Stillwater Critical Minerals Engages Mine Technical Services to Complete an Updated Mineral Resource Estimate at Stillwater West in Montana, USA

Stillwater Critical Minerals Corp. (TSX-V: PGE) (OTCQB: PGEZF) (FSE: J0G) is pleased to announce that it has engaged Mine Technical Services to complete an updated NI 43-101-compliant Mineral Resource Estimate for the Company’s 100%-owned Stillwater West critical minerals project (Ni-Cu-Co-PGE-Au) in Montana, USA.

Highlights

- The updated Mineral Resource Estimate is expected in H1 2026 and will mark the next step in advancing Stillwater West as a potential large-scale source of ten minerals listed as critical in the U.S.

- Stillwater West hosts nickel, copper, cobalt, chromium, platinum, palladium, rhodium, ruthenium, iridium, gold, and osmium — a unique mix of battery, alloy, and platinum group metals essential to clean energy, defense, and technology supply chains.

- The update will build on the January 25, 2023, Inferred Mineral Resource estimate as detailed below.

- Results will support further technical studies and economic assessments.

- MTS has completed a site visit and is updating deposit models to incorporate new data, improved geologic domaining, geostatistics, and structural controls — leveraging insights from the Platreef district in South Africa.

- The work is being led by Mr. Timothy Kuhl (MTS) and Dr. Danie Grobler (Stillwater) who together previously worked with the late Dr. Harry Parker on the resource estimation and technical reports for Ivanhoe Mines’ Platreef Mine.

- The updated MRE will incorporate 14 drill holes totaling 5,781 meters (“m”) from the 2023 and 2025 programs, plus select historic holes not included in the current estimate.

- The 2025 drill campaign is now complete, totaling 3,471m in eight holes, with all assays pending.

President and CEO, Michael Rowley commented, “Reuniting the team responsible for defining the large-scale polymetallic critical mineral resources at Ivanhoe’s Platreef Mine to complete an updated resource estimate is an important step towards evaluating production scenarios at Stillwater West. With platinum, palladium, rhodium and gold all demonstrating strong recent market performance, Stillwater West offers significant leverage to these precious metals. Based on the Company’s current NI 43-101 Mineral Resource estimate, Stillwater owns one of the largest development-stage PGM (Pt, Pd, Rh, Au) resources in the United States. Our work applying those robust mine models to similar geology in Montana is timely given America’s focus on securing domestic supplies of the commodities we have at Stillwater West. We continue to have a very positive reception from all levels of government and look forward to updates on all activities in the near term.”

VP Exploration, Dr. Danie Grobler, added “I am pleased to collaborate again with Tim Kuhl and the MTS team on the updated Stillwater resource estimate. Their extensive experience in Platreef-type geology and resource estimation is expected to provide significant value to the project. The revised estimate will incorporate data from the previous two drilling campaigns and will reflect advances in our understanding of the lower Stillwater complex, informed by recent geophysical surveys and geological modelling. Recent exploration drilling and airborne geophysical surveys substantially enhanced our target generation and prioritization for the 2025 expansion drill campaign, resulting in the successful intersection of multiple near-surface magmatic sulphide zones in all three target areas. We look forward to reporting drill results and potentially extending resource areas at Iron Mountain and Chrome Mountain accordingly.”

Current Mineral Resources of Critical Minerals at Stillwater West

The current MRE1 positions Stillwater West with a NI 43-101 resource of eight minerals listed as critical by the U.S. government in a historic and actively producing American mining district. The January 2023 MRE is contained within five deposits in the 9.5-kilometer central area of the project, all of which are open along strike and at depth. Excellent expansion potential has been identified in multi-kilometer scale geophysical targets and metal-in-soil anomalies within the 20-kilometer length area now modeled in detail by the Company. Untested anomalies and earlier stage targets extend beyond this area, across much of the 33-kilometer-long Stillwater West project.

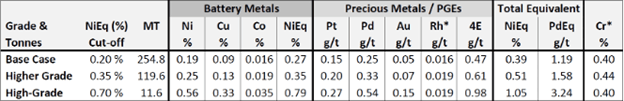

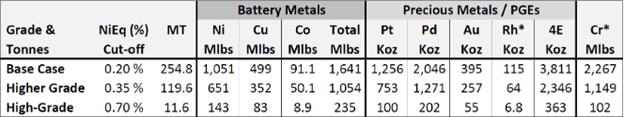

The current MRE presents base case mineralization at a 0.20% NiEq cut-off with higher-grade mineralization at 0.35% and 0.70% NiEq cut-off as detailed in Tables 1 and 2:

TABLE 1 – Grade at Three NiEq Cut-off Grades

Stillwater West Inferred Mineral Resource Estimate, as Released January 25, 20231

TABLE 2 – Contained Metal at Three NiEq Cut-off Grades

Stillwater West Inferred Mineral Resource Estimate, as Released January 25, 20231

Notes:

1) As released January 25, 2023 and available in the Technical Report referenced in Footnote 1.

2) Inferred Mineral Resources are reported at a base case cut-off grade of 0.20% NiEq. Values in this table reported above the cut-off grades are only presented to show the sensitivity of the block model estimates to the selection of cut-off grade. Equivalent grade and contained metal calculations do not include Rhodium and Chromium values as denoted by *.

3) All figures are rounded to reflect the relative accuracy of the estimate. Totals may not add or calculate exactly due to rounding.

4) Mineral Resources are reported at a base case cut-off grade of 0.20% NiEq using metal prices of $9.00/lb Ni, $3.75/lb Cu, $24.00/lb Co, $1,000/oz Pt, $2,000/oz Pd and $1,800/oz Au, assumed metal recoveries of 80% for Ni, 85% for copper, 80% for Co, Pt, Pd and Au, a mining cost of US$2.50/t rock and processing and G&A cost of US$18.00/t mineralized material.

Expansion of mineralization in the higher and high-grade zones of mineralization has been a primary objective of the 2025 drill campaign.

Eight critical minerals are defined in the current MRE:

- Nickel – Nickel is primarily used in stainless steel and superalloys, with rapidly growing demand from the electric vehicle battery sector. Current global supply is dominated by Chinese-backed operations in Indonesia, with Russia also playing a significant role in the market.

- Copper – Copper is a cornerstone of the U.S. clean energy and technology supply chain — vital not only for electric vehicles and renewable power but increasingly for AI data centers, cloud computing, high-performance electronics, and the national electric grid modernization.

- Cobalt – Cobalt is a critical element in lithium-ion battery chemistries, particularly for high-performance and energy-dense applications. Recent U.S. government support for domestic cobalt production reflects its strategic importance, as most current supply is concentrated in the Democratic Republic of Congo.

- Palladium – Palladium is a key component in automotive catalytic converters, playing a vital role in reducing emissions from internal combustion engines. Demand remains robust, supported by global emissions regulations. Russia is a major global supplier, contributing to market volatility and supply risk.

- Platinum – Platinum is used in catalytic converters, hydrogen fuel cells, and various industrial applications, with growing interest in green hydrogen technologies. Supply is concentrated in South Africa and Russia, making diversification of sources increasingly important.

- Rhodium – Stillwater West hosts the largest known rhodium resource in the U.S. This ultra-rare metal is critical for high-performance catalytic converters. With extremely limited global production and high price volatility, rhodium remains a high-value strategic metal. See Stillwater news release dated November 4, 2024, for historical context and significance.

- Gold – Gold provides significant by-product potential. It remains a globally recognized store of value and is widely used in jewelry, investment products, and central bank reserves.

- Chromium – Stillwater West hosts the largest known chromium resource in the U.S. Chromium (chrome) is primarily used in stainless steel production and corrosion-resistant alloys. It is classified as a critical mineral in several jurisdictions due to its essential industrial uses and limited supply chain diversity. Strategic value is enhanced by growing demand for infrastructure and defense applications. Stillwater is evaluating its inclusion in formal mining plans.

Stillwater West also contains yet-to-be inventoried quantities of other rare platinum group metals including ruthenium and iridium, both listed as critical in the U.S., as well as osmium.

As the U.S. government prioritizes domestic production of energy transition metals under initiatives like the Defense Production Act and FAST-41, the role for these critical metals has expanded from traditional infrastructure to powering the next generation of digital, defense, and clean energy technologies.

Near-Term Outlook

The Company anticipates the following key milestones and updates through the first half of 2026:

- Results from the 2025 drill program, including assays and interpretations from priority target areas.

- Updated 3D geological and mineralization models integrating new drilling, geophysics, and surface data.

- An updated MRE for the Stillwater West project, incorporating 20232 and 2025 drilling results and new modeling work.

- Updates on non-core assets across North America.

- Updates on U.S. government initiatives.

Upcoming Events

Michael Rowley, President and CEO of Stillwater, is scheduled to attend the following events. Additional events will be announced as confirmed.

- Red Cloud Fall Showcase – Toronto, Canada, November 4-5, 2025. For information, click here.

- Precious Metals Summit – Zurich, Switzerland, November 10-11, 2025. For information, click here.

- AEMA’s Annual Meeting – Sparks, Nevada, December 7-12, 2025. For information, click here.

- VRIC 2026 – Vancouver, Canada – January 25-26, 2026. For information, click here.

- AMEBC Round Up – Vancouver, Canada – January 26-29, 2026. For information, click here.

- PDAC 2026 – Toronto, Canada, March 1-4, 2026. For information, click here.

- Swiss Mining Institute Conference – Zurich, Switzerland, March 18-19, 2026. For information, click here.

About Stillwater Critical Minerals Corp.

Stillwater Critical Minerals is a mineral exploration and development company focused on its flagship Stillwater West Ni-PGE-Cu-Co + Au project in the iconic and famously productive Stillwater mining district in Montana, USA. With the addition of two renowned Bushveld and Platreef geologists to the team and strategic investments by Glencore plc, the Company is well positioned to advance the next phase of large-scale critical mineral supply from this world-class American district, building on past production of nickel, copper, and chromium, and the on-going production of platinum group, nickel, and other metals by neighboring Sibanye-Stillwater. An expanded NI 43-101 Mineral Resource Estimate, released January 2023, positions Stillwater West with the largest nickel-platinum group element resource in an active U.S. mining district as part of a compelling suite of eight minerals now listed as critical in the USA.

Stillwater also holds a 49% interest in the high-grade Drayton-Black Lake-gold project adjacent to Nexgold Mining’s development-stage Goliath Gold Complex in northwest Ontario, currently under an earn-in agreement with Heritage Mining, and the Kluane PGE-Ni-Cu-Co critical minerals project on trend with Nickel Creek Platinum‘s Wellgreen deposit in Canada‘s Yukon Territory. The Company also holds the Duke Island Cu-Ni-PGE property in Alaska and maintains a back-in right on the high-grade past-producing Yankee-Dundee in BC, following its sale in 2013.

Footnotes: Stillwater West Inferred Mineral Resource Estimate

- See news release dated January 25, 2023 and associated NI 43-101 Technical Report dated March 14, 2023, entitled “Mineral Resource Estimate Update for the Stillwater West Ni-PGE-Cu-Co-Au Project, Montana, USA”, with an effective date of January 20, 2023. The Mineral Resources were estimated by Allan Armitage, Ph.D., P.Geo of SGS Geological Services who is an independent Qualified Person. The Technical Report is available on the company website at www.criticalminerals.com and under the Company’s profile at www.sedarplus.ca.

- See news release dated June 26, 2024 entitled Stillwater Critical Minerals Drills Wide and High-Grade Nickel, Platinum, and Palladium Mineralization in Resource Expansion Drilling at Stillwater West in Montana, USA for the 2023 drill campaign results.

Quality Control and Quality Assurance

Mr. Mike Ostenson, P.Geo., is the qualified person for the purposes of National Instrument 43-101, and he has reviewed and approved the technical disclosure contained in this news release. Mr. Ostenson is a Geologist at Stillwater and is not independent of the Company.

MORE or "UNCATEGORIZED"

Cerro de Pasco Resources Enters Project Development Funding Agreement with U.S. International Development Finance Corporation for Quiulacocha

Cerro de Pasco Resources Inc. (TSX-V: CDPR) (OTCQB: GPPRF) (BVL: CDPR) announces that it has ... READ MORE

NorthWest Announces Updated Mineral Resource at Kwanika Reflecting Strategic Shift to Higher-Grade Copper-Gold Focus

NorthWest Copper Corp. (TSX-V: NWST) is pleased to announce an updated mineral resource estimate for... READ MORE

Monument Reports Second Quarter Fiscal 2026 Results

Monument Mining Limited (TSX-V: MMY) (FSE: D7Q1) today announced its financial results for the three... READ MORE

Taseko announces First Cathode Harvest at Florence Copper

Taseko Mines Limited (TSX: TKO) (NYSE American: TGB) (LSE: TKO) is pleased to announce its F... READ MORE

Highland Copper Closes Sale of 34% Interest in White Pine for US$30 Million

Highland Copper Company Inc. (TSX-V: HI) (OTCQB: HDRSF) is pleased to announce, further to its press... READ MORE