SSR Mining Announces Positive Exploration Results at Puna

Drilling Highlights Include 27 Meters at 836 g/t Ag and 16 Meters at 699 g/t Ag

Near-Mine Exploration Success Presents Opportunity to Extend Mineral Reserves and Mine Life

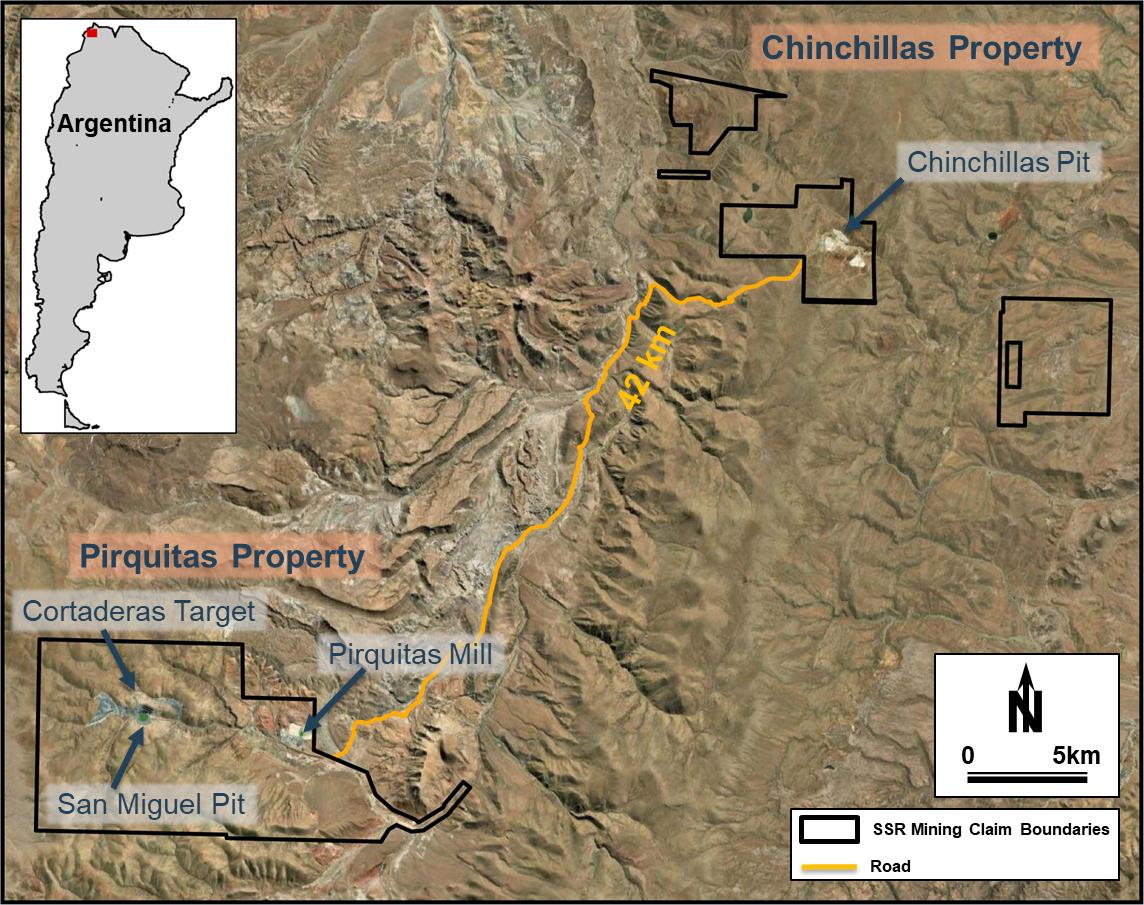

SSR Mining Inc. (TSX: SSRM) (NASDAQ:SSRM) (ASX: SSR) is pleased to announce results from 48 drill holes completed at the Puna project for the period of August, 2022 to December, 2022. Puna includes the Pirquitas and Chinchillas properties, both located in the Jujuy Province of northern Argentina (see Figure 1). Chinchillas is an open pit silver-lead-zinc mine and is the current source of the ore processed at the Pirquitas processing plant, located approximately 42 kilometers southwest of the Chinchillas property.

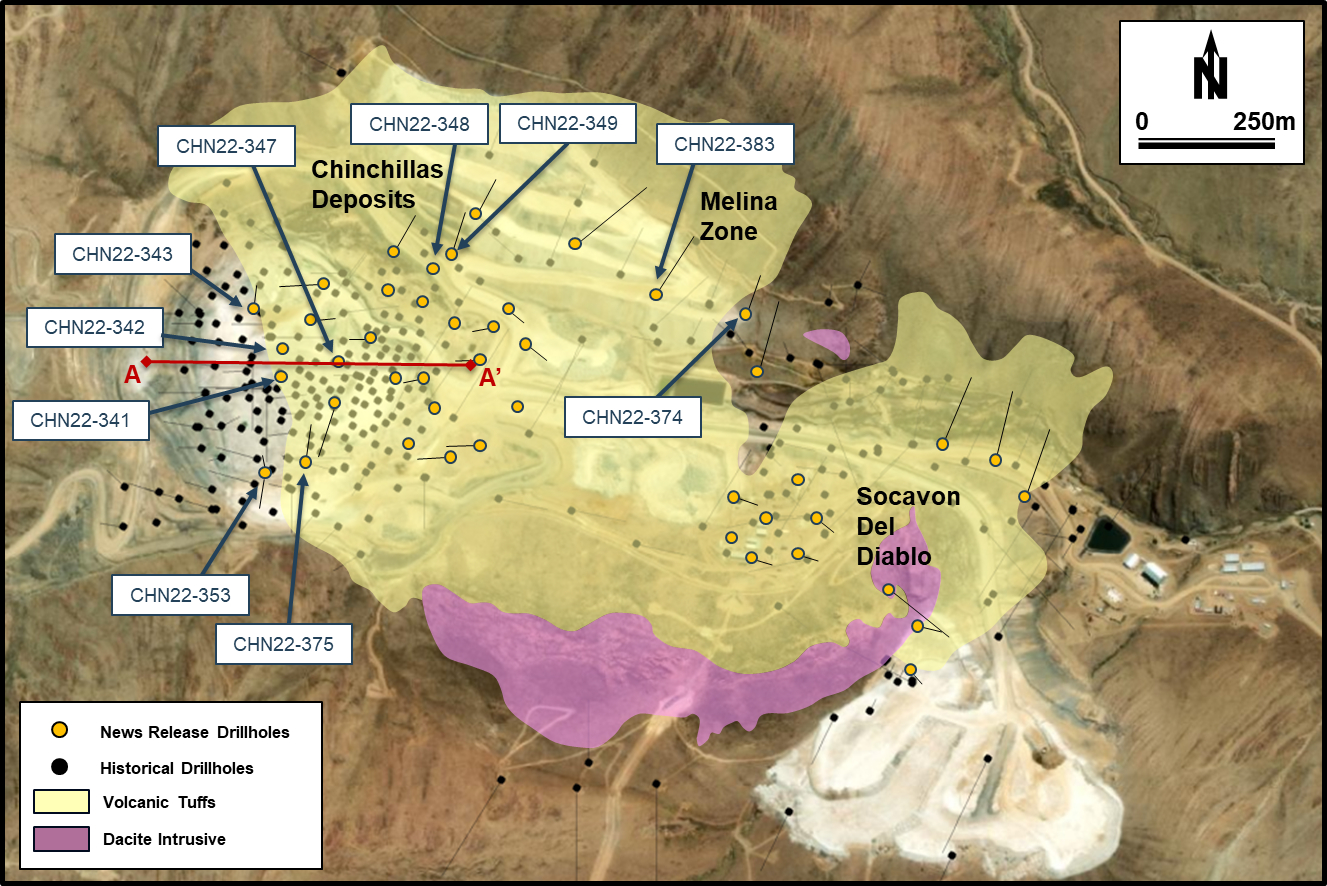

The 2022 exploration program focused on resource expansion, discovery and reconciliation drilling at Chinchillas and was the first exploration drilling completed at the property since 2016. Of the 48 holes reported, 27 targeted extensions of the Chinchillas mineralization to the east, northeast and at depth. Drilling also intersected mineralization at the Melina zone and at Socavon Del Diablo, two separate targets located adjacent to existing Chinchillas infrastructure that host potential to complement the ore currently mined from the main Chinchillas deposit. Additionally, two drill holes were completed at the Cortaderas target on the Pirquitas property.

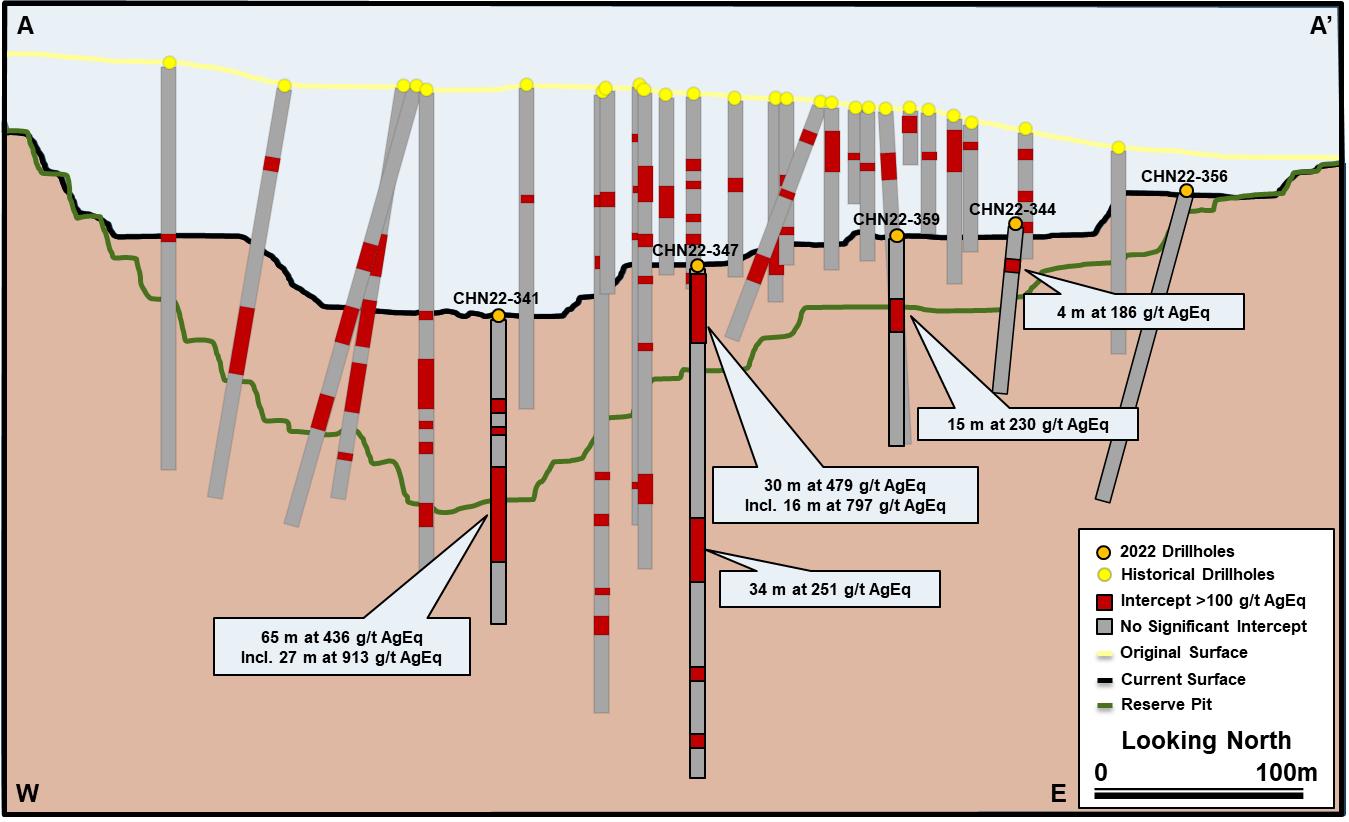

Drilling highlights from the Chinchillas property include (see Figures 2 and 3) (see Table 1):

- CHN22-341: 65 meters at 386 g/t Ag (435 g/t AgEq) from 53 meters

- Including: 27 meters at 836 g/t Ag (913 g/t AgEq) from 73 meters

- CHN22-374: 63 meters at 219 g/t Ag (451 g/t AgEq) from 90 meters

- Including: 18 meters at 382 g/t Ag (840 g/t AgEq) from 101 meters

- CHN22-343: 31 meters at 453 g/t Ag (542 g/t AgEq) from 25 meters

- CHN22-347: 30 meters at 422 g/t Ag (479 g/t AgEq) from 2 meters

- Including: 16 meters at 699 g/t Ag (797 g/t AgEq) from 9 meters

Rod Antal, President and CEO of SSR Mining, said, “Puna has been a tremendous contributor to the SSR Mining portfolio over the last two years, generating solid production and strong free cash flow. This update features the first exploration drilling activity completed at Chinchillas since before the mine commenced production and demonstrates mineralization from near-mine and in-pit step-out intercepts that bode well for potential extensions to Puna’s current Mineral Reserve life. In addition, high-grade intercepts at the Melina and Socavon Del Diablo targets indicate the potential for additional open pit mining opportunities immediately adjacent to the main Chinchillas pit, while positive results from the Cortaderas target at the Pirquitas property could present a longer-term development pathway for further mine life extension at Puna. We have expanded the Puna exploration budget to 15,000 meters in 2023 as we aim to accelerate Mineral Resource conversion and expansion efforts.”

Table 1: Significant intercepts from 2022 exploration drilling at the Chinchillas property.

| Hole ID | From (m) | To (m) | Interval (m) | Ag (g/t) | Pb (%) | Zn (%) | AgEq (g/t) |

| CHN22-341 | 40 | 49 | 9 | 590 | 2.1 | 0.6 | 671 |

| 53 | 118 | 65 | 386 | 1.4 | 0.3 | 435 | |

| Including | 73 | 100 | 27 | 836 | 2.4 | 0.2 | 913 |

| CHN22-342 | 49 | 69 | 20 | 177 | 1.5 | 0.5 | 238 |

| 91 | 103 | 12 | 544 | 1.0 | 1.3 | 619 | |

| CHN22-343 | 25 | 56 | 31 | 453 | 2.9 | 0.1 | 542 |

| CHN22-347 | 2 | 32 | 30 | 422 | 1.9 | 0.0 | 479 |

| Including | 9 | 25 | 16 | 699 | 3.3 | 0.0 | 797 |

| 123 | 157 | 34 | 198 | 1.0 | 0.7 | 251 | |

| Including | 127 | 143 | 16 | 292 | 1.0 | 0.8 | 350 |

| CHN22-348 | 33 | 48 | 15 | 411 | 1.2 | 0.0 | 446 |

| Including | 33 | 42 | 9 | 658 | 1.4 | 0.0 | 699 |

| CHN22-349 | 13 | 29 | 16 | 276 | 0.6 | 0.0 | 294 |

| CHN22-353 | 0 | 66 | 66 | 149 | 1.2 | 0.1 | 189 |

| CHN22-374 | 90 | 153 | 63 | 219 | 3.8 | 3.4 | 451 |

| Including | 101 | 119 | 18 | 382 | 6.2 | 7.7 | 840 |

| CHN22-375 | 0 | 32 | 32 | 146 | 0.7 | 0.2 | 174 |

| CHN22-383 | 160 | 179 | 19 | 175 | 1.4 | 0.1 | 220 |

| Including | 164 | 170 | 6 | 370 | 2.3 | 0.1 | 441 |

Significant intervals are reported using a 50 grams per tonne (g/t) silver equivalent (AgEq) cut-off and with a maximum 3 meters of contiguous dilution. All intercepts are core width intervals.

Silver equivalent values are calculated using the following metal prices: Silver price of $22 per troy ounce, Lead price of $0.95 per pound and Zinc price of $1.15 per pound. Metallurgical recoveries for the Chinchillas operation were not used in the calculation of AgEq values (recoveries were 95.7% for silver, 92.3% for lead and 48.7% for zinc in 2022).

Overview of Puna

Puna is 100% owned by SSR Mining and is comprised of the Chinchillas and Pirquitas properties (see Figure 1). SSR Mining approved the start of the Pirquitas mine and processing plant in October 2006, and the Chinchillas mine declared commercial production in December 2018. Chinchillas is an open pit silver-lead-zinc mine that provides all of the ore currently processed at the Pirquitas processing plant, located 42 km to the southwest. The processing plant produces a silver-lead concentrate and a zinc concentrate that are shipped to international smelters.

The Chinchillas and Pirquitas properties are located within the Bolivian tin-silver–zinc belt that extends from the San Rafael tin-copper deposit in southern Peru into the Puna region of Jujuy, Argentina. These deposits are generally characterized by the intrusion of dacite dome complexes with mineralization hosted in shear zones and breccias within the dacite domes or within the country rock. More rarely, as in the case of the Chinchillas property, the deposits also contain disseminated flat lying manto bodies within sedimentary and pyroclastic rocks that are cut by ‘feeder’ shears.

Chinchillas Property Exploration and Overview

The Chinchillas property is comprised of three contiguous claims totaling over 2,000 hectares. The open pit Chinchillas mine achieved commercial production in December 2018. As reported in the 2021 Puna Technical Report Summary, the mine has a Mineral Reserve life extending through 2026 with an average annual production profile of 7.0 million silver ounces. Over the next three years, SSR mining expects Puna to produce 8.0 to 9.0 million ounces of silver annually.

Significant silver-lead-zinc mineralization occurs in four main areas at the Chinchillas property: the Silver Mantos and Mantos Basement zones in the west part of the property, and the Socavon del Diablo and Socavon Basement zones in the east part. Mining is currently active at the two Mantos deposits, which remain open for expansion to the east.

In 2022, SSR Mining had two drill rigs operating at the Chinchillas property completing nearly 7,500 meters of drilling across 46 drill holes (see Figure 2 and Table 5). Drilling was completed within and around the margin of the open pit operation, and focused on resource expansion and reconciliation drilling, as well as testing a series of high potential targets including Socavon Del Diablo and Melina along the northern rim of the Chinchillas volcanic dome complex. Fieldwork earlier in 2022 focused on geological mapping and prospecting to help identify mineralization and drill targets.

Drilling within the center of the current Chinchillas pit successfully infilled sections of the Mantos Basement deposit, returning broad intercepts of higher-grade mineralization that have the potential to enhance the resource. Drill hole CHN22-347 intersected both the Silver Mantos (30 meters at 422 g/t Ag starting 2 meters from surface) and the Mantos Basement deposit (34 meters at 198 g/t Ag starting 123 meters from surface) due to the stacked nature of the two deposits, potentially extending the deposits vertically and down-dip to the east (see Figure 3). At the northeast end of the Chinchillas deposit, drill hole CHN22-349 expanded the shallow Silver Mantos deposit with mineralization starting within 30 meters from surface (see Figure 2).

The undeveloped Socavon Del Diablo deposit is located approximately 700 meters east of current open pit mining and consists of near surface silver-lead-zinc mineralization hosted within a clay-altered volcanic rock. A new metallurgical program was initiated in January of 2023 to help evaluate the viability of this deposit and its potential contribution to the Puna life of mine plan.

At the Melina zone, located on the northern rim of the Chinchillas dacite volcanic center, broad zones of mineralization occur proximal to a brecciated volcanic-sedimentary contact that is similarly hosting the Mantos Basement deposit 750 meters to the west. Near surface mineralization at the Melina zone appears to have a similar geometry to the Silver Mantos deposit.

Pirquitas Property Exploration and Overview

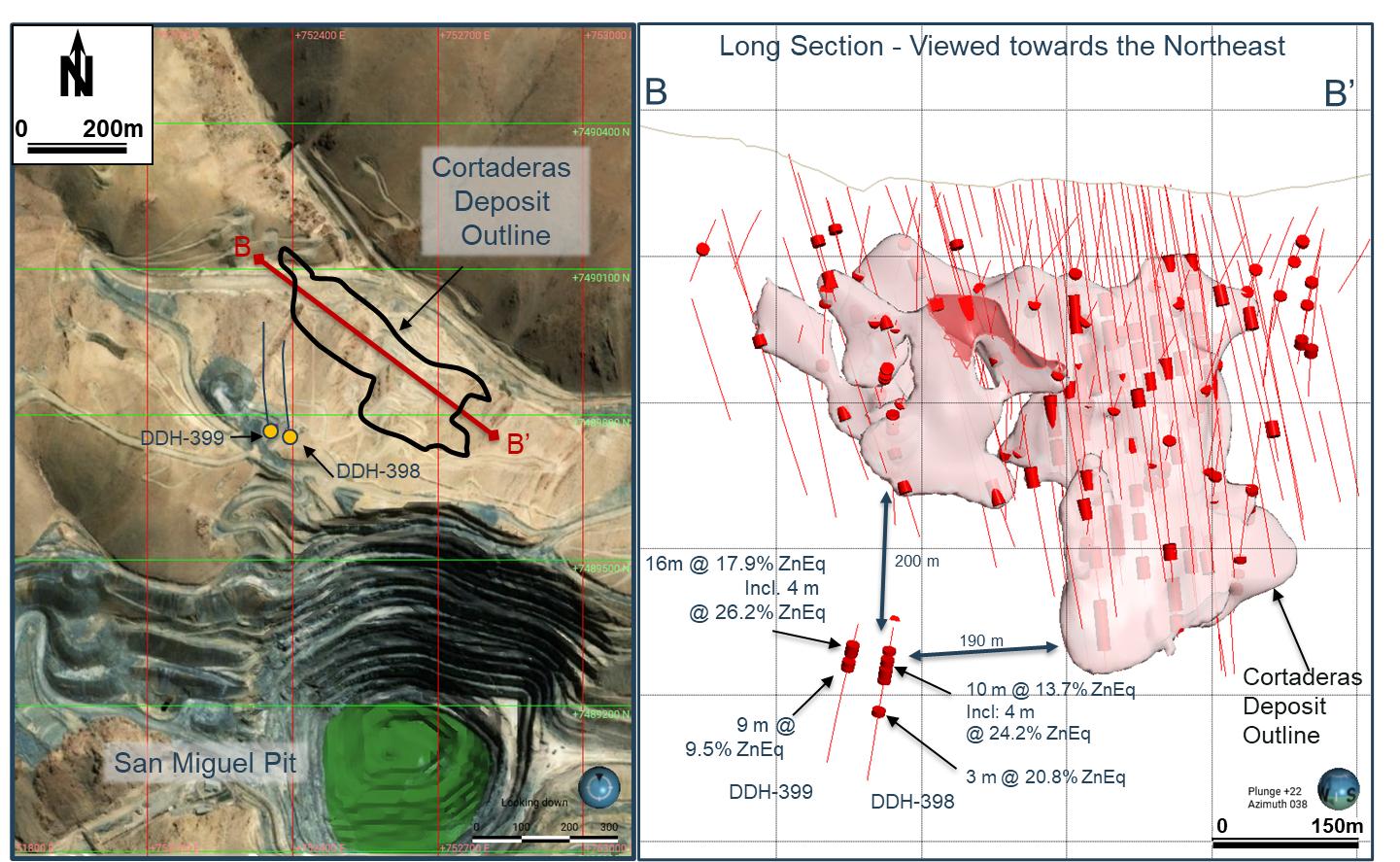

The Pirquitas property includes surface rights covering an area of approximately 7,500 hectares, which includes the Pirquitas processing plant and the Cortaderas deposit, as well as the past producing San Miguel pit. The Cortaderas deposit is a zinc-silver-lead deposit located approximately 500 meters to the north of the San Miguel pit. Cortaderas is a structurally controlled sulfide breccia deposit that trends southeast and dips steeply (60-70 degrees) to the southwest. It has a strike length of 440 meters, a vertical extent of approximately 350 meters and varies from 3 to 20 meters in thickness.

The current Cortaderas deposit includes a 1.46 Mt indicated resource grading 203 g/t Ag and 7.1% Zn, and a 1.03 Mt inferred resource grading 204 g/t Ag and 7.7% Zn. In 2022, 1,420 meters of drilling was completed in two deep holes testing the western margin of the Cortaderas vein-breccia deposit. Concentrations of vein-type sulfide mineralization were intersected at the expected depth and successfully expanded mineralization approximately 200 meters further down-dip and to the northwest. Starting at a downhole depth of 574 meters in DDH-398, an intercept grading 10.6% ZnEq was intersected over 17 meters, including a high-grade sub-interval grading 24.2% ZnEq over 4 meters. Approximately 40 meters to the west, DDH-399 intersected 16 meters of mineralization starting at a down-hole depth of 553 meters and grading 17.9% ZnEq. Within this brecciated zone, 4 meters grading 26.2% ZnEq. With this successful and aggressive step-out to the west, the 2023 drill program is well positioned to continue testing along strike to the west and further down-dip to the south.

Table 2: Significant intercepts from 2022 exploration drilling from the Pirquitas property.

| Hole ID | From (m) | To (m) | Interval (m) | Ag (g/t) | Pb (%) | Zn (%) | ZnEq (%) |

| DDH-398 | 574 | 591 | 17 | 113 | 0.1 | 7.4 | 10.6 |

| Including | 581 | 591 | 10 | 149 | 0.1 | 9.4 | 13.7 |

| Including | 581 | 585 | 4 | 268 | 0.2 | 16.6 | 24.2 |

| 613 | 616 | 3 | 168 | 3.2 | 13.5 | 20.8 | |

| DDH-399 | 553 | 569 | 16 | 247 | 0.1 | 10.9 | 17.9 |

| Including | 554 | 558 | 4 | 341 | 0.3 | 16.4 | 26.2 |

| 575 | 584 | 9 | 95 | 0.9 | 6.0 | 9.5 |

Significant intervals are reported using a 50 grams per tonne (g/t) silver equivalent (AgEq) cut-off and with a maximum 3 meters of contiguous dilution. All intercepts are core width intervals.

Zinc equivalent values are calculated using the following metal prices: Silver price of $22 per troy ounce, Lead price of $0.95 per pound and Zinc price of $1.15 per pound.

Metallurgical recoveries for the Cortaderas deposit were not used in the calculation of ZnEq values (recoveries were 81% for silver and 91% for zinc in metallurgical analysis completed in 2018).

Technical Procedural Information Sampling and Analytical Procedures

All drill samples in respect of the Chinchillas and Cortaderas surface drilling program were analyzed at ALS Laboratories (“ALS”) in Mendoza, Argentina. SSR Mining’s drill and geochemical samples were collected in accordance with accepted industry standards. SSR Mining conducts routine QA/QC analysis on all assay results, including the systematic utilization of certified reference materials, blanks, field duplicates and umpire laboratory check assays. Sampling interval was most commonly 1 meter, using geological and/or structural criteria. ALS crushed each sample to 70% passing 2 mm mesh and a 250 g split was pulverized to better than 85% passing 75 microns. A four-acid multi-element analysis with a MS finish, using a 0.25 g sample, was used to produce Ag, Pb and Zn analytical results. For all Ag, Pb and Zn results > 100 ppm (Ag) or >10,000 ppm (Pb and Zn), a four acid overlimit method was completed using a 0.4 g sample size. Fire assay with an atomic absorption finish was completed on a 30-gram aliquot to produce gold analytical results with a 0.005 g/t gold detection limit.

External review of data and processes relating to Chinchillas and Cortaderas exploration data has been completed by independent consultant Carl Edmunds in the first quarter of 2023. There were no adverse material results detected and the QA/QC indicates the information collected is acceptable, and the database can be used for further studies.

Qualified Persons

The scientific and technical data contained in this news release relating to exploration activity at the Puna Project has been reviewed and approved by David Gale, P.Geo., Senior Manager, Exploration, and a qualified person for purposes of Subpart 1300 of Regulation S-K and National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

You are encouraged to also review the 2021 Puna TRS, which is available on SSR Mining’s Current Report on Form 8-K filed with the Securities and Exchange Commission’s EDGAR system (sec.gov) on September 29, 2022.

About SSR Mining

SSR Mining Inc. is a leading, free cash flow focused gold company with four producing operations located in the USA, Türkiye, Canada, and Argentina, combined with a global pipeline of high-quality development and exploration assets. Over the last three years, the four operating assets combined have produced on average more than 700,000 gold-equivalent ounces annually.

Figure 1. Location of Puna’s Pirquitas property and Chinchillas property. (Photo: Business Wire)

Figure 2. Simplified geological map showing the Chinchillas pit and select drill locations. (Photo: Business Wire)

Figure 3. Cross section A-A’ from Figure 2 showing select drill intercepts from the 2022 program at Chinchillas. (Photo: Business Wire)

Figure 4. Plan view and long section showing step-out intercepts against existing Cortaderas resource. (Photo: Business Wire)

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE