STEP OUT DRILLING AT PANUCO EXPANDS THE SAN ANTONIO VEIN ALONG STRIKE AND DOWN DIP

Vizsla Silver Corp. (TSX-V: VZLA) (NYSE: VZLA) (Frankfurt: 0G3) is pleased to report results from seven new drill holes targeting the San Antonio vein along the Cordon del Oro Vein Corridor, at its 100%-owned, flagship Panuco silver-gold project located in Mexico. The results expand mineralization at the San Antonio Vein beyond the boundary of the March 2022 maiden resource estimate by over 100 metres along strike and down dip.

Highlights

- CO-22-51 returned 992 g/t AgEq over 6.40 mTW (621 g/t silver and 5.76 g/t gold)

- CO-22-53 returned 281 g/t AgEq over 7.50 mTW (213 g/t silver and 1.15 g/t gold)

- CO-22-54 returned 676 g/t AgEq over 4.50 mTW (549 g/t silver and 2.29 g/t gold)

- CO-22-56 returned 671 g/t AgEq over 2.00 mTW (355 g/t silver and 4.75 g/t gold)

- Acquisition of a key inset claim to control the entire 1,800m length of the San Antonio vein

“Vizsla continues to test target areas in the Central portion of the district in parallel with resource growth at Napoleon and Tajitos-Copala”, commented Michael Konnert, President and CEO. “These wide, high-grade intersections announced today are the reward for this strategy, with San Antonio demonstrating that the Cordon del Oro Corridor has significant potential to become another important resource centre at Panuco. Drilling has now expanded San Antonio mineralization outside of the maiden resource by over 100 metres in both strike length and depth, underpinned by a high-grade precious metal rich shoot, which remains open. Furthermore, the acquisition of a key inset claim now provides Vizsla with an additional approximately 250 metres of mapped vein strike to be explored with drilling, which hosts historic workings and multiple high-grade surface results. At the district scale, even with the rapid pace of discoveries and resource growth, today’s results reinforce that only a small percentage of the identified targets on the Project have been drilled and that Vizsla remains in the initial stages of defining Panuco’s full silver and gold endowment.”

About the San Antonio Vein

The Cordon del Oro Vein Corridor is a fault-vein zone located in the central portion of the district that trends roughly north-northwest and dips moderately to the east. Mapping and sampling have traced the main structure over approximately 7.6 km of strike length, with local widths exceeding 15 meters. Cordon del Oro is one of the major northwest trending vein corridors at Panuco and is interpreted to be exposed at a shallower level of erosion compared to that of Napoleon and Tajitos. Artisanal-scale mining has occurred within the corridor along select high-grade mineralized shoots, however, Vizsla is not aware of any drilling completed by previous operators testing mineralization at depth. Company geologists suspect that the intermittent silver and gold mineralization encountered at shallow levels in the epithermal system deterred historic miners from going deeper and believe the potential for preserved mineralization at depth remains high.

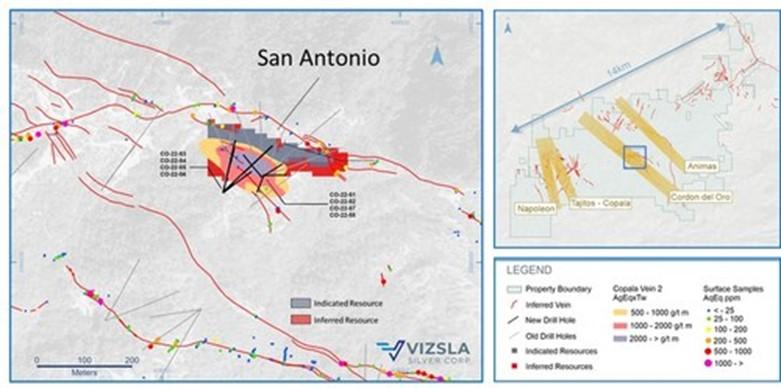

The San Antonio Vein represents a splay off the main Cordon del Oro Vein and currently hosts an estimated in-situ indicated resource of 0.2Moz AgEq grading 210 g/t AgEq and an in-situ inferred resource of 0.2Moz AgEq grading 186 g/t AgEq (The Technical Report, titled “National Instrument 43-101 Technical Report for the Panuco Project Mineral Resource Estimate Concordia, Sinaloa, Mexico” was filed on SEDAR on April 7, 2022, has an effective date of March 1, 2022 and was prepared in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) by Tim Maunula, P.Geo., Principal Geologist, T. Maunula & Associates Consulting Inc and Kevin Murray, P.Eng, Manager Process Engineering, Ausenco).

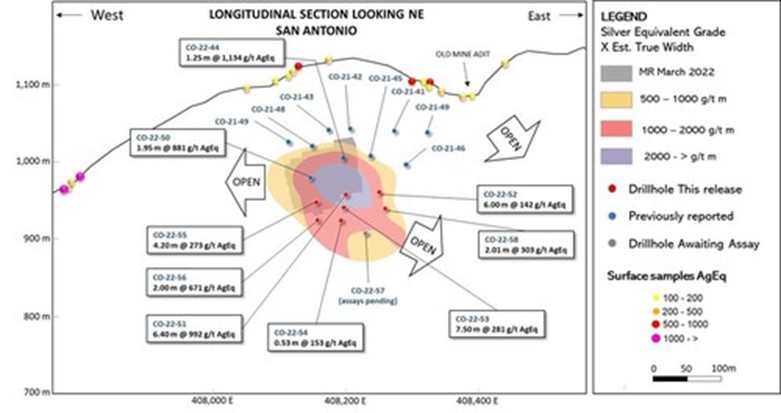

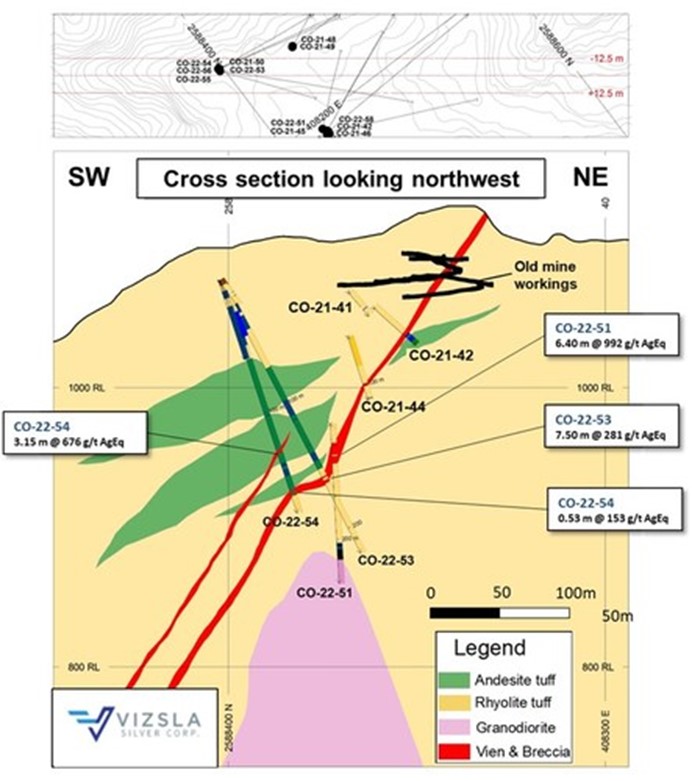

The San Antonio Vein has now been traced over 325 metres along strike and to a depth of 300 m below surface. The Vein is predominantly hosted by rhyolite tuffs and is composed of banded and massive epithermal quartz. Previously reported intercepts returned up to 705 g/t Ag and 6.64 g/t Au (1,283 g/t AgEq) over 2.07 metres at shallow elevations (less than 100 metres below surface) (see press release dated July 28, 2021).

Today’s reported intercepts confirm the continuity of high-grade mineralization down dip to the east – southeast, outlining a high-grade shoot with dimensions of over 200 metres by 150 metres. The Company plans to continue exploring the mineralized shoot along trend of the high grades both to the east and west, where surface sampling has returned values up to 4,244 g/t AgEq.

Claim Acquisition

Vizsla recently acquired the San Antonio claim (7 Ha) situated on the central portion of the San Antonio Vein. This acquisition allows for ongoing exploration to continue immediately west of open, high-grade drill intercepts and results in the Company owning 100% of the entire, 1,800 metre strike length of San Antonio vein. The Company plans to mobilize a second drill rig in August to test the full extent of mineralization along both the San Antonio Vein and greater Cordon del Oro Corridor.

| Drillhole | From | To | Downhole Length |

Estimated True Width |

Ag | Au | AgEq | Comments | ||

| (m) | (m) | (m) | (m) | (g/t) | (g/t) | (g/t) | ||||

| CO-22-51 | 129.35 | 144.55 | 15.20 | 6.40 | 621 | 5.76 | 992 | San Antonio | ||

| Inc. | 139.10 | 140.45 | 1.35 | 0.57 | 2,940 | 34.20 | 5,195 | |||

| Inc. | 140.45 | 141.80 | 1.35 | 0.57 | 1,410 | 16.25 | 2,481 | |||

| CO-22-52 | 129.60 | 141.20 | 11.60 | 6.00 | 124 | 0.37 | 142 | San Antonio | ||

| Inc. | 129.60 | 130.90 | 1.30 | 0.67 | 538 | 1.19 | 586 | |||

| Inc. | 140.70 | 141.20 | 0.50 | 0.26 | 196 | 0.51 | 219 | |||

| And | 154.20 | 163.65 | 9.45 | 4.89 | 122 | 0.60 | 156 | FW Splay | ||

| Inc. | 154.20 | 155.10 | 0.90 | 0.47 | 131 | 1.07 | 198 | |||

| Inc. | 155.10 | 155.90 | 0.80 | 0.41 | 240 | 1.41 | 325 | |||

| Inc. | 156.85 | 157.80 | 0.95 | 0.49 | 183 | 0.80 | 227 | |||

| Inc. | 157.80 | 159.25 | 1.45 | 0.75 | 190 | 0.87 | 239 | |||

| CO-22-53 | 153.05 | 164.25 | 11.20 | 7.50 | 213 | 1.15 | 281 | San Antonio | ||

| Inc. | 161.85 | 162.75 | 0.90 | 0.60 | 908 | 4.02 | 1,134 | |||

| Inc. | 163.40 | 164.25 | 0.85 | 0.57 | 750 | 4.04 | 988 | |||

| CO-22-54 | 127.50 | 132.00 | 4.50 | 3.15 | 549 | 2.29 | 676 | HW Splay | ||

| Inc. | 129.50 | 130.95 | 1.45 | 1.01 | 1,250 | 4.96 | 1,519 | |||

| And | 159.50 | 160.25 | 0.75 | 0.53 | 87 | 1.00 | 153 | San Antonio | ||

| CO-22-55 | 127.50 | 129.30 | 1.80 | 1.54 | 165 | 0.71 | 205 | HW Splay | ||

| CO-22-55 | 142.75 | 147.65 | 4.90 | 4.20 | 202 | 1.19 | 273 | San Antonio | ||

| Inc. | 144.80 | 145.60 | 0.80 | 0.69 | 475 | 2.99 | 657 | |||

| CO-22-56 | 167.55 | 170.45 | 2.90 | 2.00 | 355 | 4.75 | 671 | San Antonio | ||

| Inc. | 169.00 | 170.45 | 1.45 | 1.00 | 578 | 7.95 | 1,110 | |||

| CO-22-58 | 154.90 | 157.65 | 2.75 | 2.01 | 226 | 1.29 | 303 | San Antonio | ||

| Inc. | 154.90 | 156.00 | 1.10 | 0.80 | 414 | 2.47 | 563 | |||

| Table 1: Downhole drill intersections from the holes completed along the San Antonio vein in the Cordon Colorado Vein Corridor. | ||||||||||

| Note: AgEq = Ag g/t x Ag rec. + (Au g/t x Au Rec x Au price/gram)/Ag price/gram. Metal price assumptions are $20.70/oz silver and $1,655/oz gold and metallurgical recoveries assumed are 93% for silver and 90% for gold. Gold and silver metallurgical recoveries used in this release were estimated for the Napoleon vein (see press release dated February 17, 2022). | ||||||||||

| Drillhole | Easting | Northing | Elevation | Azimuth | Dip | Depth |

| CO-22-51 | 408,207 | 2,588,430 | 1086 | 320 | -77 | 258 |

| CO-22-52 | 408,213 | 2,588,431 | 1086 | 57 | -77 | 216 |

| CO-22-53 | 408,121 | 2,588,380 | 1100 | 48 | -62 | 302 |

| CO-22-54 | 408,121 | 2,588,380 | 1100 | 53 | -70 | 218 |

| CO-22-55 | 408,122 | 2,588,384 | 1100 | 13 | -64 | 258 |

| CO-22-56 | 408,122 | 2,588,384 | 1100 | 13 | -70 | 279 |

| CO-22-58 | 408,213 | 2,588,432 | 1086 | 91 | -79 | 248 |

| Table 2: San Antonio vein drillhole details. Coordinates in WGS84, Zone 13. | ||||||

Corporate Update

The Company also announces that Stuart Smith has resigned from the Board of Directors to focus his efforts on other professional ventures.

“Stuart’s contributions have been instrumental to Vizsla’s success,” said Michael Konnert, President, and CEO. “On behalf of the Board of Directors, I would like to thank Stuart for his invaluable service over the years and wish him the best of luck in his future endeavours.”

About the Panuco project

The newly consolidated Panuco silver-gold project is an emerging high-grade discovery located in southern Sinaloa, Mexico, near the city of Mazatlán. The 6,761-hectare, past producing district benefits from over 75 kilometres of total vein extent, 35 kilometres of underground mines, roads, power, and permits.

The district contains intermediate to low sulfidation epithermal silver and gold deposits related to siliceous volcanism and crustal extension in the Oligocene and Miocene. Host rocks are mainly continental volcanic rocks correlated to the Tarahumara Formation.

The Panuco Project hosts an estimated in-situ indicated mineral resource of 61.1Moz AgEq and an in-situ inferred resource of 45.6Moz AgEq (see Company news release dated March 1, 2022).

About Vizsla Silver

Vizsla Silver is a Canadian mineral exploration and development company headquartered in Vancouver, BC, focused on advancing its flagship, 100%-owned Panuco silver-gold project located in Sinaloa, Mexico. To date, Vizsla has completed over 140,000 metres of drilling at Panuco leading to the discovery of several new high-grade veins. For 2022, Vizsla has budgeted +120,000 metres of resource/discovery-based drilling designed to upgrade and expand the maiden resource, as well as test other high priority targets across the district.

Quality Assurance / Quality Control

Drill core and rock samples were shipped to ALS Limited in Zacatecas, Zacatecas, Mexico and in North Vancouver, Canada for sample preparation and for analysis at the ALS laboratory in North Vancouver. The ALS Zacatecas and North Vancouver facilities are ISO 9001 and ISO/IEC 17025 certified. Silver and base metals were analyzed using a four-acid digestion with an ICP finish and gold was assayed by 30-gram fire assay with atomic absorption (“AA”) spectroscopy finish. Over limit analyses for silver, lead and zinc were re-assayed using an ore-grade four-acid digestion with AA finish.

Control samples comprising certified reference samples, duplicates and blank samples were systematically inserted into the sample stream and analyzed as part of the Company’s quality assurance / quality control protocol.

Qualified Person

In accordance with NI 43-101, Martin Dupuis, P.Geo., COO, is the Qualified Person for the Company and has reviewed and approved the technical and scientific content of this news release.

Figure 1: Plan map of recent drilling along the eastern end of the San Antonio Vein (CNW Group/Vizsla Silver Corp.)

Figure 2: San Antonio Vein Contour Longitudinal Section. The section is inclined along the dip of the structure. (CNW Group/Vizsla Silver Corp.)

Figure 3: San Antonio cross section with significant intercepts. (CNW Group/Vizsla Silver Corp.)

MORE or "UNCATEGORIZED"

Bonterra Announces Closing of Upsized Brokered Private Placement for Proceeds of $10.5M

Bonterra Resources Inc. (TSX-V: BTR) (OTCQX: BONXF) (FSE: 9BR2) i... READ MORE

ESGold Expands Montauban Mine Building to 4,000 sq. ft. Ahead of Key Operational Milestones

Increased facility footprint reflects advanced construction progr... READ MORE

ARIS MINING COMPLETES INSTALLATION AND COMMISSIONING OF SECOND MILL AT SEGOVIA, ON TIME AND ON BUDGET

Aris Mining Corporation (TSX: ARIS) (NYSE-A: ARMN) announces the... READ MORE

Zodiac Gold Expands Arthington Discovery with Broad Gold Intercepts

Zodiac Gold Inc. (TSXV: ZAU) a West-African gold exploration co... READ MORE

Appia Announces Final Closing of Its Non-Brokered Private Placement

Appia Rare Earths & Uranium Corp. (CSE: API) (OTCQB: APAAF) (... READ MORE