The Prospector News

Spanish Mountain Gold Announces Larger Scale Preliminary Economic Assessment With a Base Case NPV5% After-Tax of C$1.0 Billion, 18.2 % IRR and 3.4 Year Payback at US$ 2,450/Oz Gold Price; at US$3,300/Oz Spot Gold Price NPV5% C$2.3 Billion, 32.0% IRR and 2.0 Year Payback; Including an Updated Mineral Resource Estimate for Its Spanish Mountain Gold Project

You have opened a direct link to the current edition PDF

Open PDF CloseSpanish Mountain Gold Announces Larger Scale Preliminary Economic Assessment With a Base Case NPV5% After-Tax of C$1.0 Billion, 18.2 % IRR and 3.4 Year Payback at US$ 2,450/Oz Gold Price; at US$3,300/Oz Spot Gold Price NPV5% C$2.3 Billion, 32.0% IRR and 2.0 Year Payback; Including an Updated Mineral Resource Estimate for Its Spanish Mountain Gold Project

Spanish Mountain Gold Ltd. (TSX-V: SPA) (FSE: S3Y) (OTCQB: SPAUF) is pleased to announce the results of a Preliminary Economic Assessment including an updated mineral resource estimate, for the Spanish Mountain Gold Project, located within central British Columbia, Canada. The PEA is a conceptual study of the potential economic viability of the Main Deposit Mineral Resource, that includes the Main Zone and North Zone. The PEA will be published in an independent National Instrument 43-101 Technical Report within 45 days of this news release and filed on SEDAR+. Once filed on SEDAR+, the PEA will supersede the Spanish Mountain Gold Project Prefeasibility Study 43-101 Technical Report dated May 31, 2021. The PEA study was commissioned by the Company and prepared by a consortium of consultants led by Ausenco Engineering Canada ULC. The PEA envisions a conventional open pit mining and milling operation with a projected 24.5-year life of mine producing 3 million ounces of payable gold, with a front weighted production profile and attractive economics. All currency amounts herein are in Canadian dollars unless otherwise indicated.

President and CEO, Peter Mah stated:

“The re-envisioned, larger scale Spanish Mountain Gold Project and the completion of a new robust, de-risked PEA with updated MRE marks a significant achievement for the Company’s transformation from explorer to developer. With over 235,000 metres of drill information our confidence in the resource quality and proposed mine confirm our strategy to advance the Project towards feasibility and ultimately a build decision by 2027. Project upside is supported by drill success in 2024 to 2025 reinforcing the potential for new additional discoveries of high grade near surface gold mineralization in prospective gold host rocks over the 10 km long property wide corridor. With a regional setting of nearby experienced First Nations, communities, currently producing mines, a power interconnection point near William’s Lake, B.C. that is progressing through Stage 2 of B.C. Hydro’s system impact study, established mining infrastructure plus workforce, and year round paved road access to within 6 km of the Project site, the Project’s favourable location and jurisdiction speak volumes to the Project’s overall quality and likelihood to advance to production. Spanish Mountain’s commitment to create BC based jobs, business opportunities, and sustainable shared benefits for the First Nation’s and surrounding communities has been demonstrated during the 2024-25 drill programs. We’ve heard the First Nations’ and communities’ feedback regarding the environment and are pleased to have found a way to address those shared concerns to derisking tailings, waste, and water management. Considering the rising gold price environment supporting the need to rapidly advance gold projects in Canada, and alongside the amazing regional support we’ve received in British Columbia for the Project to date, we look forward to continuing to earn support for our Project, while conserving and improving the economic sustainable value for all stakeholders. Spanish Mountain Gold has a bright future ahead creating a new definition of responsible sustainable mining that generations of Canadians will be proud of!”

Highlights

- Robust Economics: Base case after-tax NPV5% of C$1,025 million with an after-tax IRR of 18.2% using a gold price assumption of US$2,450/ounce. Using a spot gold price of US$3,300/oz gold, after-tax NPV5% increases to C$2,315 million and the after-tax IRR to 32.0%.

- Significant Production and Low Cost: 203,265 oz average annual gold production in the first 5 years at an all-in sustaining cost net of by-product credits (“AISC”) of US$1,024/oz and 122,041 oz average annual gold production over a 24.5-year LOM at an AISC of US$1,338/oz.

- Rapid Payback of Capital Expenditures: C$1,250 million initial capital paid back over 3.4 years at PEA base case and decreasing to 2.0 years at spot gold price of $3,300/oz gold.

- High Degree of Resource Confidence: Economic analysis is based on Measured and Indicated Resources sub-totalling 33.3% and 65.1% respectively or grand total of 98.4% but excludes potential upside opportunities from the 2025 drill results and MRE from the Phoenix deposit.

- Low Risk: Conventional open pit and milling operation with road access and hydro-electric power.

- New Innovative, De-risked Tailings Facility: Dry stack plus coarse free draining tailings, waste and water management facilities that are integrated and significantly reduce volume of tailings impacted runoff for treatment and discharge. The proposed tailings facility includes 100% reuse of process water, avoids discharge near the Cedar Point Provincial Park and minimizes the disturbance of fish bearing waters. The proposed tailings facility utilizes feedback obtained from the First Nations, nearby communities and industry to utilize best in class available environmental solutions that the Company anticipates will significantly reduce risks at closure and promote protection of the land and waterways to perpetuity.

- Significant Opportunities: Potential to further enhance Project economics and expand production rate have been identified with the addition of the maiden Phoenix deposit MRE, ongoing endowment potential extensions and preconcentration technologies such as mineralized material sorting to boost mill feed grade.

- Strong Discovery Growth Potential: Exploration diamond drill programs completed in 2024 and 2025 extended gold mineralization and intercepted higher-grade mineralization adjacent to Project infrastructure over a strike length in excess of 3 km.

Table 1: PEA Results Summary

| Open Pit PEA Study Results | 2025 PEA

Base Case |

Spot Prices

(as of July 1, 2025)1 |

| After-Tax NPV (C$M, 5% discount rate) | $1,025 | $2,315 |

| After-Tax IRR (%) | 18.2% | 32.0% |

| Annual Average Free Cash Flow (C$M)4 | $85 | $173 |

| Annual Average Free Cash Flow Yr. 1-5 (C$M)4 | $311 | $454 |

| Initial Capex (C$M) | $1,250 | $1,250 |

| Total Cash Cost (US$ / Au oz)2 | $1,194 | $1,201 |

| AISC (US$ / Au oz)3 | $1,338 | $1,345 |

| Payback Period (years) After-Tax | 3.4 | 2.0 |

| Nominal Processing Throughput (tpd) | 26,000 | 26,000 |

| Strip Ratio (waste:mill feed resource) | 2:1 | 2:1 |

| Mine Life (years) | 24.5 | 24.5 |

| Annual Average Throughput (Mtpa) | 9,340 | 9,340 |

| Annual Average Production (koz/a) | 122 | 122 |

| Average Gold Head Grade (g/t) | 0.46 | 0.46 |

| Average Gold Recovery (%) | 89.3% | 89.3% |

| Metal Prices (US$ / oz) | $2,450 Au

$28.50 Ag |

$3,300 Au

$36.00 Ag |

| Exchange Rate USD/CAD | 1.35 | 1.35 |

| Total LOM Au ounces produced (Moz) | 3.0 | 3.0 |

| Total LOM Ag ounces produced (Moz) | 2.1 | 2.1 |

| Notes for Table 1 | ||

| 1. Spot price is based on the LBMA gold price as of the close of business on July 1, 2025, rounded down to the nearest $100/oz for gold and $1/oz for silver.

2. Cash Costs consist of mining costs, processing costs, mine-level G&A, offsite charges, and royalties less by-product credits. Refer to the “Non-Gaap Financial Measures” section in Appendix B of this news release for more information. 3. All-In Sustaining Costs (AISC) includes cash costs plus sustaining capital, closure costs, and salvage credits. Refer to the “Non-GAAP Financial Measures” section in Appendix B of this news release for more information. 4. Free cash flow is calculated as after tax cash flow from mine-site operating activities less capital expenditures, including closure costs (net of salvage value). Refer to the “Non-GAAP Financial Measures” section in Appendix B of this news release for more information. |

||

The economic analysis contained in this news release is preliminary in nature and is based primarily on Measured and Indicated Mineral Resources totalling 33.3% and 65.1% respectively, and in part, Inferred Mineral Resources totalling 1.6% of the proposed mill feed from the Main deposit. Inferred Mineral Resources are considered too geologically speculative to have the economic considerations applied to them that would enable them to be categorized as Mineral Reserves. There is no certainty that economic forecasts on which this PEA is based will be realized. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. Table 2 lists the breakdown by resource category of the run of mine mill feed for the PEA life of mine plan.

Table 2: ROM mill feed and ounces by resource category

| Category | ROM Mill Feed (Mt) | ROM Au (Moz.) | ROM Ag (Moz.) |

| Measured | 76.2 | 1.22 | 1.62 |

| Indicated | 148.9 | 2.10 | 3.09 |

| Total M+I | 225.1 | 3.32 | 4.72 |

| Inferred | 3.7 | 0.03 | 0.05 |

Mineral Resource Estimate for the Main Deposit

Note: The Main Deposit is included in the financial modelling for the 2025 PEA.

The updated MRE for the Main deposit is based on the amalgamation of what have been historically described as the Main Zone, North Zone, Slipper Zone, and K Zone, effective January 10, 2025, and it is reported at a 0.15 g/t gold cut-off (see Table 3). There is no certainty that Mineral Resources will be converted into Mineral Reserves. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. Mineral Resources include Inferred Mineral Resources which have had insufficient work to classify them as Indicated Mineral Resources. It is uncertain but reasonably expected that Inferred Mineral Resources could be uplifted to Indicated Mineral Resources with additional drilling.

Geological and resource domain modelling and estimation for the Project was completed using Leapfrog 2024.1. The lithological model was developed based on data from the extensive re-logging program of 170,000 m drill core that was completed in 2023 and 2024, in addition to geochemical classification of 56,550 previously sampled intervals. Mineralization domains are modelled by identifying zones with gold values greater than 0.3 g/t over a minimum width of 3 m. Two primary styles of mineralization were recognized. Early mineralization includes disseminated stratabound mineralization in argillite-bearing lithologies. Late mineralization includes gold associated with late-stage quartz veins. Three high-confidence faults were modelled, including the North Fault, South Fault, and Fault 1. The Main Block is bound by the North and South Faults, representing significant discontinuities in stratigraphy and mineralization. Within the Main Block, Fault 1 introduces a minor offset in the main block.

Reasonable prospects for eventual economic extraction were evaluated by performing a pit optimization using the Lerchs-Grossman algorithm with the following parameters: gold price of US$2,400/oz, silver price of US$30/oz, and gold selling costs of C$7/oz for offsite charges, and a 1.5% royalty. Mining costs for mineralized material and waste are C$3.75/t, with incremental mining costs of C$0.03/t. Processing costs are C$12/t for mill processing and include site G&A. Payability for gold is 99.8%, and payability for silver is 90%. Process recovery for gold is 90%, while process recovery for silver is 50%. The exchange rate used is C$0.73 to US$1.

Total Measured and Indicated Mineral Resources for the Main deposit includes 292.1 Mt at an average grade of 0.44 g/t gold and 0.66 g/t silver, for a total of 4.2 M contained ounces of gold and 6.2 M contained ounces of silver. Total Inferred Mineral Resources for the Main deposit includes 14.8 Mt at an average grade of 0.33 g/t gold and 0.95 g/t silver, for a total of 0.2 M ounces of gold and 0.5 M ounces of silver.

Table 3: Mineral Resource for the Main deposit

| Category | Cut-off Grade | Tonnes (kt) | Au Avg. Grade | Au (koz) | Ag Avg. Grade | Ag (koz) |

| Measured | 0.15 | 77,370 | 0.53 | 1,321 | 0.68 | 1,701 |

| Indicated | 0.15 | 214,702 | 0.41 | 2,842 | 0.65 | 4,463 |

| Measured & Indicated | 0.15 | 292,072 | 0.44 | 4,163 | 0.66 | 6,163 |

| Inferred | 0.15 | 14,830 | 0.33 | 155 | 0.95 | 454 |

| Notes for Table 3: | ||||||

| 5. The qualified person responsible for the Main deposit MRE, with an effective as of as of January 10, 2025, is Bahram Bahrami, P.Geo of Equity Exploration Consultants Ltd.

6. Mineral Resources are classified in accordance with CIM (2014) definition standards 7. Bulk density assigned on a block per block basis 8 . Mineral Resources are reported using a 0.15 g/t gold cut-off grade 9. Metal price assumptions include US$2,400/oz Au and US$30/oz Ag 10. Metallurgical recoveries assumptions are 90% recovery for gold and 50% for silver. 11. 99.8 payability for gold and 90% for silver 12. Numbers may not add due to rounding 13. Mineral resources are not Mineral reserves and do not have demonstrated economic viability. 14. The qualified persons responsible for this section of the technical report are not aware of any environmental, permitting, legal, title, taxation, socio-economic, marketing, political, or other relevant factors that could materially affect the Mineral Resource estimate other than those disclosed in this news release and in the PEA Technical Report. |

||||||

Mineral Resource Estimate for the Phoenix Deposit

Note: The Phoenix Deposit is not included in the financial modelling for the 2025 PEA.

The inaugural MRE for the Phoenix deposit is reported at a 0.20 g/t gold cut-off. Total Indicated Mineral Resources for the Phoenix deposit include 0.05 Mt at an average grade of 0.35 g/t Au, for a total of 0.6 thousand ounces (koz) of contained gold. Inferred Mineral Resources include 25.4 Mt at an average grade of 0.44 g/t Au, for a total of 357 koz of contained gold (see Table 4).

Table 4: Mineral Resources for the Phoenix deposit

| Resource Classification |

Cut-off Grade (Au, g/t) |

Tonnes (kt) |

Gold Grade (Au, g/t) |

Contained Gold (Au, koz) |

| Indicated | 0.2 | 52 | 0.35 | 0.57 |

| Inferred | 0.2 | 25,426 | 0.44 | 357 |

| Notes for Tables 4 and 5: | ||||

| 1. The qualified person responsible for the Phoenix deposit MRE, with an effective as of as of June 17, 2025, is Bahram Bahrami, P.Geo of Equity Exploration Consultants Ltd.

2. Mineral Resources are classified in accordance with CIM (2014) definition standards 3. Mineral Resources are reported using a 0.20 g/t gold cut-off grade 4. Metal price assumptions include US$2,400/oz Au 5. Metallurgical recoveries assumptions are 90% recovery for gold 6. 99.8 payability for gold 7. Numbers may not add due to rounding 8. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. 9. The qualified persons responsible for this section of the technical report are not aware of any environmental, permitting, legal, title, taxation, socio-economic, marketing, political, or other relevant factors that could materially affect the Mineral Resource estimate other than those disclosed in this news release and in the PEA Technical Report 10. Refer to Appendix C for the estimation methodology |

||||

Geological and resource modelling for the Phoenix deposit was completed using Leapfrog 2024.1 and Micromine Origin & Beyond 2025. The lithological model was developed based solely on geochemical classification, with six principal stratigraphic units identified: Upper Mafic Tuff, Upper Sedimentary Sequence, Lower Mafic Tuff, Intermediate Sedimentary Sequence, Intermediate Tuff, and Lower Sedimentary Sequence. These units generally dip gently to the northeast. A steeply dipping north-south trending fault divides the Phoenix deposit into eastern and western blocks. The eastern block contains the full stratigraphic sequence, while the western block includes only the two lowermost stratigraphic units found in the eastern block.

Gold mineralization was modelled based on downhole structural data measured from oriented drill core. This interpretation includes identifying two principal sets of mineralized structures: flat to gently east-dipping and steeper northeast-dipping orientations. These define three mineralized lenses—two upper, gently dipping zones and a deeper, steeper-dipping zone.

Capping values for the Phoenix deposit were determined using decile analysis and log-scaled probability plots of length-weighted gold assays. Outlier restrictions were applied to lithological domains during the second estimation pass, excluding samples above 0.2 g/t gold where search distances exceeded 30% of the variogram range. No outlier restrictions were applied to mineralized domains. A semi-hard boundary approach was applied to specific lithological contacts reflecting gradational contacts of lithological units. These included the Lower Mineralized Zone (Domain 630) with a distance threshold of 5 m, the Lower Mafic Tuff with 15 m, and the Lower Sedimentary unit with 50 m. This approach was used to reduce artefacts and better represent grade continuity in stratigraphically complex or sparsely drilled areas.

The block model was constructed using a parent block size of 5m x 5m x 5m, with sub-blocks refined down to 1.25 m to accurately honor geological boundaries and minimum mining widths. Grade estimation was conducted using a combination of Ordinary Kriging (OK) and inverse distance cubed (ID3) methods. OK was used for all mineralized domains where variograms could be reliably modelled; ID3 was applied to other domains where variogram stability could not be achieved. Locally varying anisotropy (LVA) was applied within mineralized domains to reflect observed structural controls.

Resource classification followed the CIM Definition Standards (2014) and was guided by geological confidence, data spacing, and estimation support. The current drilling density supports predominantly Inferred classification. These are supported by at least two drill holes within a spacing of ≤155 m. Indicated Mineral Resources are supported by drill hole spacing of ≤70 m with minimum of 3 drill holes used for estimation.

Reasonable prospects for eventual economic extraction were applied by performing a resource pit optimization and applying the following parameters: a gold price of US$2,400/oz, gold selling costs of C$7/oz for offsite charges, a 1.5% royalty, Mining costs of C$3.75/t with incremental costs of C$0.03/t, and combined processing and site G&A costs of C$12/t. Gold payability was assumed to be at 99.8%, with a metallurgical recovery of 90%. The exchange rate used was C$0.73 to US$1.00. No by-product metals were included in the estimate.

For Phoenix, a cutoff grade of 0.20 g/t gold is used due to limited metallurgical data compared to the Main deposit. This higher cut-off accounts for increased geological and metallurgical uncertainty for the Phoenix deposit. Cut-off sensitivities of the Phoenix deposit mineral resource are summarized in Table 5.

Table 5: Mineral Resource for the Phoenix deposit at varying gold cut-off grades

| Resource Classification |

Cut-off Grade (Au, g/t) |

Tonnes (kt) |

Gold Grade (Au, g/t) |

Contained Gold (Au, koz) |

| Indicated | 0.15 | 96 | 0.27 | 0.8 |

| 0.2 | 52 | 0.35 | 0.6 | |

| 0.25 | 35 | 0.41 | 0.5 | |

| 0.3 | 23 | 0.47 | 0.4 | |

| Inferred | 0.15 | 33,451 | 0.37 | 402 |

| 0.2 | 25,426 | 0.44 | 357 | |

| 0.25 | 20,152 | 0.49 | 319 | |

| 0.3 | 16,827 | 0.54 | 290 |

Notes: See Table 4

Spanish Mountain Project Consolidated Mineral Resources

Total combined Mineral Resources for the Spanish Mountain Gold Project are summarized in Table 6. Total Measured and Indicated mineral resources include 292.1 Mt at 0.44 g/t gold for total 4.16 M contained gold ounces. Total inferred mineral resources include 40.3 Mt at 0.40 g/t gold for total 512 k contained gold ounces.

Table 6: Consolidated Mineral Resources for the Spanish Mountain Gold Project

| Area | Classification | Cut Off Gold Grade (g/t) |

Tonnes

(Mt) |

Gold

(g/t) |

Contained Gold

(koz) |

Silver

(g/t) |

Contained Silver

(koz) |

| Main Deposit | Measured | 0.15 | 77.4 | 0.53 | 1,321 | 0.68 | 1,701 |

| Indicated | 214.7 | 0.41 | 2,842 | 0.65 | 4,463 | ||

| M&I | 292.1 | 0.44 | 4,163 | 0.66 | 6,163 | ||

| Inferred | 14.8 | 0.33 | 155 | 0.95 | 454 | ||

| Phoenix Deposit | Indicated | 0.20 | 0.1 | 0.35 | 0.58 | – | – |

| Inferred | 25.4 | 0.44 | 357 | – | – | ||

| Total Spanish Mountain Gold Project | M&I | 292.1 | 0.44 | 4,164 | 0.66 | 6,163 | |

| Inferred | 40.3 | 0.40 | 512 | 0.95 | 454 | ||

| Notes on Table 6: | |||||||

| 1. The Mineral Resource for the Main Deposit is reported using a cut-off grade of 0.15 g/t Au, while the Phoenix Deposit uses a 0.20 g/t Au cut-off.

2. The Mineral Resources are constrained within an optimized pit shell generated using Lerchs–Grossman pit optimization based on a gold price of US$2,400/oz, 99.8% payability, 90% gold recovery, C$12/t processing and G&A, C$3.75/t mining for ore and waste, C$0.03/t incremental mining cost, 1.5% royalty, C$7/oz offsite charges, and an exchange rate of 0.73:1 (CAD:USD). 3. Mineral Resources are derived from resource statements for each deposit and area, prepared by Bahram Bahrami, P.Geo., a Qualified Person as defined under NI 43-101. 4. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. 5. The Mineral Resource estimate complies with NI 43-101 Standards of Disclosure for Mineral Projects (May 2016) and CIM Definition Standards for Mineral Resources and Mineral Reserves (May 2014). 6. Any discrepancies in totals are due to rounding. 7. The effective date of the Mineral Resource statement is January 10, 2025 for the Main Deposit and June 17, 2025 for the Phoenix Deposit. |

|||||||

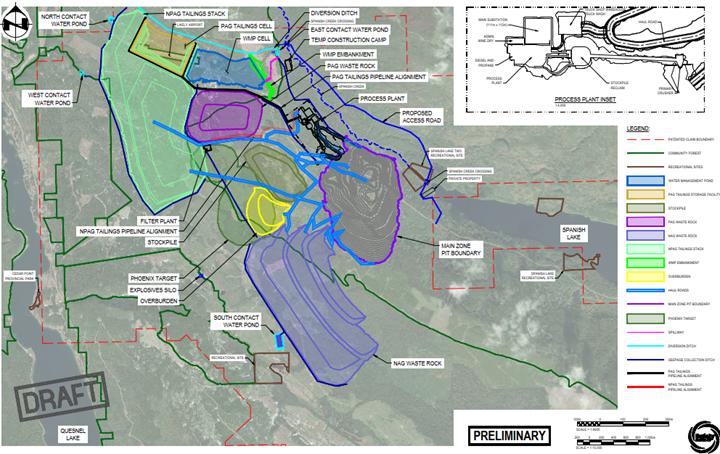

Mining and Processing

Open pit mine designs, mine production schedules and mine capital and operating costs have been developed for the Main deposit, at a scoping level of engineering. The mineral resources, including inferred resources, form the basis of the mine planning. The Phoenix deposit MRE are not included or considered as part of the mine plan.

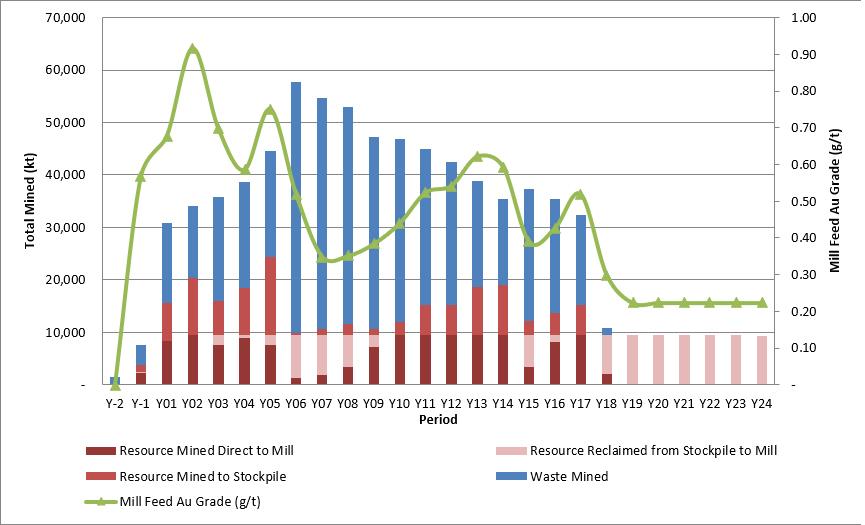

Open pit mining activities are designed for approximately 24.5 years of operation. Mine planning is based on large scale conventional drill/blast/load/haul open pit mining methods suited for the Project location and local site requirements. The subset of mineral resources contained within the designed open pits are summarized in Table 7, with a 0.2 g/t Au cut-off grade, and form the basis of the mine plan and production schedule, which is summarized in Figure 5.

Table 7: PEA Mine Plan Production Summary

| Mine Plan Pit Contents | Total |

| PEA Mill Feed | 229 Mt |

| Mill Feed Au Grade | 0.46 g/t |

| Mill Feed Au Metal | 3.3 Moz. |

| Mill Feed Ag Grade | 0.65 g/t |

| Mill Feed Ag Metal | 4.8 Moz. |

| Waste Overburden and Rock | 458 Mt |

| Waste: Resource Ratio | 2.0 |

Mill feed quantities and grades include estimates of mining dilution and recovery based on a 10 m selective block size and 2 m dilution skins applied to all waste contacts. This results in an addition of 16% dilution and 2% loss to the original resource block model.

Figure 5: PEA Mine Production Schedule Summary

Processing of the mill feed at 26,000 tpd (or 9.5 Mt per annum) is by means of a conventional process flowsheet including primary grinding, gravity concentration, flotation, and regrinding of the concentrate followed by cyanidation via a CIL circuit to produce doré. The process achieves an average overall LOM gold recovery of 89%. The average silver recovery as a by‐product of the milling process for the life of the Project is 44%. Non-Acid Generating tailings from the plant are dewatered by screening and filtering and conveyed to a dry stack tailings facility, where it will be spread and compacted in engineered lifts. All site water is managed through a separate water management pond that includes a water treatment plant for any water to be discharged during the LOM.

The tailings storage facilities proposed for construction and development at Project are primarily based on utilization of filtered tailings technology for the base case scenario. Multiple tailings storage locations, designs, and technologies were analyzed to arrive at the preferred location and tailings technology.

Initial Capital Costs

The initial capital expenditures for the Project as estimated by Ausenco are summarized in Table 8 and the capital expenditures to be incurred after the start-up of operations are assigned to sustaining capital and are projected to be covered by operating cash-flows. Project contingencies have been added where applicable, excluding capitalized operating costs, which results in an overall contingency of $270.3M or 22.6% (excluding taxes).

The Project will benefit from established infrastructure in central British Columbia, noting that the Project is approximately 100 km by road to the city of Williams Lake. Local infrastructure in Likely will further support the Project development. The estimated initial capital cost of $1,250 M is inclusive of applicable taxes.

Table 8: Initial Capital Cost Estimate

| 2025 PEA Total (C$M) | |

| Mining (Including contingency) | $113 |

| Process Plant and Facilities(1) | $419 |

| On-site Infrastructure (including tailings, water management, water treatment, environmental, site costs, and earthworks)(1) | $152 |

| Off-site Infrastructure | $159 |

| Project Indirects | $38 |

| EPCM, Owners Cost, Consultants | $112 |

| Project Contingency (excluding mining contingency) | $259 |

| TOTAL(2) | $1,250 |

| Notes on Table 8: | |

| 1. Direct process plant capital costs are based on benchmarking and not from engineering design.

2. Totals do not necessarily equal the sum of the components due to rounding adjustments; not all cost components are illustrated in this table. |

Sustaining Capital Costs:

Ausenco estimates the LOM sustaining capital for Project to be C$443 M, which is expected to be funded by operating cash flows. The sustaining capital estimate is primarily for the expansion of the tailing storage facility, mining fleet additions as total material movements increase with depth, and reclamation and closure. The PEA has assumed C$163 M in closure and reclamation costs.

On Site Direct Operating Costs

The estimated Opex for Project is US$15.33/t of mill feed – see Table 7. Ausenco and MMTS have estimated the Opex based on first-principles calculation, industry benchmarking, proprietary information and its professional experience.

Table 9: On Site Operating Cost for Base Case

| Metric | Unit | 2025 PEA |

| Open pit mining cost (excl. pre-prod) | US$/t milled | 7.60 |

| Processing cost (excluding G&A) | US$/t milled | 6.66 |

| G&A | US$/t milled | 1.07 |

| Total site operating cost | US$/t | 15.33 |

| Notes for Table 9: | ||

| 1. Totals do not necessarily equal the sum of the components due to rounding adjustments; not all cost components are illustrated in this table. | ||

Royalties

There is a 1.0 to 1.5% Net Smelter Royalty payable to two royalty holders. These are the only royalties that apply to the current Mineral Resources as mill feed for the Project and has been incorporated into the economic analysis of the 2025 PEA. The Company plans to exercise its right to buydown the NSRs to 1.5% and 1% respectively, for a total buydown payment of $1 million as provided in the agreements.

Infrastructure

The major infrastructure items considered and costed in the PEA support a mining and milling operation that is expected to operate 24-hours per day, seven-days per week. The design of Project infrastructure has prioritized environmental protection, workforce safety, and operating efficiency while minimizing community impacts. The Project site will consist of the open pit mine and mining related workshops, a processing plant, waste rock and tailings stack, and support service infrastructure such as warehousing, offices and workshops.

The Project site-wide water balance is positive for which water capture, treatment and discharge infrastructure has been allowed for and designed. The Project will draw water from within the property and contain process water and tailings within the water management pond and tailings stack, effectively. Water management and treatment has been included to treat both open pit dewatering and surface facilities run-off to required environmental discharge standards.

The site will be supported by renewable electrical grid power through a new, 75 km long 230kV, transmission line constructed by the Company from site to a new switching station designated as SMM, which is currently being designed by BC Hydro, located near the McLeese Lake Capacitor station. The mine and process operations are supported by functional maintenance and administration infrastructure located on site as well as off-site locations for non-critical administrative functions. Select local access roads will be upgraded and maintained throughout the mine life.

The proposed tailings storage method is placement of dewatered material containing both tailings and minor amounts of process water. The minor proportion of Potential Acid Generating tailings will be managed within a dedicated conventional tailings lined cell contained within the tailings stack. NAG waste rock, PAG waste rock and over burden will be split by type and placed in suitably designed facilities that will be designed for physical stability and collect and manage run-off from the waste rock storage facilities. All facilities are located near the open pit mine to maximize efficiencies and minimize impact, subject to condemnation drilling.

Environmental and Community Matters

All exploration permits with the Government of British Columbia are in good standing. During its recent 2024 to 2025 exploration drill programs, the Company has regularly engaged communities and pro-actively sought shared benefits opportunities with each local to regional businesses, contractors and workers. The Company recognizes and respects the First Nations asserted aboriginal rights and title in the Project area and looks forward to continuing meaningful engagement with each First Nation on our proposed next steps to advance the Project. The Company has continued baseline studies during the PEA on the climate and waterways. Further work is anticipated during the next stages of advancement due to the new vision proposed in the PEA for a larger scale operation and associated tailings, waste and water management facilities as compared to the 2021 PFS.

Opportunities and Future Work

Ausenco, the team of consultants, and the Company have identified several areas and opportunities that may provide significant costs savings and improved economics for the Project. Post-PEA the Company will embark on additional technical work and engineering studies to better position and further de-risk the Project, including but not limited to the following:

Mining

- Optimization of the pit phasing and mine production schedule, especially as the Mineral Resource is modified through further exploration and infill drilling;

- Optimization of the open-pit design through collection of additional geotechnical information;

- Further work to increase confidence in the Mineral Resource and lead to the definition of a Mineral Reserve;

- Detailed equipment costing to determine potential discounts to list price for all major components, as well as review purchase versus leasing options for mining equipment;

- Further planned electrification of the mine fleet, specifically the mine hauling function, as cutting-edge technologies for battery and trolley operations become commercialized in the near future; and

- Back-filling of waste rock into the open pit.

Milling and Metallurgy

- Additional metallurgical work to optimize results from geometallurgical domains and continue research on the optimum grind size, analyze recoveries of the gold and silver, and the effects of the higher grade coming from the mineral sorters on metal recoveries;

- Optimize reagents to reduce costs and improve metallurgy;

- Investigate the potential for a gold recovery circuit from a pyrite concentrate not currently in the PEA; and

- Ore sorting of low grade for expansion scenarios.

Tailings Storage and Waste Rock Facilities

- Detailed analysis of tailings storage and waste rock storage facilities for an integrated waste management plan and design to optimize the management of mine-impacted runoff and associated collection and treatment costs;

- Phasing of tailings and water storage starter structures to reduce initial capex;

- Alternative water treatment solutions being considered to the included reverse osmosis that meet BC discharge regulations; and

- Whole tailings belt filtration options to dewater tails before placement.

Other

- Construction camp location, and a trade-off study between at site accommodation versus daily commutes to the Project from local communities;

- Investigate regional quarry sites and quality of quarry material for construction purposes, notably the tailing storage facility;

- Water supply for the Project, and a trade-off study between a constructed reservoir with Project infrastructure or a water pipeline from a local source; and

- Addition of the 2025 drill results and Phoenix maiden resource.

Changes to the conceptual mine plan and mine design that may be recommended in the PEA study, if approved and implemented as the Project moves forward, could impact the capital and operating costs, profitability and cash flows and an eventual timeline to production, the impact of which cannot be quantified at this time. As a result, there are additional uncertainties with respect to the size and grade of the Mineral Resources that may become Mineral Reserves in the future, and that will serve as the basis for future studies.

In addition, the Company will continue to conduct exploration activities within the 11,633-hectare SMG mineral claims property which encompasses the estimated MRE, which the PEA is based upon. The objective of continuing regional exploration is to develop and assess targets that could further maximize the Company’s flexibility with respect to future development decisions on the Project.

Additional Considerations Related to the PEA

Investors should be cautioned that there is no guarantee that the future construction and development of the Project that will be completed in accordance with the 2025 PEA results set forward in this news release. There is no certainty that production will begin, or that operating capital, or that financial results will be consistent with the 2025 PEA.

Technical Information and Quality Control & Quality Assurance

Once received from the drill and processed, all drill core samples were sawn in half, labeled, and bagged. The remaining half of the drill core was securely stored on-site. Numbered security tags were applied to sample shipments to ensure chain of custody compliance. The Company inserts quality control (QC) samples at regular intervals, including blanks and reference materials, for all sample shipments to monitor laboratory performance. Standards and blanks account for a minimum of 15% of the samples in addition to the laboratory’s internal quality assurance programs. The QAQC program was overseen by the Company’s Qualified Person, Julian Manco, P.Geo, Director of Exploration (as described below).

Drill core samples from the 2025 drill program were submitted to MSALABS’ analytical facility in Prince George, British Columbia, for sample preparation and PhotonAssayTM analysis. The MSALABS facilities are accredited to the International Standards ISO/IEC 17025 and ISO 9001 standard for gold and multi-element assays, with all analytical methods incorporating quality control materials at defined frequencies and established data acceptance criteria. MSALABS Inc. is independent of the Company. Details on the historical assay work before 2025 will be included in the 43-101 Technical Report to be published within 45 days.

PhotonAssayTM

The PhotonAssayTM method utilizes gamma ray analysis for gold detection using the Chrysos PhotonAssayTM instrument (PA1408X). This non-destructive, fully automated technique offers high accuracy for analyzing crushed core and pulps. Sample preparation begins with drying and crushing up to 1 kg of material to achieve at least 70% passing through a 2-millimetre (mm) sieve. The sample is then riffle split to obtain a suitable aliquot for 2 testing cycles (MSALABS Method CPA-Au1).

The PhotonAssayTM instrument bombards 400 to 600-gram samples contained in sealed containers with gamma rays. These containers remain sealed throughout the process, preserving the sample for potential further testing. The analysis is performed robotically, with results that integrate into existing laboratory management systems.

Each sample is accompanied by a reference disc traceable to a Certified Reference Material. Both the sample and reference disc undergo gamma ray exposure, with signals detected and analyzed to ensure accurate and reliable results.

The method offers a gold detection range from 0.015 parts per million (ppm – lower limit) to 10,000 ppm (upper limit). Quality control includes the use of reference materials and blanks, with all results reviewed by a competent person before reporting.

Spanish Mountain Gold implemented two QAQC methodologies to validate the accuracy of PhotonAssayTM results, both demonstrating good comparability: 1) comparative analysis of diverse mineralization styles using Total Au screen metallic methods with both FAS-415 (gravimetric finish) and FAS-211 (AAS finish), and 2) comprehensive testing of both sample aliquots and rejects using FAS-211 (AAS finish).

QAQC Testing typically can include the following spot checks: 1) Pulverizing tests to evaluate variability in sample preparation, 2) Cross-analysis at external laboratories using screen metallic method, and 3) Four-cycle radiation testing to identify and calibrate potential variability in gold results with variable radiation intensity.

To effectively manage the nugget effect on high-grade gold samples MSALABS tested samples to “extinction” (CPA-Au1E method). This approach divides samples into multiple splits, analyzes each separately using PhotonAssayTM, and then calculates a weighted average of the results. By testing various portions of the sample independently and combining their values proportionally, this method provides significantly more representative gold values than traditional single-split analysis for samples with a large nugget effect.

Multi-Elemental Analysis

For the 2025 drilling campaign Spanish Mountain Gold used IMS-230 method to provide multi-element determination using a four-acid digestion followed by ICP-OES and ICP-MS analysis.

Key Process Steps:

Sample Preparation: Samples are dried and ground to specific criteria (85% passing 75 microns (μm) for rocks and drill core; 180μm for soils and sediments). A homogeneous 10-gram sample is required.

Digestion: Samples undergo sequential digestion with nitric, perchloric, hydrofluoric, and hydrochloric acids, followed by dilution with deionized water. Analysis: The solution is analyzed via ICP-OES and ICP-MS for multi-element quantification. Quality Control: The process includes reference materials, blanks, and duplicates, with corrections for spectral interferences and thorough review before final reporting.

Qualified Persons

Various consultants provided input and helped write the forthcoming PEA Technical Report. Consultants that are responsible for elements of the Technical Report are independent qualified persons as defined within NI 43-101.

- Geology: Ron Voordouw, P.Geo., Equity Exploration

- Mineral Resource for Main Deposit: Bahram Bahrami, P.Geo., Equity Exploration

- Mineral Resource for Phoenix Deposit: Bahram Bahrami, P.Geo., Equity Exploration

- Metallurgy, Processing, Infrastructure, and Economic Evaluation: Kevin Murray, P.Eng., Ausenco

- Mining: Marc Schulte, P.Eng., Moose Mountain Technical Services

- Tailings and Water Management: Brad Russell, P.Eng., BGC

- Water Treatment: Lee Josslyn, PE, Linkan Engineering

- Geochemistry: Andrea Samuels, P.Geo., pHase Geochemistry

- Off-site Power and Electrical: Neil Brazier, P.Eng., WN Brazier Associates

- Environmental & Community: James Millard, P.Geo., Ausenco

The QPs have reviewed the information in this news release that pertain to the sections of the forthcoming PEA Technical Report for which they are responsible. All scientific and technical information in this press release in respect of the PEA is based on information prepared by or under the supervision of those individuals. The Mineral Resource estimate in this news release has been classified in accordance with CIM Definition Standards – For Mineral Resources and Mineral Reserves (May 14, 2014) and CIM Estimation of Mineral Resources & Mineral Reserves Best Practice Guidelines (November 29, 2019).

In accordance with NI 43-101, the PEA Technical Report will be filed on SEDAR within 45 days of the disclosure of this news release.

Julian Manco, M.Sc., P.Geo., Director of Exploration with Spanish Mountain Gold, is the Qualified Person as defined under National Instrument 43-101 who has reviewed and has approved the contents of this news release.

About the Company

Spanish Mountain Gold Ltd. is focused on advancing its 100%-owned Spanish Mountain Gold Project (Project) towards construction of the next gold mine in the Cariboo Gold Corridor, British Columbia. The Company will publish, within 45 days of this news release, a new NI 43-101 Technical Report setting out the new executable vision to advance the Project. This new NI 43-101 Technical Report, with a de-risked and optimized Preliminary Economic Assessment (PEA) with an updated Mineral Resource Estimate (MRE), will supersede the prior technical report of the Company. Upon receipt of the new PEA and updated MRE, the Company will decide the next steps to advance the Project to position the Company to make a construction decision in or before 2027. We are striving to be a leader in community and Indigenous relations by leveraging technology and innovation to build the ‘greenest’ gold mine in Canada. The Relentless Pursuit for Better Gold means seeking new ways to achieve optimal financial outcomes that are safer, minimize environmental impact and create meaningful sustainability for communities.

Figure 5: PEA Mine Production Schedule Summary

APPENDIX B – Proposed site layout

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE