Superior Gold Reports 10% Increase in Second Quarter Gold Production to 19,356 Ounces

Superior Gold Inc. (TSX-V:SGI) announced detailed production results for the second quarter of 2021 for the Company’s 100%-owned Plutonic Gold operations, located in Western Australia.

Second Quarter Highlights

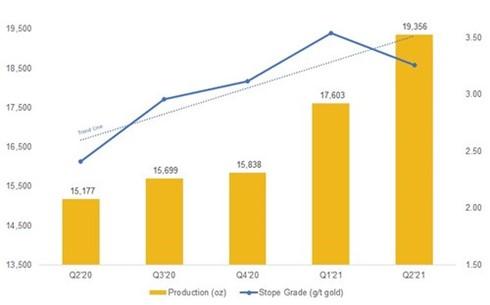

- Production of 19,356 ounces, a 10% increase over the prior quarter and 28% increase over the prior year period

- Stope grade of 3.3 g/t gold in the second quarter as the Company remains on track to target an average stope grade in excess of 3.0 g/t gold for the year

- Commenced open pit mining at Plutonic East on schedule increasing surface feed grade

- Recovery increased to 88% from 86% in the prior quarter as a result of higher head grades due to the contribution of Plutonic East open pit ore

- Continued exploration success including 14.8 g/t gold over 13.4 metres (hole UDD24342) at the Baltic Gap Mining Front1

- Full repayment of Auramet gold loan on schedule which will provide close to $10 million per year in additional cash flow beginning in the third quarter of 20212

- Exited the quarter with a strong financial position of $17.4 million in cash and cash equivalents

- Recorded zero incidences of COVID-19 infection for a sixth consecutive quarter

Chris Jordaan, President and CEO of Superior Gold stated: “We are extremely pleased to report a fourth consecutive quarter of improving production at our Plutonic Gold Operations. Our second quarter production of 19,356 ounces, represents a 10% quarter-over-quarter and 28% year-over-year increase (Figure 1). The strategic projects and operational initiatives that we put in place last year have resulted in a steady improvement in our performance as we continue to target an average underground stope grade in excess of 3.0 g/t gold as well as increase our surface grades by re-commencing open pit mining.

We continue to advance the strategic projects necessary to reposition Plutonic for sustainable, long term success. These projects include the resumption of open pit mining with mining at Plutonic East commencing on schedule during the second quarter. The higher-grade open pit feed in conjunction with opening new high-grade underground mining fronts is expected to result in a continued improvement in our grade profile moving forward. Over the course of the first half of the year, we have provided a number of important exploration updates that continue to point towards the identification of higher-grade stopes on the operational front in the near future. Ongoing geological initiatives have improved our understanding of the mineralization at Plutonic and specifically the northwest trending faults that control the concentration of higher-grade gold mineralization.

These operational improvements plus our improved understanding of the mineralization at Plutonic, combined with the full repayment of our gold loan during the quarter, will result in a significant improvement in our ability to generate free cash flow over the course of 2021 and beyond.”

The Company expects to release its complete financial and operating results for the second quarter in August 2021.

Second Quarter Production Details

Preliminary production details are summarized in the table below.

| Operating Parameters1 | Three Months Ended

March 31,2021 |

Three Months Ended

June 30, 2021 |

Six Months

Ended June 30, 2021 |

| Stope material mined (Tonnes) | 137,191 | 156,006 | 293,197 |

| Stope grade mined (g/t Au) | 3.54 | 3.26 | 3.39 |

| Development material mined (Tonnes) | 49,771 | 56,163 | 105,933 |

| Development grade mined (g/t Au) | 1.30 | 1.63 | 1.47 |

| Surface material milled (Tonnes)2 | 154,089 | 157,520 | 311,609 |

| Surface material grade (g/t Au)2 | 0.41 | 0.58 | 0.50 |

| Total material milled (Tonnes) | 355,678 | 359,403 | 715,081 |

| Grade milled (g/t Au) | 1.78 | 1.90 | 1.84 |

| Gold recovery (%) | 86 | 88 | 87 |

| Gold Produced (ounces) | 17,603 | 19,356 | 36,959 |

| Gold Sold (ounces) | 17,538 | 19,099 | 36,637 |

| Cash and Cash Equivalents ($ million) | 17.9 | 17.4 | 17.4 |

| 1Numbers may not add due to rounding. 2Surface material milled in Q2 2021 includes surface feed from Plutonic East |

|||

Figure 1: Steady Improvement on the Operational Front

Commencement of Open Pit Production on Schedule

As part of the Company’s strategy to expand production and fully utilize the existing infrastructure at the Plutonic Gold Operations, work continued during the second quarter of 2021 on optimizing several potential open pit sources and finalizing resources and scheduling. These open pits are comprised of the Plutonic East, Perch and Salmon pits on the Plutonic Mine property, along with the Hermes and Hermes South open pits to the southwest. The Company began the mining of the Plutonic East open pit in the second quarter as scheduled. The Company aims to utilize the production from these open pits plus the Main Pit push-back, along with operational improvements from the underground, to maximize the Plutonic Gold Operations’ ability to generate significant free cash flow.

Expanding into New Mining Fronts

During the second quarter of 2021, the Company provided an exploration update for the Baltic Gap mining front containing important high-grade drill results from its underground drill program as part of its strategy to expand into new mining fronts, improve mining grades and productivity, and reduce reliance on remnant mining.

The drill results released on June 23, 2021, showed continued growth of the new Baltic Gap mining front, which now extends over an interpreted strike length of 350 metres and up to 200 metres down dip, while remaining open along strike and at depth. The new Baltic Gap mining front is also directly adjacent to existing underground infrastructure, thus requiring minimal capital to develop the area. Results such as drill hole UDD24342, which intersected 14.8 g/t gold over 13.4 metres, give the Company further confidence in mining higher grades at Plutonic in the future.

Results to date support our view that the Baltic Gap is potentially an important new area of production at Plutonic. The Baltic Gap results are now drilled at an average spacing of 20 metres, but are not yet included in our current Mineral Resource estimates.1

_______________________

1 Refer to the Press Release dated June 23, 2021 for additional information.

2 Refer to the Press Release dated June 21, 2021 for additional information.

Qualified Person

Scientific and technical information in this news release has been reviewed and approved by Keith Boyle, P.Eng., Chief Operating Officer of the Company, who is a “qualified person” as defined by NI 43-101. Mr. Boyle is not independent of the Company within the meaning of NI 43-101.

About Superior Gold

Superior Gold is a Canadian based gold producer that owns 100% of the Plutonic Gold Operations located in Western Australia. The Plutonic Gold Operations include the Plutonic underground gold mine and central mill, numerous open pit projects including the Plutonic Main Pit push-back project, the Hermes open pit projects and an interest in the Bryah Basin joint venture. Superior Gold is focused on expanding production at the Plutonic Gold Operations and building an intermediate gold producer with superior returns for shareholders.

MORE or "UNCATEGORIZED"

Silver Mountain Announces Closing of Prospectus Offering

Silver Mountain Resources Inc. (TSX-V: AGMR) (OTCQB: AGMRF) is ... READ MORE

Mandalay Extends the Storheden Gold Deposit Adjacent to the Operating Björkdal Mine

Mandalay Resources Corporation (TSX: MND) (OTCQB: MNDJF) announce... READ MORE

Collective Mining Intercepts 632.25 Metres at 1.10 g/t Gold Equivalent in a 200 Metre Step-Out Hole to the South at Trap

Collective Mining Ltd. (TSX: CNL) (OTCQX: CNLMF) (FSE: GG1) is pl... READ MORE

Koryx Copper Intersects 207 Meters at 0.49% and 116 Meters at 0.54% Copper Equivalent

Significant copper and molybdenum intersections include: HM19: 11... READ MORE

Red Pine Intercepts Significant Mineralization at the Wawa Gold Project, including 5.34 g/t over 13.39 metres including 16.50 g/t gold over 0.97 metre and 13.62 g/t gold over 2.13 metres

Red Pine Exploration Inc. (TSX-V: RPX) (OTCQB: RDEXF) is pleased ... READ MORE