Southern Silver Targets Resource Expansion as Drill Crews Mobilize to the Cerro Las Minitas Ag-Pb-Zn Project

Southern Silver Exploration Corp. (TSX-V: SSV) reported that crews have mobilized in preparation for the start of the 2020-21 drill campaign on the Cerro Las Minitas Project, Durango, Mexico.

Commencement of exploration follows the closing of the transaction with Electrum Global Holdings L.P. to acquire Electrum’s 60% indirect working interest in the CLM Project (thus increasing Southern Silver to a 100% interest) and the closing of previously announced private placements with gross proceeds of Cdn$14.456 million (see NR-12-20; September 16, 2020).

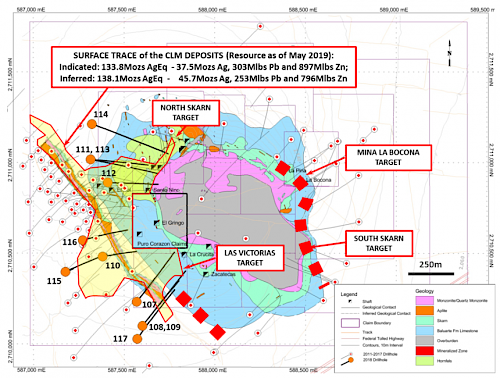

The exploration/drill program includes up to 10,000 metres of core drilling in 20 to 25 holes which will focus on the development of mineral resources on the east side of the Cerro through step-out drilling from previously identified high-grade, strongly silver-enriched mineralization in the Mina La Bocona and South Skarn target areas (see Figure 1 and Table 1). Some meterage will also be used to further extend mineralization at the Las Victorias target.

Figure 1: Plan Map of the Area of the Cerro showing the distribution of the CLM deposits and the location for new drill targeting, at the Mina La Bocona, South Skarn and Las Victorias targets.

Drilling will test an approximate 800 metre strike length of the Skarn Front mineralized zone on the east side of the Cerro to depths of up to 650 metres, as well as a high-grade hanging wall zone in the Mina La Bocona target area. Between 2011 to 2015, Southern Silver drilled 15 core holes on the east side of the Cerro with select assay results summarized below. New drill targeting will step out from this known mineralization and aims to increase the current mineral resource estimate on the property by approximately 30%. The CLM Project remains one of the larger undeveloped silver-lead-zinc projects in the world and is fully funded and permitted.

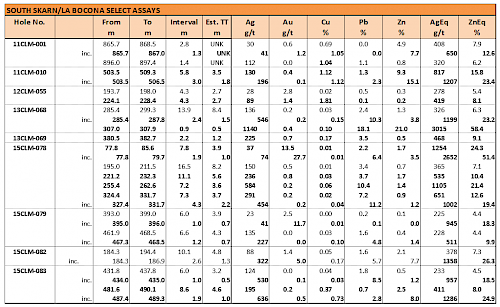

Table 1: Select Assay intervals from the Mina La Bocona and South Skarn Target areas

Analyzed by FA/AA for gold and ICP-AES by ALS Laboratories, North Vancouver, BC. Silver (>100ppm), copper, lead and zinc (>1%) overlimits assayed by ore grade ICP analysis, High silver overlimits (>1500g/t Ag) and gold overlimits (>10g/t Au) re-assayed with FA-Grav. High Pb (>20%) and Zn (>30%) overlimits assayed by titration. AgEq and ZnEq were calculated using average metal prices of: US$16.6/oz silver, US$1275/oz gold, US$2.8/lbs copper and US$1.00/lbs lead and US$1.25/lbs zinc. AgEq and ZnEq calculations did not account for relative metallurgical recoveries of the metals. Ore-grade composites calculated using a 80g/t AgEq cut-off and <20% internal dilution, except where noted; anomalous intercepts calculated using a 10g/t AgEq cut-off.

Cerro Las Minitas Project

The Cerro Las Minitas project is an advanced exploration stage polymetallic Ag-Pb-Zn-Cu Skarn/CRD project located in southern Durango, Mexico.

The Cerro Las Minitas project as of May 9th, 2019 contains a Mineral Resource Estimate, at a 175g/t AgEq cut-off, of(1)

- Indicated – 134Moz AgEq: 37.5Moz Ag, 40Mlb Cu, 303Mlb Pb and 897Mlb Zn

- Inferred – 138Moz AgEq: 45.7Moz Ag, 76Mlb Cu, 253Mlb Pb and 796Mlb Zn

A total of 133 drill holes for 59,000 metres have now been completed on the CLM Project with exploration expenditures of approximately US$25.5 million equating to exploration discovery costs of approximately C$0.09 per AgEq ounce to the end of 2019.

Stock Option Grant

Southern Silver also reports that it has granted 9,500,000 incentive stock options to directors, officers and consultants. The options are exercisable at a price of $0.51 per common share for a period of five years and are subject to the policies of the TSX Venture Exchange.

About Southern Silver Exploration Corp.

Southern Silver Exploration Corp. is an exploration and development company with a focus on the discovery of world-class mineral deposits. Our specific emphasis is the 100% owned Cerro Las Minitas silver-lead-zinc project located in the heart of Mexico’s Faja de Plata, which hosts multiple world-class mineral deposits such as Penasquito, San Martin, Naica and Pitarrilla. We have assembled a team of highly experienced technical, operational and transactional professionals to support our exploration efforts in developing the Cerro Las Minitas project into a premier, high-grade, silver-lead-zinc mine. The Company engages in the acquisition, exploration and development either directly or through joint-venture relationships in mineral properties in major jurisdictions. Our property portfolio also includes the Oro porphyry copper-gold project located in southern New Mexico, USA.

- The 2019 Cerro Las Minitas Resource Estimate was prepared following CIM definitions for classification of Mineral Resources. Resources are constrained using mainly geological constraints and approximate 10g/t AgEq grade shells. The block models are comprised of an array of blocks measuring 10m x 2m x 10m, with grades for Au, Ag, Cu, Pb, Zn values interpolated using ID3 weighting. Silver and zinc equivalent values were subsequently calculated from the interpolated block grades. The model is identified at a 175g/t AgEq cut-off, with an indicated resource of 11,102,000 tonnes averaging 105g/t Ag, 0.10g/t Au, 1.2% Pb, 3.7% Zn and 0.16% Cu and an inferred resource of 12,844,000 tonnes averaging 111g/t Ag, 0.07g/t Au, 0.9% Pb, 2.8% Zn and 0.27% Cu. AgEq cut-off values were calculated using average long-term prices of $16.6/oz. silver, $1,275/oz. gold, $2.75/lb. copper, $1.0/lb. lead and $1.25/lb. zinc. Metal recoveries for the Blind, El Sol and Las Victorias deposits of 91% silver, 25% gold, 92% lead, 82% zinc and 80% copper and for the Skarn Front deposit of 85% silver, 18% gold, 89% lead, 92% zinc and 84% copper were used to define the cut-off grades. Base case cut-off grade assumed $75/tonne operating, smelting and sustaining costs. All prices are stated in $USD. Silver Equivalents were calculated from the interpolated block values using relative recoveries and prices between the component metals and silver to determine a final AgEq value. The same methodology was used to calculate the ZnEq value. Mineral resources are not mineral reserves until they have demonstrated economic viability. Mineral resource estimates do not account for a resource’s mineability, selectivity, mining loss, or dilution. The current Resource Estimate was prepared by Garth Kirkham, P.Geo. of Kirkham Geosciences Ltd. who is the Independent Qualified Person responsible for presentation and review of the Mineral Resource Estimate. All figures are rounded to reflect the relative accuracy of the estimate and therefore numbers may not appear to add precisely.

Robert Macdonald, MSc. P.Geo, is a Qualified Person as defined by National Instrument 43-101 and supervised directly the collection of the data from the CLM Project that is reported in this disclosure and is responsible for the presentation of the technical information in this disclosure.

MORE or "UNCATEGORIZED"

Sirios Extends the Eclipse Zone 400 Metres Downdip and it Remains Completely Open

Sirios Resources Inc. (TSX-V: SOI) (OTCQB: SIREF) is pleased to p... READ MORE

New Found Intercepts 14.8 g/t Au Over 5m at Honeypot & 43.1 g/t Au Over 2m at Jackpot

New Found Gold Corp. (TSX-V: NFG) (NYSE-A: NFGC) is pleased to a... READ MORE

STLLR Gold Announces Remaining Tower Gold Project Infill Drilling Results

STLLR Gold Inc. (TSX: STLR) (OTCQX: STLRF) (FSE: O9D) announces the fin... READ MORE

AVANTI HELIUM CLOSES SECOND AND FINAL TRANCHE OF PRIVATE PLACEMENT

Avanti Helium Corp. (TSX-V: AVN) (OTC: ARGYF) is pleased to anno... READ MORE

PAN GLOBAL INTERSECTS 11 METERS AT 2.36G/T GOLD AND 22 METERS AT 0.41% COPPER, EXPANDING CAÑADA HONDA COPPER-GOLD DISCOVERY, SPAIN

New drill results from Cañada Honda return best gold grade and t... READ MORE