SUPERIOR GOLD REPORTS FIRST QUARTER 2023 RESULTS

Superior Gold Inc. (TSX-V: SGI) (OTCQX: SUPGF) announces financial results for the first quarter of 2023 for the Company’s 100%-owned Plutonic Gold Operations, located in Western Australia.

First Quarter Highlights

- Production of 14,437 ounces of gold, with sales of 14,351 ounces of gold in Q1 2023.

- Underground production tonnage mined of 234kt, exceeding the quarterly production rates over the last two years.

- Leading underground key performance indicators continued to improve for the quarter relative to Q1 2022:

- Development for the first quarter was 1,853m, exceeding Q1 2022 by 13%;

- Production drilling for the first quarter was 41,371m, exceeding Q1 2022 by 7%; and

- Stope grade of 2.41 g/t gold was 6% below Q1 2022, a result of stope sequencing

- Announced the entering into of a unanimously Board approved arrangement agreement with Catalyst Metals Limited (“Catalyst”) whereby Catalyst would acquire the common shares of the Company, representing a premium of 62% to the closing price of Superior shares on the day prior to the announcement (February 22, 2023). See news release dated May 16, 2023 for the merits of the transaction.

- Secured a C$5 million standby loan financing with Auramet International during the quarter which was drawn down subsequent to the end of the quarter to improve short term liquidity and for transactional related costs.

- All-in sustaining costs1 of $1,969 per ounce sold, a decrease of 6% compared to the fourth quarter of 2022 as the Company continues to focus on its operational improvement program initiated in third quarter of 2022.

| 1 For Non-IFRS Measures noted above and included elsewhere in this news release, refer to the Non-IFRS measures section of the Company’s MD&A for a description of these measures. . |

Chris Jordaan, President and CEO of Superior Gold stated: “The Company remained focused on improving its leading key performance indicators during the first quarter of 2023. Development and production drilling rates remain on a positive trajectory since we ceased open pit operations in order to re-focus on the underground.

Importantly, drilled stocks increased by approximately five-fold to 95,466t compared to the end of Q4 2022. Development and production drilling rates along with improved stock inventories were delivered to plan and were much improved over 2022 levels. In addition, these initiatives have led to improving underground production from 11,923 ounces in Q4 2022 to 14,329 in Q1 2023, a 20% improvement. By continuing to focus on these leading performance indicators the Company expects to improve its operational flexibility throughout the remainder of 2023.

Plutonic requires consistent drilling and development and we are starting to see the benefits of the operational improvement program implemented in the fourth quarter of 2022. April production was 5,818oz of gold with sales of 5,783oz, delivering improved performance and cash flow. In April 2023, 87,547t of total ore were mined at an overall grade of 2.41g/t with a stope grade of 2.53g/t. The improved development rates, drilled stocks and ability to truck the ore to surface have all contributed to this performance as we continue to implement the Plutonic Operational Improvement Program.

We continue to advance work on the transaction with Catalyst for the scheduled special meeting of shareholders for June 26, 2023.”

Summary of Operational and Financial Results:

Operational details for the last three quarters are summarized in the table below:

| Operating Parameters1 | Three Months Ended

Mar 31, 2023 |

Three Months Ended

Dec 31, 2022 |

Three Months Ended

Sept 30, 2022 |

| Stope material mined (Tonnes) | 197,600 | 153,951 | 148,980 |

| Stope grade mined (g/t Au) | 2.41 | 2.41 | 2.62 |

| Stope production drilling (metres) | 41,371 | 46,382 | 22,466 |

| Development material mined (Tonnes) | 36,187 | 57,519 | 29,020 |

| Development grade mined (g/t Au) | 1.28 | 0.99 | 0.82 |

| Development metres | 1,853 | 1,971 | 1,608 |

| Surface material milled (Tonnes) | 7,588 | 138,143 | 261,437 |

| Surface material grade (g/t Au) | 0.52 | 0.67 | 0.65 |

| Total material milled (Tonnes) | 246,439 | 359,900 | 438,987 |

| Grade milled (g/t Au) | 2.14 | 1.46 | 1.32 |

| Gold recovery (%) | 85 % | 86 % | 86 % |

| Gold Produced (ounces) | 14,437 | 14,448 | 15,946 |

| Gold Sold (ounces)2 | 14,351 | 14,794 | 14,875 |

| Total cash costs ($/ounce)3 | $1,827 | $1,964 | $1,789 |

| All-in sustaining costs ($/ounce)3 | $1,969 | $2,091 | $1,989 |

| 1 Numbers may not add due to rounding. | |||

| 2 Difference between produced and sold is due to timing of sales vs production for the period. | |||

| 3 For Non-IFRS Measures noted above and included elsewhere in this news release, refer to the Non-IFRS measures section of the Company’s MD&A for a description of these measures. | |||

Financial details for the first quarter of 2023 and comparable quarter of 2022 are summarized in the table below:

| Financial Parameters

All amounts in $ millions except where noted |

Three months

Ended March 31, 2023 |

Three months

Ended March 31, 2022 |

| Revenue | 26,516 | 30,216 |

| Cost of sales | 29,618 | 26,691 |

| General and administrative | 2,237 | 1,465 |

| Operating income (loss) | (5,532) | 1,441 |

| Income (loss) before taxes | (7,331) | 1,281 |

| Net income (loss) | (7,362) | 1,424 |

| Earnings (loss) per share – basic and diluted | (0.06) | 0.01 |

| Adjusted net income (loss)1 | (6,352) | 1,424 |

| Adjusted net income (loss) per share – basic1 | (0.05) | 0.01 |

| Cash flow from operations after working capital changes | (2,189) | 412 |

| Weighted average number of common shares outstanding (basic) | 123,419,989 | 122,888,508 |

| 1 For Non-IFRS Measures noted above and included elsewhere in this news release, refer to the Non-IFRS measures section of the Company’s MD&A for a description of these measures. | ||

Plutonic Gold Operations

The Plutonic Gold Operations produced and sold 14,437 and 14,351 ounces of gold, respectively, for the first quarter of 2023. In comparison, 16,747 and 15,823 ounces of gold were produced and sold, respectively for the first quarter of 2022. The reduction over the comparable prior period in 2022 was primarily a result of lower grade tonnes milled from underground operations and no contribution of tonnages from open pit sources in the first quarter of 2023. During the comparable quarter of 2022, open pit tonnes milled were sourced from the Plutonic East and Perch open pits.

Total cash costs of $1,827/ounce sold were below the realized gold price of $1,846/ounce, while all-in sustaining costs of $1,969/ounce sold were above, for the three-month period ended March 31, 2023. Total cash costs of $1,558/ounce sold and all-in sustaining costs of $1,729/ounce sold were below the realized gold price of $1,910/ounce for the three-month period ended March 31, 2022.

The Company generated a net loss from operations of $5.5 million for the three months ended March 31, 2023 compared operating income of $1.4 million in the comparable period of 2022. The reduction was driven by primarily lower revenue from lower ounces sold, increased depreciation and a reduction in changes in inventory due to a build up of gold in circuit and the timing of sales at the end of the quarter of 2022

2023 Plutonic Operational Improvement Program and April 2023 Comparative Results

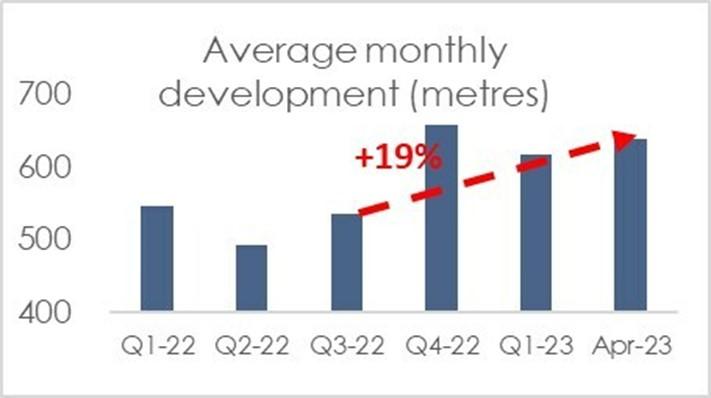

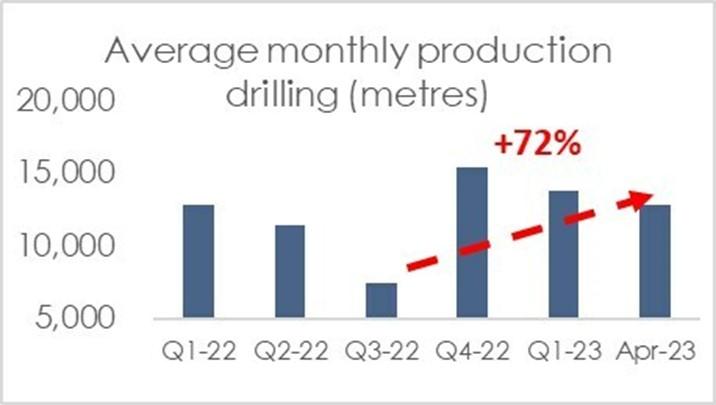

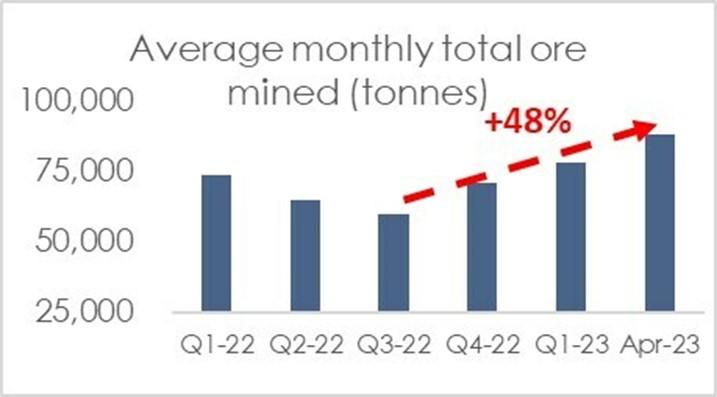

During the fourth quarter of 2022, the Company suspended open-pit mining operations and focused solely on the underground mine and the key leading performance indicators to target future improved operational results. The key performance drivers identified included: i) a commitment to further improving safety performance, ii) a drive to improve development rates to improve access to an increased number of stopes and at higher grades, iii) increased production drilling rates, iv) improved underground drilled and broken stock, and v) improved underground unit mining costs. The following figures illustrate the operation’s key leading performance indicators.

Development rates were 1,853 metres for Q1 2023, down 4% on a daily rate from 1,971 metres achieved in Q4 2022. Rates equivalent to Q4 2022 have been maintained in April. Lower rates were planned for Q1 and Q2, 2023 with the Company ramping up to a target in excess of 2,100metres per quarter later in 2023 given the latest optimised mine planning and schedules.

Production drilling rates were 41,371 metres for Q1 2023, down from 46,382 in the fourth quarter, but remain well above the rates achieved during the COVID impacted quarters of Q2 and Q3 2022. Rig availability was impacted in the latter half of Q1 and into April, however, the Company is commissioning a rental unit in May to improve rates. Higher productivity from the drill rigs in operation has contributed to an uplift in stope tonnes liberated per metre of long hole drilling and at these demonstrated rates, the Company revised the monthly target to between 18,000-18,500m/month.

Total underground ore mined has increased markedly from Q3 2022. Continued improvements has resulted in an increase in total ore mined to 89,958 tonnes for April, a 15% improvement over the Q1 2023 and a 27% increase relative to Q4 2022 average monthly rate.

Qualified Person

The scientific and technical information in this news release has been reviewed and approved by Ettienne Du Plessis, who is a “qualified person” as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects. Mr. Du Plessis is not independent of the Company within the meaning of NI 43-101.

About Superior Gold

Superior Gold is a Canadian-based gold producer that owns 100% of the Plutonic Gold Operations located in Western Australia. The Plutonic Gold Operations include the Plutonic underground gold mine and central mill, numerous open-pit projects, and an interest in the Bryah Basin joint venture. Superior Gold is focused on expanding production at the Plutonic Gold Operations and building an intermediate gold producer with superior returns for shareholders.

Figure 1. (CNW Group/Superior Gold Inc.)

Figure 2. (CNW Group/Superior Gold Inc.)

Figure 3. (CNW Group/Superior Gold Inc.)

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE