StrikePoint Gold: Hungry for Golden Opportunities in Nevada

With a sharp focus on Nevada, StrikePoint Gold (TSX-V:SKP) (OTCQB:STKXF) continues to develop its assets in the Walker Lane gold trend while divesting its non-core assets. We recently announced on May 8 the sale of our non-core Porter silver asset in BC to Dolly Varden Silver for an all-stock value of C$1.1 million. This non-dilutive financing will support our ongoing exploration efforts that will focus on our Nevada properties.

Meanwhile, a subsidiary of Electrum Group LLC, acquired ground inside and around StrikePoint’s Cuprite project.

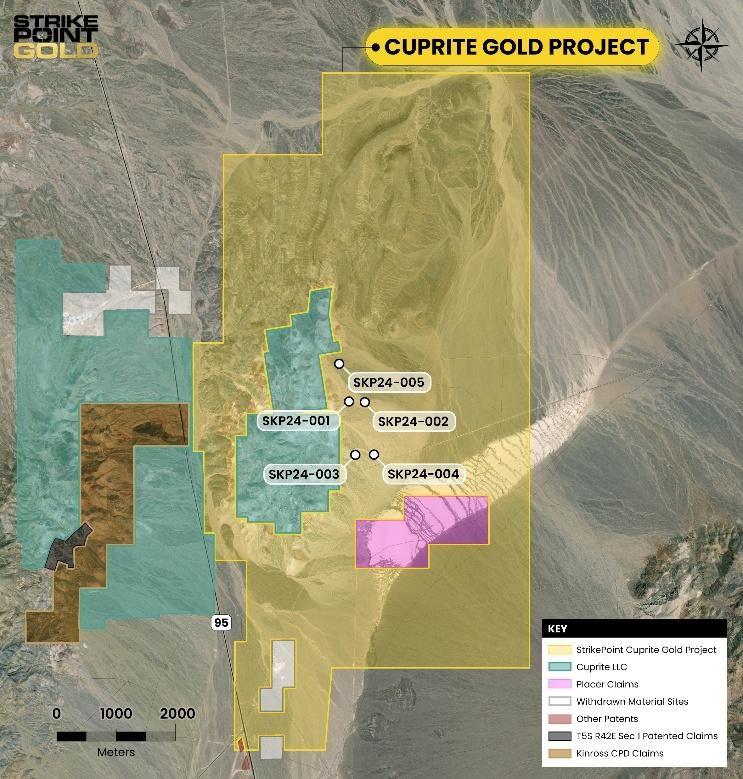

In September of 2024, Electrum Group has acquired 152 claims adjacent to the west of Cuprite and 54- claim of inlier ground (see map below). Electrum is a billion+ dollar gold fund led by Thomas S. Kaplan, a natural resources entrepreneur and investor.

“The recent activity validates our excitement about the Cuprite Gold Project,” says StrikePoint CEO Michael Allen. “Our drill results show that the Cuprite Project hosts a large-scale mineralized system, and others are moving into this emerging gold district in Nevada where StrikePoint has a strong land position.”

Map showing StrikePoint’s Cuprite Project (yellow), with ground held by Electrum (blue) within it and to the west. Imminent drilling is anticipated within Electrum’s “donut hole”, surrounded by StrikePoint’s Cuprite Project.

The Cuprite Gold Project consists of approximately 574 unpatented claims covering approximately 44-square kilometers, located 15-kilometers south of Goldfield Nevada, and 85-kilometers northwest of Beatty. The project is easily accessible by Highway 95 on the western margin of the property. The project is located within the Walker Lane Gold Trend, which hosts Anglogold’s Expanded Silicon Gold (16.6 Moz Au) discoveries approximately 75-kilometers southeast of Cuprite. Cuprite acquired due to its similarities to Silicon, another low sulphidation epithermal system, with mineralization hosted along the margins of a volcanic caldera. The steam heated alteration seen at Cuprite may in fact be larger than at Silicon.

In addition, the Walker Lane hosts Tier 1 gold mines including Kinross’s Round Mountain Mine located approximately 130-kilometers North of Cuprite Gold Project.

In June 2024 SKP completed 5 holes totaling 3,100 meters of reverse circulation drilling at Cuprite. Gold-silver mineralization was found in four of the five holes over approximately 1,600 meters. This includes an economic intercept of 12.19 metres of 0.46 g/t Au and 10.10 g/t Ag.

The mineralization is coincident with the extensive surface mercury anomaly and the geophysical work the company has completed. These results confirm the potential of this epithermal system to host higher grade mineralization. Currently the company evaluating clay alteration in the 3rd dimension to further refining the targets for a potential next phase of drilling targeting higher grade mineralization, perhaps associated with feeder structures on the property.

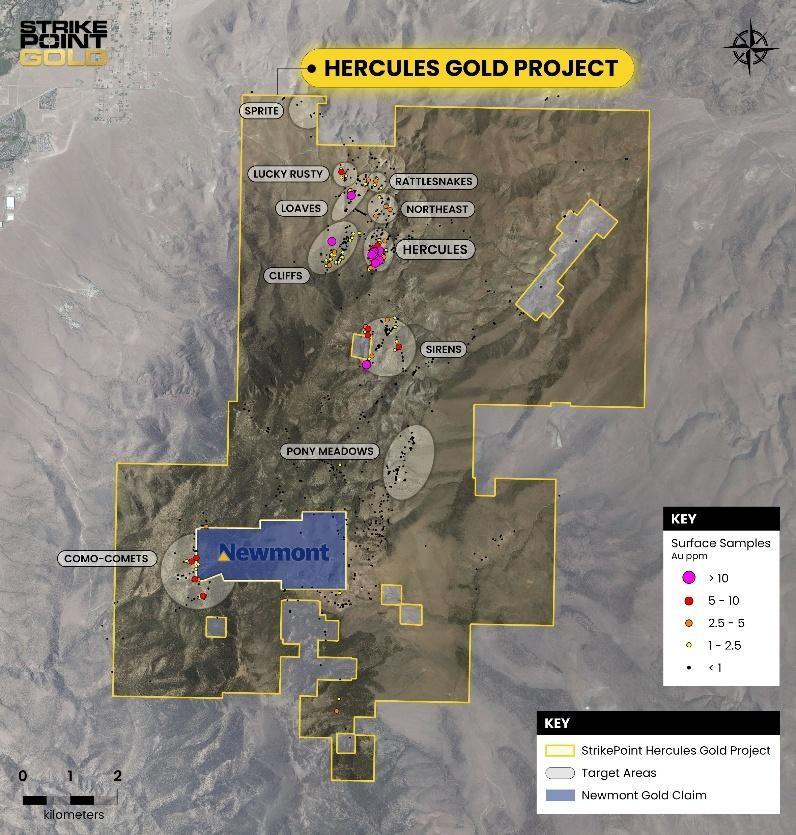

StrikePoint CEO Michael Allen and his team continue to look for additional opportunities for accretive acquisitions or partnership to add shareholder value. Another potential opportunity is the Como Comets target in the southern portion of the Cuprite property. Como Comets, finds itself along strike from another mining giant: Newmont.

Data from the Como Claims include good historical intersections with surface samples from 0 to +3 g/t Au. StrikePoint holds a Notice of Intent permit in place for drilling and continues to evaluate this asset for further exploration, while sharing it is findings with its good neighbour, Newmont.

MORE or "UNCATEGORIZED"

Cerro de Pasco Resources Enters Project Development Funding Agreement with U.S. International Development Finance Corporation for Quiulacocha

Cerro de Pasco Resources Inc. (TSX-V: CDPR) (OTCQB: GPPRF) (BVL: CDPR) announces that it has ... READ MORE

NorthWest Announces Updated Mineral Resource at Kwanika Reflecting Strategic Shift to Higher-Grade Copper-Gold Focus

NorthWest Copper Corp. (TSX-V: NWST) is pleased to announce an updated mineral resource estimate for... READ MORE

Monument Reports Second Quarter Fiscal 2026 Results

Monument Mining Limited (TSX-V: MMY) (FSE: D7Q1) today announced its financial results for the three... READ MORE

Taseko announces First Cathode Harvest at Florence Copper

Taseko Mines Limited (TSX: TKO) (NYSE American: TGB) (LSE: TKO) is pleased to announce its F... READ MORE

Highland Copper Closes Sale of 34% Interest in White Pine for US$30 Million

Highland Copper Company Inc. (TSX-V: HI) (OTCQB: HDRSF) is pleased to announce, further to its press... READ MORE