Ted J Butler – “Silver Set To Skyrocket As Fed Fails Inflation Fight”

I’ve come to know the silver market like the back of my hand, thanks to 3 years of writing the annual silver chapter for the In Gold We Trust report – a 400-page treasure trove of world-class precious metals research.

Now in my new role as Senior Analyst at Silver Advisor, I’m delighted to have the opportunity to share with you the No.1 silver price catalyst I’m watching in Q3: The potential dawn of a Federal Reserve rate-cutting cycle.

Silver Set To Skyrocket As Fed Fails Inflation Fight

Fed Chair, Jerome Powell, is a Steady Eddie – one of those old-school “company man” types whose first words as a baby were more than likely “inflation is transitory” instead of the conventional “mama” or “dada”.

As a Brit, his lack of charisma reminds me of our former Prime Minister, Theresa May, who famously made herself into a meme after confessing the naughtiest thing she ever did was “running through fields of wheat”.

Unfortunately, though, there is nowhere left to run at present for our rockstar Fed Chair, who finds himself stuck between a rock and a hard place as the September FOMC meeting draws nearer and nearer.

What is Powell’s Prisoner’s Dilemma?

Put simply, if Powell opts to increase or hold interest rates at 4.25-4.5%, he risks tightening the noose around the U.S economy, all while angering President Trump who incessantly calls for his resignation.

On the other hand, if he caves to pressure from Trump and lowers interest rates, he risks unleashing a new wave of inflation that would destroy both his legacy and the purchasing power of the U.S dollar.

For context, Trump has publicly branded Powell, as a “major loser” and “Mr. Too Late,” criticizing him for not lowering interest rates quickly enough to counteract the economic effects of his own trade policies.

Frankly, it’s easy to see why Trump is furious with Powell: The U.S President just passed a big, beautiful spending bill which will cost significantly more to finance if Powell doesn’t lower interest rates pronto.

Already sitting close to $37 trillion, the U.S Government’s debt pile would grow by a further $3 trillion over the next 10 years just from Trump’s BBB alone – and that’s not even considering all the wars still being financed.

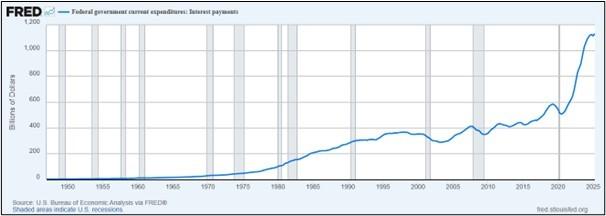

While on that topic, it’s worth noting that the U.S Government’s $1.1 trillion annualised cost of servicing its debt has become its largest expense – even bigger than its yearly outlay for military and defense spending.

https://fred.stlouisfed.org/series/A091RC1Q027SBEA#

Putting the debt problem to one side, lower rates would also necessitate a weaker USD, boosting the attractiveness of U.S exports. As such, it’s easy to see why Trump is piling the pressure on Powell to cut.

Judging by the language from his Jackson Hole speech, it would seem that Powell has succumbed to the character assassination from Trump and is set to cut rates for the first time in 9 months in September.

More specifically, Powell remarked in his Jackson Hole speech on August 22: “With policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance.”

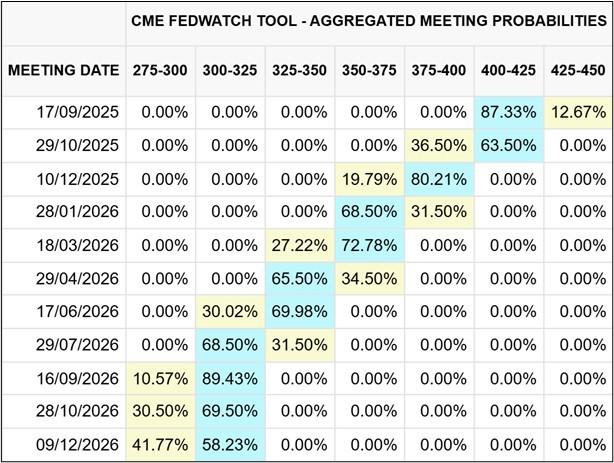

Since then, the market has read between the lines of Powell’s Fedspeak and is pricing in an 87.33% chance of a 25bps cut in September, as well as an 89.43% probability of 125bps worth of cuts by September 2026.

https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

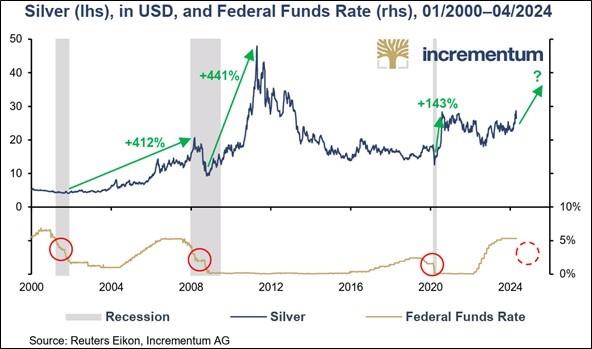

Incidentally, as your author outlined in the 2024 edition of the In Gold We Trust report, the silver price has performed marvellously in the last 3 Fed rate cutting cycles since 2000, averaging a staggering 332% return.

https://ingoldwetrust.report/archive/?lang=en (IGWT24, pg. 327)

As a result, silver investors would do well to hold onto their hats if Powell cuts. Not to mention, investors in silver mining companies, which are leveraged to the silver price, may not even have a hat left to hold onto!

Admittedly, there’s a chance that Mr. Market is selfishly trying to manifest an “equities boom” scenario, while also failing to consider Powell’s past comments about the importance of getting inflation down to 2%.

Speaking in May, Powell hawkishly stated: “Keeping longer‑run inflation expectations anchored was a driving force behind establishing the 2 percent target… we remain fully committed to the 2 percent today”.

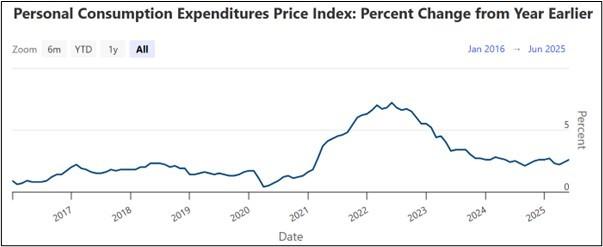

Despite this, Powell has since contradicted himself, while inflation has proved to be incredibly sticky in recent months, outright refusing to go below 2.5% – let alone the 2% target that has defined this Fed Chair’s tenure.

https://www.federalreserve.gov/economy-at-a-glance-inflation-pce.htm

Therefore, if Powell does indeed cut as the market is anticipating, you can bet your bottom dollar that silver – and silver miners to a greater degree – will ride the hot winds of inflation and rate cuts all the way to the bank.

Ultimately, if you’d like to learn how rate cuts and other catalysts are driving silver’s next big move, you can check out my latest interview with Mining Network: https://www.youtube.com/watch?v=lXb0ZnQ70mA&t=1s

Given that we expect silver miners to be turbocharged by this next rate cutting cycle, consider our FREE Silver Advisor newsletter.

Silver Advisor provides detailed analysis on a number of top notch, high-potential silver mining companies, ranging from junior explorers to larger developers and producers.

You can subscribe to Silver Advisor for FREE here: https://thegoldadvisor.com/registration/

Courtesy of the Gold Advisor

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE