | 281.0 | 282.0 | 1 | 2.07 | 0.8 |

Table 4: Recent Drillhole Intersections Received

(0.5g/tAu cut off, Min. length 0.5m, Max. internal dilution 1m)

Figure 3: Drillhole Location Map

About Thor Explorations

Thor Explorations Ltd. is a Canadian mineral exploration company engaged in the acquisition, exploration and development of mineral properties located in Nigeria, Senegal and Côte d’Ivoire. Thor holds a 100% interest in the Segilola Gold Project located in Osun State of Nigeria. Mining and production commenced at Segilola in 2021. Thor holds a 100% interest in the Douta Gold Project located in south-eastern Senegal. Thor trades on the TSX Venture Exchange under the symbol “THX”.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE