Strategic Joint Venture With Global Lithium Producer SQM

HIGHLIGHTS

|

Novo Executive Co-Chairman and Acting CEO Mike Spreadborough said, “To be participating in a JV with a global lithium leader like SQM is an excellent outcome for Novo and will see us receive an immediate payment of A$10 million that will further boost cash reserves for our primary gold exploration focus.

“Meanwhile, SQM can focus on the battery metals prospectivity of the West Pilbara area and our shareholders can benefit from future exploration success with a free-carried interest until a decision to mine.

“SQM has been very active in the Western Australian lithium sector with a ~ 19% shareholding in Azure Minerals, and a 50% JV with Wesfarmers in Mt. Holland, that among other investments demonstrates that SQM clearly sees the potential of Western Australia for battery metals, as do we for gold.

“This joint venture expands Novo’s lithium exploration exposure given the existing lithium Quartz Hill JV with Liatam Mining.”

Novo Resources Corp. (ASX: NVO) (TSX: NVO & NVO.WT.A) (OTCQX: NSRPF) is pleased to announce that (though its Australian subsidiaries) it has entered into a tenement sale agreement, joint venture agreement, and coordination agreement with SQM Australia Pty Ltd a wholly owned subsidiary of Sociedad Química y Minera de Chile S.A., in relation to five of Novo’s prospective lithium and nickel exploration tenements in the West Pilbara (Harding Battery Metals JV, HBMJV). The joint venture name reflects the importance of the Harding River to the West Pilbara region.

SQM will pay Novo A$10 million for a 75% interest in the Priority Tenements, and for an option over additional Novo Pilbara exploration tenements, with Novo to retain 25% interest, along with 100% ownership of the gold, silver, PGE, copper, lead and zinc mineral rights. Novo will continue to explore for these minerals across these tenements. Novo’s 25% interest will be free carried by SQM until a decision to mine is made by the HBMJV participants.

Novo will also be entitled to a contingent success payment based on the lithium contained in a JORC compliant ore reserve upon completion of a feasibility study.

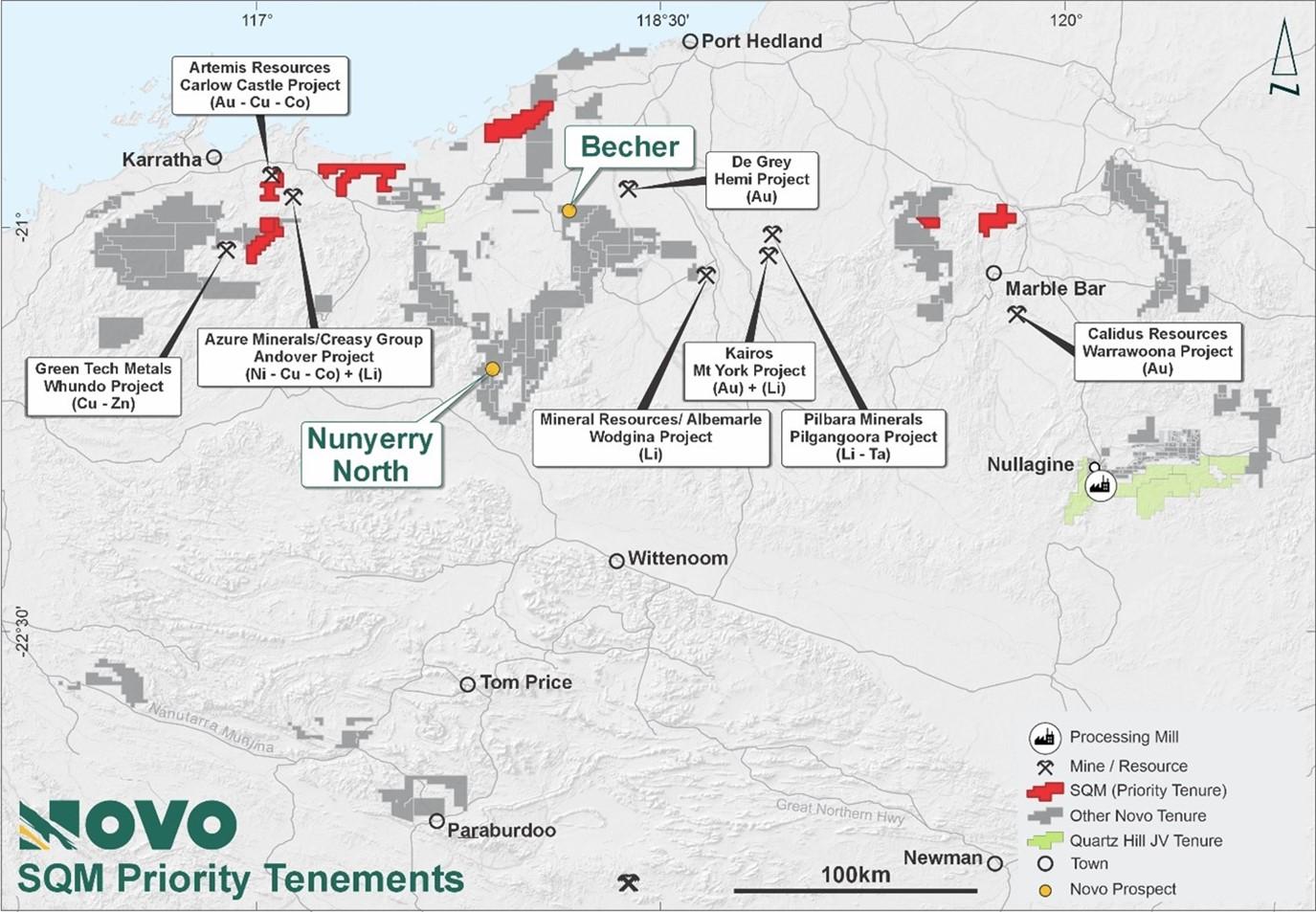

The HBMJV with SQM is a significant milestone for Novo, providing leverage to battery metals discoveries across a package of tenements adjacent to or in the vicinity of Azure Minerals’ Andover Lithium – Nickel Project and Artemis Resources’ Carlow Castle Gold – Copper – Cobalt Project.

Harding Battery Metals Joint Venture (HBMJV) Details

Novo and SQM have entered into a joint venture agreement relating to Novo’s West Pilbara battery metals portfolio where SQM will be the manager HBMJV.

Key transaction details of the joint venture include

- SQM will obtain a 75% interest in the Priority Tenements (refer Appendix), and the option referred to below, upon payment of A$10 million, following which the parties will form an unincorporated joint venture in respect of their respective 75% and 25% interests.

- SQM will have a 12-month option to acquire a 75% interest in additional Novo West Pilbara tenements (Option Tenements) (refer Appendix). Any tenements over which the option is exercised will be held by the HBMJV in the same proportions as the existing HBMJV tenements (75% SQM and 25% Novo).

Price and structure terms

- SQM will acquire a 75% interest in the Priority Tenements for a purchase price comprising of the following payments.

- A$10,000,000 upfront payment.

- A contingent success payment calculated on the tonnes of lithium contained in a JORC compliant ore reserve on which a feasibility study is based.

Additional key terms of the Joint-Venture

- Novo will be free carried by SQM until a decision to mine has been approved by the HBMJV.

- Novo will retain 100% of the gold, silver, PGE, copper, lead and zinc mineral rights and will continue to explore for these minerals across these tenements.

- If SQM exercises the option to acquire an interest in any of the Option Tenements, then SQM must reimburse Novo for reasonable costs incurred by Novo to keep the relevant tenements in good standing during the option period.

- Each party will have a pre-emptive right in respect of any disposal of the other party’s interest in the HBMJV.

Figure 1: Harding Battery Metals JV Priority Tenements

Figure 2: Location of Priority Tenement adjacent to Azure Minerals’

Andover Lithium – Nickel Project2

ABOUT NOVO

Novo explores and develops its prospective land package covering approximately 9,000 square kilometres in the Pilbara region of Western Australia, along with the 22 square kilometre Belltopper project in the Bendigo Tectonic Zone of Victoria, Australia. In addition to the Company’s primary focus, Novo seeks to leverage its internal geological expertise to deliver value-accretive opportunities to its stakeholders.

Priority Tenements

| Tenement | Holder |

| E47/4703 (application only) | Meentheena Gold Pty Ltd |

| E47/1745 | Karratha Gold Pty Ltd |

| E47/3677 | Grant’s Hill Gold Pty |

| E45/3675 | Whim Creek Pty Ltd – beneficially owned by and in process of transfer to Nullagine Gold Pty Ltd |

| E47/3608 | Grant’s Hill Gold Pty Ltd |

Option Tenements

| Tenement | Holder |

| E47/3443 | Karratha Gold Pty Ltd |

| P47/1845 | Grant’s Hill Gold Pty Ltd |

| P47/1846 | Grant’s Hill Gold Pty Ltd |

| P47/1847 | Grant’s Hill Gold Pty Ltd |

| E47/3700 | Grant’s Hill Gold Pty Ltd |

| E47/3713 | Grant’s Hill Gold Pty Ltd |

| E47/4090 (application only) | Karratha Gold Pty Ltd |

| E47/4091 | Karratha Gold Pty Ltd |

| E47/4092 (application only) | Karratha Gold Pty Ltd |

| E47/4116 | Rocklea Gold Pty Ltd |

| E47/3659 | Grant’s Hill Gold Pty Ltd |

| E47/3660 | Grant’s Hill Gold Pty Ltd |

| E45/3724 | Whim Creek Pty Ltd – beneficially owned by and in process of transfer to Nullagine Gold Pty Ltd |

| E45/3952 | Witx Pty Ltd– beneficially owned by and in process of transfer to Nullagine Gold Pty Ltd |

| E45/5282 | Meentheena Gold Pty Ltd |

| E45/4921 | Bamboozler Pty Ltd |

| E45/5281 (application only) | Meentheena Gold Pty Ltd |

| E45/5868 | Grant’s Hill Gold Pty Ltd |

| E45/5329 (application only) | Grant’s Hill Gold Pty Ltd |

| E47/3701 | Grant’s Hill Gold Pty Ltd |

| E47/4041 | Karratha Gold Pty Ltd |

| E47/4012 | Karratha Gold Pty Ltd |

| E47/3779 | Meentheena Gold Pty Ltd |

| E47/3818 | Meentheena Gold Pty Ltd |

| E47/3826 | Karratha Gold Pty Ltd |

| E47/4353 (application only) | Meentheena Gold Pty Ltd |

| E47/4347 | Grant’s Hill Gold Pty Ltd |

| E47/3622 | Grant’s Hill Gold Pty Ltd |

| E47/3778 | Meentheena Gold Pty Ltd |

| E47/3611 | Grant’s Hill Gold Pty Ltd |

| E47/3817 | Meentheena Gold Pty Ltd |

| E47/3615 | Grant’s Hill Gold Pty Ltd |

| E47/3821 | Meentheena Gold Pty ltd |

| E47/3822 | Meentheena Gold Pty Ltd |

__________________________

1 Refer to Azure Minerals Limited ASX announcement dated 10 October 2023. Results referred to in Azure Minerals’ news release are not necessarily representative of mineralisation on Novo’s tenements in the West Pilbara, near Roebourne, Western Australia.

2 No assurance can be given that a similar or any commercially mineable deposit will be determined on Novo’s adjacent tenements.

MORE or "UNCATEGORIZED"

Ascot Announces Closing of C$34 Million Bought Deal Financing

Ascot Resources Ltd. (TSX: AOT) (OTCQX: AOTVF) is pleased to anno... READ MORE

RUA GOLD Closes C$8 Million Brokered Offering and Announces Commencement of Trading on the TSX Venture Exchange

Highlights Closing the fully subscribed brokered offering for C$8... READ MORE

Mosaic Acquires 100% of the Amanda Project

Mosaic Minerals Corporation (CSE: MOC) announces that it has sign... READ MORE

First Phosphate Confirms Significant High-Quality Igneous Phosphate Deposit at Its Bégin-Lamarche Project in the Saguenay-Lac-St-Jean Region, Quebec au Canada

First Phosphate Corp. (CSE: PHOS) (OTC: FRSPF) (FSE: KD0) is ple... READ MORE

PROSPECT RIDGE ANNOUNCES FINAL CLOSING OF ITS OVERSUBSCRIBED PRIVATE PLACEMENT

Prospect Ridge Resources Corp. (CSE: PRR) (OTC: PRRSF) (FRA: OE... READ MORE