Ted J Butler – How High Can Silver Fly?

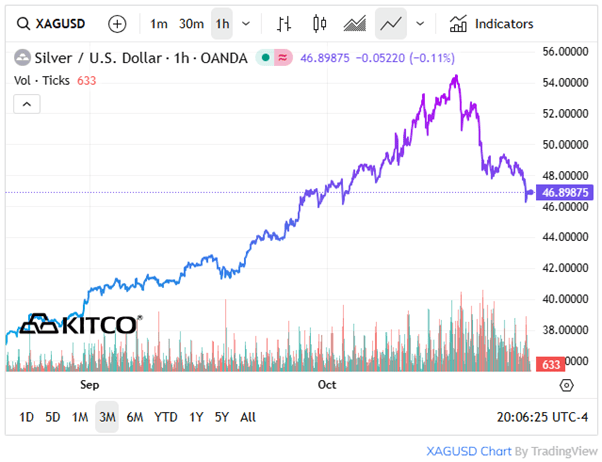

The silver price plunged 7% to $48 on Tuesday this week, marking the first real hiccup in a relentless rally that culminated with a nominal all-time high above $54 last Friday.

Since that healthy correction, the white metal has reacquainted itself with $49 and now appears to be entering a period of high-level consolidation before the next leg-up.

In the meantime, it’s possible that silver’s volatility exposes investors to some short-term downside, with a moderate Fibonacci retracement toward $43 not entirely out of the question.

However, with the gold-silver ratio still historically high, and with many of the catalysts behind silver’s surge beyond $50 still in play, most investors remain squarely focused on silver’s upside.

With this in mind, today’s article will aim to answer the question: How High Can Silver Fly?

https://www.kitco.com/charts/silver

To understand the degree to which silver could outperform, we first need to ascertain the extent to which it’s undervalued, overvalued or fairly valued relative to historical bull cycles.

Fiat currencies are an extremely poor measuring stick for this task due to their inability to hold purchasing power, so gold remains the optimal lens to apply when valuing the silver price.

Historically, silver’s value relative to gold has been 7:1 — a ratio which is ironically proportionate to 2024 gold and silver mine production — and even hit lows of 2:1 in Ancient Egyptian times.

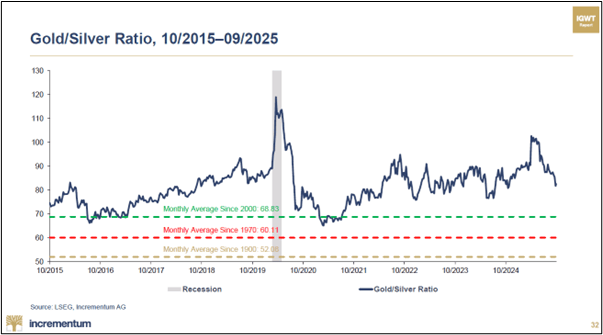

More recently, the gold silver ratio (GSR) has averaged 68.83 since 2000, 60.11 since 1970, and 52.08 since 1900. At today’s $4105 gold price, that equates to a silver price between $60-$79.

https://ingoldwetrust.report/monthly-gold-compass/?lang=en

Assuming the gold price stays at $4,105, this means that silver could rise a further 23–62% from today’s price of $48.62. That is, if today’s GSR of 85.4 reverted to its historical mean of 52-68.

To some, a 23-62% increase may seem conservative. And frankly, it is, since it assumes that the GSR won’t go lower than 52 – an end-game that we, and also Tavi Costa, rate as highly unlikely.

“Gold bull cycles don’t typically peak with the gold-to-silver ratio as high as 85. For perspective: In 1980, the ratio fell below 20. In 2011, it dropped to 30 before gold peaked a few months later. Given the scale of today’s economic imbalances, a sharp contraction in the gold-to-silver ratio toward historic lows is highly likely, in my view.” – Tavi Costa, Crescat Capital

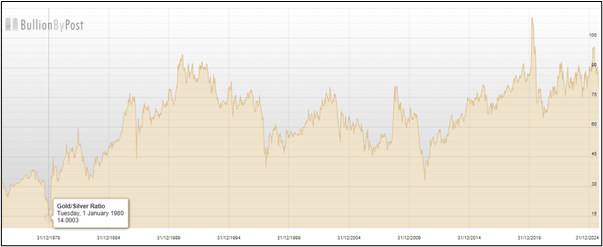

Put simply, the closing act of a gold bull market has historically seen a rapid compression of the GSR, to levels ranging between 45 and 14 – the latter being the all-time low from January 1980.

https://www.bullionbypost.co.uk/price-ratio/gold-silver-ratio-chart/

Admittedly, an anomaly came in March 2020, when the GSR soared to a record 124.04. From this peak to its cycle lows of 69.54 in August 2020, the GSR shed approximately 54.5 points.

For reference, the GSR peaked at 107.23 in April 2025 and has since fallen ~22 points to 85. So, if we see a similar drop in the GSR today as we did in 2020, there’s still another 30+ points to go.

In other words, the most recent silver bull market indicates that the GSR’s reversion in today’s cycle is far from complete. And by extension, that means much of silver’s upside may lie ahead.

Speaking of upside, if we assume that gold stays at $4,105, a 20–30 GSR would translate to a $137–$205 silver price, implying an additional 182–322% upside from today’s $48.62 level.

If we take it a step further, the GSR returning to its 1980 low of 14 at a gold price of $4,105 would imply a $293 silver price — a staggering ~503% increase from today’s $48.62 price.

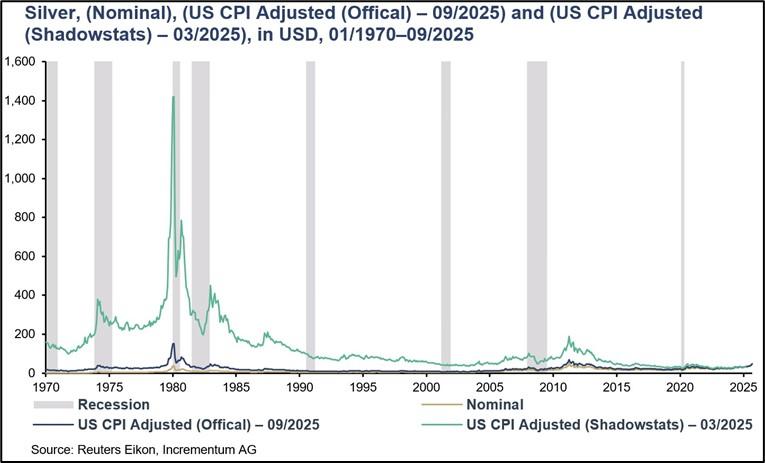

Arguably, a decline in the GSR to historically low levels would render silver overvalued versus gold. That said, a $293 silver price starts to look cheap, when adjusting for “shadow” inflation…

https://ingoldwetrust.report/monthly-gold-compass/?lang=en

Indeed, as the exceptional chart from our friends at Incrementum illustrates, silver’s all-time high in 1980, when adjusted for real inflation numbers from Shadowstats, comes in at ~$1400.

Shadowstats inflation diverges from official U.S. CPI data because it reconstructs inflation using pre-1990s government methodologies, before ‘revisions’ diluted how price growth is measured.

In essence, it shows what inflation would look like if measured the same way it was in 1980, revealing that today’s asset prices aren’t nearly as overvalued as they appear under official CPI.

Importantly, us drawing on this data is not to say that silver is going to $1400 tomorrow. Rather, we do it to contextualise how cheap silver remains in an era of chronic monetary debasement.

Still, even if we adjust for the more conservative, albeit inaccurate, official CPI figures, silver’s 1980 all time high comes in at ~$150, which is roughly 3 times where we’re at 45 years later.

Ultimately, whether silver reaches $151, let alone the lofty heights of $1400, the reality is that $48 silver is still a whole lot better than the $20-25 price we were stuck with for the past decade.

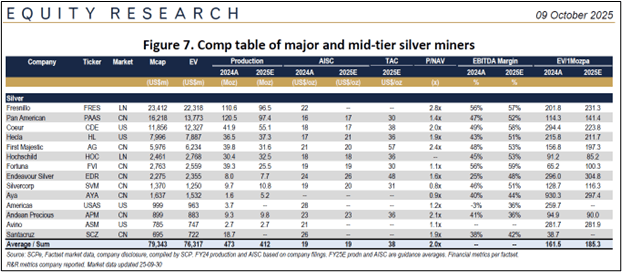

As a result, most of the silver majors and mid-tiers are booking a cool ~60% profit margin already, with the industry average AISC expected to be around $19 in 2025.

In this sense, the handful of primary silver miners that exist in today’s market do not need the silver price to go above $50 in order to turn a profit. In fact, they’d even be fine at $30-35 silver.

Naturally, we find ourselves in a sweet spot for silver stocks, where share prices are starting to reflect higher metal prices, but haven’t yet priced in the leveraged effect of future cash flows.

At Silver Advisor, Peter Krauth and I cover best-in-class silver stocks positioned to thrive in this higher silver price environment – one that, in our view, still holds significant upside potential.

So, if you’re looking to ride the wave of this generational gold and silver bull market, we at Silver Advisor — together with our esteemed colleague Jeff Clark at Gold Advisor — have you covered.

As always, read our disclaimer here.

Courtesy of The Gold Advisor

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE