The Japan Gold – Barrick Alliance Encounters Wide Intervals of Gold Mineralization in Its Initial Drill Program at the Mizobe Project

Japan Gold Corp. (TSX-V: JG) (OTCQB: JGLDF) is pleased to announce results of its initial ‘framework’ drilling program at the Barrick Alliance Mizobe Project in Southern Kyushu, Japan. Drilling has encountered wide, and locally high-grade intervals in the initial, broad spaced framework drill program.

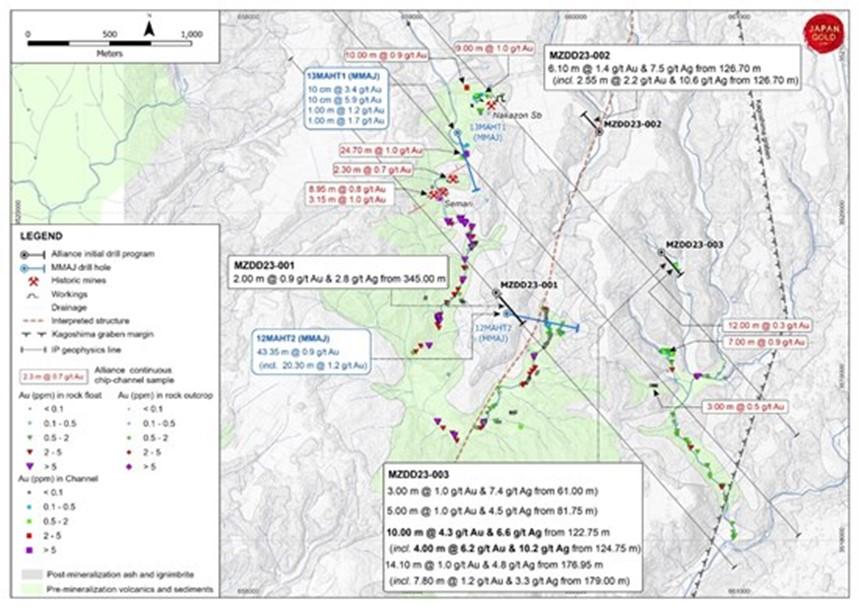

Highlights: Drill holes MZDD23-001, 002, and 003 successfully intersected gold mineralized intervals including the following notable results (all intervals are down-hole lengths), (Figures 1-4, Table 1 & 2):

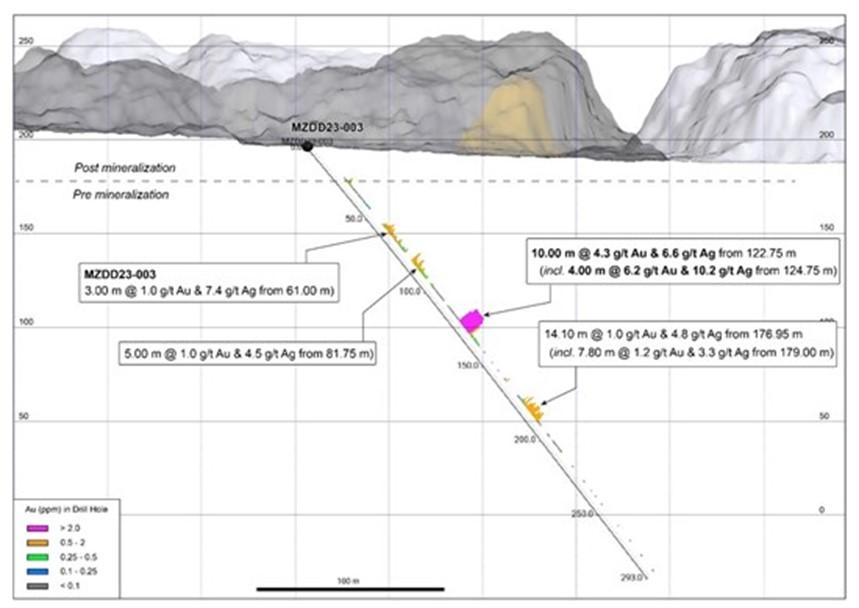

- MZDD23-003

10.0 m @ 4.3 g/t Au & 6.6 g/t Ag from 122.75 m

(incl. 4.0 m @ 6.2 g/t Au & 10.2 g/t Ag) &

14.1 m @ 1.0 g/t Au & 4.8 g/t Ag from 176.95 m

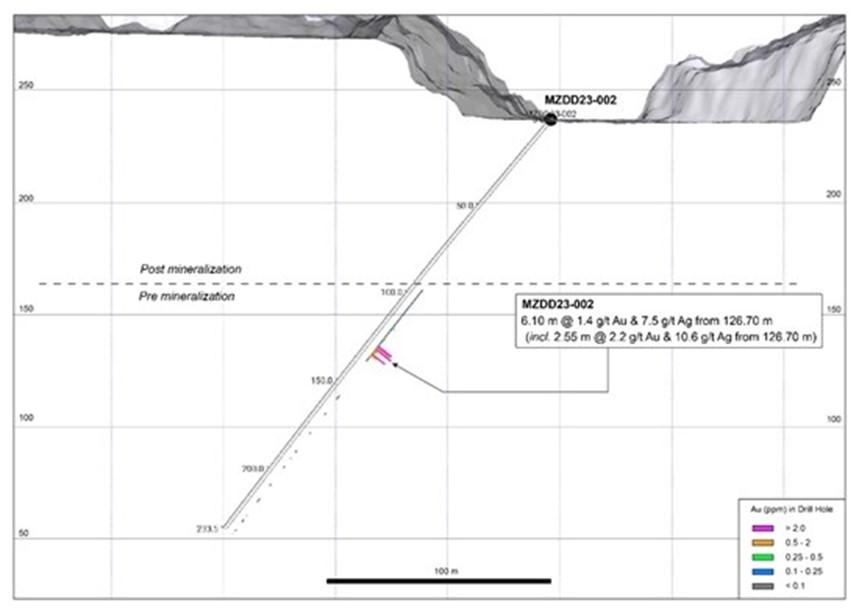

- MZDD23-002

6.1 m @ 1.4 g/t Au & 7.5 g/t Ag from 126.7 m

(incl. 2.6 m @ 2.2 g/t Au & 10.6 g/t Ag)

Mizobe Project

The Mizobe project is located within the Hokusatsu Region of Southern Kyushu, Japan’s largest gold producing district, with more than 11 million ounces of combined production from low-sulphidation epithermal deposits1-5.

Within the Mizobe Project, historical mining activities focused on antimony-rich hydrothermal breccias at the Semari and Nakazon workings, prior to 1942. In 2000, the Metal Mining Agency of Japan drill hole 12MAHT-2 was drilled 1 km to the southeast of the historical antimony workings, targeting a geophysical anomaly, the drill hole intersected a down-hole mineralized interval of 43.35 m @ 0.9 g/t gold, with an included interval of 20.3 m @ 1.2 g/t gold5, (Figure 1). No further drilling was completed around this mineralized intersection.

Sampling by the Alliance of discontinuous outcrop and quartz-vein / breccia float across a 2 by 2.5 km area showed strong anomalism with channel samples including 24.7 m grading 1.0 g/t gold, and river float samples up to 18.9 g/t gold, (Figure 1). The extent of gold and antimony anomalism was seen as highly encouraging considering much of the target area is concealed by a veneer of post-mineral volcanic ash.

Drilling Results

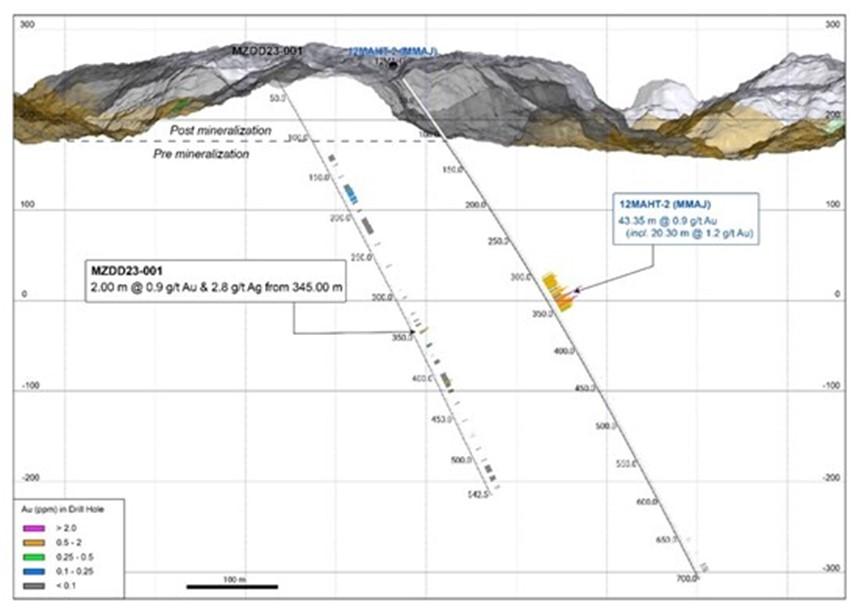

The three initial, widely spaced frame-work drill holes at Mizobe targeted interpreted structural extensions below post-mineral volcanic ash on large step-outs between 600 to 1,000 m from known surface mineralization and historical drilling data, (Figure 1). Gold mineralization intersected includes both vein and breccia hosted styles. The significant widths of mineralization intersected in drilling below post-mineral cover, and the broad footprint of gold and pathfinder mineralization identified in channel sampling at surface indicate the potential of a significant gold-bearing hydrothermal system at Mizobe. Next steps at Mizobe will include step-out drilling to further extend, and define the geometry of the wide mineralized intervals. Further drilling will be scheduled at Mizobe around geophysical work programs already in progress on the high priority Aibetsu and Togi Alliance projects in Hokkaido and Honshu.

Table 1: Significant Drill Hole Intersections

| Drill Hole Number | From (m) | To (m) | Length (m) | Au (g/t) | Ag (g/t) |

| MZDD23-001 | 345.00 | 347.00 | 2.00 | 0.9 | 5.5 |

| incl. | 345.00 | 346.00 | 1.00 | 1.1 | 2.9 |

| MZDD23-002 | 126.70 | 132.80 | 6.10 | 1.4 | 7.5 |

| incl. | 126.70 | 129.30 | 2.60 | 2.2 | 10.6 |

| MZDD23-003 | 58.00 | 76.75 | 18.75 | 0.6 | 4.1 |

| incl. | 61.00 | 64.00 | 3.00 | 1.0 | 7.4 |

| 81.75 | 94.75 | 13.00 | 0.7 | 3.2 | |

| incl. | 81.75 | 86.75 | 5.00 | 1.0 | 4.5 |

| 122.75 | 138.75 | 16.00 | 2.8 | 4.5 | |

| incl. | 122.75 | 132.75 | 10.00 | 4.3 | 6.6 |

| incl. | 124.75 | 128.75 | 4.00 | 6.2 | 10.2 |

| 176.95 | 191.00 | 14.05 | 1.0 | 4.8 | |

| incl. | 179.00 | 186.75 | 7.75 | 1.2 | 3.3 |

Table 2: Drill Hole Collar Data

| Drill Hole Number | Location | Easting | Northing | RL | Azimuth | Dip | Length |

| IKDD21-001 | Mizobe East | 659513 | 3519513 | 267.2 | 138 | 60 | 542.40 |

| IKDD21-002 | Mizobe East | 660145 | 3520495 | 236.9 | 318 | 50 | 233.20 |

| IKDD21-003 | Mizobe East | 660524 | 3519759 | 196.4 | 138 | 50 | 293.00 |

| TOTAL | 1,068.60 | ||||||

References

1 Sumitomo Metal Mining Co., LTD. Integrated Report, March 2022.

2 Watanabe Y, 2005. Late Cenozoic evolution of epithermal gold metallogenic provinces in Kyushu, Japan. Mineralium Deposita (2005) 40: pp 307-323.

3 Garwin, S.G. et al. 2005. Tectonic setting, Geology, and gold and copper mineralization in the Cenozoic magmatic arcs of Southeast Asia and the West Pacific. Economic Geology 100th Anniversary Vol. pp 891-930.

4 Shikazono, N. 2003. Geochemical and Tectonic Evolution of Arc-Backarc Hydrothermal Systems, Volume 1. Elsevier, 2003.

5 Metal Mining Agency of Japan, June 2001, Regional Geological Structure Survey Report for Fiscal Year 2000, Hokusatsu, Kushikino District.

Sampling Techniques and Assaying

The drilling results discussed in this news release are from drill core samples obtained by PQ, HQ and NQ-size triple-tube diamond core drilling using a PMC700 and PMC-400 man-portable drill rigs owned and operated by the Company. The drilling program was fully supervised by Company senior geologists at the drilling site.

Drill core was collected in plastic core-trays at the drill site and transported by road in Company vehicles to its core shed storage facility in the nearby Urushi Village, near the project area. The drill core was carefully logged, photographed and sample intervals marked-up along predicted mineralized and selected unmineralized intervals by Japan Gold senior project geologists.

Sample lengths varied from 0.25 to 1.0 m; depending on the positions of geological contacts and variations in alteration composition. The core was split by diamond rock saw supervised by project geologists. Half-core sample was collected from the entire length of each designated sample interval and placed into individual-labelled, self-sealing calico bags for secure packaging and transport to the laboratory. The half-core samples weighed between 0.25 to 5 kg depending on the sample length and core size. A Chain-of-Custody was established between the Company and receiving laboratory to ensure the integrity of the samples during transportation from site to the lab. The samples were sent in batches to ALS Laboratories in Vancouver, Canada for sample preparation and assaying.

Samples were crushed, pulverised and assayed for gold 50 g charge Fire Assay / AAS Finish (Au-AA24; 0.005 ppm lower detection limit) and a 48 multi-element by 4-acid digest with ICP-MS determination (ME-MS61L; Ag 0.002 ppm lower detection limit). Over-limit Au and Ag samples were re-assayed by fire-assay and gravimetric finish (GRA-22, LDL of 0.5 and 5 ppm for Au and Ag respectively).

Certified Reference Materials were inserted by Japan Gold KK at every 20th sample to assess repeatability and assaying precision of the laboratory. In addition, the laboratory applied its own internal Quality Control procedure that includes sample duplicates, blanks & geochemical standards. They report these results with the certified Assay Report. Laboratory procedures and QAQC protocols adopted are considered appropriate. The CRMs and internal QC-QA results fall within acceptable levels of accuracy & precision and are considered to lack any bias.

Rock results presented in this news release and accompanying figures are from 1-3 kg selected grabs of river float samples, and continuous chip-channel samples. The grab samples of float material reported in this announcement are believed to originate from the underlying bedrock of the drainage basin from which they were collected. The Company cautions that grab and float samples are selective by nature and may not be representative of typical mineralization on the property. Composited chip-channel samples have been collected continuously along exposures of bedrock at intervals between 0.5 to 1.5 m. Sample preparation and assaying were done by ALS Perth, WA, Australia. Samples were crushed and pulverised and gold was analysed by 50 gram-charge Fire Assay and AAS finish. A 48 multielement analysis including silver was done by four-acid digest and ICP-MS determination.

A Chain-of-Custody was established between the Company and receiving laboratory to ensure the integrity of the samples during transportation from site to the lab. Certified Reference Materials (CRMs) were inserted by Japan Gold at every 20th sample to assess repeatability and assaying precision of the laboratory. In addition, the laboratory applied its own internal Quality Control procedure that includes sample duplicates, blanks & geochemical standards. They report these results with the certified Assay Report. Laboratory procedures and QAQC protocols adopted are considered appropriate. The CRMs and internal QC-QA results fall within acceptable levels of accuracy & precision and are considered to lack any bias.

Qualified Person

The technical information in this news release has been reviewed and approved by Japan Gold’s Vice President of Exploration, Andrew Rowe, BAppSc, FAusIMM, FSEG, who is a Qualified Person as defined by National Instrument 43-101.

About Japan Gold Corp.

Japan Gold Corp. is a Canadian mineral exploration company focused solely on gold exploration across the three largest islands of Japan: Hokkaido, Honshu, and Kyushu. The Company holds a portfolio of 34 gold projects which cover areas with known gold occurrences, a history of mining and are prospective for high-grade epithermal gold mineralization. Japan Gold’s leadership team represent decades of resource industry and business experience, and the Company has an operational team of geologists, drillers and technical advisors with experience exploring and operating in Japan.

Japan Gold has a country-wide alliance with Barrick Gold Corporation to jointly explore, develop, and mine certain gold mineral properties and mining projects. The Barrick Alliance has completed a successful two-and-a-half-year country-wide screening program of 29 projects and has selected 6 with the potential to host Tier 1 or Tier 2 gold ore bodies for further advancement and 3 more recently acquired project areas and one recently acquired project, for initial evaluation.

Figure 1: Simplified geological map of the east side of Mizobe Project with the three completed Barrick Alliance drill holes, historical drilling by the MMAJ, and Alliance rock-outcrop and float gold geochemistry.

Figure 2: Drill hole section for MZDD23-001.

Figure 3: Drill hole section for MZDD23-002.

Figure 4: Drill hole section for MZDD23-003.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE