SSR Mining Announces Exploration Results on the In-Pit Copper-Gold Porphyry C2 Target at Çöpler

INTERCEPT OF 0.74% COPPER EQUIVALENT 1 OVER 241.5 METERS, INCLUDING 1.77% COPPER EQUIVALENT 1 OVER 32 METERS DIRECTLY BELOW ÇÖPLER MAIN PIT

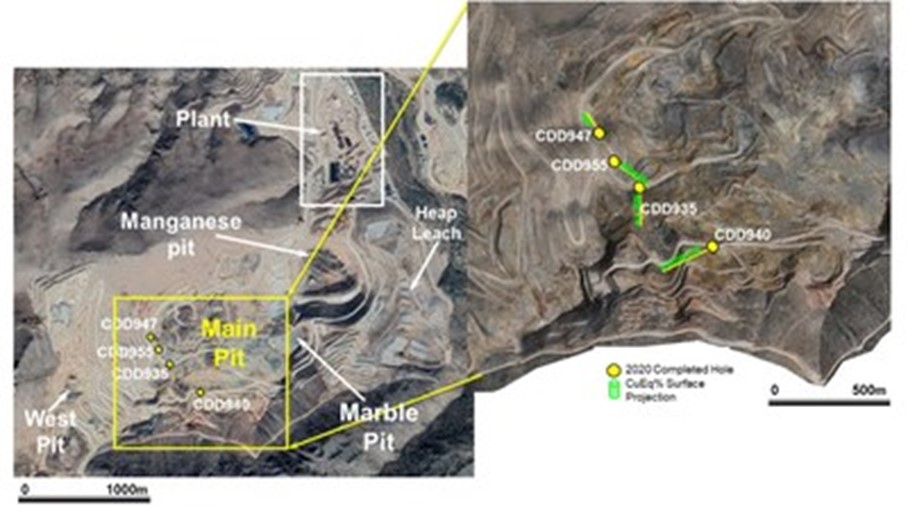

SSR Mining Inc. (NASDAQ: SSRM) (TSX: SSRM) (ASX: SSR) is pleased to announce positive results from the diamond drilling program for the Çöpler copper-gold porphyry target. The C2 target sits directly below the Çöpler Main pit, which is currently in production. Four diamond drill holes were completed along a line of approximately 730 meters, with all holes intersecting gold-rich copper porphyry mineralization. Chalcopyrite is visible in the drill core with mineralization starting at or close to the bottom of the ultimate Çöpler Main pit.

The four diamond drill holes had intercepts including:

- CDD955 returned 0.74% CuEq over 241.5 meters from 37 meters, including 1.77% CuEq over 32 meters from 96.2 meters, 1.92% CuEq over 17.4 meters from 136.2 meters, and 0.42% CuEq over 166.2 meters from 287.5 meters.

- CDD935 returned 0.86% CuEq over 108.6 meters from 103.1 meters, including 1.19% CuEq over 8.6 meters from 146.3 meters, 1.40% CuEq over 23.6 meters from 161 meters, and 1.36% CuEq over 5.3 meters from 199 meters.

Rod Antal, President and CEO said, “The C2 results are another example of the long-term potential of Çöpler. It has long been contemplated that there are copper-gold porphyries associated with the Çöpler mineralization and recent in-pit exploration mapping identified mineralization and structures pointing to the possibility of a porphyry. Drilling began mid-year with the first four holes all returning long mineralized intercepts. While we are in the early stage for this exploration target, we are excited by the potential of C2 for a large volume and higher-grade zone close to what will be the ultimate bottom of the Çöpler Main pit. Drilling is continuing with three drills exploring the extent of the mineralization while we also start metallurgical test work programs. C2 is another excellent example of our organic growth opportunities.”

| ____________________________ |

| 1 Copper equivalent calculated as CuEq = [Cu ppm + ((Au ppm*Au price(g) / Cu price(g)) /10000)]. Based upon metal prices of $1,750/oz gold and $3.00/pound copper with recovery assumed to be 100% as no metallurgical test data is available. CuEq will change proportionally to the metal’s relative recoveries once metallurgical test work is complete. Intervals reported are sections with more than 0.2%CuEq (and a minimum 0.1%Cu) and less than of 5 meters contiguous dilution. |

Mineralization Style

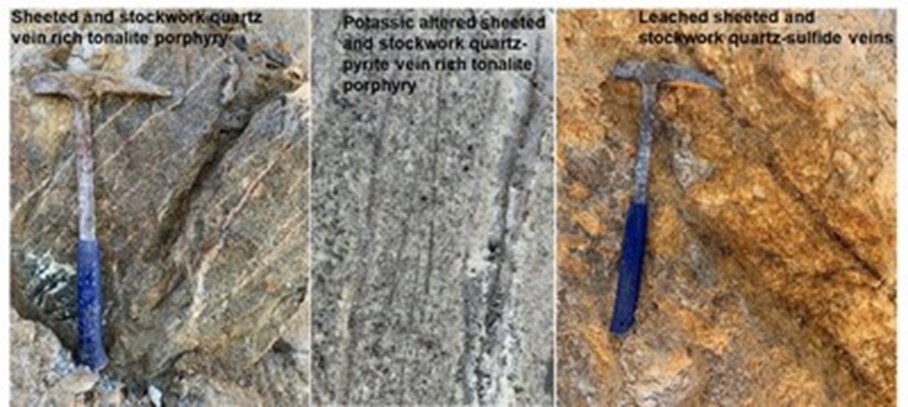

The C2 target lies within the Main pit of the Çöpler mine (Figure 1). Çöpler is currently mining sulfide gold ore, hosted mainly in hornfels, in the Main pit. Some of the newly discovered porphyry intrusive has been exposed in parts of the lower benches (Figure 2). The porphyry has well-developed stockwork and sheeted sulfide-quartz veins. Where exposed in the pit benches, these veins are locally overprinted by thicker quartz-sericite-sulfide veins. The mineralized intrusive was subjected to potassic alteration that is characterized by development of K-Feldspar, secondary biotite, quartz and magnetite as veins and as replacement of earlier rock forming minerals. Potassic alteration is overprinted by a supergene clay alteration and locally overprinted by chlorite and sericite. The copper mineralization is predominantly chalcopyrite formed as disseminations in the matrix and as thin veins associated with quartz accompanied with rare molybdenite mineralization. There is elevated arsenic in some zones, but this does not seem to be directly correlated to the copper mineralization. The gold mineralization is not visible.

Drilling

Between June 2020 and September 2020, SSR Mining drilled four diamond core holes totaling 1,882.5 meters (Figure 3), designed to test the C2 target. The holes are located in the Main pit, all within 80% owned and managed license2. All drilling used either HQ (63.5 millimeters in diameter) or PQ (85 millimeters in diameter) core sizes. Currently there are three drills at the C2 target. The exploration drilling is, at times, restricted by mining activities within the pit.

Significant results are down hole length and include:

- CDD935 returned 0.86% CuEq over 108.6 meters from 103.1 meters, including 1.19% CuEq over 8.6 meters from 146.3 meters, 1.40% CuEq over 23.6 meters from 161 meters, and 1.36% CuEq over 5.3 meters from 199 meters.

- CDD940 returned 0.71% CuEq over 81.5 meters from 271.2 meters, including 1.29% CuEq over 10.8 meters from 274.2 meters, 1.28% CuEq over 5.7 meters from 308.5 meters, 1.30% CuEq over 9 meters from 327.6 meters, and 0.34% CuEq over 74.7 meters from 359.7 meters.

- CDD947 returned 1.14% CuEq over 49.6 meters from 156.9 meters, including 1.06% CuEq over 10.0 meters from 162.3 meters, 1.29% CuEq over 6.7 meters from 181.0 meters, 2.82% CuEq over 9.8 meters from 194.7 meters, 1.20% CuEq over 18.4 meters from 237.8 meters, and 0.30% CuEq over 127.7 meters from 303.3 meters.

- CDD955 returned 0.74% CuEq over 241.5 meters from 37 meters, including 1.77% CuEq over 32 meters from 96.2 meters, 1.92% CuEq over 17.4 meters from 136.2 meters, and 0.42% CuEq over 166.2 meters from 287.5 meters.

Table 1 presents significant mineralized drill hole intercepts. To view the complete drill assay results and further technical information relating to this news release, please visit SSR Mining’s website at www.ssrmining.com.

| ____________________________ |

| 2 The Çöpler gold mine is owned and operated by Anagold Madencilik Sanayi ve Ticaret Anonim Şirketi (Anagold). SSR Mining controls 80% of the shares of Anagold, Lidya Madencilik Sanayi ve Ticaret A.Ş. (Lidya), controls the remaining 20%. |

Table 1. Significant mineralized drill hole CuEq3 intercepts at the C2 target.

| Hole ID | From (meters) |

To (meters) |

Interval (meters) |

Cu (%) |

Gold (g/t) |

CuEq (%) |

Depth (meters) |

|

| CDD935 | 2.00 | 32.80 | 30.80 | 0.15 | 0.34 | 0.44 | 449.1 | |

| 38.80 | 76.10 | 37.30 | 0.14 | 0.27 | 0.38 | |||

| 84.10 | 89.10 | 5.00 | 0.16 | 0.41 | 0.51 | |||

| 103.10 | 211.70 | 108.60 | 0.26 | 0.70 | 0.86 | |||

| (including) | 146.30 | 154.90 | 8.60 | 0.39 | 0.95 | 1.19 | ||

| (including) | 161.00 | 184.60 | 23.60 | 0.42 | 1.10 | 1.40 | ||

| (including) | 199.00 | 204.30 | 5.30 | 0.39 | 1.13 | 1.36 | ||

| 224.7 | 230.6 | 5.9 | 0.11 | 0.22 | 0.30 | |||

| CDD940 | 9.5 | 17.2 | 7.7 | 0.13 | 0.11 | 0.22 | 470.4 | |

| 105.40 | 127.10 | 21.70 | 0.10 | 0.28 | 0.34 | |||

| 152.30 | 157.30 | 5.00 | 0.11 | 0.16 | 0.24 | |||

| 168.30 | 188.30 | 20.00 | 0.12 | 0.18 | 0.27 | |||

| 233.60 | 260.00 | 26.40 | 0.10 | 0.54 | 0.56 | |||

| 271.20 | 352.70 | 81.50 | 0.16 | 0.64 | 0.71 | |||

| (including) | 274.20 | 285.00 | 10.80 | 0.18 | 1.30 | 1.29 | ||

| (including) | 308.50 | 314.20 | 5.70 | 0.27 | 1.18 | 1.28 | ||

| (including) | 327.60 | 336.60 | 9.00 | 0.16 | 1.34 | 1.30 | ||

| 359.70 | 434.40 | 74.7 | 0.13 | 0.25 | 0.34 | |||

| 451.90 | 458.90 | 7.00 | 0.14 | 0.19 | 0.30 | |||

| CDD947 | 107.30 | 143.40 | 36.10 | 0.11 | 0.12 | 0.21 | 434.3 | |

| 156.90 | 206.50 | 49.60 | 0.23 | 1.06 | 1.14 | |||

| (including) | 162.30 | 172.30 | 10.00 | 0.27 | 0.92 | 1.06 | ||

| (including) | 181.00 | 187.70 | 6.70 | 0.10 | 1.41 | 1.29 | ||

| (including) | 194.70 | 204.50 | 9.80 | 0.52 | 2.70 | 2.82 | ||

| 213.50 | 228.30 | 14.80 | 0.10 | 0.90 | 0.87 | |||

| 237.80 | 256.20 | 18.40 | 0.10 | 1.28 | 1.20 | |||

| 262.80 | 271.80 | 9.00 | 0.17 | 0.14 | 0.30 | |||

| 279.80 | 290.00 | 10.20 | 0.23 | 0.14 | 0.35 | |||

| 303.30 | 431.00 | 127.70 | 0.16 | 0.16 | 0.30 | |||

| CDD955 | 9.50 | 28.50 | 19.00 | 0.14 | 0.22 | 0.33 | 528.7 | |

| 37.00 | 278.50 | 241.50 | 0.25 | 0.58 | 0.74 | |||

| (including) | 96.20 | 128.20 | 32.00 | 0.46 | 1.54 | 1.77 | ||

| (including) | 136.20 | 153.60 | 17.40 | 0.54 | 1.62 | 1.92 | ||

| 287.50 | 453.70 | 166.20 | 0.17 | 0.28 | 0.42 | |||

| 467.80 | 507.00 | 39.20 | 0.10 | 0.19 | 0.26 | |||

| 520.00 | 528.70 | 8.70 | 0.10 | 0.25 | 0.31 | |||

| _________________________________ | ||||||||

| 3 Copper equivalent calculated as CuEq = [Cu ppm + ((Au ppm*Au price(g) / Cu price(g)) /10000)]. Based upon metal prices of $1,750/oz gold and $3.00/pound copper with recovery assumed to be 100% as no metallurgical test data is available. CuEq will change proportionally to the metal’s relative recoveries once metallurgical test work is complete. Intervals reported are sections with more than 0.2%CuEq (and a minimum 0.1%Cu) and less than of 5 meters contiguous dilution. | ||||||||

Sampling and Analytical Procedures

The C2 drilling program started in 2020. Diamond drill core is sampled as half core at 1m intervals or geological contacts. Sampling interval varies between 0.6 meters and 2 meters with an average of 1.02 meters length. The samples were submitted to ALS Global laboratories in Izmir, Turkey for sample preparation and analysis which is of an ISO/IEC 7025:2005 certified and accredited laboratory. Bureau Veritas (Acme) laboratory, Ankara was used for umpire check sample analysis. Gold was analyzed by fire assay with an AAS finish, and the multi-element analyses were determined by four acid digestion and ICP-AES and MS finish. For gold assays greater than or equal to 10 g/t, the fire assay process is repeated with a gravimetric finish for coarse gold. If copper assays are greater than or equal to 10,000ppm, four acid digestion and ICP finish (Cu-OG62) is implemented. The drill and geochemical samples were collected in accordance with accepted industry standards. SSR Mining conducts routine QA/QC analysis on all assay results, including the systematic utilization of certified reference materials, blanks, field duplicates, and umpire laboratory check assays. External review of data and processes relating to C2 have been completed by independent consultant Dr. Erdem Yetkin, P.Geo. in November 2020. There were no adverse material results detected and the QA/QC indicates the information collected is acceptable, and the database can be used for further studies.

No metallurgical work has been completed to date on C2 samples. The process of compositing samples for the initial metallurgical test work program has begun.

Qualified Persons

The exploration results disclosed in this document were prepared under the supervision and approved by Dr. Cengiz Y. Demirci, AIPG Registered Member and a CPG (Certified Professional Geologist), and VP Exploration at SSR Mining. Dr. Demirci has sufficient experience that is relevant to the style of mineralization and type of deposit under consideration and is a qualified person pursuant to National Instrument 43-101.

The information in this document which relates to C2 exploration results is based on, and fairly represents, information and supporting documentation prepared by Dr. Mesut Soylu, P.Geo., Eurgeol, who is a Chief Geologist at SSR Mining. Dr. Soylu has sufficient experience which is relevant to the style of mineralization and type of deposit under consideration and is a qualified person pursuant to NI 43-101. Dr. Soylu consents to the inclusion in this document of the matters based on this information in the form and context in which it appears.

External review of data and processes relating to the C2 target was completed in November 2020 by independent consultant Dr. Erdem Yetkin, P.Geo. a qualified person as defined by NI 43-101. There were no adverse material results detected and Dr. Yetkin is of the opinion that the QA/QC indicates the information collected is acceptable, and the database can be used for announcing the exploration results.

About SSR Mining

SSR Mining Inc. is a leading, free cash flow focused intermediate gold company with four producing assets located in the USA, Turkey, Canada, and Argentina, combined with a global pipeline of high-quality development and exploration assets in the USA, Turkey, Mexico, Peru, and Canada. In 2019, the four operating assets produced over 720,000 ounces of gold and 7.7 million ounces of silver.

SSR Mining’s diversified asset portfolio is comprised of high margin, long-life assets along several of the world’s most prolific precious metal districts including the Çöpler mine along the Tethyan belt in Turkey; the Marigold mine along the Battle Mountain-Eureka trend in Nevada, USA; the Seabee mine along the Trans-Hudson Corridor in Saskatchewan, Canada; and the Puna mine along the Bolivian silver belt in Jujuy, Argentina. SSR Mining has an experienced leadership team with a proven track record of value creation. Across SSR Mining, the team has expertise in project construction, mining (open pit and underground), and processing (pressure oxidation, heap leach, and flotation), with a strong commitment to health, safety and environmental management.

SSR Mining intends to leverage its strong balance sheet and proven track record of free cash flow generation as foundations to organically fund growth across the portfolio and to facilitate superior returns to shareholders.

MORE or "UNCATEGORIZED"

Red Pine Provides Further Update On Assay Results for Wawa Gold Project

Red Pine Exploration Inc. (TSX-V: RPX) (OTCQB: RDEXF) further to... READ MORE

Getty Copper Intersects High-grade Copper Mineralization in the First Drill Holes, Glossie Occurrence, Highland Valley Area, Southern B.C.

Getty Copper Inc. is pleased to report drill results from the fir... READ MORE

Guanajuato Silver Announces Closing of C$11.35 Million Brokered Financing

Guanajuato Silver Company Ltd. (TSX-V:GSVR) is pleased to announc... READ MORE

Hot Chili Closes A$24.9 Million Private Placement and Announces Full Underwriting of A$5 Million Share Purchase Plan

Positioning for Near-Term, Meaningful, Copper Production H... READ MORE

Barksdale Announces San Javier Preliminary Economic Assessment

Barksdale Resources Corp. (TSX-V: BRO) (OTCQX: BRKCF) is pleased ... READ MORE